Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Northern Ireland Labour Force Survey – Young People Not In Education, Employment Or Training (NEET)

NORTHERN IRELAND - Young people out of work in Northern Ireland remains stubbornly high.

Statistics on young people who are not in education, employment, or training (NEET) were published today by the Northern Ireland Statistics & Research Agency.

Young people who were NEET

There were an estimated 21,000 young people aged 16-24 years in Northern Ireland who were not in education, employment, or training (NEET) in January - March 2020. This was equivalent to 10.7% of all aged 16-24 years. The proportion of young people who were NEET in the UK was 10.3%.

The number of NEETs has been on a general downward trend over the last four years from a peak of 39,000 in January - March 2015.

In January - March 2020 there were an estimated 16,000 young people aged 16-24 years who were not in education, employment, or training and who were not looking for work and/or not available to start work (economically inactive). The remainder of those who were not in education, employment or training was looking for work in the previous four weeks and available to start within the next two weeks (unemployed).

ABC Comment, have your say below:

Strains on Global Food Banks Showing and Food Prices Increasing Internationally

FOOD BANKS - As lockdowns loosen, the economic devastation caused by COVID-19 remains. In many places, people are now paying significantly more for food due to supply chain disruptions caused by the pandemic. This trend, compounded by the steep rise in unemployment worldwide, is making it more difficult for many families to put food on the table. So says the Global Food Banking Network.

Food banks in 44 countries are reporting a 50-100 percent increase in demand for service, according to a pulse survey conducted last week by The Global FoodBanking Network (GFN). Nearly all say that they need significantly more food, and that key staples like rice, wheat, and pulses are in high demand.

As lockdowns loosen, the economic devastation caused by COVID-19 remains. In many places, people are now paying significantly more for food due to supply chain disruptions caused by the pandemic. This trend, compounded by the steep rise in unemployment worldwide, is making it more difficult for many families to put food on the table.

Food banks in 44 countries are reporting a 50-100 percent increase in demand for service, according to a pulse survey conducted last week by The Global FoodBanking Network (GFN). Nearly all say that they need significantly more food, and that key staples like rice, wheat, and pulses are in high demand.

Karen Hanner, Director of Food Sourcing and Strategic Partnerships, explains the challenges food banks face:“ On one hand, because of the disruptions in the food service supply chain, food banks must access all the perishable food they can, as quickly as it becomes available. In the short term, here is an abundance of nutritious food with a limited shelf life that needs to be moved from one place to the next. On the other hand, food cannot be distributed in communities through normal charity partners. There are limits in congregate feeding, so many food banks must take food directly to families and this is hard to do with perishable food. Many food banks must purchase more staple items to distribute more widely and efficiently.”

Food price increases mean more expenses for food banks, during a time when financial donations are down, and need is surging. The price of rice – a key staple in many households across the world – climbed 11 percent in Thailand and 6.6 percent in Peru since March, for example. The cost of overall food items soared by 4.4 percent in Argentina and 2.6 percent in the United States, the latter of which was the highest rate of increase in more than fifty years.

Thailand has been especially affected by the shutdown of the tourism industry. The food bank there, which is purchasing rice for its meal kits, is struggling to expand service while food prices shoot up. “The desperation in some communities are becoming larger as the crisis goes on. The job is to listen to these communities and see how we can maximize the impact of our contributions,” said Bo H. Holmgreen, Founder and CEO of Scholars of Sustenance. The organization desperately needs more support for logistics to continue relief.

Image: Courtesy of Scholars of Sustenance Thailand

Rise Against Hunger Philippines is working around the clock to respond to both the changes in the food supply chain and the increasing volume of people requesting food. “During ‘normal’ times, 70 percent of Filipino households are already food insecure, and 85 children die of hunger every day in the Philippines. The Covid-19 crisis will worsen this situation,” warned Jomar Fleras, Executive Director of Rise Against Hunger Philippines.

Rise Against Hunger Philippines works with local government organizations to do house-to-house food distributions. In two months, the food bank has reached over 20,000 families and 31 hospitals and is working with more food manufacturers than ever before. And to help offset the effects of hoarding at stores, the organization increased its distribution of personal care products to vulnerable communities.

Image: Courtesy of Rise Against Hunger Philippines.

In Indonesia, FoodCycle recovered and redistributed surplus cooked food from wedding and banquet venues before COVID-19. Because of the health crisis, special events have taken a pause, drying up the food bank’s primary source of donations. Now, the organization works directly with food companies, and uses incoming financial support to purchase products they cannot get from donations. They also assemble and distribute emergency parcels directly to struggling families in Indonesia.

Image: Courtesy of FoodCycle Indonesia

The Global Foodbanking Network is increasing their monitoring of food prices whilst working to reduce waste.

ABC Note, In the UK there are demands for a rent freeze as clearly a lot of peoples incomes have fallen dramatically and there are concerns that people will go hungry if they pay their rent as priority.

ABC Comment, have your say below:

Today's Employment Figures Not Showing the Full Picture However Lack of Vacancies Alarming

ONS - The latest employment figures are released today however they do not show the effects yet of COVID-19 and the pandemic. What is showing that is very interesting is the rapid decline in vacancies. What seems clear to us that had their not been this pandemic that the economy worldwide was facing a major downturn after ten years of stimulus packages following the Great Recession in 2008. Truth be told it was like breathing life into a corpse. Employment grew but what was the real quality of jobs? Real incomes were falling a lot of the time during this period an odd thing to happen during a period of full employment.

According to the BBC, The number of people claiming unemployment benefit in the UK soared to 2.1 million in April, the first full month of the coronavirus lockdown.

The total in April jumped by 856,500, the Office for National Statistics (ONS) said.

Before the lockdown began, employment had hit a record high.

The benefit claimant count does not include everyone who is out of work since not all can claim assistance, but it does indicate the trend.

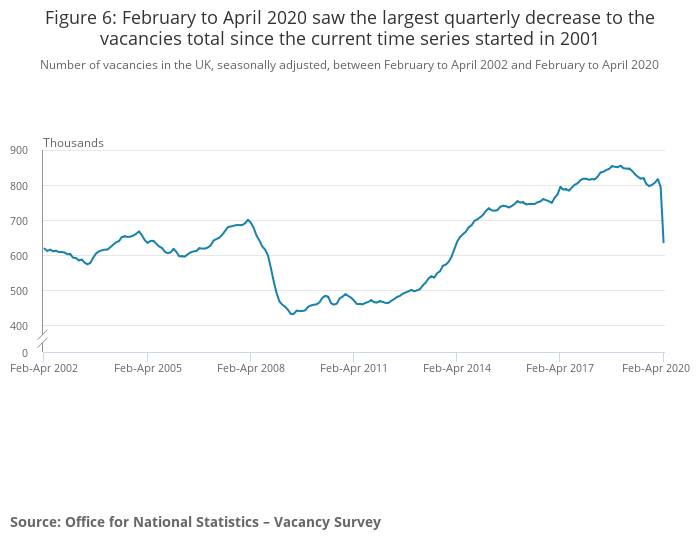

In another indication of the bleak employment landscape, the number of job vacancies fell by nearly a quarter to 637,000 in the three months to April.

Meanwhile, claims for universal credit - the benefit for working-age people in the UK - hit a record monthly level in the early weeks of lockdown.

According to research by the Resolution Foundation, young people are most likely to have lost work or seen their income drop because of the coronavirus pandemic.

More than one in three 18 to 24-year-olds is earning less than before the outbreak, the research indicated.

It said younger workers risk their pay being affected for years, while older staff may end up involuntarily retired.

The ONS have said:

The coronavirus (COVID-19) pandemic has been a major shock to the UK economy. The Office for Budget Responsibility (OBR)'s three-month lockdown scenario analysis forecasts a 13.0% fall in annual gross domestic product (GDP) in 2020 and the unemployment rate to reach 10.0% by Quarter 2 2020, before gradually reducing to just below 6.0% by the end of 2021.

In the three months to March 2020, GDP fell by 2.0%, signalling the first direct impact of the coronavirus on the economy. The production sector fell by 2.1%, construction by 2.6% and the services sector by 1.9%.

The latest Labour Force Survey (LFS) estimates published today (19 May 2020) cover the period January to March 2020, and therefore remain mostly unaffected by the impact of the coronavirus. On the quarter, employment increased 211,000 to 33.14 million. Alongside official statistics from the LFS, the Office for National Statistics (ONS) and HM Revenue and Customs (HMRC) jointly published a experimental monthly flash estimate of paid employees and their pay from Pay As You Earn Real Time Information. The estimates for April 2020 indicate that the number of paid employees fell by 1.2% compared with April 2019, and fell by 1.6% when compared with March 2020. The median monthly pay grew by 2.7% in March 2020, compared with the same period of the previous year. In addition, the median monthly pay for April 2020 fell by 0.9% compared with the same period of the previous year.

In addition, the latest Vacancy Survey estimates for the period February to April 2020 show that the number of vacancies decreased by 21.0% compared with the previous quarter, showing a slump in the demand for labour. The decrease of 170,000 vacancies is the largest quarterly fall in the history of the time series. The Institute for Employment Studies' (IES) analysis of the ADZUNA vacancy data shows that the overall vacancy level decreased by 59% between the second week of March and the week ending 3 May 2020.

Further evidence of the impacts of the coronavirus pandemic on the labour market are reflected in the ONS Business Impact of Coronavirus (COVID-19) Survey (BICS). The survey for the period 6 April to 19 April 2020 showed that 23.0% of businesses that responded had temporarily closed or paused trading. Across all industries, 28.0% of the workforce had been furloughed under the terms of the UK government's Coronavirus Job Retention Scheme, and less than 1% of the workforce was made redundant. Workers on the furlough scheme are not at work but remain employed.

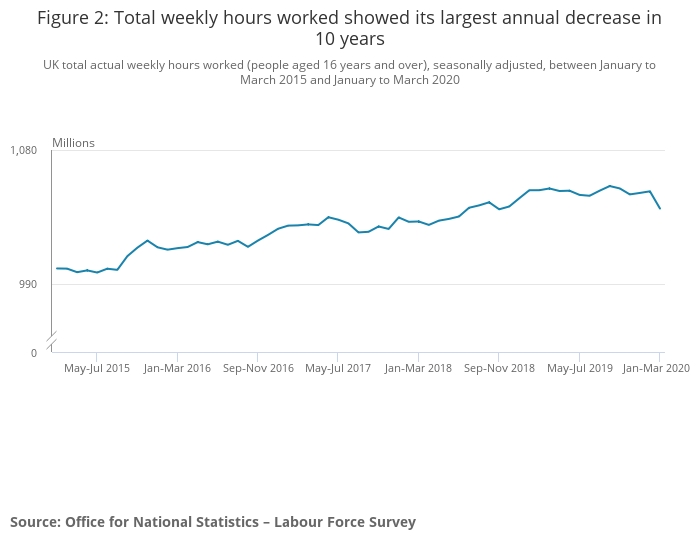

Experimental LFS weekly hours data show that seasonally-adjusted actual hours worked in the main job declined in the last two weeks of March 2020. Compared with the same period in 2019, the numbers of people who were temporarily away from work, and those who worked fewer than usual hours because of economic reasons both increased, which contributed to lower actual hours worked.

The Bank of England (BoE) Monetary Policy Report (MPR) for May 2020 covers findings from the Bank/Ipsos MORI Survey, in which over half of employed respondents reported that they were employed but not currently working, or were working fewer hours, as a result of the pandemic. Most workers said that it was a result of firm closure or lower demand. The MPR also reports that the combination of lower individual productivity and disrupted supply chains is expected to cause a fall in labour productivity on a per-hour basis. It also anticipates a larger fall in productivity per head because furloughed workers are still employed but may have zero working hours. The self-employed were most likely to report working fewer hours.

Comparing various indicators shows that the impact of the coronavirus has been felt to greater extent by certain industries. The accommodation and food services activities sector recorded the largest quarterly decrease in vacancies (negative 32,000) for the period February to April 2020 and the largest proportion of workforce being furloughed (73.0%) based on BICS Wave 3 data. The accommodation and food services activities output declined by 9.5% in the three months to March 2020, based on GDP first quarterly estimates for Quarter 1 2020.

The Department for Work and Pensions (DWP)'s weekly management information on Universal Credit (UC) "declarations" (claims) and advances also provide an indication of performance of the labour market in terms of the unemployed and those in employment who qualify for UC. The DWP reports that, since the start of the pandemic, there have been exceptional levels of demand for UC. However, not all applicants will be eligible for benefits.

The experimental Claimant Count data, which cover claims for Jobseeker's Allowance and those claimants in the UC "searching for work" conditionality, show that there was a 69.1% increase in the number of claims between March and April, taking the level to over 2 million. The IHS Markit UK Household Finance Index for April 2020 shows that the coronavirus pandemic has caused households' perceptions of employment incomes and job security to decline.

Figures released today show that total and regular average weekly earnings growth slowed to 2.4% and 2.7% respectively in the three months to March 2020. In addition, consumption and expenditure patterns as reflected through the ONS's retail sales data in Great Britain for March 2020 changed. The initial impacts of the coronavirus on retail sales in March were a sharp fall in sales volume (5.1%) and strong growth in online sales as a proportion of all retailing (22.3%).

ABC Comment, all in all the situation looks pretty bleak. Coronavius has distracted people from a major downturn anyway, it has been an excuse to pump 'helicopter' money into many economies without having to come up with an excuse for printing money.

ABC Comment, have your say below:

Useful Information for Businesses During the COVID-19 Pandemic

COMPANY FINANCE - Kate Templeton, Chief Outreach Executive, has sent us this information.

If you are running a small company, you might find this website to be usefull there is so much 'chatter' it can be overwhellming.

Kate makes a good point, information is fragmented but hopefully you can find the advice you need here: https://www.companydebt.com/coronavirus-business-help/

ABC Comment, have your say below:

Scotland - New Call for Emergency Support For Children

POVERTY ALLIANCE SCOTLAND – have informed us that over 100 children’s charities, faith groups, academics, think tanks, poverty campaigners and trade unions have today written an open letter to the First Minister calling for a direct financial boost for all families living on low incomes to support them through the coronavirus crisis.

The letter expresses “grave concern” that families across Scotland are struggling to stay afloat through the crisis, and that her government’s progress on tackling child poverty is being put at huge risk.

Signatories include the STUC, Scottish Women’s Aid, Scottish Association for Mental Health, Joseph Rowntree Foundation, IPPR, Barnardo’s, Poverty Alliance, Child Poverty Action Group in Scotland and One Parent Families Scotland. They say that a payment equivalent to at least £10 per week per child is needed to provide families “a lifeline now to help them weather the storm.”

To read the media statement, the letter to the First Minister and list of signatories please click here

Additionally:

The Institute for Public Policy Research in Scotland have published new information on the impact of Covid-19 on families in Scotland. Amongst the key findings are that 49% of families with dependent children are ‘in serious financial difficulty’ or ‘struggling to make ends meet’. Their findings have reinforced the need for significant urgent action to address the needs of families with children. Key calls include:

- The Scottish Government to make a lump sum payment to eligible families of £250 per child (the equivalent of £10 per week for six months)

- The UK Government to increase Child Benefit by £5 and child supplements in Universal Credit by £10 for the duration of the crisis

Both these measure are needed now to relieve some of the pressure on families.

ABC Comment, have your say below:

Benefits Information Available Via WhatsApp

DWP ANNOUNCEMENT - People can now access the most up-to-date benefits and support information via their smart phones, using WhatsApp.

The service, which can be accessed by sending ‘Hi’ in a WhatsApp message to 07860 064 422, has been launched to help combat the spread of incorrect information and to make the correct information easily accessible.

The GOV.UK service currently has more than 312,000 unique users, and has sent more than 2.6 million messages since its launch on 25 March 2020.

DWP is one of the first government departments to provide information via the service which includes information on benefits support available, how to check if you are eligible and how to apply.

ABC Comments, have your say below:

Takeaway Food Market Has Been Booming in the COVID-19 Lock-down

TAKEAWAY FOOD - the market has been booming in recent years. We recieved this information from Foodhub:

When the chips are down, it appears Brits turn to good old-fashioned grub as fish ‘n’ chips is revealed as the most popular takeaway food during lockdown.

The sales data from online takeaway delivery platform, Foodhub, reveals the traditional dish has doubled in popularity with a massive 208% uplift in fish n chips orders since lockdown as uncertainty calls for familiar comfort food.

This is followed by Quarter Pounder Burgers (158%) and Donner Kebabs (156%) as Brits look for ways to satisfy their taste for fast food.

Other foods on the up since lockdown include Chicken Nuggets (146%), Sausage and Chips (152%), Chicken Burgers (147%) and Garlic Bread (148%).

Pizzas are also included in the top 10 most ordered foods with Hawaiian proving the most popular, followed by Pepperoni.

Desserts have also increased in popularity since lockdown proving our love for sweet treats when things turn sour, with Cheesecake the favourite up 129%, Chocolate Chip Cookie Dough ice cream up 113% and Chocolate Cake also up 113%.

Philip Mostyn, Foodhub spokesperson, said: “For many of us, takeaways have provided us small moments of joy and a break from the monotony we’re all experiencing in lockdown. It’s interesting to see how, as a nation, we’re turning to the old favourites and seeking comfort in familiar nostalgic foods, such as Fish ‘n’ Chips.”

Overall, orders through Foodhub have increased over 50% since lockdown.

Foodhub is an online food website and app launched in 2017. There are more than 12,000 takeaways currently featured online at foodhub.co.uk and through the apps available for iOS and Android.

Foodhub is unique in that it does not take a commission from the food establishments for each order placed. This enables them to offer better prices and deals to customers than other online food platforms

Top 10

- Fish n Chips (up 208%)

- Quarter Pounder Burgers (up 158%)

- Donner Kebabs (up 156%)

- Sausage and Chips (up 152%)

- Garlic Bread (up 148%)

- Chicken Burgers (up 147%)

- Chicken Nuggets (up 146%)

- Cheesecake (up 129%)

- Pizza (up 115%)

- Chocolate Cake and Chocolate Chip Cookie Dough ice cream (up 113%)

Image: Alishan Tandoori.

ABC Note: What takeaway do we eat here at the good ship ABC - well Indian of course, from the Alishan Tandoori in Colchester: https://alishantandooricolchester.com/our_menu.php?utm_source=google&utm_medium=pin&utm_content=menu-button Highly rated, Alishan deliver a wide range of Indian food to your door.

Governor Andrew Cuomo: What Washington Must Do to Protect Workers

GOVERNOR ANDREW CUOMO SPEAKS - This makes an interesting read. Massive job losses were officially announced today in the US.

Total nonfarm payroll employment fell by 20.5 million in April 2020, after declining by 881,000 in March. The April over-the-month decline is the largest in the history of these data and brought employment to its lowest level since early 2011. (These BLS employment data start in 1939). Employment fell sharply in all major industry sectors, with particularly heavy job losses in leisure and hospitality.

Today, The Washington Post published an op-ed by Governor Andrew M. Cuomo urging Washington to make corporations ineligible for government funding if they don't maintain the same number of employees they had before the COVID-19 pandemic. Yesterday, Governor Cuomo announced that members of the New York Congressional Delegation will propose the 'Americans First Law' to help prevent corporate bailouts following the pandemic. The text of the op-ed that was published by The Washington Post is available here.

Full text of the op-ed is available below:

The covid-19 pandemic has thrust us all into unprecedented circumstances, even more dire than the economic collapse of the Great Recession. As the nation plots a course forward, I fear that mistakes of the past are being repeated — errors that put the well-being of large corporations above that of working Americans.

The latest monthly jobs report was staggering: Businesses across the nation shed more than 20.5 million jobs in April. The U.S. unemployment rate has climbed to 14.7 percent — the highest rate on record since tracking began in 1948. One in every five Americans employed before the onset of the pandemic are out of work. Ten years of unprecedented economic gains in our state were wiped out in a single month.

Over the past decade, New York generated 1.3 million jobs, reaching a record high of 8.3 million private-sector jobs in February, as unemployment fell to a record low. Wages increased by 47 percent, and we raised the minimum wage to $15 per hour. Now, our state is looking at a multiyear recovery, one longer and with a deeper decline than we faced after the Great Recession.

As states throughout the country take steps to reopen, Washington must not repeat mistakes of the past. Large corporations receiving government bailouts must be held accountable for doing right by their workers.

So far, Washington has been in repeat mode.

The $2 trillion federal assistance package passed in March included hundreds of billions of dollars to prop up large corporations without questioning their commitment to workers or business practices. I understand the desire to keep businesses from failing, but doing so makes sense only if government funds are being used to support workers — not to enrich executives and shareholders.

But that's what is happening. The Federal Reserve and Treasury Department are jointly launching a $500 billion bond-buying program without any requirement that companies receiving aid retain workers or limit distributions to their executives and shareholders. This is even more shocking given that the Federal Reserve's principal mandate is to promote maximum employment.

Think about that prospect — $500 billion in federal financial support with no strings attached. That's great for executives and shareholders! That's great for the largest corporations in this country, those that have increased their debt by close to $4 trillion since 2009, while enriching themselves via stock buybacks and massive dividends. Meanwhile, workers get laid off and taxpayers foot the bill for unemployment benefits, Medicaid, food assistance and other public supports.

We've seen this movie before. This is what Washington did after the 2007-2009 recession caused by mortgage fraud. Homeowners lost life savings and equity in their homes while bankers made fortunes. Taxpayers bailed out corporations and executives while those same taxpayers' home equity was lost. The injustice of our system was glaring and obnoxious. Bankers that had reaped record profits by selling what turned out to be toxic securities were then handed a taxpayer-funded parachute for a soft landing during the crash. This inequity is poised to happen again, as corporations are planning their next bailout scheme with their friends in Washington.

Even as the number of coronavirus cases in our country continues to rise, some corporations are looking for a chance to increase their profit margins on the backs of Americans they have laid off. Corporate leaders are telling Wall Street analysts that this is an opportunity to rethink their businesses and permanently reduce their payrolls as they get lean. This would mean significantly higher structural unemployment for longer periods. It would mean more spending by governments at all levels to keep Americans fed, housed and healthy. Ultimately, this stands to result in greater inequality, greater income disparity and potentially greater social unrest.

Our country cannot let that happen again. Washington must put in place stronger requirements for corporations that take federal bailout money. Corporations that do so must hire back at the same levels that they employed before the onset of the public health crisis and subsequent economic fallout. Federal financial assistance that refinances corporate balance sheets shouldn't be the catalyst for bigger corporate profit margins at the expense of workers.

Washington's bailout rule should be simple and clear: No government support if you don't hire back all of your pre-pandemic workers.

Government should not subsidize corporate plans to lay off workers, while any corporate layoffs must require a return of any government subsidy. The path forward for all of us will be difficult enough. Corporations are driven by profits. It is the role of government to ensure that those profits do not come at the expense of the Americans who are the backbone of our economy.

Image: The brakes are on for the US economy.

ABC Comment, have your say below:

Housing Market Lock Down Eases

LOCK DOWN CHANGES - From today, surveyors can enter the home to complete valuations, renters and prospective buyers can view property and removals can once again assist people in their moves.

Miles Robinson, Head of Mortgages at online mortgage broker Trussle, brought us this:

New regulations set to come into force today should provide the property market with a much-needed boost after the lockdown period. From today, surveyors can enter the home to complete valuations, renters and prospective buyers can view properties and removals can once again assist people in their moves.

Reallowing surveyors to enter homes as long as a distance of two metres is maintained means that physical valuations can get going again. Some lenders, such as HSBC and Virgin Money have already confirmed that valuations are starting to be booked in.

Over the past few weeks, we’ve seen desktop valuations acting as a stop gap in an attempt to keep surveys happening. A high proportion of those desktop valuations have only been for those with a loan-to-value of less than 75%. Additionally, some properties require a physical valuation. These include those in flood risk areas, those with previous adverse valuations, and some new build properties.

While surveyors can now enter the home, it’s important to stress that visits are still only advised when absolutely essential. With a high proportion of the UK watching their finances more closely, we may see today’s announcement boost the remortgage market further.

Image: Housing market coming out of the lock down.

ABC Comment have tour say below,

No Plans to Change Benefit Cap Say the Government

BENEFIT CAP - The government have said there are no plans to change the benefit cap.

East Ham MP Stephen Timms says failure to increase benefit cap prevents people from receiving extra support, however, the government say they have no plans to change the benefit cap.

London’s benefit cap is £442.31 per week for couples or single parents with dependent children, and £296.35 per week for single adults.

Image: East Ham MP Stephen Timms.

The East Ham MP took issue with Thérèse Coffey, secretary of state for the DWP, in a recent parliamentary session: “The unchanged benefit cap is now blocking increased support which the government has decided people should receive — it’s having a particular effect in London.”

Mr Timms argued that increases to universal credit, working tax credit and local housing allowance cannot be enjoyed because of this cap. In response, Ms Coffey said that the government do not intend to increase the cap.

Ms Coffey explained that “aspects of housing benefit regulation” have been changed, and that Londoners “should see an increase” in what they receive in that respect.

ABC Comment, have your say below: