Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Universal Credit Survey Speaks of Hardship Particularly For New Claimants

UNIVERSAL CREDIT - National poverty charity Turn2us has surveyed 2,014 working age adults around the UK to better understand their financial situation and concerns. The research shows how:

An additional 3.46 million are expected to make a claim for Universal Credit as 15% of working age adults are going to rely on the welfare state through this pandemic

- The average UK worker is expecting £278 per month less income than they would normally receive

- One in eight people are struggling to afford food and basic bills while one in twelve can’t afford cleaning supplies

Here’s a summary of the themes that came through from the survey:

Universal Credit

- 15% of respondents planned to make a new Universal Credit claim as a result of coronavirus, while among 18-24 year olds, that figure jumped to 28% of respondents

- This equals around 3.46 million new UC claims as a result of the coronavirus

Financial concerns

- Around one in every eight people (13%) still cannot afford food, heating or electricity

- One in eleven (9%) cannot afford essential toiletries

- One in twelve (8%) cannot afford cleaning supplies

- The average UK working age adult will receive 22% less in income this month compared to last month; this equates to £278

Zero-hour contract workers

- People on zero-hour contracts are expecting to see a £193 drop in income per month

- To put this into perspective, a person on a zero hour contract is now expected to live on around £614 per month.

- People on zero hours contracts are being hit the hardest by coronavirus, with more than three out of four people (78%) having seen a drop in income or change to employment; one in four of whom are not receiving any pay because their work has closed

Self-employed workers

- Self-employed workers are expecting to see the largest drop-in take-home income each month – this works out as £386

- Self-employed workers are the second most affected group, with more than half (57%) already having had their employment affected (income and/or hours reduced) as a result of the coronavirus

Employees

- Employed workers are expecting to see a drop in income of £219 per month

- More than one in two (53%) employed people have reported changes to income or employment status

- Based on anticipated future earnings, in the long-term, people working in retail, hospitality, creative arts and leisure and tourism are the worst affected by the pandemic

ABC Comment, have your say below:

Bill to Protect Northern Ireland Private Renters Passed By Assembly

NI EVICTION - Communities Minister Deirdre Hargey MLA has thanked Assembly members for swiftly passing legislation to strengthen protection to private renters during the COVID-19 crisis.

The Private Tenancies (Coronavirus Modifications) Bill was introduced into the Assembly 21 April 2020 and had its final stage today (Tuesday 28 April).

It will mean that landlords will be required to give tenants a 12 week notice to quit period, ensuring tenancies are protected throughout this period.

Minister Hargey said: “It was necessary to introduce measures to help prevent households having to leave their homes.

“This legislation will protect private renters, securing their accommodation, allowing them to protect their health and reducing the movement of people. It will enable vulnerable people to shield, self-isolate and social distance.

“Private renters continue to be a group facing significant concerns and anxiety during this period in particular due to loss of employment. In these extraordinary times people who may temporarily struggle to pay their rent through no fault of their own, need certainty in the meantime that their homes are safe and that their landlords can’t evict them.

“This legislation will ensure that no renter in private accommodation will be forced out of their home during this difficult time. Landlords will now be required to give tenants 12 weeks’ notice to quit before seeking a court order to begin proceedings to evict.”

The Minister concluded: “I would like to thank all the Assembly members and the Communities Committee for their support and help in getting this legislation through so quickly as well all the supporting officials in the Department and Assembly. Everyone has understood why it is urgent and gone above and beyond to prepare and process the Bill quickly.”

ABC Comment, have your say below:

US Household Debt Surpasses $14 Trillion Mark

US HOUSEHOLD DEBT - The United States household debt surpassed the $14 trillion mark for the first during the fourth quarter of 2019 to stand at $14.15 trillion. The debt which entails mortgage, revolving credit, auto loan, credit card, student loans and other forms of loans have been rising steadily and continued an upward trend for the last five years.

Apps To Help You Manage Your Kids Pocket Money

POCKET MONEY - If you can measure it goes the adage, you can manage it. We have been sent a list of useful apps if you want to control your childrens pocket money.

1. gohenry

If you want your child to start learning about saving and spending (but with parental control), gohenry is the app for you! With this app you get a parent account, which allows you to top up your child’s allowance and apply rules on how they can spend that money. Plus, they will be able to use their card in shops, online and to withdraw cash. But don’t worry, you will get an instant notification whenever they use the card and can set weekly spending limits.

2. Rooster Money

Rooster Money will let you keep track of the total owed for things like pocket money or completed chores. One nice feature of this app is the ability to add pictures of items that kids are saving up for and set a savings target, which is great for helping your child to visualise the end goal. Children will also be able to see how much money they have saved and how they’ve spent it in an easy to read statement.

3. iAllowance

The makers of iAllowance claim it’s had a role in getting over 20 million chores completed. This useful app will allow you to track the amount of allowance you owe to each child and virtually “prompt” them to finish tasks and chores linked to their pocket money earning potential! The information syncs across devices, and you can even email or print reports on how your child is doing.

4. Gimi

Gimi is designed to help you and your child keep track of their allowance and chores, but also to provide financial education along the way. A virtual piggy bank fills with the weekly allowance you set, and you can define rewards for specific tasks. But what’s most special about this app is there are three sets of lessons to learn, which you and your child can work through together. The lessons are currently themed around Earning, Saving and Spending and help to identify financial topics to discuss, and are accompanied by bright animated videos.

5. Otly!

Otly! has two parts – the Otly! app for parents and an optional companion app that you can install on your child’s device, Otly! Jr. The main app for parents will allow you to set up a digital record of your child’s allowance and track how much they’ve earned and spent. In the junior app, children can separate their money into different savings pots, see graphs of how their savings will grow and get a countdown to the next allowance! A bright and friendly app!

Information provided by: Saveonenergy.com/uk/

ABC Comment, have your say below:

Live Broadcast Parliaments Economics Affairs Committee to Examine Universal Credit

PARLIAMENT - You may want to visit this Economic Affairs Committee meeting on Universal Credit.

Economic Affairs Committee

Tuesday 28 April 2020 Meeting starts at 3.35pm

AGENDA

Subject: The economics of Universal Credit

Witness(es): Paul Gray; Gareth Morgan

Witness(es): Victoria Mills; Sue Ramsden, Policy Lead, National Housing Federation

Please click here:

ABC Comment, have your say below:

New Economics Foundation Talk about Homelessness, Renters and the COVID-19 Crisis

HOUSING - New Economics Foundation senior researcher Hanna Wheatley, Islington councillor Diarmaid Ward, and Acorn national organiser Anny Cullum talk about homelessness and renters.

At the end of last month, the Government gave councils 48 hours to house all rough sleepers in their areas. A temporary ban on evictions has also been put in place, and the Government have called for landlords to be ‘compassionate’ in their dealings with tenants.

But are these measures enough? What has been the experience of tenants and the homeless community so far during the crisis? And what changes should we be pushing for now.

The New Economics Foundation talk about the effect of COVID-19 crisis.

ABC Comment, have your say below:

DWP failing to Publish Statistics Say UK Statistics Authority

DWP FAILURE - The UK Statistics Authority wrote to DWP on 22 April to express concern that it had not published some information about Universal Credit claims during the coronavirus outbreak, despite having previously announced—including to the Committee—that it would do so.

The results of a survey to find out people’s experiences of the benefit system during the coronavirus outbreak have today been published by the Work and Pensions Committee.

- Coronavirus survey response

- Letter from Permanent Secretary to Chair

- Inquiry: DWP's response to the Coronavirus outbreak

- Work and Pensions Committee

More than 6,000 people responded to the Committee’s call for submissions from people claiming benefits for the first time, from existing claimants, and from people who need support but have found they are unable to claim any benefits.

The summary of responses has been divided into nine key themes which will inform the Committee’s work and scrutiny of the DWP’s response to the coronavirus outbreak.

The Committee is also publishing today a letter from the DWP Permanent Secretary in response to questions from the Chair about Universal Credit Advance payments and telephone waiting times.

ABC Comment, have your say below:

Children in Poverty Due to COVID-19

HARDSHIP - 134,000 families applying for Universal Credit as a result of coronavirus are estimated to be affected by the Two-child Limit. Almost a third of children in the UK live in poverty – that's around nine in the average classroom. The situation is getting worse, with the number set to rise to five million during 2020.

Over 10.5 million children in 5.8 million households across the UK are facing financial crisis as one or both of their parents have lost income because of the coronavirus, warns national poverty charity, Turn2us.

This means 71% of children are living in households where their parents’ employment has been affected. The charity is calling for an increase in Child Benefit of £10 per week per child to help struggling families through the crisis.

According to the charity’s nationwide survey of 2064 working age adults, parents are more likely to have experienced a change in their employment status than any other group of working age adults. Nearly two thirds of households with children have already seen their employment situation affected by coronavirus (62%), compared to 43% of households without children.

Furthermore, a significant number of families with children are unable to afford essentials due to coronavirus. This includes 57% who cannot afford at least one household essential, as a consequence of their employment being affected by the pandemic.

Tom Lawson, Chief Executive of Turn2us, comments:

“It’s a worrying time for families, many of whom will have suddenly lost income as a result of changes to their employment situation. Whether you’ve lost your job, are working reduced hours, or have been furloughed, you still need to put food on the table and pay the bills.

“There are already 4.5 million children in the UK living in poverty; and this crisis has the potential to dramatically increase this number. We can’t let that happen. Ultimately, families need more support to see them through this crisis and we urge the government to intervene and increase Child Benefit payments, which have been subject to freezes since 2011, by £10 per child, per week. This payment will go a long way to helping families cover additional costs – such as extra meals and other household costs – and prevent even more children from being plunged into poverty.”

The survey findings also show:

- * 2.2 million households, including 2.5 million children, are currently unable to afford rent or mortgage payments

- * 1.8 million households, including 2.0 million children, are currently unable to afford heating or electricity costs.

- * 602,000 households, including 944,000 children are currently unable to afford childcare essentials, like nappies and baby food

- * 571,000 households, including 934,000 children are currently unable to afford essential school supplies, due to coronavirus affecting employment.

A large number of families are anticipating a significant drop in their income with 11% of households expecting their net household income to drop below £1000 in April. This corresponds to 1.9 million children affected by this drop.

Summary of recommendations to the government:

- 1. Increase Child Benefit by £10 per child per week. This would provide a fast and effective way of reaching the families of 12.7 million children. This increase, on top of uprating from 6 April, would reduce child poverty by approximately five percentage points.

- 2. Suspend the Benefits Cap and Two-child Limit*, both of which stop many families from getting the necessary amount of support they need to get by.

ABC Comment, have your say below:

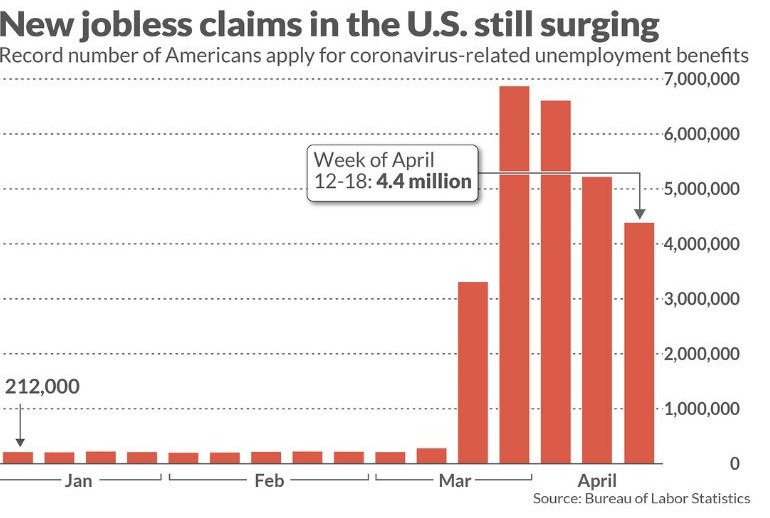

US Unemployment at Record Level

US UNEMPLOYMENT - Another 4.4 million people filed jobless claims in the U.S. last week, bringing the five-week total to a staggering 26 million, the highest on record.

ABC Comment, have your say below:

eBay Resolve an Issue

BUYING ONLINE - We ordered a pack of two 'hotel quality' pillows from eBay and only one pillow turned up. This is difficult because there was no delivery note in the parcel. However, the invoice showed two items.

So we wrote to the trader and complained:

Nasir Amini

32 Hammerton Street

Bradford West Yorkshire BD3 9QQ

However, we had NO response.

So we contacted eBay. Once we found the right area on the website and we chatted with customer services on-line, a refund was offered for the missing pillow. The process was much less stressful than we thought and customer services organised a refund without a fuss. Buying online is risky. Just delivering half the order could see plausibly denial. So overall we're impressed and having bought a mobile phone from eBay previously with no issues, we have had our confidence in eBay restored.

In the meantime, if you are thinking of buying pillows from Mr Amini, you might get a better nights sleep, buying them elsewhere.

We found this website very useful: https://www.thebalancesmb.com/ebay-buyer-complaint-tips-1140309

ABC Comment, have your say below: