Today's Employment Figures Not Showing the Full Picture However Lack of Vacancies Alarming

Tuesday 19 May, 2020 Written by Simon Collyer

ONS - The latest employment figures are released today however they do not show the effects yet of COVID-19 and the pandemic. What is showing that is very interesting is the rapid decline in vacancies. What seems clear to us that had their not been this pandemic that the economy worldwide was facing a major downturn after ten years of stimulus packages following the Great Recession in 2008. Truth be told it was like breathing life into a corpse. Employment grew but what was the real quality of jobs? Real incomes were falling a lot of the time during this period an odd thing to happen during a period of full employment.

According to the BBC, The number of people claiming unemployment benefit in the UK soared to 2.1 million in April, the first full month of the coronavirus lockdown.

The total in April jumped by 856,500, the Office for National Statistics (ONS) said.

Before the lockdown began, employment had hit a record high.

The benefit claimant count does not include everyone who is out of work since not all can claim assistance, but it does indicate the trend.

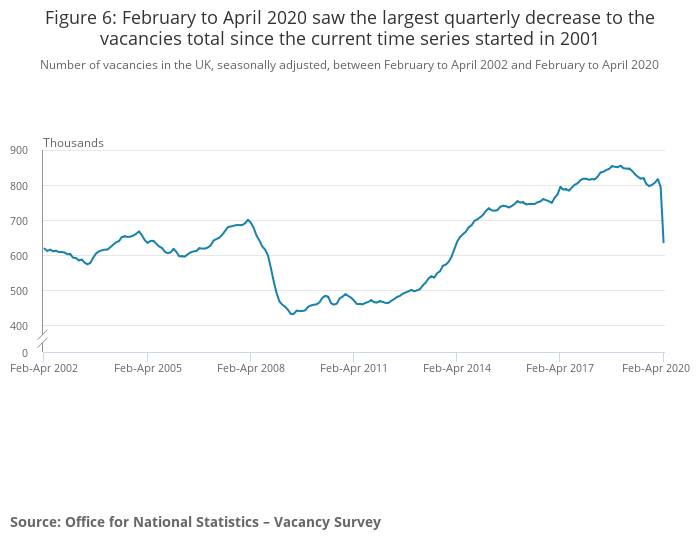

In another indication of the bleak employment landscape, the number of job vacancies fell by nearly a quarter to 637,000 in the three months to April.

Meanwhile, claims for universal credit - the benefit for working-age people in the UK - hit a record monthly level in the early weeks of lockdown.

According to research by the Resolution Foundation, young people are most likely to have lost work or seen their income drop because of the coronavirus pandemic.

More than one in three 18 to 24-year-olds is earning less than before the outbreak, the research indicated.

It said younger workers risk their pay being affected for years, while older staff may end up involuntarily retired.

The ONS have said:

The coronavirus (COVID-19) pandemic has been a major shock to the UK economy. The Office for Budget Responsibility (OBR)'s three-month lockdown scenario analysis forecasts a 13.0% fall in annual gross domestic product (GDP) in 2020 and the unemployment rate to reach 10.0% by Quarter 2 2020, before gradually reducing to just below 6.0% by the end of 2021.

In the three months to March 2020, GDP fell by 2.0%, signalling the first direct impact of the coronavirus on the economy. The production sector fell by 2.1%, construction by 2.6% and the services sector by 1.9%.

The latest Labour Force Survey (LFS) estimates published today (19 May 2020) cover the period January to March 2020, and therefore remain mostly unaffected by the impact of the coronavirus. On the quarter, employment increased 211,000 to 33.14 million. Alongside official statistics from the LFS, the Office for National Statistics (ONS) and HM Revenue and Customs (HMRC) jointly published a experimental monthly flash estimate of paid employees and their pay from Pay As You Earn Real Time Information. The estimates for April 2020 indicate that the number of paid employees fell by 1.2% compared with April 2019, and fell by 1.6% when compared with March 2020. The median monthly pay grew by 2.7% in March 2020, compared with the same period of the previous year. In addition, the median monthly pay for April 2020 fell by 0.9% compared with the same period of the previous year.

In addition, the latest Vacancy Survey estimates for the period February to April 2020 show that the number of vacancies decreased by 21.0% compared with the previous quarter, showing a slump in the demand for labour. The decrease of 170,000 vacancies is the largest quarterly fall in the history of the time series. The Institute for Employment Studies' (IES) analysis of the ADZUNA vacancy data shows that the overall vacancy level decreased by 59% between the second week of March and the week ending 3 May 2020.

Further evidence of the impacts of the coronavirus pandemic on the labour market are reflected in the ONS Business Impact of Coronavirus (COVID-19) Survey (BICS). The survey for the period 6 April to 19 April 2020 showed that 23.0% of businesses that responded had temporarily closed or paused trading. Across all industries, 28.0% of the workforce had been furloughed under the terms of the UK government's Coronavirus Job Retention Scheme, and less than 1% of the workforce was made redundant. Workers on the furlough scheme are not at work but remain employed.

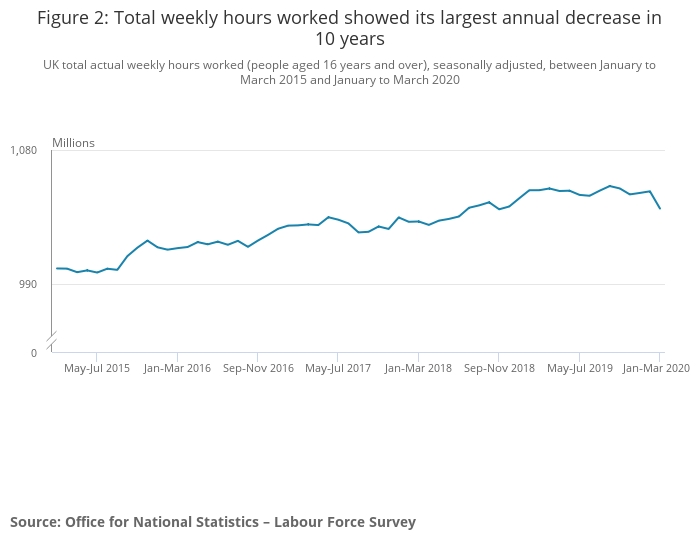

Experimental LFS weekly hours data show that seasonally-adjusted actual hours worked in the main job declined in the last two weeks of March 2020. Compared with the same period in 2019, the numbers of people who were temporarily away from work, and those who worked fewer than usual hours because of economic reasons both increased, which contributed to lower actual hours worked.

The Bank of England (BoE) Monetary Policy Report (MPR) for May 2020 covers findings from the Bank/Ipsos MORI Survey, in which over half of employed respondents reported that they were employed but not currently working, or were working fewer hours, as a result of the pandemic. Most workers said that it was a result of firm closure or lower demand. The MPR also reports that the combination of lower individual productivity and disrupted supply chains is expected to cause a fall in labour productivity on a per-hour basis. It also anticipates a larger fall in productivity per head because furloughed workers are still employed but may have zero working hours. The self-employed were most likely to report working fewer hours.

Comparing various indicators shows that the impact of the coronavirus has been felt to greater extent by certain industries. The accommodation and food services activities sector recorded the largest quarterly decrease in vacancies (negative 32,000) for the period February to April 2020 and the largest proportion of workforce being furloughed (73.0%) based on BICS Wave 3 data. The accommodation and food services activities output declined by 9.5% in the three months to March 2020, based on GDP first quarterly estimates for Quarter 1 2020.

The Department for Work and Pensions (DWP)'s weekly management information on Universal Credit (UC) "declarations" (claims) and advances also provide an indication of performance of the labour market in terms of the unemployed and those in employment who qualify for UC. The DWP reports that, since the start of the pandemic, there have been exceptional levels of demand for UC. However, not all applicants will be eligible for benefits.

The experimental Claimant Count data, which cover claims for Jobseeker's Allowance and those claimants in the UC "searching for work" conditionality, show that there was a 69.1% increase in the number of claims between March and April, taking the level to over 2 million. The IHS Markit UK Household Finance Index for April 2020 shows that the coronavirus pandemic has caused households' perceptions of employment incomes and job security to decline.

Figures released today show that total and regular average weekly earnings growth slowed to 2.4% and 2.7% respectively in the three months to March 2020. In addition, consumption and expenditure patterns as reflected through the ONS's retail sales data in Great Britain for March 2020 changed. The initial impacts of the coronavirus on retail sales in March were a sharp fall in sales volume (5.1%) and strong growth in online sales as a proportion of all retailing (22.3%).

ABC Comment, all in all the situation looks pretty bleak. Coronavius has distracted people from a major downturn anyway, it has been an excuse to pump 'helicopter' money into many economies without having to come up with an excuse for printing money.

ABC Comment, have your say below:

1 comment

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here