Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

The ABC Helps Derbyshire Damsels in Distress Avoid Lock Down Injustice

LOCKDOWN OFFENSES - Not quite the usual remit from the ABC but we wrote to the Police and Crime Commissioner in Derbyshire following the fines served on women who were fined £200 each when they drove five miles for a walk by Foremark Reservoir, Derbyshire.

From the BBC: Jessica Allen and Eliza Moore were walking at Foremark Reservoir, Derbyshire, when they were "surrounded" by officers.

At the time Derbyshire Police insisted driving to exercise was "not in the spirit" of the most recent lockdown.

But new national guidance for police has led the force to quash the fines, and apologise to the women.

And

The ABC wrote this to the Derbyshire Police and Crime Commissioner and to the BBC

Image: Jessica Allen and Eliza Moore meet the Derbyshire police.

https://www.bbc.co.uk/news/uk-england-derbyshire-55547302

I founded the ABC (see below) and I am chasing funding for SAILING WELLNESS a mental health opportunity for military personnel suffering from PTSD and mobility issues.

The BBC created a video about the EU Blue Health project: https://youtu.be/jM48kK_0IGw

Leading the UK’s Blue Health research effort is:

Lora E FLEMING MD PhD MPH MSc

Professor, Chair, Director

European Centre for Environment and Human Health

University of Exeter Medical School

College of Medicine and Health

University of Exeter

c/o Knowledge Spa RCHT

Truro Cornwall TR1 3HD

Tel +44(0)1872242595

Derbyshire's new chief constable Rachel Swann needs to familiarise herself with this project. I have sent a copy of this email to:

The Official Website Of The Police And Crime Commissioner For Derbyshire.

The police have obviously have to have had a rethink about these ladies and their Coivid-19 health and well being activities. It is hard for the police I know to distinguish rule breakers from those seeking relief from ‘Cabin Fever’ and lockdown. However this initiative points to the mental health benefits of being on or near water.

I would be happy to talk on the BBC about this and why I think ‘Blue Health’ is important.

<end>

Image courtesy of the BBC: Jessica Allen and Eliza Moore,

ABC comment have your say below:

UK Government Bends to Pressure to Provide More Homeless Help Moving Eviction Ban Once More

RENTERS - The government has caved in to pressure and extended the eviction moratorium. The government are providing extra funding to help councils homeless people.

In Scotland, the ban on eviction orders, which was due to expire on 22 January, was extended to the end of March on Thursday.

This will apply to all evictions in areas subject to level three or four restrictions, except in cases of serious anti-social behaviour, including domestic abuse.

Now, in Wales, plans have been announced to extend its ban to the end of March with ministers saying this "is an extremely difficult time for many people and renters should not be forced out of their homes".

Extra support to help protect rough sleepers and renters from the effects of COVID-19 has been announced by the Communities Secretary Robert Jenrick today (8 January 2021).

Backed by an additional £10 million in funding, all councils in England are being asked to redouble their efforts to help accommodate all those currently sleeping rough and ensure they are swiftly registered with a GP, where they are not already.

This will ensure they can be protected from the virus and contacted to receive vaccinations in line with the priority groups outlined by the Joint Committee on Vaccination and Immunisation.

Councils will also be asked to reach out again to those who have previously refused help, given rising infection rates and the colder winter months.

Renters will continue to be supported during the new national restrictions, with an extension to the ban on bailiff evictions for all but the most egregious cases for at least 6 weeks – until at least 21 February – with measures kept under review.

Image: Rt Hon Robert Jenrick MP.

Communities Secretary, Rt Hon Robert Jenrick MP said:

At the start of this pandemic we made sure that the most vulnerable in society were protected. This winter, we are continuing in this vein and redoubling our efforts to help those most in need.

Our ongoing Everyone In initiative is widely regarded as one of the most successful of its kind in the world, ensuring 33,000 people are safe in accommodation. We are now going further and focusing on GP registration of rough sleepers.

We are also extending the ban on bailiff evictions – helping to protect the most vulnerable renters.

Court rules and procedures introduced in September to support both tenants and landlords will remain in place and regularly reviewed. The courts will continue to prioritise cases, such as those involving anti-social behaviour, illegal occupation and perpetrators of domestic abuse in the social sector.

Landlords continue to be required to give 6-month notice periods to tenants until at least 31 March except in the most serious circumstances.

Councils will work closely with local health partners to ensure those sleeping rough are able to access the COVID-19 vaccine in line with the priority groups outlined by the Joint Committee on Vaccination and Immunisation.

This will be done through a GP, or by other means if mainstream provision is unsuitable, ensuring that the wider health needs of rough sleepers are addressed and assessed for clinical vulnerability to COVID, supporting them now and for the future.

Image: Jon Sparkes, Chief Executive of Crisis.

Jon Sparkes, Chief Executive of Crisis, said:

These renewed efforts to protect people who are homeless in the pandemic will save lives.

It was truly a landmark moment when, back in March, everyone on the streets was offered somewhere safe to stay. It’s as important, if not more so, that today we see government leadership to protect all those sleeping rough. The highly infectious new strain of coronavirus alongside the cold weather makes this the most dangerous moment of the pandemic for those without a home.

What is very welcome here is the two-pronged approach – a continued commitment to getting everyone into safe accommodation but also now making sure people are registered with a GP so they can quickly access the vaccines. We know through our services that people facing homelessness often are not registered with a doctor’s surgery. Addressing this issue will be a lifesaving intervention and a step towards ensuring people who are homeless are protected in the longer-term.

Image: Steve Douglas CBE.

Steve Douglas CBE, Chief Executive of St Mungo’s, said:

We and other homelessness charities called on government to provide an urgent and decisive response to support those sleeping rough who now face the double threat of severely cold weather and a continued health emergency.

We welcome this response and will work with our local authority and health partners to provide both the immediate accommodation and the health care advice that is needed to protect lives.

A new mediation pilot will further support landlords and renters who face court procedures and potential eviction from next month (February). It will offer mediation as part of the possession process to try and help landlords and tenants to reach a mutual agreement and keep people in their homes.

Helping to resolve disputes through mediation will enable courts to prioritise urgent cases, supporting landlords and tenants to resolve issues quickly without the need for a formal hearing. The mediation pilot will work within the existing court arrangements in England and Wales.

The protections for renters are on top of the comprehensive package of support the government has put in place to help households, including support for businesses to pay staff salaries and strengthening the welfare safety-net by billions of pounds.

This has helped to protect renters from the economic fallout of the pandemic by supporting them meet their outgoings, including paying their rent.

The government has also provided unprecedented support for rough sleepers during the pandemic. This £10 million investment builds on more than £700 million government spending on homelessness and rough sleeping this year alone.

Through Everyone In, by November we had supported around 33,000 people with nearly 10,000 in emergency accommodation and over 23,000 already moved on into longer-term accommodation.

Further information

Renters’ additional information

The package of support is reducing the number of evictions as applications to the courts for possession by private and social landlords were down 86% between July and September 2020, compared to the same quarter in 2019. No repossessions were recorded between April and end September 2020 compared to 14,847 in the same period last year.

The government has changed the law in England to ensure bailiffs do not enforce evictions for 6 weeks until 22 February, with no evictions expected to 8 March at the earliest. This will be kept under review.

The only exceptions to this are for the most egregious cases – anti-social behaviour, illegal occupation, death of a tenant where the property is unoccupied, fraud, perpetrators of domestic abuse in social housing and extreme rent arrears equivalent to 6 months’ rent.

Guidance to support landlords and tenants in the social and private rented sectors understand the possession action process and new rules within the court system in England and Wales is available.

For those renters who require additional support, there is an existing £180 million of government funding for Discretionary Housing Payments for councils to distribute to support renters with housing costs.

Rough sleepers’ additional information

A recent study published by the Lancet showed that because of this response 266 deaths were avoided during the first wave of the pandemic among England’s homeless population, as well as 21,092 infections, 1,164 hospital admissions and 338 admissions to Intensive Care Units.

The government has allocated £91.5 million to 274 councils in September to fund immediate support and interim accommodation for vulnerable people, as well as the £10 million Cold Weather Fund for councils to help to keep rough sleepers safe this winter.

This is alongside over £150 million to bring forward 3,300 long-term homes this year alone, alongside £112 million funding of the Rough Sleeping Initiative this year.

Councils have also received £4.6 billion in unringfenced grants to help them to manage the impacts of COVID-19, which we have been clear includes their work to support rough sleepers.

ABC Note: The National Residential Landlords Association have consistently opposed efforts to extend the eviction ban and they must be condemned for their attitude. Calls for financial support for landlords are likely to fall on deaf ears and have little sympathy from the public.

The NRLA says the move will do nothing to support landlords and tenants long term and what is needed is a comprehensive financial package, to allow tenants to continue to pay their rent without building unmanageable debt.

The restrictions do include exemptions, meaning landlords whose tenants have built rent arrears for six months, irrespective of when they were accrued, will now be able to repossess alongside exemptions for anti-social behaviour, fraud and the most egregious cases. The move comes as a result of a sustained NRLA campaign, which includes calls for a comprehensive package of financial support to help tenants pay their rent.

Ben Beadle, NRLA chief executive said: “The repossessions ban is a sticking plaster that will ultimately lead to more people losing their homes. It means tenants’ debts will continue to mount to the point where they have no hope of paying them off leading eventually to them having to leave their home.

“Instead the Government should recognise the crisis facing many tenants and take immediate action to enable them to pay their debts as is happening in Scotland and Wales. The objective should be to sustain tenancies in the long term and not just the short term.”

ABC Comment, have your say below:

Scottish Parliament Moves to Protect Scottish Tenants from Eviction But Where is Boris Johnson and the Tory Response Ask Renters?

EVICTIONS - Scot's organise a temporary ban on eviction orders will be extended until the end of March.

Regulations will be laid in the Scottish Parliament on 14 January to extend the current ban, which is in place at present until 22 January. The extended ban – will apply to all evictions in areas subject to level 3 or 4 restrictions, except cases of serious anti-social behaviour, including domestic abuse. Subject to review every three weeks to ensure it remains necessary to protect against the spread of coronavirus (COVID-19), it will remain in force until 31 March.

This will provide renters with safe homes during the pandemic. It will reduce the burden on local authorities, who have a duty to rehouse people made homeless through evictions, and will also make it easier for people to follow the guidelines during the current lockdown.

Housing Minister Kevin Stewart said:

“Extending the temporary ban on the enforcement of eviction orders in the private and social rented sectors in areas subject to level 3 and 4 restrictions will support tenants, and offer people protection from transmission of the virus by being able to stay safe in their homes.

“It will also prevent additional burdens being placed on health and housing services during a time where they are already working hard due to the impact of the pandemic. This is a proportionate response to an extremely challenging set of circumstances.

“In the case of serious anti-social or criminal behaviour – including domestic abuse – eviction orders can still be enforced.

“We have been clear that no landlord should evict a tenant because they have suffered financial hardship due to the pandemic. Tenants in difficulty should engage with their landlord and seek advice on the options open to them.”

Background:

Other measures to protect renters in Scotland during coronavirus were taken in the Coronavirus (Scotland) Act 2020.

These apply to all eviction notices issued on, or after, 7 April 2020. The original end date was 30 September 2020.

A number of actions have been taken to support tenants through the pandemic, including increasing the Discretionary Housing Fund from £11 million to £19 million to provide additional housing support and the introduction of the Tenant Hardship Loan Fund.

Further information on tenants’ rights during the pandemic can be accessed here: https://www.mygov.scot/private-rental-rights/

ABC Note: Where is Boris Johnson on evictions? The Tory government was elected on the basis they were going to repeal Section 21 but nothing has happened?

Half a million renters in arrears as evictions set to resume.

Average amount owed on rent is over £700, with an estimated £360 million owed across the UK says Citizens Advice. One in four private renters in arrears have been threatened with eviction or cancellation of contract by their landlord. Half a million private renters in the UK are behind on their rent, with protections against eviction due to expire this weekend.

ABC Comment, have your say below:

Investment Banks Live Large Generating $124.5 Billion in Fees While the Poor Suffer

INVESTMENT BANKS – If our government in the UK claims they cannot find £20 a week to renew the Universal Credit increase in April, perhaps they should look at the Investment Bank results.

Top 5 US Investment Banks Accounted for 30% of Global Investment Banking Fees in 2020.

Investment banks generated $124.5 billion in investment fees in 2020. According to the research data analyzed and published by Stock Apps, the top five US investment banks accounted for a 30% share of this total, at $37 billion.

JP Morgan Chase took the lead. During the first nine months of the year, it generated $6.8 billion in investment banking fees, getting a 7.5% market share.

IPO Underwriting Fees Soar by 90% in 2020 to $13 Billion, Highest in Two Decades.

Goldman Sachs was second with $5.9 billion and a 6.5% market share. Bank of America was third with $5.3 billion and a market share of 5.9%. Rounding up the top five were Morgan Stanley and Citigroup with $4.9 billion and $4.5 billion, respectively.

The increase in fees was attributed to an increase in the number of businesses raising capital. Per Refinitiv data, businesses raised $300 billion from IPOs globally. In the US alone, they raised $159 billion thanks to an increase of 70% in deal activity during the year. Among the top contributors to the record performance in the US were debt and equity offerings by Boeing and Airbnb.

Boeing raised $25 billion in a bond offering in April 2020. By December, its debt totaled $61 billion. Airbnb raised $2 billion at an $18 billion valuation and sold shares in its December 2020 IPO at a $47 billion valuation.

Moreover, global investment banking fees in the first nine months of 2020 soared by 14% in 2020, reaching $91.2 billion. September 2020 alone saw an increase of 11% to $11.4 billion, the fourth highest ever for investment banking fees. All in all, companies raised over $5 trillion in debt in 2020, setting a new record. IPO underwriting fees during the year soared by 90% to reach $13 billion, the highest level in two decades.

ABC Comment, have your say below:

Energy Arrears Skyrocket As Cold Snap Bites

ENERGY ARREARS - Since February an estimated 2 million households are in arrears with their energy bills according to Citizens Advice. On Average billpayers owe £760 for electricity and £605 for gas.

With an additional 600,000 owing payments to energy suppliers, Linda Dodge, energy expert from energy comparison site SaveOnEnergy.com/uk, has provided key advice to homeowners on what to do if you’re in debt to your energy supplier.

Should I be worried about getting into debt with my energy supplier?

Getting into debt to your energy supplier can be a frightening prospect, but you’re not alone. As energy prices rise, millions of people find it increasingly difficult to keep up with their monthly bills, leading to energy debt. However, your energy supplier will be able to help you put together a plan to get you out of debt.

Can I change energy supplier if I’m in debt?

Yes, although it depends on the length of time that you’ve been in debt. If you’ve been in debt for 28 days or less, you can switch provider and your outstanding balance will be added onto your final bill. This can be a good option if you choose to switch to a cheaper energy plan, as you’ll start paying less for energy, making it easier to pay off what you owe to your old supplier.

If you’ve been in debt for longer than 28 days, you will not be able to switch provider. Legally, you are obligated to pay off what you owe to your supplier before you can switch to a different energy plan with a new provider. At this point, you should get in touch with your energy supplier.

Paying off your debt through a repayment plan

If you’re in debt with gas and electric, your first call should be your energy supplier. Either call or write to your supplier to discuss the situation and find out what help you can receive. After all, it’s in your supplier’s interest that your gas and electric debt is resolved as quickly as possible.

One of the main ways that your energy supplier will help you resolve your energy debt is with a repayment plan, giving you the option of gradually repaying your debt. In most cases, you’ll pay monthly, fortnightly, or even weekly until your energy debt is all paid back. Some of the money will go towards your energy debt, while the rest will pay for the energy that you’re currently using.

In rare cases, people who have organised a repayment plan will not be able to keep up with payments. At this point, it’s possible that you can renegotiate your repayment plan with your supplier so that the payment schedule is more manageable. Citizen’s Advice has a useful letter template that you can use to request a new repayment rate for your energy debt.

Paying off your debt through a prepayment meter

If you’re paying off your gas and electric debt through a prepayment meter, you can switch to a new supplier (assuming you owe less than £500 for electricity and £500 for gas). This is called the “Debt Assignment Protocol.” Basically, your new supplier takes on the debt and you’ll continue to repay it.

In addition, you can ask your current supplier to fit a prepayment meter so that you can pay off your energy debt over a longer period. In some cases, your supplier can receive a court warrant to enter your home and fit a prepayment meter. If you do switch to a prepayment meter for debt, you may be put on a more expensive tariff, so it’s a good idea to talk to your supplier to see if this is the right move for you.

The main benefits of prepayment meters are the fact that they give you much more control over your energy spending. You can’t spend more than you put in the meter (usually through some sort of top-up system), which stops you from running up a significant energy debt.

Plus, installing a prepayment meter is more likely to lead people to pursue other energy-saving initiatives, such as keeping the lights switched off or installing energy-saving bulbs, all of which reduces the amount you spend on energy and makes it easier to pay back your gas and electric debt.

Of course, if you do run out of credit, you won’t be able to receive electricity or gas, which means that it’s very important to stay on top of your prepayment meter debt.

Paying off your debt through your benefits

Yes, in some cases you may be able to make small deductions from your benefits that go towards paying off your gas and electric debt. This is known as the Fuel Direct Scheme or third-party deductions. Essentially, a fixed amount will be deducted from your weekly benefits to cover the amount you owe, as well as your current use. To benefit from the Fuel Direct Scheme, you must be receiving one of the following benefits:

- Income Support

- Pension Credit

- Income-Based Jobseeker’s Allowance

- Income-related Employment and Support Allowance

- Universal Credit (if you’re unemployed)

There are a couple of other schemes that can contribute to your energy bills. Although they aren’t specifically designed for people who are in debt with gas and electric, the Warm Home Discount, Winter Fuel Payment, and Cold Weather Payment schemes can be a useful way for low-income or elderly people to get some assistance with their bills.

What happens if the energy supplier I am in debt to closes?

Even if you’re in debt with gas and electric to a supplier that shuts down before you’ve finished repaying what you owe, you still need to keep making payments unless you’re told otherwise. In some cases, your new supplier will have arranged to take on your debt, so you’ll need to pay back the energy debt to it.

Can my energy supplier disconnect me?

Yes, as a last result, your energy supplier may apply for a warrant to disconnect your energy supply. Before disconnecting you, you’ll be sent a disconnection notice at least 28 days after your bill. In addition, suppliers are legally required to give you seven days’ written notice. Once you have received a disconnection notice, there is usually very little that you can do as it represents the final straw for the energy supplier. However, if you are disabled, have serious financial problems, or long-term health problems, there are extra measures to help protect you from being disconnected.

Image: Icy weather courtesy of the Express.

ABC Comment, have your say below:

Rogue Employers Named and Shamed For Failing To Pay Minimum Wage

ROGUE EMPLOYERS - The 139 named companies failed to pay £6.7 million to over 95,000 workers.

Published 31 December 2020

From: Department for Business, Energy & Industrial Strategy, Low Pay Commission, and Paul Scully MP

139 companies, including major household names, have short-changed their employees and have been fined

Offending firms failed to pay £6.7 million to their workers, in a completely unacceptable breach of employment law.

Image: Business Minister Paul Scully.

Business Minister Paul Scully says the list should be a ‘wake-up call’ to rogue bosses, as department relaunches naming scheme after 2-year pause.

Almost 140 companies, including some of the UK’s biggest household names, are being named and shamed today for failing to pay their workers the minimum wage.

Investigated between 2016 and 2018, the 139 named companies failed to pay £6.7 million to over 95,000 workers in total, in a flagrant breach of employment law. The offending companies range in size from small businesses to large multinationals who employ thousands of people across the UK.

Preserving and enforcing workers’ rights is a priority for this government. While the vast majority of businesses follow the law and uphold workers’ rights, the publication of the list is intended to serve as a warning to rogue employers that the government will take action against those who fail to pay their employees properly.

This is the first time the government has named and shamed companies for failing to pay National Minimum Wage since 2018, following reforms to the process to ensure only the worst offenders are targeted.

Business Minister Paul Scully said:

Paying the minimum wage is not optional, it is the law. It is never acceptable for any employer to short-change their workers, but it is especially disappointing to see huge household names who absolutely should know better on this list.

This should serve as a wake-up call to named employers and a reminder to everyone of the importance of paying workers what they are legally entitled to.

Make no mistake, those who fail to follow minimum wage rules will be caught out and made to pay up.

Image: Bryan Sanderson.

Bryan Sanderson, Chair of the Low Pay Commission, said:

There can be no excuses for non-compliance with the minimum wage rates. The annual changes are well publicised 6 months in advance following a well understood process.

Those affected are among the most needy and vulnerable in our country - the companies concerned should be deeply ashamed of their performance.

One of the main causes of minimum wage breaches was low-paid employees being made to cover work costs, which would eat into their pay packet, such as paying for uniform, training or parking fees.

Also, some employers failed to raise employees’ pay after they had a birthday which should have moved them into a different National Minimum Wage bracket.

Employers who pay workers less than the minimum wage have to pay back arrears of wages to the worker at current minimum wage rates. They also face hefty financial penalties of up to 200% of arrears - capped at £10,000 per worker - which are paid to the government. Each of the companies named today have paid back their workers, and were forced to pay financial penalties.

While not all breaches of minimum wage rules are intentional, it is the responsibility of all employers to ensure they are following the law. With this round, we are also publishing a short educational bulletin that summarises public guidance on paying workers and common reasons for underpayment – helping to ensure that workers are not short-changed in future.

National Minimum Wage Naming Scheme, Round 16: educational bulletin (PDF, 242KB, 6 pages)

The companies the government is naming today were served a notice of underpayment between September 2016 and July 2018, following investigations by HMRC.

Last month, the government announced a measured increase in National Living Wage and National Minimum Wage rates, which will come into effect from April 2021. Every worker is entitled to the National Minimum Wage, no matter their age or profession.

This is the full list of companies named for failing to pay the National Minimum Wage:

- Tesco stores Limited, Welwyn Hatfield AL7, failed to pay £5,096,946.13 to 78,199 workers

- Pizza Hut (U.K.) Limited, City of Edinburgh WD6, failed to pay £845,936.41 to 10,980 workers

- The Lowry Hotel Limited, trading as The Lowry Hotel, Salford EC4A, failed to pay £63,431.51 to 99 workers

- Doherty & Gray Limited, Mid and East Antrim BT42, failed to pay £43,470.16 to 128 workers

- Independent Care & Support Ltd, Medway ME2, failed to pay £40,275.17 to 55 workers

- Amber Valley Council for Voluntary Services, trading as Amber Valley Centre for Voluntary Services, Amber Valley DE5, failed to pay £37,346.46 to 104 workers

- Premier Care Limited, Salford M27, failed to pay £31.198.61 to 407 workers

- Hill Biscuits Limited, Tameside OL7, failed to pay £25,867.06 to 247 workers

- Sendon Garage Services Limited, Lambeth SW8, failed to pay £24,869.52 to 2 workers

- Natural Nails Beauty London Ltd, Haringey N15, failed to pay £15,265.58 to 4 workers

- Superdrug Stores PLC, Croydon CR0, failed to pay £15,228.57 to 2222 workers

- St Johnstone Football Club Limited (The), Peth and Kinross PH1, failed to pay £14,266.74 to 28 workers

- Home Grown Hotels Limited, New Forest SO43, failed to pay £13,790.44 to 25 workers

- Rebus Construction Ltd, Hart RH12, failed to pay £13,379.94 to 5 workers

- Mrs Emma Hartley, trading as Whitehall Hairdressing, Leeds, failed to pay £12,882.14 to 2 workers

- The Walshford Inn Limited, trading as The Bridge Hotel & Spa, Harrogate W1W, failed to pay £11,947.23 to 26 workers

- Southern Health and Social Care Trust, Armagh City, Banbrige and Craigavon, failed to pay £11,285.34 to 269 workers

- Müller UK & Ireland Group LLP, Shropshire TF9, failed to pay £10,702.11 to 54 workers

- Dakota Forth Bridge Limited- Dissolved 20/03/2020, City of Edinburgh S70, failed to pay £10,236.50 to 4 workers

- Pinnacle PSG Limited, City of London NW1, failed to pay £10,166.03 to 10 workers

- Preystone Property Investments Limited, trading as Battlesteads Hotel and Restaurant, Northumberland NE48, failed to pay £9767.15 to 26 workers

- Western Brand Poultry Products (NI) Ltd, Fermanagh and Omagh BT92, failed to pay £9,275 to 50 workers

- Nahid Residential Limited, trading as Manor House Hotel, Guildford GU1, failed to pay £9,159.53 to 5 workers

- Norfolk Coastal Pubs Limited, trading as The Golden Fleece, North Norfolk NR23 failed to pay £8,141.69 to 14 workers

- Worldwide Foods (Birmingham) Limited, trading as Al-Halal Supermarket, Birmingham B10, failed to pay £8,062.88 to 1 worker

- Eat Food Limited, trading as Albatta Restaurant, Colchester CO1, failed to pay £7,987.15 to 5 workers

- G & J Properties Limited, Bolton BL7, failed to pay £7,858.16 to 1 worker

- Adi’s Hand Car Wash Ltd - Dissolved 19/02/2019, Barking and Dagenham RM8, failed to pay £7,750.84 to 2 workers

- South Eastern Health and Social Care Trust, Lisburn and Castlereagh BT16, failed to pay £7,564.66 to 193 workers

- Discount Wallpapers Limited, trading as O’Neills Decorating Centre, Bolton WA12, failed to pay £7,446.14 to 11 workers

- Sturgess & Thompson Limited, Leicester LE1, failed to pay £7,385.40 to 2 workers

- Belfast Health and Social Care Trust, Belfast BT9, failed to pay £7,303.41 to 192 workers

- Helio Leisure Limited, trading as Helio Fitness, Fylde FY3, failed to pay £7,298.69 to 26 workers

- Northern Health and Social Care Trust, Antrim and Newtownabbey, failed to pay £6,900.72 to 146 workers

- Hoar Cross Hall Limited, East Staffordshire OX7, failed to pay £6,651.94 to 26 workers

- Renard Resources Limited, Westminster WC2E, failed to pay £6,492.95 to 484 workers

- Imago @ Loughborough Limited ,Charnwood LE11, failed to pay £6,319.05 to 101 workers

- Western Health and Social Care Trust, Derry City and Strabane, failed to pay £6,170.97 to 170 workers

- Littlemoss Preservation Limited, Tameside M43, failed to pay £5,434.18 to 4 workers

- Mr Phillip Brookman, trading as Phillip Brookman Decorator & Plasterer, Cardiff failed to pay £5,141.70 to 1 worker

- O & H Electrical Limited, Torbay TQ2, failed to pay, £5,139.02 to 6 workers

- Mr Jonathan Evans, trading as Jonty Evans Equestrian Activities, Gloucester, failed to pay £5,008.16 to 5 workers

- SKL Professional Recruitment Agency Limited, trading as SKL Homecare, Hertsmere WD19, failed to pay £4,628.69 to 43 workers

- Wigan Rugby League Club Limited, trading as Wigan Warriors, Wigan WN5, failed to pay £4,559.24 to 1 worker

- Mr Blerim Bajrami, trading as Secure Hand Car wash, Cannock Chase, failed to pay £4,475.01 to 3 workers

- Tring Park Day Nursery Ltd, Dacorum HP23, failed to pay £4,415.63 to 2 workers

- Pet Charmer Ltd - Company in liquidation April 2019, trading as Wild Animal Adventures and Pet Mania, Stockton-on-Tees LS15, failed to pay £4,168.90 to 1 worker

- WKW Partnership Limited, trading as Cairngorm Hotel, Highland KA21, failed to pay £4,057.00 to 7 workers

- Mr Roan Bradshaw and Ms Joy Bradshaw, trading as First Glance, Lewisham, failed to pay £3,997.58 to 1 worker

- Costco Wholesale UK Limited , Hertsmere WD25, failed to pay £3,747.52 to 58 workers

- Gregg Little Testing Centre Limited, County Durham TS18, failed to pay £3,703.90 to 4 workers

- Solent Build Group Limited - Company Status Liquidation 06/12/2018, Southampton SO51, failed to pay £3,676.33 to 1 worker

- Blakerin International Holdings Limited, trading as Cumbria Park Hotel, Carlisle LA12, failed to pay £3,611.13 to 46 workers

- Multitech Site Services Limited, Uttlesford CM6, failed to pay £3,294.52 to 1 worker

- Dr Jaskaram Bains and Dr Bernie Chand, Hanwell Dental Practice, Unknown, failed to pay £3,072.25 to 5 workers

- Byron Hamburgers Limited, Westminster W1D, failed to pay £3,062.03 to 77 workers

- Nina’s Nursery (Davenport) Limited, Stockport SK2, failed to pay £3,058.20 to 18 workers

- Walton Bannus Estates Limited, Harborough LE17, failed to pay £3,051.60 to 2 workers

- Circus in Schools Limited - Notice of voluntary strike-off - Nov 17, Cornwall TR13, failed to pay £2,958.85 to 2 workers

- KKM Enterprises Limited- Liquidation- 23/08/2019, trading as The Cleaning Company, Redbridge B77, failed to pay £2,876.68 to 4 workers

- The Bobby Dhanjal Practice Limited, trading as Bobby Dhanjal Wealth Management, Blaby LE19, failed to pay £2,868.69 to 3 workers

- Manor House Country Hotel Limited, Fermanagh and Omagh BT94, failed to pay £2,837.04 to 139 workers

- Morden Estates Company Limited, Dorset BH20, failed to pay £2,761.45 to 43 workers

- The Education Development Service Ltd, Telford and Wrekin TF4, failed to pay £2,520.40 to 2 workers

- Mr Malcolm Gilmour and Mr David Gilmour, trading as Gilmour Bros, South Lanarkshire, failed to pay £2,446.58 to 3 workers

- Storrs Hall Limited, South Lakeland BB1, failed to pay £2,402.23 to 3 workers

- DCS&D Limited Heritage Healthcare, Darlington DL1, failed to pay £2,393.39 to 13 workers

- Rainbow Room (East Kilbride) Limited, South Lanarkshire G74, failed to pay £2,378.77 to 15 workers

- Mr Darran Vaughan, trading as VAS Car Sales, Newry, Mourne and Down, failed to pay £2,351.41 to 1 worker

- Mr Gnanenran Arumugam, trading as Lavender Convenience Store, Cheshire East, failed to pay £2,335.88 to 1 worker

- The Calderdale Community Childcare Company Ltd, Calderdale HX2, failed to pay £2,321.81 to 2 workers

- Gzim Workshop Limited Valeting Car wash, Haringey N17, failed to pay £2,297.21 to 3 workers

- Alaska Fast Foods Ltd - Dissolved 05/02/2019, trading as Freddy’s Chicken & Pizza, Hyndburn M21, failed to pay £2,180.93 to 7 workers

- Tracy Hart, trading as Little Oaks Pre School, Dacorum, failed to pay £2,134.47 to 1 worker

- Chi Yip Group Limited , Oldham M24, failed to pay £2,121.51 to 14 workers

- Four Pillars Hotels Limited, Harrogate HG2, failed to pay £2,092.55 to 29 workers

- Mr William Fleeson, trading as Rainbow Room International, Stirling, failed to pay £2,089.66 to 11 workers

- D & D Decorators Limited, East Ayrshire KA3, failed to pay £2,080.35 to 1 worker

- Kiddi Day Care Limited-Liquidation of the company commenced Feb 2019, trading as Blue Giraffe Childcare, Birmingham SA1, failed to pay £1,978.57 to 9 workers

- Dessian Products Limited, Belfast BT12, failed to pay £1,885.00 to 1 worker

- Crewe Hotel Trading Limited, trading as Holiday Inn Express Crewe, Cheshire East S43, failed to pay £1,871.52 to 19 workers

- Fast Fresh Ltd- Liquidated Dec 2019, trading as Subway, Sunderland BN1, failed to pay £1,833.02 to 3 workers

- Document Transport Limited, trading as Kegworth Hotel, North West Leicestershire PE2, failed to pay £1,801.07 to 10 workers

- Larne Coachworks Limited, Mid and East Antrim BT1, failed to pay £1,791.69 to 1 worker

- Mrs Therese Ann Binns, trading as Winston Churchill, Bradford, failed to pay £1,774.35 to 3 workers

- Mr Brian Wilde, Ms Mariella Gabbutt, Mr Tony Wilde, Mr Joseph Wilde, trading as J & B Wilde & Sons, Manchester, failed to pay £1,717.23 to 4 workers

- UKS Group Limited, Bristol, City of BS1, failed to pay £1,666.88 to 13 workers

- LM Bubble Tea Ltd, trading as Mooboo, Liverpool L15, failed to pay £1,628.49 to 14 workers

- The Wensleydale Heifer Limited, Richmondshire DL8, failed to pay £1,625.89 to 3 workers

- Fewcott Healthcare Limited, Cherwell OX27, failed to pay £1,575.00 to 2 workers

- Hotel Birmingham Ltd , trading as Travellers Inn, Sandwell B69, failed to pay £1,516.25 to 3 workers

- Keasim Glasgow Limited, trading as Malones Glasgow, Glasgow City G2, failed to pay £1,503.43 to 1 worker

- Shades Hair Design Limited- Dissolved 18/12/2018, trading as Shades Hair & Beauty, Bridgend CF32, failed to pay £1,487.98 to 2 workers

- Signature Inns Limited, trading as Westmead Hotel, Bromsgrove B48, failed to pay £1,456.81 to 5 workers

- Kingsland Engineering Company Limited (The), North Norfolk NR26, failed to pay £1,331.79 to 4 workers

- The Roxburghe Hotel Edinburgh Limited (we have been notified that this company is no longer operating and that the Roxburghe Hotel is under new management), City of Edinburgh EH3, failed to pay £1,317.43 to 47 workers

- Business Services Organisation, Belfast BT2, failed to pay £1,310.69 to 32 workers

- Clare McFarlane and Suzanne McGill, trading as Rainbow Room International, South Lanarkshire, failed to pay £1,304.77 to 16 workers

- Mrs Krystle Purdy, trading as Krystalized, Epping Forest, failed to pay £1,294.13 to 1 worker.

- Oakminster Healthcare Limited, trading as Cumbrae House Care Home, Glasgow City G41, failed to pay £1,292.30 to 21 workers

- Rainbows Day Care (Pembrokeshire) Limited-Company dissolved 03/03/2020, Pembrokeshire SA66, failed to pay £1,273.38 to 46 workers

- Maltings Entertainment Limited, trading as Carbon Nightclub and The Mill Bar and Grill Restaurant, Mid Suffolk IP6, failed to pay £1,263.44 to 1 worker

- Ben Ong UK Limited - Company Status Liquidation 28/11/2018, Barnet N12, failed to pay £1,257.12 to 3 workers

- Mr Nosh Fusha, trading as Green Lane Car Wash, Walsall, failed to pay £1,254.73 to 1 worker

- Cygnet Health Care Limited, Tonbridge and Malling TN15, failed to pay £1,249.55 to 15 workers

- Thurlaston Meadows Care Home Ltd, Rugby CV23, failed to pay £1,223.54 to 1 worker

- Trent Park Catering Limited Companies Status- Active Proposal to Strike Off, trading as Trent Park Café, Enfield EN4, failed to pay £1,213.77 to 10 workers

- Lord Hill Hotel Limited, Shropshire SY2, failed to pay £1,168.91 to 18 workers

- Smart Solutions (Recruitment) Limited, Newport NP18, failed to pay £1,152.09 to 90 workers

- Black Rock Hotels Limited, trading as Leighinmohr House Hotel,Mid and East Antrim BT42, failed to pay £1,138.05 to 30 workers

- Gino’s Dial-A-Pizza Ltd, Cannock Chase WS11, failed to pay £1,117.38 to 7 workers

- Mitras Automotive (UK) Limited, Cheshire West and Chester CW7, failed to pay£1,048.29 to 3 workers

- Anjana Bhog Sweets Limited-Dissolved 17/09/19, Brent UB3, failed to pay £1,020.00 to 1 worker

- Mr Mohammed Nasir, trading as Omar Khayyam, City of Edinburgh, failed to pay £935.31 to 2 workers

- About Face Beauty Clinic Limited, Glasgow City G74, failed to pay £924.51 to 6 workers

- Mr Howard Coy, trading as H Coy & Son, Melton failed to pay £902.29 to 1 worker

- Jameson Knight Estates Limited-Dissolved 29/01/2019, Tower Hamlets E2, failed to pay £885.06 to 2 workers

- Croome International Transport Limited, Maidstone ME17, failed to pay £869.19 to 8 workers

- Rainbow Room (24 Royal Exchange Square) Limited, Glasgow City G1, failed to pay £851.70 to 6 workers

- The Coaching Inn Group (No2) Limited-Application for voluntary strike-off - Dec 2019, Boston PE21, failed to pay £811.88 to 2 workers

- Cotswold Motor Group Limited, Cheltenham GL51, failed to pay £796.31 to 2 workers

- Glenpac Bacon Products Limited , Newry, Mourne and Down BT35, failed to pay £752.02 to 2 workers

- Mistsolar Limited, trading as Bridgend Ford, Bridgend CF31, failed to pay £739.00 to 1 worker

- Robinson’s of Failsworth (Bakers) Limited, Tameside M35, failed to pay £736.82 to 9 workers

- Mr Timothy Lock and Mrs Beatrice Lock, trading as Woodborough Hall, Gedling, failed to pay £723.60 to 2 workers

- Nova Display Limited, Leeds LS25, failed to pay £722.78 to 1 worker

- Dessert House on the River Limited- Compulsory notice to strike off - 17/03/20 suspended 29/04/20, trading as Kaspa’s Desserts, Lewisham M16, failed to pay £719.10 to 1 worker

- Mr Edwin Minchin, trading as Eddie’s Diner, Great Yarmouth, failed to pay £670.13 to 3 workers

- The Izaak Walton Hotel (Dovedale) Ltd, Staffordshire Moorlands LA22, failed to pay £667.60 to 2 workers

- Mr David Blake, trading as Foxhills Farm and Riding Centre, Walsall, failed to pay£667.54 to 1 worker

- Shaoke Hospitality Ltd- Dissolved 30/04/2020, trading as Mooboo, Leeds L15, failed to pay £664.94 to 5 workers

- Richard Webster & Co Limited, Eastleigh SO50, failed to pay £621.23 to 1 worker

- Newemoo Limited, Birmingham B5, failed to pay £591.86 to 2 workers

- Regional Buildings Assessments LLP, Hyndburn BB1, failed to pay £562.89 to 2 workers

- Ace Hospitality Ltd, trading as Holiday Inn Express Birmingham- South A45, Birmingham B73, failed to pay £556.15 to 14 workers

- Mrs Elizabeth Norris and Dr Terry Hooper, trading as St Bart’s Day Nurseries, Dover, failed to pay £552.53 to 9 workers

- The Club Company (UK) Limited, Wokingham RG10, failed to pay £540.30 to 11 workers

- Eat Tokyo Limited, Barnet NW11, failed to pay £530.83 to 2 workers

- Molescroft Nursing Home (Holdings) Limited, trading as Beverley Grange Nursing Home, East Riding of Yorkshire HU13, failed to pay £510.24 to 1 worker

ABC Note: The business department said that Britain’s biggest supermarket chain had underpaid 78,199 workers by almost £5.1 million after it failed properly to account for all of its employees’ time.

The Naming Scheme was paused in 2018 so that an evaluation into its effectiveness could be carried out. On 11 February 2020 the government announced that the Naming Scheme would resume.

The government undertook a review of the Naming Scheme in order to ascertain its effectiveness and ensure naming was used in the most efficient way. The review was published in February 2020.

ABC Comment, have your say below:

DWP Benefit Increases in April 2021

BENEFIT INCREASES - In April 2021 below are the increases in benefits based on the old amounts. Universal Credit was given an additional boost of £1,040 a year (around £20 a week or £80 a month) however it is not clear if this will be continued.

Benefit levels had not risen in line with inflation for at least four years.Universal Credit claimants and the benefits it is replacing could have lost as much as £1,800 a year while the cuts were in place.

A similar coronavirus boost was given to those on Working Tax Credits, with the basic element going up by £1,045 per year. Again these could be cut.

These figueres are based on the April 2020 Universal Credit amount after a rise of 1.7 per cent and before the Covid boost was added on top.

Standard allowances

For those single and aged under 25, standard allowance per month will rise from £256.05 to £257.33 (this is lower than the 2020 amount of £342.72 which includes the coronavirus boost)

For those single and aged 25 or over, standard allowance per month will rise from £323.22 to £324.84 (this is lower than the 2020 amount of £409.89 which includes the coronavirus boost)

For joint claimants both under 25, standard allowance per month will rise from £401.92 to £403.93 (this is is lower than the 2020 amount of £488.59. which includes the coronavirus boost)

For joint claimants where one or both are 25 or over, standard allowance per month will rise from £507.37 to £509.91 (this is lower than the 2020 amount of £594.04. which includes the coronavirus boost)

Extra amounts for children

For those with a first child born before April 6, 2017, the extra amount is going up from £281.25 to £282.50

For those with a child (born on or after April 6, 2017) or second child and subsequent child (where an exception or transitional provision applies), the extra amount is going up from £235.83 to £237.08

For those with a disabled child, the lower rate of the additional payment is going up from £128.25 to £128.89 and the higher rate from £400.29 to £402.12

Extra amount for limited capability for work

For those deemed to have limited capability for work, the extra amount is going up from £128.25 to £128.89

For those deemed to have limited capability for work or work-related activity, the extra amount is going up from £341.92 to £343.63

Extra amounts for childcare costs

Those on UC who need help with childcare costs can get up to 85 per cent of it back:

For those on UC with one child, the maximum amount given for childcare costs is staying the same at £646.35

For those on UC with two or more children, the maximum amount given for childcare costs is staying the same at £1108.04

Extra amount for being a carer

If you are on UC and provide care for at least 35 hours a week for a severely disabled person who receives a disability-related benefit, the extra amount you receive in your UC is going up from £162.92 to £163.73

Housing costs

Non-dependants’ housing cost contributions are going up from £75.15 to £75.53 (this is the amount taken off your UC).

Image: Universal Credit faces more cuts.

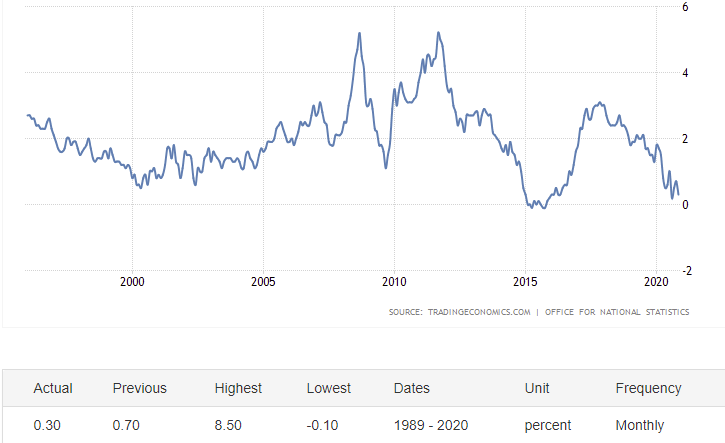

Image: The UK Inflation rate, source the ONS and Trading Economics.

ABC Comment, have your say below:

Number of In-Work Recipients Of Universal Credit Skyrockets During Pandemic Say SNP

UNIVERSAL CREDIT - The SNP has urged the UK Tory Chancellor to make work pay and increase support for those in employment, after new figures revealed the number of people working while claiming Universal Credit has sky-rocketed in the last year.

In 2019, the number of people in Scotland in work and claiming Universal Credit was 71,000. In 2020 that has soared by more than 100,000 to 175,000.

Similar trends have followed in England and Wales with the number of claimants in employment increasing from 739,000 to 1.8million in England and 42,000 to 100,000 in Wales.

The latest figures, independently verified by the Scottish Parliament Information Centre (SPICe), show that nearly two-fifths of all claimants in Scotland, England and Wales are in employment.

Image: SNP MSP Willie Coffey.

Commenting, SNP MSP Willie Coffey said:

“These figures show that the support given out by the Westminster Tory government is nowhere near enough to support hard-working people during the pandemic.

“The harsh realities of the furlough scheme have kicked in for many as even though the Chancellor has offered to pay 80% of wages, bills are not 80% cheaper, food is not 80% cheaper and clothes are not 80% cheaper.

“This has forced people onto Universal Credit and may have led to them piling on more debt as they wait for advance payments.

“That is why the SNP has been calling for the Chancellor to make the £20 uplift in Universal Credit permanent, in order to ensure no one is left worse off by this crisis.

“It’s time the Tory Chancellor provided more support for people in work - ensuring that work pays and Scottish workers have the support needed to get through this pandemic.”

ABC Comment, have your say below:

Trump Does A U-Turn on The Coronavirus Relief And Spending Package Bill

BREAKING NEWS - US President Donald Trump has signed into law a coronavirus relief and spending package bill, US media report, averting a partial government shutdown.

Mr Trump had initially refused to sign the bill, saying he wanted to give people bigger one-off payments.

Millions of Americans are struggling to make ends meet during the pandemic and his refusal to sign the bill has plunged the livelihoods of people across the country into further uncertainty.

The delay meant that millions of Americans temporarily lost unemployment benefits.

The relief package worth $900bn (£665bn) was approved by Congress after months of negotiation.

Trump has spent much of Christmas on the golf course - Christmas Day he was on the fairways with South Carolina's Republican Senator, Lindsey Graham.

Image: South Carolina's Republican Senator, Lindsey Graham.

ABC Note: In the week ending December 19, the advance figure for seasonally adjusted initial claims was 803,000, a decrease of 89,000 from the previous week's revised level. The previous week's level was revised up by 7,000 from 885,000 to 892,000. The 4-week moving average was 818,250, an increase of 4,000 from the previous week's revised average. The previous week's average was revised up by 1,750 from 812,500 to 814,250.

ABC Comment have your say below:

Statement by President-Elect Joe Biden On The Need To Sign The COVID-19 Economic Relief Bill

UNITED STATES - President-Elect Joe Biden makes a statement about the COVID-19 Economic Relief Bill

Statement

It is the day after Christmas, and millions of families don’t know if they’ll be able to make ends meet because of President Donald Trump’s refusal to sign an economic relief bill approved by Congress with an overwhelming and bipartisan majority.

This abdication of responsibility has devastating consequences. Today, about 10 million Americans will lose unemployment insurance benefits. In just a few days, government funding will expire, putting vital services and paychecks for military personnel at risk. In less than a week, a moratorium on evictions expires, putting millions at risk of being forced from their homes over the holidays. Delay means more small businesses won’t survive this dark winter because they lack access to the lifeline they need, and Americans face further delays in getting the direct payments they deserve as quickly as possible to help deal with the economic devastation caused by COVID-19. And while there is hope with the vaccines, we need funding to be able to distribute and administer them to millions of Americans, including frontline health care workers.

This bill is critical. It needs to be signed into law now. But it is also a first step and down payment on more action that we’ll need to take early in the new year to revive the economy and contain the pandemic — including meeting the dire need for funding to distribute and administer the vaccine and to increase our testing capacity.

In November, the American people spoke clearly that now is a time for bipartisan action and compromise. I was heartened to see members of Congress heed that message, reach across the aisle, and work together. President Trump should join them, and make sure millions of Americans can put food on the table and keep a roof over their heads in this holiday season.

ABC Comment, have your say below: