BENEFIT INCREASES - In April 2021 below are the increases in benefits based on the old amounts. Universal Credit was given an additional boost of £1,040 a year (around £20 a week or £80 a month) however it is not clear if this will be continued.

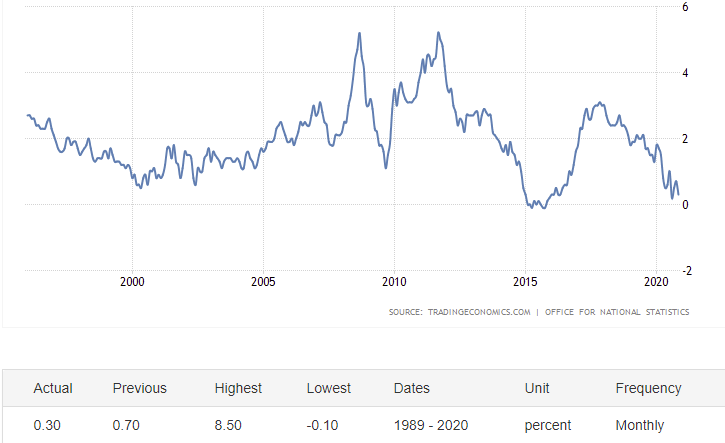

Benefit levels had not risen in line with inflation for at least four years.Universal Credit claimants and the benefits it is replacing could have lost as much as £1,800 a year while the cuts were in place.

A similar coronavirus boost was given to those on Working Tax Credits, with the basic element going up by £1,045 per year. Again these could be cut.

These figueres are based on the April 2020 Universal Credit amount after a rise of 1.7 per cent and before the Covid boost was added on top.

Standard allowances

For those single and aged under 25, standard allowance per month will rise from £256.05 to £257.33 (this is lower than the 2020 amount of £342.72 which includes the coronavirus boost)

For those single and aged 25 or over, standard allowance per month will rise from £323.22 to £324.84 (this is lower than the 2020 amount of £409.89 which includes the coronavirus boost)

For joint claimants both under 25, standard allowance per month will rise from £401.92 to £403.93 (this is is lower than the 2020 amount of £488.59. which includes the coronavirus boost)

For joint claimants where one or both are 25 or over, standard allowance per month will rise from £507.37 to £509.91 (this is lower than the 2020 amount of £594.04. which includes the coronavirus boost)

Extra amounts for children

For those with a first child born before April 6, 2017, the extra amount is going up from £281.25 to £282.50

For those with a child (born on or after April 6, 2017) or second child and subsequent child (where an exception or transitional provision applies), the extra amount is going up from £235.83 to £237.08

For those with a disabled child, the lower rate of the additional payment is going up from £128.25 to £128.89 and the higher rate from £400.29 to £402.12

Extra amount for limited capability for work

For those deemed to have limited capability for work, the extra amount is going up from £128.25 to £128.89

For those deemed to have limited capability for work or work-related activity, the extra amount is going up from £341.92 to £343.63

Extra amounts for childcare costs

Those on UC who need help with childcare costs can get up to 85 per cent of it back:

For those on UC with one child, the maximum amount given for childcare costs is staying the same at £646.35

For those on UC with two or more children, the maximum amount given for childcare costs is staying the same at £1108.04

Extra amount for being a carer

If you are on UC and provide care for at least 35 hours a week for a severely disabled person who receives a disability-related benefit, the extra amount you receive in your UC is going up from £162.92 to £163.73

Housing costs

Non-dependants’ housing cost contributions are going up from £75.15 to £75.53 (this is the amount taken off your UC).

Image: Universal Credit faces more cuts.

Image: The UK Inflation rate, source the ONS and Trading Economics.

ABC Comment, have your say below:

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here