Simon Collyer

Cold Weather Payments Reminder From the DWP

EXTRA MONEY - Households receiving certain benefits could be eligible for extra money to help keep warm during the cold weather between now and the end of March 2023.

DWP’s Cold Weather Payments are an automatic bank top-up of £25. The payments are triggered to eligible households when the average temperature has been recorded as, or is forecast to be, zero degrees C or below over seven consecutive days at the weather station linked to an eligible person’s postcode.

Customers will have the payment credited to their bank account within 14 days of the trigger.

You can check if payments are being issued in your area on GOV.UK.

ABC Comment, have your say below:

Simon Appears on City Talk Radio Show With Nita Jhummu - Whole Show

Help For Pensioners with Cost of Living

EXTRA PAYMENTS - Over 11 million pensioners have started to receive payments of up to £600 to help with their energy bills this winter. This includes the Pensioner Cost of Living Payment, a top up to regular Winter Fuel Payments of an additional £300 per household. These are being paid by the Government over the next two months, the vast majority automatically. There is more information on Winter Fuel Payments eligibility and how to claim on GOV.UK.

The money will appear in bank statements with the payment reference starting with the customer’s National Insurance number followed by ‘DWP WFP’ for people in Great Britain, or ‘DFC WFP’ for people in Northern Ireland.

Pensioners can also check if they are eligible for Pension Credit - worth an average £3,500 a year - using the Pension Credit calculator. The DWP urge people to apply as soon as possible, and no later than 18 December to ensure they qualify for an extra £324 cost of living help.

ABC Comment, have your say below;

Full List of DWP Payment Rates From April 2023 As Benefits Uprated By 10%

UPRATED BENEFITS - Around 40 million individuals across the UK currently in receipt of a State Pension or benefits from the Department for Work and Pensions (DWP) and HM Revenue and Customs (HMRC) will see their payments increase next year. State pensions and disability and working-age benefits will all be increased due to inflation.

In his Autumn Statement the Chancellor, Jeremy Hunt, confirmed that State Pension, disability and working age benefits will be uprated by 10.1% from April in line with the rate of inflation.

"On average, a family on universal credit will benefit next year by around £600. And to increase the number of households who can benefit from this decision, I will also exceptionally increase the benefit cap with inflation next year."

Attendance Allowance

Higher rate: £101.75 (from £92.40)

Lower rate: £68.10 (from £61.85)

Carer’s Allowance

April 2023 rate: £76.75 (from £69.70)

Disability Living Allowance / Child Disability Payment

Care Component

Highest: £101.75 (up from £92.40)

Middle: £68.10 (from £61.85)

Lowest: £26.95 (from £24.45)

Mobility component

Higher: £71.05 (from £64.50)

Lower: £26.95 (from £24.45)

Employment and Support Allowance (ESA)

Under 25: £67.25 (from £61.05)

25 or over: £84.80 (from £77.00)

Housing Benefit

Under 25: £67.25 (from £61.05)

25 or over: £84.80 (from £77.00)

Entitled to main phase ESA: £84.80 (from £77.00)

Incapacity Benefit (long-term)

April 2023 rate: £130.20 (from £118.25)

Income Support

Under 25: £67.25 (from £61.05)

25 or over: £84.80 from (£77.00)

Jobseeker’s Allowance (contributions based)

Under 25: £67.25 (from £61.05)

25 or over: £84.80 (from £77.00)

Jobseeker’s Allowance (income-based)

Under 25: £67.25 (from £61.05)

25 or over: £84.80 (from £77.00)

Maternity/Paternity/Shared Parental Allowance

Standard rate: £172.50 (from £156.66)

Pension Credit

Single: £201.05 (from £182.60)

Couple: £306.85 (from £278.70)

Personal Independence Payment (PIP) / Adult Disability payment

Daily Living Component

Enhanced: £101.75 (from £92.40)

Standard: £68.10 (from £61.85)

Mobility Component

Enhanced: £71.05 (from £64.50)

Standard: £26.95 (from £24.45)

State Pension

Full New State Pension: £203.85 (from £185.15)

Basic Old State Pension (Category A or B): £156.20 (from £141.85)

Widow’s Pension

Standard rate: £139.15 (from £126.35)

Universal Credit (Monthly rates shown)

Standard allowance

Single under 25: £292.11 (from £265.31)

Single 25 or over: £368.74 (from £334.91)

Couple

Joint claimants both under 25: £458.51 (from £416.45)

Joint claimants, one or both 25 or over: £578.82 (from £525.72)

Many groups expressed relief that benefits will rise in line with inflation, but they warned many vulnerable people will still fall through the cracks. Rebecca McDonald, chief economist at the Joseph Rowntree Foundation, said: "It will be a huge relief to families on benefits that they are not facing what would have amounted to a historic cut.

ABC Comment, have your say below:

Tip For Landlords and Tenants

ENERGY SAVING - We have been sent some tips for landlords that are useful reading for tenants as well.

NEW statistics revealed by the Alan Boswell Rent Guarantee Insurance experts have highlighted:

● A 60% surge in demand for Rent Guarantee Insurance (RGI)* in October compared to April 2022

● A 46% increase in RGI claims in October compared to April 2022

In a bid to help ease the financial pressure, the experts have offered their five top tips for landlords to help tenants amid the cost of living crisis.

[*Insurance that covers landlords’ rental incomes if tenants fail to pay their rent]

Five top tips for landlords to help tenants during the cost of living crisis

- Prepare an information pack for new tenants to reduce maintenance cost

To avoid repair costs, landlords could create handy information packs for new tenants that provide essential information on keeping the property well-maintained. For instance, how to use appliances and heating, prevent moulds and pests, make sure ventilation is properly functioning, as well as encouraging tenants to report faults and other maintenance issues in a timely manner - issues neglected for a long period of time will only cost more.

Be open and communicate regularly with your tenants

Rushed decisions will not benefit anyone as we all feel the cost of living pinch. Have regular dialogues with your tenants to learn about their financial status and the issues they are facing. Raising rental fees without reasonable notice or proper communication will strain the relationship if they cannot afford the sudden rise and in turn, get into arrears as they fall behind on payments. As well as being open to hearing their thoughts, share your financial burdens so they’re equally aware of the rising landlord costs you’re shouldering to find a solution that’s viable for both sides.

Invest in improving your property’s energy efficiency

Around a quarter (26%) of landlords have already made energy efficiency upgrades to help reduce bills - landlords should continue with these efforts, starting with smaller eco-home improvements (e.g. installing insulations, draught-proofing, LED lighting) and building up. It may seem like a daunting cost to bear, but these will be inevitable as the government plans to raise the Energy Performance Certificate (EPC) rating to a C or above for all newly rented properties from 2025. With 52% of tenants happy to pay more for a greener house, these will be worth the investment in the long run.

Shop around for the best value energy and utilities

Whether your property is all-bills-inclusive or your tenants cover their own bills, compare your energy and utility costs with friends and online to ensure that you’re getting yourself the best deal. By helping to relieve the pressure of rising bills, your tenants will be happier and ultimately reduces vacancies and boosts tenant retention.

Check your tax band and eligibility for council tax discounts

Around 46.1% of tax challenges made last year succeeded in reducing their band, and the UK’s outdated council tax system means it’s imperative to check with your neighbours or run a 1991 valuation check to ensure you are not overpaying. From single-person discounts to empty properties, you and your tenants could also be eligible for reductions of between 25% to 100%, so always check!

ABC Comment, have your say below:

Fraud On The Rise In The UK

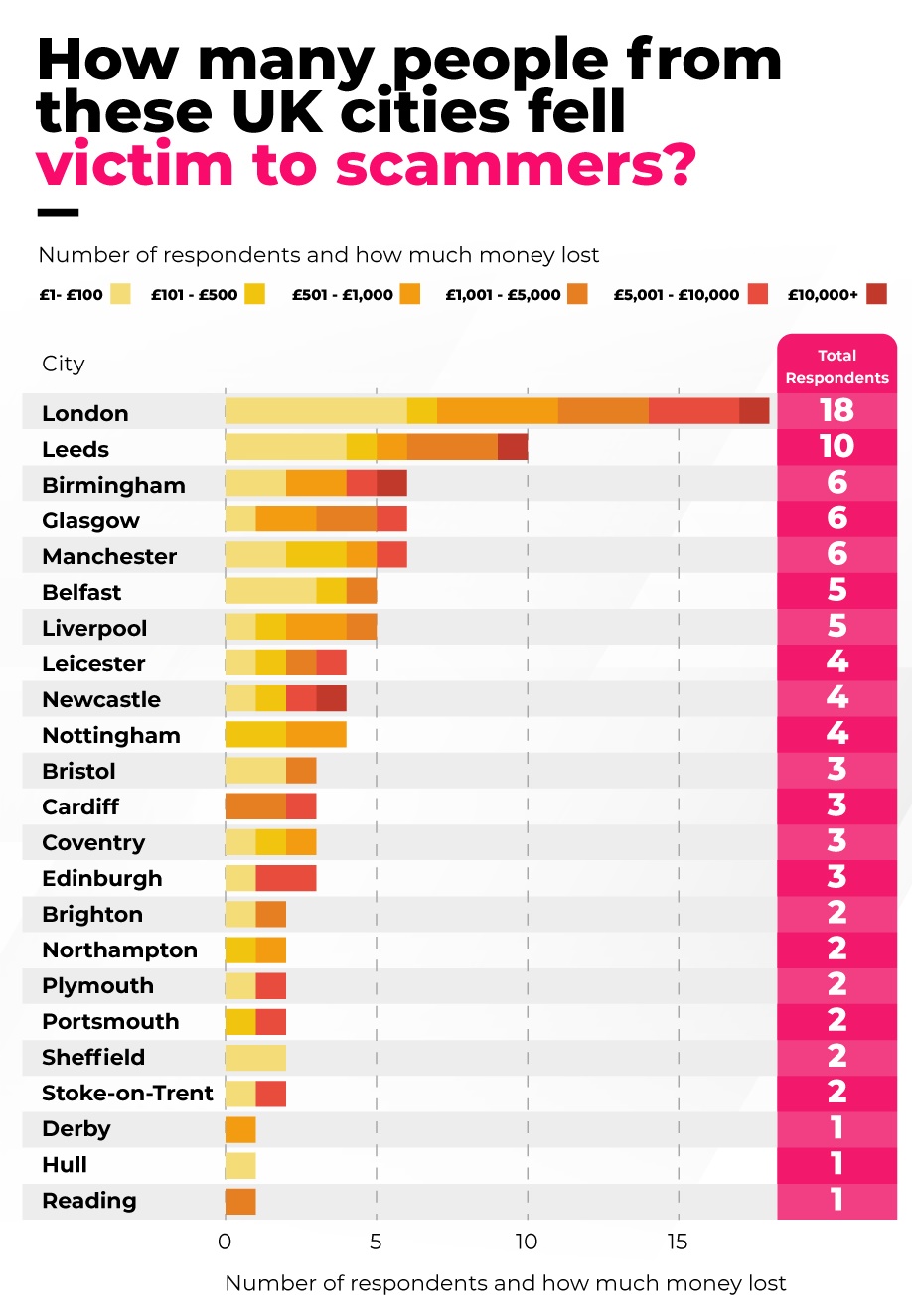

FRAUD ON THE RISE - Recent data from Forbes revealed over £609.8 million was stolen through scams in the first half of 2022. A popular tactic used by scammers is to pretend they're calling from a trusted business or organisation, often with the promise of money should the person they're speaking to provide them with secure details.

Ahead of International Fraud Awareness Week (13-19 November), a new survey from Reboot Digital PR Agency has revealed the online scams that British people fall for the most.

They surveyed 1,376 people from different parts of the UK to find out which scams were the most common, and which regions lost the most money as a result.

Highlights from the research:

- Hull had the highest percentage of people losing money from scams, with a massive 33.3% claiming to have lost money because of fake calls or texts.

- Birmingham, Leeds, London, and Newcastle each had respondents claiming they lost over £10,000 from a single scammer.

- Scammers are most likely to pretend to be from HMRC, with 16.9% of respondents reporting that this is where the scammers claimed to be from.

- People from Leicester are most susceptible to scams, with 31.6% of respondents from the city initially falling victim to fraudsters.

- People aged 60+ are the most likely to be victims of fake calls or texts, with 27.7% initially falling for the scam.

- Bradford is the most scam-savvy city in the UK, with just 18.5% of residents falling victim to scams. No one from Bradford lost any money too, along with Southampton.

Image: Fraud in the UK

ABC Comment, have your say below:

Winter Fuel Payment Video - What You Need To Know

WINTER FUEL PAYMENT - If you would like to know more about the Winjter Fuel Payment this video ought to help.

Most payments will be made automatically in November or December.

You’ll get a letter telling you how much you’ll get.

If you do not get a letter or the money is not paid into your account by 13 January 2023, contact the Winter Fuel Payment Centre.

All benefits, pensions and allowances will be paid into an account, such as a bank account.

If you do not think you have been paid, you should check your account before contacting the Winter Fuel Payment Centre.

Most of those eligible do not have to claim their Winter Fuel Payment, as it is awarded automatically.

British Sign Language and Welsh Language versions will be available soon.

ABC Comment, have your say below:

Jobcentre Locked Down Amid Bomb Scare After 'Suspicious Package' Found

BONB SCARE - A Jobcentre in Fife has been locked down after the discovery of a suspicious package sparked a bombscare.

Police Scotland was called to the incident at Jobcentre Dunfermline at around 12.15pm on Friday and the building has been evacuated.

A cordon has been put in place at Merchiston House on Foundry Street, with police calling the Explosive Ordnance Disposal (EOD) squad in.

JobCentre Plus for North Scotland confirmed the Dunfermline location would be closed for the rest of Friday.

Video courtesy of stv news.

ABC Comment, have your say below:

DWP Unlawfully Prevented Release of Secret Benefit Deaths Reviews, Regulator Rules

DWP COVER UP - The Department for Work and Pensions (DWP) unlawfully prevented the release of secret reports into the deaths of at least 20 benefit claimants, the information commissioner has ruled.

The commissioner, John Edwards, has found that DWP breached the Freedom of Information Act by blocking documents which would have showed recommendations made by its own civil servants to improve safety and reduce the number of suicides and other deaths.

The victory should mean that ministers now release between 20 and 30 so-called internal process reviews (IPRs) that were completed between March 2019 and September 2020 and have until now been kept secret.

It is the latest legal defeat suffered by DWP in an eight-year fight by Disability News Service (DNS) to ensure that crucial details from its IPRs are not kept secret.

DNS has argued that releasing the recommendations made by the IPRs – previously known as peer reviews – is vital in ensuring DWP is held to account for how it has responded to deaths linked to the social security system.

DWP had argued that it could not release the IPRs because this could impact on the development of government policy, including its green paper on disability benefits, its “vulnerable customers policy”, “paying the customer the right amount at the right time”, and its national data strategy.

The information commissioner agreed that 14 IPRs that were linked to the national data strategy or the green paper were used to “inform” the development of government policy.

But the commissioner also ruled that DWP had “failed to consider the strong public interest in the timely understanding, and scrutiny of, the recommendations made in the IPRs”.

The ruling added: “The IPRs provide insight and understanding of where DWP acknowledges that errors were made or improvements are required.

“They would also allow scrutiny of whether DWP has taken action to implement these improvements or ensure that the errors do not occur again.

“Disclosure would also allow scrutiny of whether the actions taken were sufficient or timely enough to prevent the harm identified occurring again.

“The Commissioner considers that there is a strong public interest in understanding DWP’s approach to preventing future errors and safeguarding issues.”

The ruling concluded that “DWP has not provided compelling arguments regarding how the specific policies named would be undermined by disclosure of the IPRs” and “therefore considers that the balance of the public interest favours disclosure”.

A DWP spokesperson said: “We have received the decision notice from the Information Commissioner’s Office and we are currently considering its impact.”

DNS currently has another complaint being investigated by the Information Commissioner’s Office, relating to DWP’s refusal to release the recommendations made by more than 90 IPRs completed between September 2020 and April 2022.

DWP branded DNS editor John Pring “vexatious” for requesting the release of those IPRs earlier this year.

The release of recommendations made by the reviews has revealed key safety failings by the department over the last six years.

The first batch of reviews, finally released in 2016 after a lengthy freedom of information battle with DNS, showed how at least 13 of the reports explicitly raised concerns about the way that “vulnerable” benefit claimants were being treated by DWP.

Another review obtained by DNS, in 2018, helped show how DWP had been forced to soften the “threatening” tone of the agreement that claimants of universal credit are forced to sign to receive their benefits.

And in December 2020, a freedom of information request allowed DNS to show that DWP staff had had to be repeatedly reminded what to do when claimants said they may take their own lives, following reviews into as many as six suicides.

Those reviews suggested that a series of suicides between 2014 and 2019 were linked to the failure of DWP staff to follow basic rules that had been introduced in 2009.

But more recently, DWP has resorted to increasingly desperate tactics to keep all content from the reviews secret.

Image: information Commissioners Office

ABC Comment, have your say below:

Say Hello & Wave Goodbye - DWP Minister Chloe Smith

DWP MINISTER OUT: Chloe Smith No Longer Work and Pensions Secretary.

Chloe Smith, the Secretary of State for Work and Pensions, is the latest member of Liz Truss's cabinet to announce she is out. She says she will support the PM from the backbenches and continue to work hard for her Norwich North constitutents.

ABC Comment, have your say below:

Executives

-

Simon Collyer

Position: Founder & Director

Simon Collyer hails from Brightlingsea in Essex, a small town on the coast between Colchester & Clacton. Simon worked very successfully in the leisure marine industry in the UK and in Australia. Later in London Simon worked in the web development and publishing fields, founding a below-the-line sales promotion agency in the early nineties and then later a software company Red Banner in South Africa (2002-06). Here in South Africa, Simon became interested in the Third Sector and starting his own organisation.

-

Christopher Johnson

Position: Bookkeeping and Administration

Chris lived in Oxford for twenty years, having been educated at Magdalen College School. Chris sought a career with British Rail and spent twenty years in railway retail management ending with Virgin Trains at Euston Station. Christopher retrained in bookkeeping and accounts in 2000 and now works for Chelmsford Community Transport.

A strong, enthusiastic team player with a meticulous eye for detail, Christopher brings a range of skills to the ABC.

Team

-

Frances Rimmer

Position: Researcher

When not charming snakes Frances is a Modern History student at the University of Essex, focusing specifically on social history. The lives and experiences of the ordinary person rather than on politics or the military. Outside of her studies, Frances enjoys film and writing. As a keen roller skater who plays roller derby with the Kent Roller Girls, Frances secret wish would be to become a skating instructor and open her own rink, as she has always wanted to help people in some way, and feels it would be great to do so while also sharing her passion with like-minded people.

-

Stuart Meyers

Position: Researcher

Stuart Meyer, is a final year American Studies student at the University of Essex. Stuart focussed his academic life on global justice and the rights of migrants. Additionally Stuart has a passion for writing, both creatively and with the aim of providing accessible information to those who need it most Stuart has made a great contribution to our library of Advice Guides demonstrating his versatility by writing intelligently on a wide range of topics.

-

Louis Jones

Position: Film Maker

Louis is a 19 year old TV and film student studying at Colchester Institute. Along with hand-picked fellow students, Louis made the ‘Membership’ video that can be seen on the ABC website. Louis volunteers at, Hospital Radio Colchester, as a football commentator. A true fan of the ‘Great Game’ Louis insights have been sought after on occasions by key local media, the Colchester Daily Gazette & even BBC Essex.

-

Marcus Pierpont

Position: Film Director

Talented student film maker, Marcus Pierpoint, directed the ABC 'Membership' film which can be seen on the organizations website. Marcus has recently graduated from a BTEC course, studying Creative Media Production at Colchester Institute and he claims a true passion for films and filmmaking. Marcus also enjoys radio work and volunteers at the local hospital radio station, producing and presenting his own show. Marcus is enrolled at the University of Greenwich, and dreams of a career in the media industry.

-

Shane Mitchell

Position: Film Maker

Shane Mitchell, is another Colchester Institute Film and TV student that aspirers to be a Director of Photography in the future. Shane was the camera operator for the ABC Membership video, fun to make says Shane but it is also work he is very proud of. Shane loves all things ‘film’ and he makes videos even in his spare time.

-

Joe Corlett

Position: Film Director

Ex-student script writer/director, Joe Corlett, directed the ABC's corporate video (About Us) which is now viewable on the main website. Joe graduated from the Colchester Institute with a BTEC diploma in the field of media. Joe is passionate towards film making and hopes to continue making more that are constructed form his own material. On the side he's loves being out jogging in all terrains and when not out side he's writing scripts for future projects. Joe is now out in the world ready to start his life goal of working in the Media industry.

-

Jon Taylor

Position: Film Maker

Jonathan Taylor has been working in the media sector for 3 years and for our filming projects he worked as the production manager. John worked on graphical elements of our film, About Us for example, rendering images and making them look good on screen.

Jon is also experienced in animation and he made the logo and animation sequences in the ABC corporate videos.

Part of Jon’s brief was to also organise the administration side of filming, known collectively to admin experts the world over as ‘the paperwork’.

-

Thomas Hearn

Position: Film Maker

Thomas Hearn, has been involved in media, for about three years. Tom likes to work a lot at a computer, particularly the editing suite. For the ABC project, Tom worked on the edit itself; created and pieced together both the footage and the music, Tom created the visual elements of the ABC ‘About Us’ video and put most of the visual effects on the video.

I think we can agree that along with the rest of our youthful student team; Tom has done a very fine job indeed.

-

Max Gillard

Position: Film Maker

The last of our film team Max Gillard has recently finished college studying Creative Media Level 3 and Max hopes to continue the course on to University to someday gain a job in the media industry.

We wish Max the best of luck.

-

Harry

Position: Film Maker

My name is Harry Genge and I am an aspiring film maker. I have skills in the majority of film orientated jobs, though I am most interested in the creative roles such: Directing, Director of Photography and Writing. In my spare time I make short films, write, read, draw/paint and take the dog out for long walks.

-

Ned

Position: Producers

My name is Ned Woodcraft and I’m an aspiring Producer. As well as completing a diploma in media production I have also had a number of jobs in the professional market. I’m also a keen sailor and water sport enthusiast.

-

Brandon

Position: Producer

My name is Brandon and I’m an aspiring producer and actor. I enjoy bringing a production together with planning and preparations to create a great finished product. My hobbies also include street magic and bass playing.

-

Callum

Position: Writer and Director

My name is Callum Olive and I’m an aspiring writer and director. I’m always looking for a new project and love writing new stories and screenplays at home and on the move. My hobbies include playing the piano and street magic.

-

Joanie DeMuro

Joanie joined ABC team in early 2017. She was one of six student volunteers from the University of Essex in that cohort. The student team focused on a range of projects, including creation of Wikipedia page,‘training manual’ and most importantly, researching and adding entries to the website directory of organisations that assist the unwaged, or those on low incomes. “This placement was very helpful - thanks for the opportunity Simon.”

-

Cherry Lam

Cherry Lam has been volunteering for ABC for one month. Although it is a short period of time, she knows a lot more about the running of a charity organisation. Cherry is responsible for adding directories to the organisation website according to categories. Joining this placement helped her improving skills and gaining new experiences. Cherry says is extremely appreciative of the support she has received from ABC which allowed her to improve skills.

Join

FREE

Here