Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Jobseekers Learning to Game the System

HI TECH - Research suggests that candidates are learning to manipulate algorithms to better their recruitment chances.

Jobseekers are increasingly looking for ways to game or 'cheat' recruitment systems, according to TribePad research.

Hiring Humans vs. Recruitment Robots surveyed 1,041 employees and jobseekers in the UK, and found that two-thirds (67%) of jobseekers admit to using 'optimisation strategies,' such as using particular phrases likely to be picked up by recruitment algorithms, to improve their chances of getting a job.

When it came to the various tactics used, just over a fifth (22%) have searched online to find out how other people have been hired, a similar proportion (19%) have used buzzwords in their CV to manipulate an automated system, 15% have lied or exaggerated about their experience to get an interview, and 8% have cheated on a psychometric, skills or other kind of test.

The report warned that these practices mean many candidates may be given the green light because they can use the right language, rather than because they are the best person for the job. It also runs the risk of people cheating the system, it stated.

The research also found that respondents have little trust in recruitment systems, with 69% feeling that greater automation in recruitment is useless because people can cheat the system by amending their CVs accordingly.

There was also a generational and gender split when it came to perceptions of recruitment technology. Over half (59%) of 18-to 24-year-olds and nearly two-thirds (60%) of 25- to 39-year-olds said they preferred recruitment to be conducted online. The older applicants got the more likely they were to prefer face-to-face recruitment, with just under half (46%) of 40- to 54-year-olds preferring human interaction, and a 50:50 split between preferring online or offline for 55- to 64-year-olds.

Meanwhile, nearly two-thirds (61%) of women said they preferred online to human interaction, compared to 39% of men.

Dean Sadler, CEO of TribePad, said there are clear advantages for both employers and candidates to using technology in the recruitment process.

“There’s no doubt that recruitment technology systems provide huge benefits to employers and the candidates who use them. For employers, who often have to deal with hundreds or thousands of applications per role, they gain time-saving advantages, as well as the ability to filter and search for the best talent," he said.

“For applicants, ATS’ [applicant tracking systems, which sort through CVs using algorithms] can level the playing field and reduce bias, offering tech-led solutions such as video interviewing, or blind CVs, allowing them to be spotted and identified based on skills and experience, rather than background.”

However, he added that the benefits of using this tech will be undermined if employers don't deploy it in the right way: “It’s clear that as businesses automate more processes, they have to be wary that they don’t create so many hurdles that candidates try and game the system. It’s human nature to try to find shortcuts or opportunities to simplify processes. But businesses don’t want people who only fit the bill because they’ve arrived in disguise.”

While businesses should not forgo tech altogether, Sadler said they must not become over-reliant on it for finding the right talent: “However, this doesn’t mean that businesses should shun tech completely; online applications offer jobseekers the ability to job search at their own convenience. Instead, businesses have to understand more about where tech is most beneficial, and how to balance it with that crucial human touch.”

ABC Comment, have your say below:

Report here:

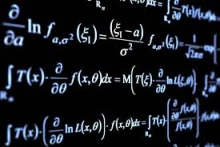

The UK National Balance Sheet

NATIONAL FINANCES - The UK’s net worth was estimated at £10.4 trillion in 2018, an average of £156,000 per person.

Growth in the UK’s net worth was estimated at 3.0% or £297 billion between 2017 and 2018; this was the weakest annual growth since 2012, and below the compound annual growth between 2009 and 2018 of 4.9%.

The household sector’s net worth grew by just 0.6%, or £58 billion, to £10.3 trillion between 2017 and 2018, because of slow growth in the value of land and an increase in financial liabilities.

General government’s net worth rose by 3.3% or £33 billion to negative £939 billion between 2017 and 2018, the result of relatively small changes in both financial and non-financial net worth.

In 2018, financial net worth dropped by 7.7% or £16 billion to negative £224 billion, with large decreases in equity and investment fund shares being substantially offset by increases in currencies and deposits.

The national balance sheet is a measure of the wealth, or total net worth, of the UK. It shows the estimated market value of financial assets, (for example, loans) and non-financial assets (for example, dwellings). The data are used to monitor economic performance, to inform monetary and fiscal policy decisions and for international comparisons.

ABC Comment, have your say below:

Northern Ireland - Hydebank Wood College Learning and Skills Centre Opens

TRAINING - Learning and skills are at the core of rehabilitation at Hydebank Wood College, NI Prison Service Director General Ronnie Armour has said.

Speaking at the opening of the newly refurbished Learning and Skills Centre at the secure college, Mr Armour said: “Since its transition into a secure college, Hydebank Wood has gone from strength to strength with learning and skills central to its rehabilitative work. The opening of this new centre is an investment in the potential of the people who live in Hydebank.

“Learning is at the core of the Hydebank community and this is a safe environment for the young men and women to re-engage with education and work-based skills. With our partners in Belfast Metropolitan College we can support and challenge those people to change, to learn and to become employable. Everything we know says, if someone has skills and is employable after release back into the community, then they are less likely to reoffend and that helps us to build a safer community.”

The refurbished Learning and Skills Centre at Hydebank was officially opened by local actor Dan Gordon, who has a long association with Hydebank Wood.

Speaking at the event, Mr Gordon said: “I first started coming into Hydebank in the early 2000’s to work with the young men and to try to steer them down a different path. I believe in second chances, especially when you are young. People need to be encouraged to take a different path when they come back into society. My father, who was a shipyard worker, used to say 'Don’t stand and wonder how to do it – do it and wonder how you did it'.”

Learning and skills is delivered in partnership with Belfast Metropolitan College. Kathleen O’Hare, from Belfast Metropolitan College, said: “This facility will provide us with the opportunity to deliver a range of vocational, essential skills and employability programmes. This means our students at Hydebank can leave with the same level of accreditation as any other student at one of our colleges. This is all part of our work to address social inclusion and increase life chances for people leaving custody.”

Find out more about the new Learning and Skills facility at Hydebank Wood College by clicking on this link: https://youtu.be/WxWGGl90tBA

And hear from two students engaging in education and learning opportunities at Hydebank Wood College by clicking on this link: https://youtu.be/uA-VoA9kHlk

Image: Hydebank Wood College opening.

ABC Note: Hydebank Wood College, which has a focus on education, learning and employment, accommodates young people between the ages of 18 and 21. It also accommodates female remand and sentenced prisoners in Ash House, a house block within the complex.

ABC Comment, have your say below:

Introduction Of 50p Minimum Unit Price for Alcohol Approved In Assembly Vote

HEALTH - The Public Health (Minimum Price for Alcohol) (Wales) Act 2018 will mean that it will be an offence for alcohol to be supplied below that price in Wales.

In Wales there are 60,000 admissions to hospital every year, because of alcohol. Alcohol costs the NHS £159 million annually. In 2018, there were 535 alcohol-related deaths in Wales.

The new law supports the Welsh Government’s comprehensive work to tackle harmful and hazardous drinking by tackling the availability and affordability of cheap, strong alcohol, which is part of wider efforts to improve and protect the health of the population of Wales.

Research estimates that introducing a 50p minimum unit price (MUP) would:

- result in 66 fewer deaths and 1,281 fewer hospital admissions in Wales per year

- would save the Welsh NHS more than £90 million over 20 years, in direct healthcare costs

- would reduce workplace absence, which is estimated to fall by up to 9,800 days per year

- over a 20 year period, the introduction of a MUP could contribute £783 million to the Welsh economy in terms of the reduction in alcohol-related illness, crime and workplace absence.

ABC Note: Image courtesy:

Link: https:https://urinedrugtest.com/

Credit Name: Urine Drug Test

ABC Comment, have your say below:

Could You Help the Samaritans’ This Christmas?

DONATIONS NEEDED - Samaritans is a unique charity dedicated to reducing feelings of isolation and disconnection that can lead to suicide. ‘Samaritans’ is a registered charity aimed at providing emotional support to anyone in emotional distress, struggling to cope, or at risk of suicide throughout the United Kingdom and Ireland, often through their telephone helpline.

Samaritans began in 1953 in London, founded by a vicar called Chad Varah. Throughout his career Chad had offered counselling to his parishioners, and wanted to do something more specific to help people struggling to cope and possibly contemplating suicide.

The initial idea for Samaritans came from the first funeral Chad conducted early on in his career: a girl aged 14 had started her period, but having no one to talk to believed that she had a sexually transmitted disease and took her own life.

Chad was immensely moved by this senseless loss of life, “I might have dedicated myself to suicide prevention then and there, providing a network of people you could ‘ask’ about anything, however embarrassing, but I didn’t come to that until later”.

When Chad was offered charge of the parish of St Stephen in the summer of 1953 he knew that the time was right for him to launch what he called a “999 for the suicidal”. He was, in his own words, “a man willing to listen, with a base and an emergency telephone”.

The first call to the new service was made on 2nd November 1953 and this date is recognised as Samaritans’ official birthday.

Every six seconds the Samaritans responds to a call for help.

Last year Samaritans volunteers answered 10,652 calls for help on Christmas day alone.

Every year on average the Samaritans answer more than 5 million calls for help by phone, email, SMS, letter, face to face at their local branches and through their Welsh language service.

We're here 24/7, before, during and after a crisis.

Whether it’s an ‘are you ok?’ at just the right moment, or the midnight support of a trained volunteer; whether it's better training in the workplace or campaigning for more investment in national and local suicide prevention – there here.

The charity works to make sure there’s always someone there, for anyone who needs someone.

Could you donate, click on this image?:

ABC Comment, have your say below:

Fuel Poverty Awareness Day

FUEL POVERTY - Ahead of Fuel Poverty Awareness Day this Friday, which aims to raise awareness of the support available for those in fuel poverty, research from uSwitch shows the harsh reality of fuel poverty as millions of households in the UK will be forced to choose between heating and eating this winter.

With temperatures expected to fall once again next week fuel poverty data shows:

3.4 million UK households are in fuel poverty, unable to afford to live in a warm, dry home.

- 1.6m households say they will be forced to choose between heating and eating this winter with the worst affected in Sheffield (14%), Norwich (12%) and Plymouth (11%)

- Over a third (36%) are worried about paying their energy bills this winter

- An estimated 4.6 million households (17%) won’t turn the heating on even if it’s cold

- 2.3 million owed their energy supplier a total of £267 million before winter even started

But help is available from multiple sources. uSwitch has put together the following advice for households who are struggling with their bills:

Investigate grants you might be eligible for to help pay your energy bills or insulate your property, including the £140 Warm Home Discount, Winter Fuel Allowance and Cold Weather Payment. You can check whether you may be eligible for help with bills using this energy help tool.

- Energy suppliers also run specific programmes for their own customers, so contact your energy company to check what extra support they offer. If you’re in debt to your supplier, ask them to set you up on a repayment plan and to switch you to one of their cheaper tariffs. Households with prepayment meters who are in debt can even switch supplier provided the amount they owe is less than £500.

- Sign up to the Priority Services Register (PSR), a free service provided by suppliers and network operators for people with additional needs, offering benefits such as advance notice of planned power cuts, priority support in an emergency, or help with communication about bills.

- See if you could pay less by comparing energy deals - you could save up to £321 on your annual energy bills.

Richard Neudegg, Head of Regulation at uSwitch.com, said:

“It is a terrifying prospect to have to choose between putting your heating on this winter or feeding yourself and your family.

“Fuel Poverty Awareness Day is crucially important in the fight to help those who can’t afford to keep their homes warm enough. Help is available and people shouldn’t feel like they need to suffer in silence.

“The first thing many energy customers should do is check whether they’re eligible for help with their bills, and contact their supplier to make sure they’re on the cheapest plan - and if they’re in any debt to the company, to ask them to arrange a repayment plan.

“In the meantime, we want to see the industry required to provide more support, targeted specifically to help vulnerable households, with anyone who is eligible for help being enrolled automatically.”

ABC Comment, have your say below,

How Can You Reduce Your Energy Bills?

MONEY SAVING TIPS - We all want to save money, right? For some it’s to afford those little luxuries in life, while for others it’s a necessity to get by. Worryingly, surveys show that six million Brits fear they’ll never get rid of their debt and a quarter are struggling to make ends meet each month.

However, there are several ways you can relieve the pressure caused by household bills. Here, with David Laing, who specialises in window installation in Newcastle, we look at the best options to reduce your energy bills:

Monitor your laundry loads

While some people think stuffing their washing machine will cut back on the number of loads required, this can be detrimental to your energy usage if you over fill. Be sure to wash your clothes at 30 degrees rather than 40 degrees and you could save up to £52 a year. Also, many utility companies have plans set up to give you discounts for switching your power usage to off-peak times, so it’s certainly worth checking if this affects you.

Replace light bulbs

A simple and cost-effective way to shave a little bit from your energy bills would be to change your lightbulbs. Did you know an LED light bulb only costs approximately £1.71 to run each year? That means that, compared to traditional bulbs, you could save up to £180 from your energy bills during the bulb’s lifespan.

If you have already switched, just remembering to turn your lights off when you aren’t in the room or don’t need them on will keep a surprising number of pennies in your bank instead of your energy supplier’s.

Check your benefit entitlement

Depending on your age and circumstances, you may be entitled to receive fuel benefits. For those over 61, you will receive an annual tax-free benefit, but many don’t know about a ‘cold weather payment’ that is available. This is paid in the event of exceptionally cold weather – if it drops below zero degrees Celsius for seven days in a row. While they are often automatically provided, you may still need to apply.

Turn off standby appliances

While you may think it won’t make a difference, turning off all your gadgets by the plug can save on average £30 per year. This is based on the average home with four occupants now using 13 electronic appliances. For homes with more gadgets, the savings each year can reach £80.

Get an energy monitor

This great handheld or table-top gadget can provide you with key information about just how much energy you are using each day. While this device won’t technically save you money, it gives you the opportunity to keep an eye on your expenditure.

Don’t get energy monitors and smart meters confused, though. While energy monitors help you to understand your electricity usage, smart meters send this information to your energy provider.

Double glaze your windows

It’s a fact that all properties will lose heat through their windows, but double glazing can limit this considerably, providing great thermal insulation. It’s impossible to put a figure on exactly how much it can save you but depending on your type of home of energy provider, you could shave hundreds of pounds off your annual energy bills.

It’s also important to remember that, while the initial cost may be high, double glazing will increase the overall value of your property.

Cavity wall insulation

If your house was built before the 1990s, it’s certainly worth looking into wall insulation. The colder it is outside, the quick heat leaves your property if your walls aren’t insulated, meaning that you will need to keep your heating on longer for it to be effective. While it can be an expensive form of insulation, some people qualify to receive it for free.

Go solar

This form of renewable energy can reduce your electricity bills considerably but are certainly not a short-term fix. While they could require an expensive outlay, you can save in the long run – and save more the further south you live.

It’s clear that being more conscious of your usage can help keep save money, as can making aesthetic changes to your property. Follow these steps and you’ll have a better chance of spending that money on yourself rather than your energy bills.

Sources

https://www.which.co.uk/reviews/energy-monitors/article/energy-monitors-explained

http://www.energysavingtrust.org.uk/home-insulation/cavity-wall

http://www.government-grants.co.uk/free-insulation

https://www.moneysavingexpert.com/utilities/free-solar-panels/

https://lifehacker.com/5953039/how-to-reduce-your-energy-bill-with-no-cost-or-sacrifice

ABC Comment, have your say below

Compass Group plc Cuts Jobs

BUSINESS NEWS - Multi-billion pound catering group Compass has announced plans to cut around 3,000 jobs, including hundreds in the UK.

The FTSE 100 constituent's market cap fell around £1.8bn, but CEO Dominic Blakemore argued it remained 'another strong year' for the company.

is the largest contract foodservice company in the world. Compass Group has operations in about 50 countries and employs over 550,000 people. It serves around 5.5 billion meals a year in locations including offices and factories, schools, universities, hospitals, major sports and cultural venues, mining camps, correctional facilities and offshore oil platforms.

Compass Group's major competitors include Aramark and Sodexo.

ABC Note: 5.5 billion is the number of meals served per year.

ABC Comment have your say below:

Eddie Stobart Logistics (ESL) in Trouble and Uber Lose Their London Licence

BUSINESS NEWS - Lorry drivers and warehouse workers employed by Eddie Stobart Logistics (ESL) are demanding urgent answers as the future of the company hangs in the balance.

ESL is understood to be in financial difficulties and trading in its shares were suspended in August.

The company has in principle accepted a conditional sale and purchase agreement with Isle of Man based venture capitalists Douglas Bay Capital (Dbay) for 51 per cent of the company.

However other major logistics companies are understood to be interested in the purchase of ESL but their bids are being hampered by a lack of financial disclosure by the company.

ESL provide logistics solutions for customers including Tesco, Pepsi Co, Nestle, Cooperative, Argos, Coca Cola, Crown Cork & Seal, SCA, Unilever, Britvic, AG Barr, Dobbies, BSW Timber, Amazon, Johnson & Johnson and Heineken.

Image: Eddie Stobart Logistics (ESL) in trouble.

Meanwhile

Unite, the UK and Ireland’s largest union has welcomed the decision of Transport for London (TfL) not to renew Uber’s licence in the capital.

Jim Kelly, chair of Unite’s London and Eastern cab section, said: “Unite welcomes the decision of TfL not to renew Uber’s licence as there remains fundamental problems in the way the company operates, particularly issues around passenger safety.

“All the taxi trade wants is a level playing field.

“Uber’s DNA is about driving down standards and creating a race to the bottom which is not in the best interests of professional drivers or customers.

“Uber has a history of undermining licencing regimes. In particular there is growing concern about how Uber has also allowed drivers to become licenced in one area and then operate in areas where they are not licenced.

“In order to protect the public and to ensure standards are maintained it is essential that TfL follows this decision with stricter licencing of private hire operators and apps.

“This is the only way that public safety and confidence in the service can be maintained and the pay and conditions of professional drivers can be preserved.”

TfL has alleged that in the past year there could have been up to 14,000 potentially fraudulent Uber journey’s in London.

Image: Uber lose their London licence.

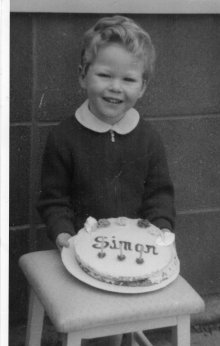

ABC Founder Simon Collyer's Birthday

HAPPY BIRTHDAY - It is Simon's birthday today, ABC founder.

Simon has made through another year. And he has a few more to go let's hope.

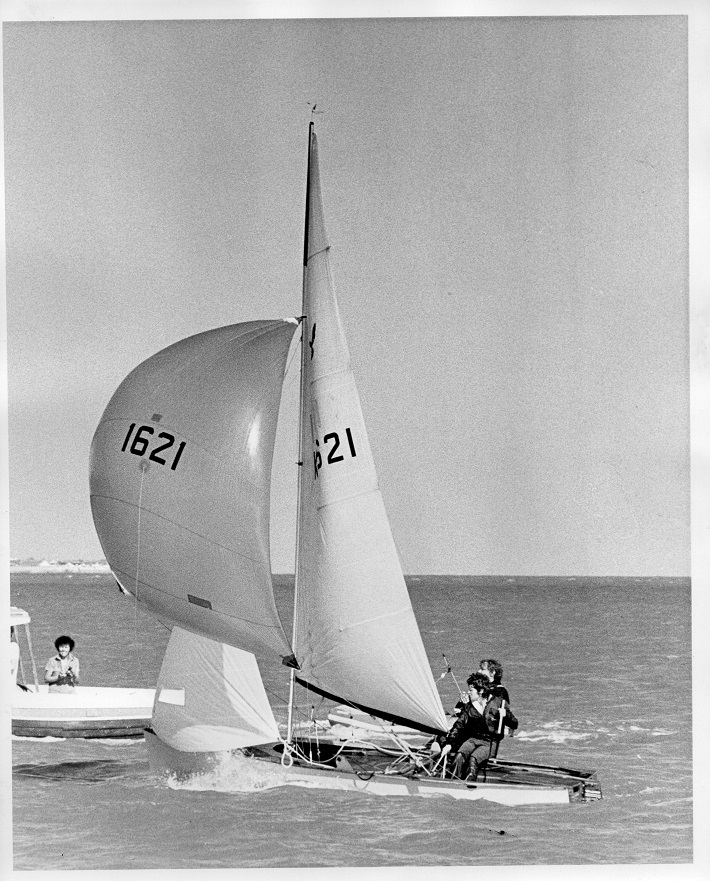

This is Simon in his younger years doing his favourite sport, competitive sailing.

Ed,Oh, to return to those halcon days. Just don't report this article to the fashion police.

Simon, third from the left in a very dapper cravat. Lifelong friends left to right: John Carter, sailor and financial services expert, Robert White, boatbuilder, Olympian, and twice Olympic Tornado catamaran world champion. On the other side of Simon [his left] military vehicle restorer Alan De'ath, and former banker turned window cleaner, Andy (Mouse) Conroy. Outside the Cherry Tree pub in Brightlingsea.

Image: Simon & Alan in Brightlingsea Sailing Club winning in the Mirror Class.

Image: Possibly winning the Double Dan trophy in his Mirror Dinghy. The Double Dan was a race from Brightlingsea to Clacton Sailing Club.

Image: Racing in the Hornet Dinghy Class with crew Tony Morgan. Tony later went on to be a reserve crew at the 1976 Olympics in Canada in the Olympic Tornado Class, crewing for Robert White.

Image: Brightlingsea - Tony on the trapeze and Simon on the helm, giving it some welly.

Image: More Hornet Class action in 'Father William' a boat purchased from Bruce Long.

Image: Simon and legendary crew 'Biggles' winning at Stone (sailing club on the Blackwater), the biggest turnout Hornet open meeting turnout that year.

Just a few shots from the archives. Who knows where the time goes?

ABC Comment, have your say below: