Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Welsh Labour Force Survey Estimates for The Three Months to June 2019

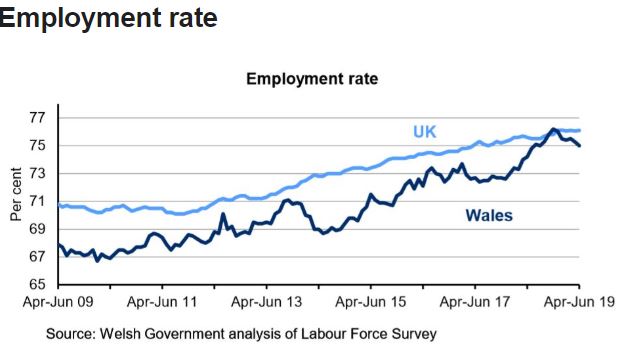

WALES: The employment rate in Wales was 75.0%. This is 0.4 percentage points down on the quarter and 0.3 percentage points up on the year.

UK: The UK employment rate was 76.1%. This is unchanged on the quarter and 0.6 percentage points up on the year.

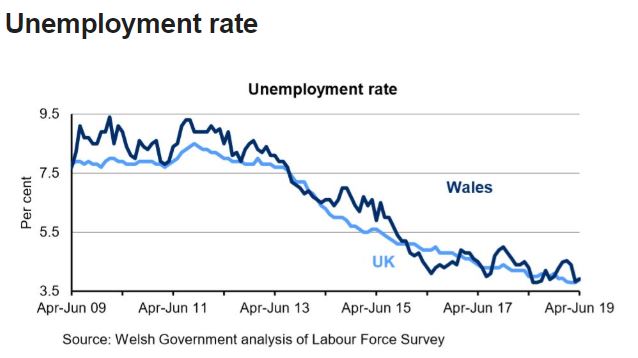

WALES: The unemployment rate in Wales was 3.9%. This is 0.6 percentage points down on the quarter and 0.1 percentage points down on the year.

UK: The UK unemployment rate was 3.9%. This is 0.1 percentage points up on the quarter and 0.1 percentage points down on the year.

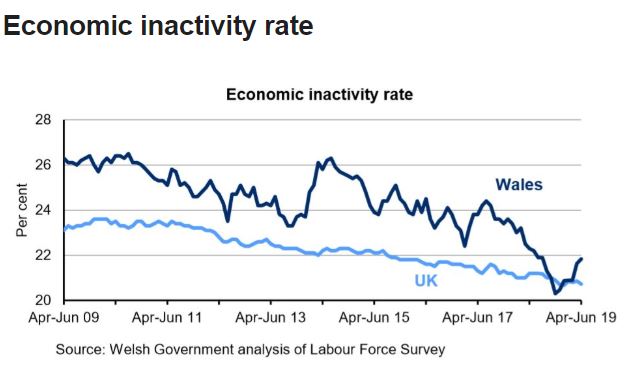

WALES: The economic inactivity rate in Wales was 21.8%. This is 0.9 percentage points up on the quarter and 0.3 percentage points down on the year.

UK: The UK economic inactivity rate was 20.7%. This is 0.1 percentage points down on the quarter and 0.5 percentage points down on the year.

ABC Comment, have your say below:

Pensioners Feel the Squeeze Financially

FINANCIALLY SQUEEZED PENSIONERS - Pensioners have long been discussed as some of the wealthiest people in the country. For example, in the mid-1980s only around 1% of those aged 65 and over in the UK were living in severe poverty, putting it equal-lowest in poverty rates of 16 western European countries. Today, however, that figure is closer to 6%, making it the worst poverty rate in all of western Europe. This comes as, today, Legal & General and the Centre for Economics and Business Research found that the 'Bank of Mum and Dad' gifted £6.3bn to help their children and grandchild get on the property ladder. This makes them the 10th largest mortgage provider in the UK.

With extreme poverty increasing and the dream of property ownership becoming out of reach for many people, there is pressure on pensioner parents to help out the future generations. However, according to new research by FairMoney.com, the fair loan comparison website, pensioners are also becoming stricken by poverty today.

The research reveals that:

18% of pensioners have stated that financial stress is causing them to lose sleep at night

15% said that they were struggling with money, they would rather consult a payday lender than a family member

10% of pensioners say that financial issues have caused strain in their marriage of relationship

9% would never publicly admit that they are living in poverty

10% have experiences issues with their mental and/or physical health as a result of financial stress

6% of pensioners haven't always been able to afford a roof over their head

7% say money is their main sources of conflict in their family

7% say fear of bills has led them to avoid opening their mail or checking their statements

4% admit to acting in an uncharacteristically aggressive way because of financial stress

ABC comment, have your say below:

Irish Government Provides School Uniforms Help

SCHOOL UNIFORMS - The Minister for Employment Affairs and Social Protection, Regina Doherty, T.D., today confirmed that over 130,000 families have received the Back to School Clothing and Footwear Allowance payment in respect of 239,230 children since July when this year’s scheme commenced. The Minister also urged families with school-going children, who have not yet applied, to check out their entitlement to this scheme as they may qualify for a payment, depending on their financial circumstances.

The Back to School Clothing and Footwear Allowance is a nationwide Department of Employment Affairs and Social Protection scheme that provides a once-off payment to eligible families towards the cost of school clothing and footwear. As provided for in Budget 2019, the payment has been increased by €25 this year for each qualifying child.

Minister Doherty said:

“This can be a particularly stressful time of year for many families. The Back to School Clothing and Footwear Allowance provides valuable support to eligible families to assist with the extra costs when children start school each autumn and this year we are providing for an additional €25 payment per child. I would urge anybody who has not yet applied to check their eligibility for the scheme which provides a once-off payment to assist with the costs of school clothing and footwear.”

An allowance of €150 is paid for each eligible child who is aged 4 - 11 on or before 30 September 2019 while an allowance of €275 is paid for each eligible child aged 12 - 22 on or before 30 September 2019.

Children aged between 18 and 22 years must be returning to full-time second-level education in a recognised school or college in the autumn of 2019.

Families who have not received notification from the Department of an automated payment will need to make an application. Application forms are available at all Intreo Centres, on the Department’s website www.welfare.ie , via SMS (text Form BTSCFA followed by customer’s name and address to 51909) or by sending an email to This email address is being protected from spambots. You need JavaScript enabled to view it. . This year, people can also apply online via the Department’s website.

The closing date for receipt of applications for this year’s Back to School Clothing and Footwear Allowance is 30 September 2019.

The Department is also providing a dedicated phone bank to answer enquiries during business hours 9.00am to 5.00pm. Anyone wishing to make enquiries about this scheme can contact (071) 9193318 or LoCall 1890 66 22 44.

ABC Comment, have your say below:

Social Housing Scottish Annual Conference Looms Up

MAJOR HOUSING CONFERANCE - The countdown is on for the Social Housing Scottish Annual Conference which takes place in just over two weeks.

Organisers say you can meet 150+ business leaders from across the Scottish housing sector in one place under one roof, to share best practice and explore forward-thinking solutions to tackle the challenges in this changing economic and political landscape.

The programme has been designed to cover all the major business issues facing the Scottish social housing sector – from the shifting political landscape for public spending and social housing providers, to the Scottish Government’s 50,000 affordable homes target, funding and partnerships

Join delegates on 5th September as peers from across Scotland come together to discuss and debate the critical issues facing Scottish social and affordable housing.

Date and venue

Thursday, 5th September

The Studio, 67 Hope Street, Glasgow, G2 6AE.

See all confirmed speakers here

ABC Comment, have your say below:

Rising Employment Drives Rising Rent Increases

RENTS SKYROCKET - Some interesting research here showing the relationship between employment and rental increases.

Research by lettings management platform Howsy has looked at how employment rates impact rental growth and where is home to the best mix of above-average employment and healthy rental increases for landlords.

The latest data on employment levels from the Annual Survey of Hours and Earnings across the UK shows that there has been strong growth in the number of us in work, with 75.2% of the population now employed, up 5.32% in the last year. During this time rents have also climbed, up 11.9% and Howsy found that on average, a 1% increase in the rate of employment brings a 1.08% increase in rental growth.

The best location for this mix of a secure rental income and good rental growth is York. Currently, the city is home to an employment rate of 78.4%, higher than the UK average, while in the last five years rents have increased by 38%.

South Gloucestershire is home to an even higher employment level with 80.7% of the population in work, with rents up 37% in the last five years.

Bristol ranks third with rents climbing 29% during the same time frame and 77.6% of the population currently in employment. Midlothian and East Lothian are the best investment option north of the border with rents up 27% and 79.4% and 78.4% of the population in work.

Edinburgh ranks sixth, followed by Bath and Waltham Forest is the first London borough in the top 20 with 78.7% of the population in work, with rents again up 27% in five years.

Central Bedfordshire and Cardiff complete the top 10, with the likes of Havering, Lewisham, Salford, Falkirk , and Southend making the top 20 to name but a few.

Founder and CEO of Howsy, Calum Brannan, commented:

“A buy to let investment is a big decision and landlords should base this on far more than the rental yields available. While the highest return will always be top of the list, it should be balanced by other factors as issues with an area, or a tenant can cause a long-term problem that may cost you more money than the property makes.

Employment levels can provide a great indicator of the quality of an investment as they usually mean greater ease for finding a reliable tenant and that an area is benefiting from a wider economic uplift.

This works both ways as tenants will often be drawn to an area for work and while not every area home to a high employment rate will translate to a higher rental return, an influx of tenant demand will generally see the profitability of your buy-to-let increase.”

|

Ranking - by average rental growth for areas with above-average employment |

||

|

Location |

Employment Rate (%) Mar 2019 |

Ave Monthly Rent - growth (2014-2019) |

|

York |

78.4 |

38% |

|

South Gloucestershire |

80.7 |

37% |

|

Bristol, City of |

77.6 |

29% |

|

Midlothian |

79.4 |

27% |

|

East Lothian |

78.4 |

27% |

|

City of Edinburgh |

77.7 |

27% |

|

Bath |

81.2 |

27% |

|

Waltham Forest |

78.7 |

27% |

|

Central Bedfordshire |

83.7 |

25% |

|

Cardiff |

75.6 |

25% |

|

Bedford |

77.7 |

24% |

|

Havering |

76.1 |

24% |

|

Lewisham |

76.9 |

24% |

|

Salford |

76.4 |

23% |

|

Falkirk |

75.4 |

22% |

|

West Berkshire |

81.2 |

21% |

|

City of London |

76.8 |

21% |

|

Southend-on-Sea |

79.9 |

20% |

|

Bexley |

76.8 |

20% |

|

Thurrock |

76.4 |

19% |

|

United Kingdom |

75.2 |

11.9% |

|

Sources |

|

|

Employment statistics |

|

|

Private rental data |

|

Image: Flats to rent Paisley.

ABC Comment, have your say below:

US Youth Labor Force Participation Rate At 61.8 Percent in July 2019, A 9-Year High

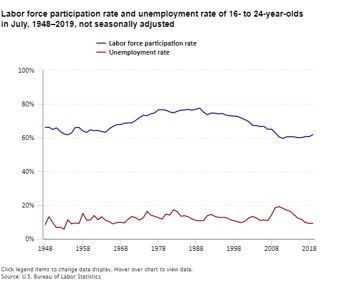

YOUNG PEOPLE GET JOBS - In July 2019, 61.8 percent of 16- to 24-year-olds participated in the labor force. That is, they were working or looking for work. The July 2019 labor force participation rate for youth was notably higher than the July rates for the prior 9 years.

However, the rate remained considerably below the July 1989 peak of 77.5 percent.

According to the US Chamber of Commerce: without employment income, young people cannot pay off the staggering U.S. student debt, help sustain the deeply strapped Social Security and Medicare systems, or contribute to their own retirement savings that rely on early-year contributions to accrue returns. The mix of high debt and joblessness fans disillusionment and frustration with our political and economic system, making the American dream seem more like an illusion and imposing huge societal costs. They include depriving our country of youth’s energy, fresh perspective, and inherent inventiveness.

Youth idleness is hardly just an American phenomenon. The Economist reports that nearly one-quarter of the world’s youth is either not employed, in training or in school. Studies show that teenagers who are neither working nor in school are more susceptible to criminal behavior, violence, and delinquency

ABC comment, have your say below:

Frustrated DWP Universal Credit Staff Going on Strike

STAFF ON STRIKE - 200 Universal Credit call handers, members of the Public Commercial Services union (PCS) will stage a two-day strike next week after "running out of patience" with what they say are cuts and overwork.

More than 200 workers are set to stage a walkout at a contact centre in Stockport, Greater Manchester, next Tuesday and Wednesday after approving the action in a strike ballot.

PCS members voted 91.9% in favour of strike action and 95% in favour of action short of strike on a 71.4% turnout.

Staffing at the Universal Credit Service Centre, Millennium House in Stockport has been in decline since its introduction in 2016/17. Despite existing staff being switched to UC to support hard-pressed members and further staff from the remaining legacy command incoming in September, PCS members are clear this is not going to tackle the problem of increasing workloads and the demands placed upon staff.

It comes after two walkouts at centres in Wolverhampton and Walsall earlier this year over similar issues.

Image: PCS general secretary Mark Serwotka

PCS general secretary Mark Serwotka said: "The decision to take strike action has not been taken lightly by our members in Universal Credit. They do their best to help claimants get the support they need.

The Department for Work and Pensions (DWP) said it is confident that staffing levels are sufficient.

A DWP spokesman said: "We are disappointed that the PCS in Stockport has taken this course of action. As with previous strikes, our contingency plans will ensure our service is maintained throughout.

"We greatly value the work that our colleagues do and we are committed to supporting them in their roles, including by monitoring staff levels and making sure their caseloads are manageable."

The DWP said it will monitor staffing and is holding regular meetings with the union locally to attempt to resolve the issues.

PCS demands the DWP:

- Recruits 100 new staff members

- Limits calls to 30 a week for case managers

- Increases the one minute time allowed for after-call work

- Allocates time for case work to be completed

- Ends the attack on flexi

- Ends the unnecessary restrictions on breaks and lunches

- Ends the victimisation of a local PCS representative and a PCS member and the dropping of cases against them.

How you can help

Show your support by attending the picket line at Millennium House in Stockport from 7.30am on both Tuesday (27) and Wednesday (28) August or by donating to the PCS Stockport and Tame Valley Branch Hardship Fund: Sort code 60-83-01, account number 20260684.

Send messages of support to This email address is being protected from spambots. You need JavaScript enabled to view it. and all will be forwarded on.

ABC Note: Two million people are now on Universal Credit. Next Summer the rest of benefits claimants will be moved onto the controversial new benefit.

ABC Comment, have your say below:

Government Blunder as Universal Credit Claimants Told They Can Work As Strippers

STRIPPERS ON UNIVERSAL CREDIT - Universal Credit claimants have been told they can work as strippers after a blunder on the Department for Work and Pensions website.

In a post, which has now been removed, the government suggested the kind of "work you could do" would be "dances in adult entertainment establishments."

It also suggested including "striptease artists" in "words to use in your online search".

And candidates would need "no formal academic entry requirements" - because "training is received typically on-the-job".

"Typical pay and hours" would be "42 hours a week for around £350.00".

A Department for Work and Pensions spokesperson said: "This is inappropriate and we will immediately review this to determine why it is mistakenly listed.

ABC Comments, have your say below:

Jobcentre Plus Opening Times and Benefit Payments for Monday 26 August

AUGUST BANK HOLIDAY - Jobcentre Plus offices and phonelines in England, Scotland and Wales will be closed on Monday 26 August.

To make sure people receive their payments on a day when Jobcentre Plus offices are open, some benefits due to be paid on Monday 26 August will be paid early on Friday 23 August.

|

2019 |

||

|

26 August |

Monday |

Summer bank holiday |

|

25 December |

Wednesday |

Christmas Day |

|

26 December |

Thursday |

Boxing Day |

|

Upcoming bank holidays in England and Wales 2020 |

||

|

1 January |

Wednesday |

New Year’s Day |

|

10 April |

Friday |

Good Friday |

|

13 April |

Monday |

Easter Monday |

|

8 May |

Friday |

Early May bank holiday (VE day) |

|

25 May |

Monday |

Spring bank holiday |

|

31 August |

Monday |

Summer bank holiday |

|

25 December |

Friday |

Christmas Day |

|

28 December |

Monday |

Boxing Day (substitute day) |

If a bank holiday is on a weekend, a ‘substitute’ weekday becomes a bank holiday, normally the following Monday.

Your employer doesn’t have to give you paid leave on bank or public holidays.

Bank holidays might affect how and when your benefits are paid.

ABC Comment, have your say below:

UK Pensions and Benefits Overseas after BREXIT

PENSIONS UPDATE -The UK leaving the EU will not affect your entitlement to continue receiving your UK State Pension if you live in the EU, EEA or Switzerland.

The UK government would wish to continue uprating pensions but will take decisions in light of whether reciprocal arrangements with the EU are in place.

You will carry on receiving other UK benefits you already receive while you are living in the EU, EEA or Switzerland, as long as you continue to meet the eligibility criteria.

Pensions and benefits paid by an EU country, an EEA country or Switzerland

If you are paid a pension or benefit by an EU country, an EEA country or Switzerland, check with the organisation that pays you to find out what will happen after Brexit.

Annuities and personal pensions from a UK pension provider

Your pension provider should have made plans to make sure you can still get payments from your annuity or personal pension after Brexit.

Your pension provider should contact you if they need to make changes to your annuity or pension or the way you are paid after Brexit.

If you have any questions, contact your pension provider.

UK workplace pensions

UK law allows for workplace pensions to be paid overseas. The government does not expect this to change after Brexit.

If you have any questions, contact your pension provider.

If your workplace pension is paid into a UK bank account, your bank should contact you if they need to change the way you receive your pension after Brexit.

ABC comment, have your say below: