Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Unite Secures Victory For ‘Stolen Weeks’ ESS Mod Workers In Hampshire

Unite, the UK and Ireland’s largest union, has secured victory after a two year struggle for a group of low paid workers employed by the sub-contractor ESS, part of the multi-million pound Compass group, following the ‘theft’ of their working weeks.

In 2017, ESS ‘stole’ up to two working weeks from the workers who were employed as cleaners, mess hands and housekeepers (most of whom were paid the minimum wage) on Ministry of Defence establishments in the Gosport area including Fort Blockhouse.

In effect the workers were paid for just 50 weeks a year rather than the standard 52.

Unite staged a lengthy campaign involving demonstrations, petitions and leafletting to put pressure on both ESS and the MoD to have the stolen weeks reinstated.

Unite then launched a legal case for breach of contract, on behalf of some of the affected workers. As a result of the legal challenge ESS accepted its decision to reduce the working weeks of their employees’ was illegal.

The workers have had their working weeks reinstated, so they are again being paid for 52 weeks a year and have received compensation which is worth on average £1,900 per worker.

ABC Note: ESS has been a market leader in the Defence and Government Services sectors for over 40 years. As well as providing quality catering, retail and leisure services, we offer a portfolio of superior and sustainable soft services, including hotel, cleaning, waste management, security and reception services.

ABC Comment: have your say below:

Tesco Stores Shed Jobs

Tesco is to cut around 4,500 staff in the latest round of retail redundancies. The majority of the jobs will be cut from 153 mid-size Metro stores and the smaller Express chain of shops and the larger superstores.

Footfall has been lower than hoped. Tesco wants to overhaul its Metro stores. The Metro format was originally designed for larger, weekly shops. Today people are shopping more often and buying less.

Tesco - Britain's biggest private-sector employer with more than 300,000 staff. Tescos have said it was changing the way it stocked stores, with more products going directly to the shop floor and fewer being held in the back.

Retail has been slowing down. People do not have the disposable income available.

ABC Comment, have your say below:

Trussell Trust ABC Directory Entry Updated

FOODBANKS - We have just updated the Trussell Trust entry in our directory: https://www.abcorg.net/food-bank/trussell-trust

New data released earlier in the year April 2018 to March 2019 showed this period to be the busiest year for food banks in the Trussell Trust’s network since the charity opened. During the past year, 1,583,668 three-day emergency food supplies were given to people in crisis in the UK; More than half a million of these (577,618) went to children. This is an 18.8% increase in the previous year.

The main reasons for people needing emergency food are benefits consistently not covering the cost of living (33%), and delays or changes to benefits being paid.**

Universal Credit is not the only benefit payment people referred to foodbanks have experienced problems with, but issues with moving onto the new system are a key driver of increasing need. Almost half (49%) of foodbank referrals made due to a delay in benefits being paid in the UK were linked to Universal Credit.***

From this data and other insights from food banks in the Trussell Trust’s network, the charity believes ending the five weeks for a first Universal Credit payment should be the Government’s priority to help create a future without food banks.

ABC Note: Is your organization in our directory? If not let us chat. Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

The Association of Pension & Benefits CIC (the ABC) was founded when we saw a need for an organization to represent those on state pensions and welfare benefits. This large community of millions of people is linked by a common circumstance.

We have 16,000 contacts, around 3,000+ articles on-line and daily we receive around a thousand emails from the EU, governments. politicians, pressure groups and NGOs.

This is growing weekly and people and major organizations are now finding us. With the prediction of 75 million people around the globe potential losing their jobs due to technology and the changing way we work; the ABC is here to help this community and present of a positive image of those in the 99% having to meet life’s challenges in a changing work environment.

ABC Comment, have your say below:

U.S. Department of Labor Announces Rule To Strengthen Retirement Security For Millions Of American Workers

WASHINGTON, DC – The U.S. Department of Labor today announced a rule to help strengthen retirement security for millions of small business employees across America.

The rule makes it easier for small businesses to offer retirement savings plans to their workers through Association Retirement Plans (ARPs), which would allow small businesses to band together to offer retirement plans to their employees.

"Less than a year ago, President Donald J. Trump signed an Executive Order focused on expanding quality, affordable workplace retirement plan options for America's small businesses and their employees," Acting Secretary of Labor Patrick Pizzella said. "Many small businesses would like to offer retirement benefits to their employees, but are discouraged by the cost and complexity of running their own plans. Association Retirement Plans offer valuable retirement security to small businesses' employees through their retirement years."

Enhancing workplace retirement savings is critical to the financial security of America's workers. Approximately 38 million private-sector employees in the United States do not have access to a retirement savings plan through their employers.

Under the rule, ARPs could be offered by associations of employers in a city, county, state, or a multi-state metropolitan area, or in a particular industry nationwide. In addition to association sponsors, the plans could also be sponsored through Professional Employer Organizations (PEO). A PEO is a human-resource company that contractually assumes certain employment responsibilities for its client employers.

By expressly permitting these new plan arrangements, the rule enables small businesses to offer benefit packages comparable to those offered by large employers. The Department expects the plans to reduce administrative costs through economies of scale and to strengthen small businesses' hand when negotiating with financial institutions and other service providers. The final rule effective date is September 30, 2019.

In August 2018, President Donald J. Trump issued Executive Order 13847, "Strengthening Retirement Security in America." The Executive Order called for the Secretary of Labor to clarify and expand the circumstances under which U.S. employers, especially small- and mid-sized businesses, may sponsor or adopt an ARP or Multiple Employer Plan as a workplace retirement option for their employees. The Department used its delegated authority under the Employee Retirement Income Security Act of 1974 in developing the rule.

The Department of Labor's mission is to foster, promote, and develop the welfare of the wage earners, job seekers, and retirees of the U.S.; improve working conditions; advance opportunities for profitable employment; and assure work-related benefits and rights.

ABC Note: The average retirement age in the United States among currently living retirees was 59.88 years old. The median living retiree left work at 62 years old, and the most common age to retire was 62 years old. 18.7% of retirees retired at age 62, and a whopping 63.1% retired between the ages of 57 and 66.

ABC comment, have your say below:

Fancy Working for Jobcentre Plus?

A CAREER WITH THE DWP - The Daily Record made a Freedom of Information record UK Government said 61 senior civil servants in the DWP last year got awards at an average of £9600.

The DWP’s bonus figures emerged in a freedom of information request seen by the Daily Record. Details of awards were given depending on pay scale, including for grade six staff who earn about £70,000.

They said 183 grade six employees were given awards of £1450 in the financial year 2017-18.

The most senior civil servants got between £9500 and £17,500 in performance awards, averaging £9600. More than 55,000 staff in admin, executive officers and higher executive roles got £500.

However government data reveals that over the last six years since Universal Credit was first introduced, nearly 20,000 DWP staff have been cut – a figure that accounts for a fifth of the entire workforce.

If you fancy working for the DWP please see the video below.

ABC Comments, have your say below:

Birkenhead MP Frank Field to Stand as New Social Justice Candidate

FRANK FIELD MP - first became a Labour MP after serving as Director of the Child Poverty Action Group from 1969 to 1979. Mr Field is now standing for a new party.

The 77-year-old Mr Field, who has served since 1979, shared the news in his constituency Birkenhead shortly after noon on Friday.

His team wrote on Twitter: "I will be standing at the next general election as the Birkenhead Social Justice candidate."

Mr Field is the current chair of the DWP Work & Pensions Committee. He has represented Birkenhead on behalf of the Labour Party for over 40 years.

ABC Comments, have you say below:

US Creates 164,000 Jobs in July; Unemployment Rate Unchanged At 3.7%

USA JOBS INCREASE - Total nonfarm payroll employment rose by 164,000 in July, and the unemployment rate was unchanged at 3.7 percent. Notable job gains occurred in professional and technical services, health care, social assistance, and financial activities.

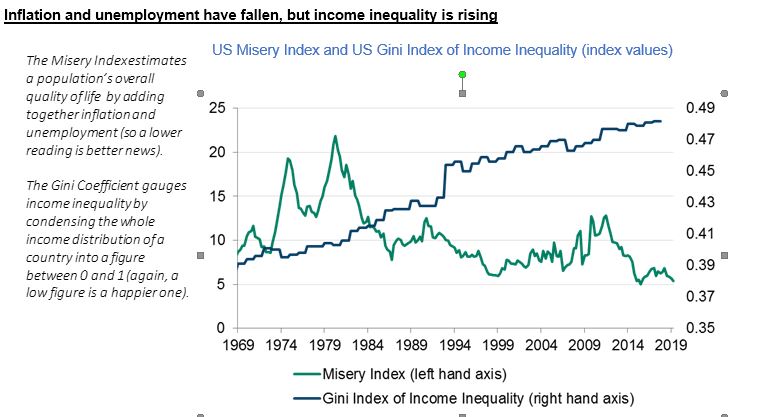

The US population is increasingly better off, and increasingly unequal

So says, Chiru Lahiri, Investment Manager at Heartwood Investment Management, the asset management arm of Handelsbanken in the UK.

According to the emotively named ‘Misery Index’, the US is better off today than ever before. Low inflation and low unemployment, the latter backed up by today’s relatively steady US jobs report data, are creating an apparently benign environment for the US population.

However, a glance at the Gini coefficient tells us that while the country may be better off on the whole, US incomes are increasingly unequal.

A number of factors have led to this turn of events. The first is a relatively organic one – income inequality can naturally rise as a country reaches a certain point in its economic development. The second is a decidedly policy-made matter: the generous quantitative easing enacted by the US Federal Reserve in the wake of the 2008 financial crisis has led to a decade-long bull run in the value of many financial assets, which are primarily held by those already in the upper echelons of the income distribution curve. The third is a comparatively new issue, but one which has echoes of past technological advances: the growing presence of automation across industries is disproportionately harming the least well off.

So the US may be better off overall, but it is seemingly an increasingly unequal place to be. Issues like these, across developed nations, are unlikely to be transitory. We believe that these long-term secular trends – often masked by short-term data points – will be a driving force in political, economic and policymaker agendas into the future.

ABC Comment, Have your say below:

Judges Releasing Council Tax Debtors From Prison

REGULATION 47 of the Local Government Finance Act 1992 states people can be given prison sentences for not paying council tax only if they have done so due to “wilful neglect or wilful refusal”, meaning those who have fallen into arrears because they can't afford to pay should not be imprisoned.

The High Court has admitted up to 17 people in England and Wales were unlawfully sent to jail for not paying their council tax last year.

Judges have been releasing people jailed by magistrates. Council Tax is a ‘Priority Debt’ and some Councils have started bankruptcy proceedings against those that have not paid. There has been considerable criticism of the way that bailiffs have been treating the public as many people do not pay because of financial hardship.

If you are in arrears, the best thing to do is to talk to your council and to confirm any discussions in writing. Thus if you have honestly tried to come to an arrangement, the Court cannot argue that you have shown “wilful neglect or wilful refusal”.

ABC Comment, have your say below:

Local Government and Social Care Ombudsman Decisions

LOCAL GOVERNMENT AND SOCIAL CARE OMBUDSMAN DECISIONS - We all know the authorities can get it wrong for time to time. By reading up on other claimants’ outcomes you can get a feel if you have a case? The more transparency the better, and it leads to better service and fairer treatment of those who feel aggrieved.

New benefits and taxation decisions

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-004-761">Salford City Council (18 004 761)

Summary: Mr D complains about the Council’s recovery action for Council Tax and Housing Benefit debts. The Ombudsman has found fault with both issues, because of problems with holding recovery and sending communications to the wrong address. But the Council has accepted fault and offered Mr D repayment arrangements that are more generous than usual standard schedules. The Ombudsman’s view is this means there is insufficient injustice to warrant a further remedy.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-009-591">Harrogate Borough Council (18 009 591)

Summary: Mr X complains about the way the Council has recovered outstanding council tax from him. We find fault by the Council in some of its consideration about whether to take bankruptcy proceedings or seek a charging order to secure its debt. This has caused some injustice to Mr X as uncertainty. The Council has therefore agreed to further consider the affordability of any payments Mr X can make towards his debt and reconsider its existing recovery protocol.

https://www.lgo.org.uk/decisions/benefits-and-tax/housing-benefit-and-council-tax-benefit/18-012-918">London Borough of Lambeth (18 012 918)

Summary: Miss B complains the Council wrongly reduced her housing benefit for seven months. Miss B says she fell into rent arrears and received a notice of possession for her home. The Ombudsman finds the Council at fault for reducing Miss B’s housing benefit. The Council agrees to apologise and pay Miss B for time and trouble, and distress caused by the fault.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-018-068">Copeland Borough Council (18 018 068)

Summary: The Ombudsman will not investigate this council tax complaint because there is insufficient evidence of injustice.

https://www.lgo.org.uk/decisions/benefits-and-tax/housing-benefit-and-council-tax-benefit/18-019-312">North Somerset Council (18 019 312)

Summary: The Ombudsman will not investigate this complaint about a housing benefit overpayment from 2004. This is because it is late complaint.

https://www.lgo.org.uk/decisions/benefits-and-tax/other/18-019-650">Northumberland Council (18 019 650)

Summary: Mr X disputes his liability for either council tax or business rates on a property he formerly leased. The Ombudsman will not investigate this complaint because this is a matter for either the Valuation Tribunal or the courts.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-017-249">Westminster City Council (18 017 249)

Summary: The Ombudsman will not investigate Mr B’s complaint about summons costs added to his council tax account. Mr B has confirmed the matter is resolved as the Council has withdrawn the costs as a goodwill gesture.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-019-324">Cheshire East Council (18 019 324)

Summary: The Ombudsman will not investigate this complaint about the Council’s decision to charge extra council tax on an empty property. This is because there is insufficient evidence of fault by the Council and because the level of council tax can only be challenged in court. In addition, the complainant could appeal to the Valuation Tribunal.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax-support/18-019-400">Winchester City Council (18 019 400)

Summary: The Ombudsman will not investigate Mrs B’s complaint about overpaid council tax reduction. This is because it is reasonable to expect her to appeal to the Valuation Tribunal.

https://www.lgo.org.uk/decisions/benefits-and-tax/housing-benefit-and-council-tax-benefit/18-014-769">Sandwell Metropolitan Borough Council (18 014 769)

Summary: Mr B complains about how the Council dealt with his claim for Housing Benefit when he was a full-time student, and his correspondence and appeal since then. The Ombudsman finds there was minor fault by the Council in that it asked him to provide information he had already provided. This caused frustration and inconvenience for which an apology is recommended.

https://www.lgo.org.uk/decisions/benefits-and-tax/housing-benefit-and-council-tax-benefit/18-018-405">Leicester City Council (18 018 405)

Summary: A housing benefit claimant complained that the Council had repeatedly used incorrect information in assessing her claim. But the Ombudsman cannot investigate this matter because the claimant has appealed to a tribunal about the Council’s benefit decisions in her case.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-018-999">High Peak Borough Council (18 018 999)

Summary: The Ombudsman will not investigate this complaint from a landlord about liability for council tax. This is because the complainant can appeal to the Valuation Tribunal and because there is insufficient evidence of fault by the Council.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-019-106">South Somerset District Council (18 019 106)

Summary: Mrs X complains about the Council’s decision not to award a council tax exemption or discount to her mother’s home whilst her mother resides in a care home. The Ombudsman will not investigate this complaint because there is a right of appeal to a Valuation Tribunal.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-019-171">Durham County Council (18 019 171)

Summary: Mr X complains about the way the Council dealt with his council tax liability. The Ombudsman will not investigate this complaint because the matter has been remedied by the Council as it has withdrawn the Liability Order and waived the costs.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-018-685">Newcastle upon Tyne City Council (18 018 685)

Summary: The Ombudsman will not investigate this complaint that the Council sent Council Tax enforcement documents to the wrong address. This is because there is insufficient evidence of fault by the Council.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-018-843">London Borough of Haringey (18 018 843)

Summary: The Ombudsman will not investigate this complaint about council tax arrears and bankruptcy. This is because it is a late complaint and because the complainant can appeal to the Valuation Tribunal.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-018-975">Preston City Council (18 018 975)

Summary: Ms X complained about the Council’s refusal of her application for a discount or exemption from council tax. The Ombudsman should not investigate this complaint. This is because it was reasonable for her to appeal to the Valuation Tribunal which is the proper authority to consider disputes appeals about council tax liability.

https://www.lgo.org.uk/decisions/benefits-and-tax/council-tax/18-019-190">Tonbridge and Malling Borough Council (18 019 190)

Summary: The Ombudsman cannot investigate this complaint about an increase in council tax and a reduction in services. This is because the law says the Ombudsman cannot investigate something that affects most of the people living in a council area and he has no power to change the level of council tax.

New adult social care complaint decisions:

https://www.lgo.org.uk/decisions/adult-care-services/assessment-and-care-plan/17-018-028">Birmingham City Council (17 018 028)

Summary: There was no fault by the Council in a complaint alleging fault because it did not take the exceptional circumstances of the complainant’s sister into account when it refused her request for direct payments to provide care for her sister.

https://www.lgo.org.uk/decisions/adult-care-services/residential-care/18-010-112">Anchor Care Homes LTD (18 010 112)

Summary: Mr X complained about the Care Provider’s communication because it had not let him know his mother’s (Mrs Y’s) health had worsened. He also complained about its handling of his complaint about this. Sadly, Mrs Y, died during these events. The Ombudsman finds the Care Provider caused Mr X distress, time and trouble. It will apologise and take action to prevent similar problems in future.

https://www.lgo.org.uk/decisions/adult-care-services/direct-payments/18-011-536">Surrey County Council (18 011 536)

Summary: Ms X and Ms Y complained the Council reduced their mother’s direct payments but her care needs had not changed. The Council calculated their mother’s personal budget based on its assessments of her needs. It has explained how the budget is sufficient to meet those needs, based on its experience of costs within the local care provider market. The Council took too long to respond to Ms X and Ms Y’s complaint. It has apologised which is appropriate to remedy the injustice.

https://www.lgo.org.uk/decisions/adult-care-services/charging/18-012-762">Norfolk County Council (18 012 762)

Summary: The Council gave incorrect advice to Mrs X about her mother’s residential care. It refused to meet the full cost of the care and required Mrs X to pay a top up. It failed to establish if Mrs X’s mother could be moved to a cheaper home without detriment to her health. The Council acknowledged its failings in this case and proposed a remedy in recognition of the injustice caused.

https://www.lgo.org.uk/decisions/adult-care-services/other/18-013-471">Norfolk County Council (18 013 471)

Summary: Mr X complains the Council has failed to secure a place for his brother in the preferred care home, resulting in him remaining in hospital with no prospect of finding a suitable placement for him. Although there has been some fault by the Council, this has not caused injustice which warrants a remedy.

https://www.lgo.org.uk/decisions/adult-care-services/charging/18-018-440">London Borough of Wandsworth (18 018 440)

Summary: Ms X complained the Council’s negligence caused an accident which meant she needed extra care services. She says she should not have to pay for the extra care and has put in an insurance claim against the Council. The Ombudsman cannot investigate this complaint. The Ombudsman cannot decide if the Council is responsible for Ms X’s accident and liable for the extra care costs.

https://www.lgo.org.uk/decisions/adult-care-services/assessment-and-care-plan/18-019-036">Wakefield City Council (18 019 036)

Summary: The Ombudsman will not investigate Mr A’s complaint about the way he was treated by his late mother’s social worker. This is because the injustice to Mr A from the actions of the Council is not significant enough to warrant an investigation by the Ombudsman.

https://www.lgo.org.uk/decisions/adult-care-services/residential-care/18-019-150">Lancashire County Council (18 019 150)

Summary: The Ombudsman will not investigate Mrs A’s complaint about the care given to her late mother, Mrs B, by her care provider between 2017-2018 prior to her death. This is because any further investigation would not add to the Council’s investigation or the Coroner’s findings, and he could not provide Mrs A with the outcome she wants.

https://www.lgo.org.uk/decisions/adult-care-services/other/18-019-175">Rochdale Metropolitan Borough Council (18 019 175)

Summary: The Ombudsman will not investigate Mr B’s complaint about the Council’s refusal to pay him the full cost of the goods it disposed of in 2017 when it cleaned his property. This is because the Ombudsman could not say what the goods were worth. It would be reasonable for Mr B to pursue his claim through the courts.

https://www.lgo.org.uk/decisions/adult-care-services/assessment-and-care-plan/18-007-546">East Sussex County Council (18 007 546)

Summary: Although the Council agreed to backdate funding for Mrs B’s care to the date her daughter first asked it for support, it failed to fully refund the amount Mrs B had paid over and above her assessed weekly contribution. It is also unclear whether the Care Provider refunded Mrs B after the Council made a backdated payment in 2012. The Council has agreed to pay Mrs B’s estate £2,705 – the amount she paid over her assessed contribution – and to look into what happened to its backdated payment in July 2012.

https://www.lgo.org.uk/decisions/adult-care-services/other/18-009-775">North East Lincolnshire Council (18 009 775)

Summary: Mrs X complains about the respite care provided to Ms Y. She says when she left, Ms Y was in pain and said she did not want to go there again. Ms X will have to find a less convenient option in future. The Ombudsman finds the Council at fault in the actions of the Care Provider. The Council will pay Ms Y £200, and Mrs X £100 for the distress and risk of harm it caused. It will also take action in addition to action already taken, to prevent similar problems in future.

https://www.lgo.org.uk/decisions/adult-care-services/charging/18-011-816">Leicestershire County Council (18 011 816)

Summary: The Ombudsman will not investigate Mr A’s complaint about the Council charging Mr B for care prior to June 2018. This is because there is no evidence of fault with the Council’s actions and no injustice to Mr A.

https://www.lgo.org.uk/decisions/adult-care-services/residential-care/18-013-340">Surrey County Council (18 013 340)

Summary: There was fault in the way the Council arranged a care home placement for Mr T’s wife. The Council has partly remedied the injustice this caused, but the Ombudsman further recommends the Council makes a payment to Mr T for his distress, uncertainty, time and trouble. The Council should also review its internal procedures to ensure it complies with statutory guidance.

https://www.lgo.org.uk/decisions/adult-care-services/transport/18-018-708">East Sussex County Council (18 018 708)

Summary: The Ombudsman will not investigate this complaint that the Council delayed assessing an application for a Blue Badge. This is because there is insufficient evidence of fault by the Council.

https://www.lgo.org.uk/decisions/adult-care-services/assessment-and-care-plan/18-004-899">Newcastle upon Tyne City Council (18 004 899)

Summary: The Ombudsman will not investigate this complaint about residential care charges. This is because there is insufficient evidence of fault by the Council.

https://www.lgo.org.uk/decisions/adult-care-services/safeguarding/17-004-725">Northamptonshire County Council (17 004 725)

Summary: X complains the Council has failed to complete a needs assessment and failed to make reasonable adjustments to reflect X’s needs. The Council failed to ensure X had an Advocate to support X during the assessment. The Council has agreed to remedy this by referring X to its advocacy service again and ensuring an Advocate is available to support X through the assessment process.

https://www.lgo.org.uk/decisions/adult-care-services/domiciliary-care/17-018-267">Trafford Council (17 018 267)

Summary: The Ombudsmen find Council-arranged domiciliary carers did not complete an adequate plan to help prevent a vulnerable person from getting pressure sores. The lady did develop painful pressure sores and it is likely better planning could have helped prevent them. Further, the Ombudsmen find both a Council and a hospital Trust failed to communicate effectively about a safeguarding concern. As a result, adequate investigations did not take place. The Council and Trust have agreed to apologise and make small financial payments to address the injustice.

https://www.lgo.org.uk/decisions/adult-care-services/domiciliary-care/18-010-228">JKD Trading Limited (18 010 228)

Summary: Mrs X is complaining on behalf of her father Mr Y. She says his care provider, JKD Trading Ltd, is at fault for not refunding him for care he paid for to another provider and for charging him for care it did provide. The Ombudsman has discontinued his investigation into this complaint because he cannot determine if there are grounds for JKD Trading Ltd to pursue payment from Mr Y. Furthermore the Ombudsman cannot ask the other care provider to refund money to Mr Y.

https://www.lgo.org.uk/decisions/adult-care-services/other/18-010-932">Herefordshire Council (18 010 932)

Summary: Ms X complained the Council delayed authorising a Deprivation of Liberty Safeguards referral for Mrs Z from her care home. The Council was at fault. The Council’s administrative errors prevented it from authorising the DoLS within the statutory timeframe. That caused Ms X avoidable frustration, uncertainty and the time and trouble of complaining to the Council. The Council had already apologised to Ms X and carried out several actions to prevent reoccurrence of the fault. I could not investigate the impact of the delay on Mrs Z because she had challenged the DoLS authorisation at the Court of Protection.

https://www.lgo.org.uk/decisions/adult-care-services/assessment-and-care-plan/18-013-050">Cornwall Council (18 013 050)

Summary: The Council has failed to carry out a review of Mrs B’s direct payments between 2012 and 2017, agreed as a resolution to a previous complaint. This has caused Mrs B significant time, trouble and frustration. The Council has agreed to carry out the review now, provide a full explanation as to the rate of pay used, calculate any underpayment and pay it to Mrs B, in addition to £500 for her time, trouble and distress.

https://www.lgo.org.uk/decisions/adult-care-services/domiciliary-care/18-016-373">City Of Bradford Metropolitan District Council (18 016 373)

Summary: The Ombudsman will not investigate Mrs A’s complaint about the care provided to her mother Mrs B. This is because he could not add to the Council’s response or make a finding of the kind Mrs A wants even if he investigated.

https://www.lgo.org.uk/decisions/adult-care-services/other/18-018-490">Suffolk County Council (18 018 490)

Summary: Ms B complains about the Council’s response to her report that personal items were removed from her home by a support worker without permission. The Ombudsman will not investigate the complaint because it is unlikely we can add to the investigation already carried out by the Council and an investigation is unlikely to lead to a different outcome.

https://www.lgo.org.uk/decisions/adult-care-services/other/18-019-168">Dorset County Council (18 019 168)

Summary: The Ombudsman will not investigate Mr A’s complaint that accommodation provided for his son, Mr B is not suitable for him. This is because there is not enough evidence of fault with the actions taken by the Council to warrant an investigation by the Ombudsman.

https://www.lgo.org.uk/decisions/adult-care-services/transport/18-019-364">London Borough of Harrow (18 019 364)

Summary: The Ombudsman will not investigate this complaint about an application for a Blue Badge because it is unlikely he would find fault by the Council.

<end>

ABC Comment, have your say below:

Bank of England Warns of Potential No-Deal Brexit Recession

RECESSION LOOMS - In its quarterly inflation report, published today, the Bank of England has warned that even with the smoothest possible Brexit there is a 1/3 chance of a UK recession.

Also published today, the IHS Markit PMI for UK Manufacturing showed that production in the sector fell to its lowest in seven years.

Image: The Bank of England.

ABC Note: Around the world things are slowing down. A No-deal Brexit could push pound to a record low the Bank of England warns. These are tricky times.

Mark Joseph Carney is an economist and banker. He holds Canadian, British and Irish citizenship and has been Governor of the Bank of England since 2013 and was Chairman of the Financial Stability Board from 2011 to 2018. Carney began his career at Goldman Sachs before joining the Canadian Department of Finance.

ABC Comment, have your say below: