Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

EUROMOD Report Blasts Gov Myths

New analysis from EUROMOD* - Institute for Social and Economic Research (ISER) at the University of Essex and the London School of Economics (LSE) have just published a ground breaking report.

Poor lose, and rich gain from direct tax and benefit changes since May 2010 – without cutting the deficit.

New analysis from Essex University and the LSE analyses the impact of benefit and direct tax changes since the election in detail. This shows that the poorest income groups lost the biggest share of their incomes on average, and those in the bottom half of incomes lost overall.

In contrast those in the top half of incomes gained from direct tax cuts, with the exception of most of the top 5 per cent – although within this 5 percent group those at the very top gained, because of the cut in the top rate of income tax.

In total, the changes have not contributed to cutting the deficit. Rather, the savings from reducing benefits and tax credits have been spent on raising the tax-free income tax allowance.

The analysis challenges the idea that those with incomes in the top tenth have lost as great a share of their incomes as those with the lowest incomes

The research, by Paola De Agostini, John Hills and Holly Sutherland suggests that who has gained or lost most as a result of the Coalition’s policy changes depends critically on when reforms are measured from.

Treasury analysis, suggesting that those at the top have lost proportionately most starts from January 2010 and therefore includes the effects of income tax changes at the top announced by Labour in 2009 and taking effect in April 2010, before the election.

But if the Coalition’s impacts are measured comparing the system in 2014-15 with what would have happened if the system inherited in May 2010, they have more clearly regressive effect.

This resulted from the combination of: changes to benefits and tax credits making them less generous for the bottom and middle of the distribution; changes to Council Tax and benefits from which those in the bottom half lost but the top half gained; higher personal income tax allowances which meant the largest gains for those in the middle, but with some income tax increases for the top 5 per cent; and the ‘triple lock’ on state pensions which were most valuable as a proportion of their incomes for the bottom half. ·

Some groups were clear losers on average – including lone parent families, large families, children, and middle-aged people (at the age when many are parents), while others were gainers, including two-earner couples, and those in their 50s and early 60s.

Prof Sutherland, Director of EUROMOD at the Institute for Social and Economic Research (ISER) at the University of Essex commented: “It is striking how seemingly technical issues or minor differences in assumptions like which tax system is taken as the starting point for Coalition reforms, or whether to assume 100% take-up of benefits have very big implications for what we conclude about whether the rich or the poor were harder hit.”

Prof Hills, Director of the Centre for Analysis of Social Exclusion at LSE, commented: “What is most remarkable about these results is that the overall effect of direct tax and benefit changes under the Coalition have not contributed to cutting the deficit.

The savings from benefit reforms have been offset by the cost of raising the tax-free income tax allowance. But those with incomes in the bottom half have lost more on average from benefit and tax credit changes than they have gained from the higher tax allowance.”

Paola De Agostini is Senior Research Officer at the Institute for Social and Economic Research (ISER) at the University of Essex.

John Hills is Professor of Social Policy and Director of the Centre for Analysis of Social Exclusion (CASE) at the London School of Economics.

Holly Sutherland is Research Professor and Director of EUROMOD at the Institute for Social and Economic Research (ISER) at the University of Essex. The paper was prepared as part of CASE’s Social Policy in a Cold Climate programme, which is funded by the Joseph Rowntree Foundation, Nuffield Foundation, and with London-specific analysis funded by the Trust for London.

The views expressed are those of the authors and not necessarily those of the funders. The analysis uses the tax-benefit model, EUROMOD, based at the University of Essex.

*EUROMOD is a tax-benefit microsimulation model for the European Union (EU) that enables researchers and policy analysts to calculate, in a comparable manner, the effects of taxes and benefits on household incomes and work incentives for the population of each country and for the EU as a whole.As well as calculating the effects of actual policies it is also used to evaluate the effects of tax-benefit policy reforms and other changes on poverty, inequality, incentives and government budgets.EUROMOD is a unique resource for cross-national research, designed to produce results that are comparable across countries and meaningful when aggregated to the EU level.

Welfare Reform Casualties

Black Triangle are a Scottish based civil rights group, known for their robust campaigning on behalf of the disabled. They recently published this list of UK Welfare reform deaths, posted by John McArdle.

It certainly makes for some sober reading. We wish Black Triangle all the best with their future campaigns.

Terry McGarvey, 48. Dangerously ill from polycytheamia, Terry asked for an ambulance to be called during his Work Capability Assessment. He knew that he wasn’t well enough to attend his WCA but feared that his benefits would be stopped if he did not. He died the following day.

Elaine Lowe, 53. Suffering from COPD and fearful of losing her benefits. In desperation, Elaine chose to commit suicide.

Mark Wood, 44. Found fit for work by Atos, against his Doctors advice and assertions that he had complex mental health problems. Starved to death after benefits stopped, weighing only 5st 8lb when he died.

Paul Reekie, 48, the Leith based Poet and Author. Suffered from severe depression. Committed suicide after DWP stopped his benefits due to an Atos ‘fit for work’ decision.

Leanne Chambers, 30. Suffered depression for many years which took a turn for the worst when she was called in for a WCA. Leanne committed suicide soon after.

Karen Sherlock, 44. Multiple health issues. Found fit for work by Atos and denied benefits. Fought a long battle to get placed into the support group of ESA. Karen died the following month of a heart attack.

Carl Payne, 42. Fears of losing his lifeline benefits due to welfare reform led this Father of two to take his own life.

Tim Salter, 53. Blind and suffering from Agoraphobia. Tim hanged himself after Atos found him fit for work and stopped his benefits.

Edward Jacques, 47 years old and suffering from HIV and Hepatitis C. Edward had a history of severe depression and self-harm. He took a fatal overdose after Atos found him fit for work and stopped his benefits.

Linda Wootton, 49 years old. A double heart and lung transplant patient. Died just nine days after the government found her fit for work, their refusal letter arriving as she lay desperately ill in her hospital bed.

Steven Cawthra, 55. His benefits stopped by the DWP and with rising debts, he saw suicide as the only way out of a desperate situation.

Elenore Tatton, 39 years old. Died just weeks after the government found her fit for work.

John Walker, 57, saddled with debt because of the bedroom tax, John took his own life.

Brian McArdle, 57 years old. Suffered a fatal heart attack the day after his disability benefits were stopped.

Stephen Hill, 53. Died of a heart attack one month after being found fit for work, even though he was waiting for major heart surgery.

Jacqueline Harris, 53. A former Nurse who could hardly walk was found fit for work by Atos and her benefits withdrawn. in desperation, she took her own life.

David Barr, 28. Suffering from severe mental difficulties. Threw himself from a bridge after being found fit for work by Atos and failing his appeal.

David Groves, 56. Died of a heart attack the night before taking his work capability assessment. His widow claimed that it was the stress that killed him.

Nicholas Peter Barker, 51. Shot himself after being told his benefits were being stopped. He was unable to work after a brain haemorrhage left him paralysed down one side.

Mark and Helen Mullins, 48 and 59 years old. Forced to live on £57.50 a week and make 12 mile trips each week to get free vegetables to make soup. Mark and Helen both committed suicide.

Richard Sanderson, 44. Unable to find a job and with his housing benefit cut forcing him to move, but with nowhere to go. Richard committed suicide.

Martin Rust, 36 years old. A schizophrenic man who killed himself two months after the government found him fit to work.

Craig Monk, 43. A vulnerable gentleman and a partial amputee who slipped so far into poverty that he hanged himself.

Colin Traynor, 29, and suffering from epilepsy was stripped of his benefits. He appealed. Five weeks after his death his family found he had won his appeal.

Elaine Christian, 57 years old. Worried about her work capability assessment, she was subsequently found at Holderness drain, drowned and with ten self inflicted wrist wounds.

Christelle and Kayjah Pardoe, 32 years and 5 month old. Pregnant, her benefits stopped, Christelle, clutching her baby son jumped from a third floor balcony.

Mark Scott, 46. His DLA and housing benefit stopped and sinking into deep depression, Mark died six weeks later.

Cecilia Burns, 51. Found fit for work while undergoing treatment for breast cancer. She died just a few weeks after she won her appeal against the Atos decision.

Chris Cann, 57 years old. Found dead in his home just months after being told he had to undergo a medical assessment to prove he could not work.

Peter Hodgson, 49. Called to JCP to see if he was suitable for volunteer work. Peter had suffered a stroke, a brain haemorrhage and had a fused leg. His appointment letter arrived a few days after he took his own life.

Paul Willcoxsin, 33 years old. Suffered with mental health problems and worried about government cuts. Paul committed suicide by hanging himself.

Stephanie Bottrill, 53. After paying £80 a month for bedroom tax, Stephanie could not afford heating in the winter, and lived on tinned custard. In desperation, she chose to walk in front of a lorry.

Larry Newman suffered from a degenerative lung condition, his weight dropping from 10 to 7 stone. Atos awarded him zero points, he died just three months after submitting his appeal.

Paul Turner, 52 years old. After suffering a heart attack, he was ordered to find a job in February. In April Paul died from ischaemic heart disease.

Christopher Charles Harkness, 39. After finding out that the funding for his care home was being withdrawn, this man who suffered with mental health issues, took his own life.

Sandra Louise Moon, 57. Suffering from a degenerative back condition, depression and increasingly worried about losing her incapacity benefit. Sandra committed suicide by taking an overdose.

Lee Robinson, 39 years old. Took his own life after his housing benefit and council tax were taken away from him.

David Coupe, 57. A Cancer sufferer found fit for work by Atos in 2012. David lost his sight, then his hearing, then his mobility, and then his life.

Michael McNicholas, 34. Severely depressed and a recovering alcoholic. Michael committed suicide after being called in for a Work Capability Assessment by Atos.

Victor Cuff, 59 and suffering from severe depression. Victor hanged himself after the DWP stopped his benefits.

Charles Barden, 74. Charles committed suicide by hanging due to fears that the Bedroom Tax would leave him destitute and unable to cope.

Ian Caress, 43. Suffered multiple health issues and deteriorating eyesight. Ian was found fit for work by Atos, he died ten months later having lost so much weight that his family said that he resembled a concentration camp victim.

Iain Hodge, 30. Suffered from the life threatening illness, Hughes Syndrome. Found fit for work by Atos and benefits stopped, Iain took his own life.

Wayne Grew, 37. Severely depressed due to government cuts and the fear of losing his job, Wayne committed suicide by hanging.

Kevin Bennett, 40. Kevin a sufferer of schizophrenia and mental illness became so depressed after his JSA was stopped that he became a virtual recluse. Kevin was found dead in his flat several months later.

David Elwyn Hughs Harries, 48. A disabled man who could no longer cope after his parents died, could find no help from the government via benefits. David took an overdose as a way out of his solitude.

Denis Jones, 58. A disabled man crushed by the pressures of government cuts, in particular the Bedroom Tax, and unable to survive by himself. Denis was found dead in his flat.

Shaun Pilkington, 58. Unable to cope any more, Shaun shot himself dead after receiving a letter from the DWP informing him that his ESA was being stopped.

Paul ?, 51. Died in a freezing cold flat after his ESA was stopped. Paul appealed the decision and won on the day that he lost his battle to live.

Chris MaGuire, 61. Deeply depressed and incapable of work, Chris was summonsed by Atos for a Work Capability Assessment and deemed fit for work. On appeal, a judge overturned the Atos decision and ordered them to leave him alone for at least a year, which they did not do. In desperation, Chris took his own life, unable to cope anymore.

Peter Duut, a Dutch national with terminal cancer living in the UK for many years found that he was not entitled to benefits unless he was active in the labour market. Peter died leaving his wife destitute, and unable to pay for his funeral.

George Scollen, age unknown. Took his own life after the government closed the Remploy factory he had worked in for 40 years.

Julian Little, 47. Wheelchair bound and suffering from kidney failure, Julian faced the harsh restrictions of the Bedroom Tax and the loss of his essential dialysis room. He died shortly after being ordered to downgrade.

Miss DE, Early 50’s. Suffering from mental illness, this lady committed suicide less than a month after an Atos assessor gave her zero points and declared her fit for work.

Robert Barlow, 47. Suffering from a brain tumour, a heart defect and awaiting a transplant, Robert was deemed fit for work by Atos and his benefits were withdrawn. He died penniless less than two years later.

Carl Joseph Foster-Brown, 58. As a direct consequence of the wholly unjustifiable actions of the Job centre and DWP, this man took his own life.

Martin Hadfield, 20 years old. Disillusioned with the lack of jobs available in this country but too proud to claim benefits. Utterly demoralised, Martin took his own life by hanging himself.

Annette Francis, 30. A mum-of-one suffering from severe mental illness, found dead after her disability benefits were ceased.

Ian Jordan, 60. His benefits slashed after Atos and the DWP declared Ian, a sufferer of Barratt’s Oesophagus, fit for work, caused him to run up massive debts in order to survive. Ian was found dead in his flat after taking an overdose.

Janet McCall, 53. Terminally ill with pulmonary fibrosis and declared ‘Fit for Work’ by Atos and the DWP, this lady died 5 months after her benefits were stopped.

Stuart Holley, 23. A man driven to suicide by the DWP’s incessant pressure and threat of sanctions for not being able to find a job.

Graham Shawcross, 63. A sufferer of the debilitating disease, Addison’s. Died of a heart attack due to the stress of an Atos ‘Fit for Work’ decision.

David Clapson, 59 years old. A diabetic ex-soldier deprived of the means to survive by the DWP and the governments harsh welfare reforms, David died all but penniless, starving and alone, his electricity run out.

Chris Smith, 59. Declared ‘Fit for Work’ by Atos as he lay dying of Cancer in his hospital bed.

Nathan Hartwell, 36, died of heart failure after an 18-month battle with the Department for Works and Pensions.

Michael Connolly, 60. A Father of One, increasingly worried about finances after his benefits were cut. Committed suicide by taking 13 times the fatal dose of prescription medicine on the 30th October – His Birthday.

Jan Mandeville, 52, A lady suffering from Fibromyalgia, driven to the point of mental and physical breakdown by this governments welfare reforms. Jan was found dead in her home after battling the DWP for ESA and DLA.

Trevor Drakard, 50 years old. A shy and reserved, severe epileptic who suffered regular and terrifying fits almost his entire life, hounded to suicide by the DWP who threatened to stop his life-line benefits.

Death of a severely disabled Dorset resident, unnamed, who took her own life while battling the bedroom tax.

Disclaimer: While every effort is made to insiure accuracy, the ABC cannot be held resonsibility for outside content published in good faith.

Sanction News

A man who applied for more than 60 jobs in a fortnight while protesting against “draconian and demeaning” government policies has been battling JCP officials reported the Guardian newspaper.

Peter Styles, a copywriter and public relations executive who has been unemployed for a year, been sanctioned by his local jobcentre – for not searching for “broader” employment.

Ms Styles says he writes up to 15 job applications a day. – even applying at the request of jobcentre staff to be a “personal shopper” and “grocery colleague” at local supermarkets.

Ms Styles said his mistake was to have “voiced my opposition to government policies which I thought were unhelpful and meant to keep you down … I have a good work record and was really trying hard. But the process is patronising and staff can be unhelpful” The communications specialist put his skills to use – publicising his experience in a blog that has gone viral; registering more than 9,000 hits, over 1,000 Facebook shares and hundreds of messages of support.

This publicity has concerned JCP officials who say that staff named in his blog might mean they would have to be shifted to other offices as they may be targeted by anti-austerity campaigners. There are moves to get Styles to remove the blog entirely said the Guardian article.

The pressure is taking its toll the Guardian continued. Styles says he “has been signed off by the doctor for a month, and consequently have had to end my claim for jobseeker’s allowance. Currently I have no means of support whatsoever and feel in a strange limbo-like position.”

Styles says he is “thousands in debt” without his benefits and only surviving with the help of friends. In response to his complaint, the Department of Work and Pensions wrote to Styles apologising for not “seeing him on time”. The jobcentre wrote back saying “The ‘draconian’ measures … are part of government policy … I have looked at the complaint that you have made and can assure you that we have correctly applied the policy in your case. [There] is no appeals process for policy issues.”

The ABC adds: JCP sanctions are being reviewed by the DWP Work & Pensions Select Committee. We understand their findings will be available before the General Election. This will be welcome news for those who use Jobcentre Plus. In the meantime we wish Mr Styles the very best of luck and hope his situation will improve. Mr Styles' blog can be viewed at dwpvendetta.wordpress.com

UK Minimum Wage

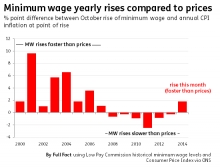

We just love the Full Fact website that checks the facts that are quoted in the media and analyzes them. This graph illistrates the the minimum wage in relation to prices.

The picture tells the story. Thank you Full Fact for the great work your organisation does.

Unemployment Falls

UK unemployment falls by 115,000 to 1.96 million

UK unemployment fell by 115,000 between July & September to 1.96 million, according to the Office for National Statistics (ONS).

Commenting n todays labour market statistics, Geraint Johnes, director at Lancaster Universities Work Foundation said:

“The labour market statistics released today indicate continued strengthening of the economy. Employment has increased by 112,000 over the quarter, while unemployment has fallen by 115,000. This keeps unemployment at the 6.0% rate reported last month.

“Numbers of self-employed have fallen over the quarter by some 87,000, with 78% of these having been part-time. Meanwhile the number of employees has increased by 196,000, and 72% of this growth is in full-time employment. All these trends suggest that the labour market is gradually returning to normal, with fewer people in relatively insecure posts.

“Total pay including bonuses continues to rise only slowly, however, and are indeed still falling in real terms. Wage growth amounted to just 1% over the last year, well below the rate of price inflation. There are some signs of faster wage growth - again in manufacturing and construction - but nominal wages are falling in the distribution sector. Increased business investment should see productivity rise over the next few months, and real wage increases can be expected to follow that. But overall the picture remains one in which there is labour market slack, and we cannot on the back of that expect any tightening of monetary policies in the immediate future.”

Around 14.7% of workers, or 4.5 million are self-employed, down 88,000 on the quarter but part-time workers wanting full-time work remains at around 1.3 million. The real value of take-home pay is 13% below pre-recession levels says Paul Kenny, general secretary of the GMB union.

So some modest good news, bringing a little good cheer.

George's Flyer Backfires

Chancellor of the Exchequer, George Osborne has publically stated the Conservative Party is planning a massive slashing of benefits should the Conservative Party win the next General Election.

Electoral Calculus, predicts the next British General Election result using scientific analysis of opinion polls and electoral geography. They have been making election predictions for twenty years, and were the most accurate pre-poll predictor at the last General Election in May 2010.

Currently Electoral Calculus predicts a Labour majority of 34% against the likelihood of a Tory majority at just 12%. Labour are predicted to take 302 seats against 263 for the Conservatives with the Lib Dems trailing with just 16 seats. Prediction based on opinion polls from 10 Oct 14 to 31 Oct 14, sampling 9,823 people.

From Monday millions of households will get “annual tax statements” from George Osborne, showing that the biggest chunk of their contribution goes towards welfare.

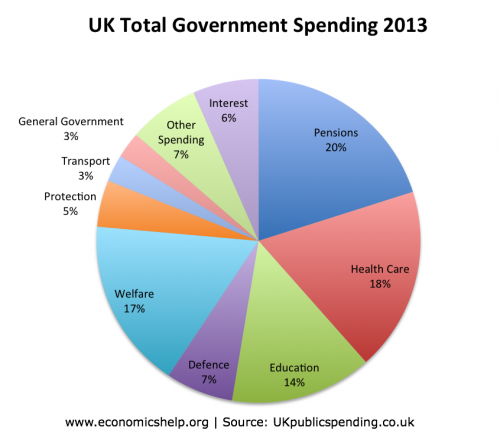

Main Areas of Government Spending 2013

- Pensions (old age and sickness) £138.1bn

- Health Care £125.9bn

- Education £34.2bn + £59.1bn (local) total education = £97.2bn

- Defence £46.4bn

- Social Welfare (income support, unemployment benefits) £117bn

- Protection (police, law, courts, fire) £33.4bn

- Transport £18.5bn

- General Government (e.g. civil service) £17.9bn

- Other Spending (mainly local, e.g. waste management, sports and leisure) – £48.6bn

- Interest payments on Government debt – £45.1bn

- Total Spending £683.bn

- Public Net Debt £1,159)

According to Richard Darlington of the head of news at the Institute for Public Policy Research (IPPR) two-fifths (42%) of welfare spending goes on pensioners: a whooping £77bn in total. And more than 15% – £31bn – goes on children, via child benefit and the child tax credit. That’s almost £6 out of every £10 of welfare spending accounted for.

There is another 10% going on support for disabled people – and this should not be confused with incapacity benefit, now called employment and support allowance, or ESA. A further 5% goes to carers and boosting the incomes of the working poor.

Only a shade over a 10th of the benefits bill – and a far smaller share of total public spending – is actually spent on directly replacing the incomes of those not in work, through jobseeker’s allowance, income support and ESA (£21bn in total). The remaining large items of spending are council tax benefit (£5bn) and housing benefit (£20bn) says Richard.

The annual tax statements, announced by the chancellor in March 2012, are going to provide more than 24 million people with a visual illustration of how their taxes are being spent.

However, Dame Anne Begg, the chair of the Commons work and pensions committee, said it appeared to be part of a trend in the presentation of figures as under the coalition had tried to “make the phrase welfare almost appear as a dirty word”.

“If they are presenting welfare in this statement as one homogeneous figure, it includes a lot of welfare spend that most people in the country agree with.

“To lump all of welfare together, given people’s understandable lack of knowledge about where it goes, is designed to make people think ‘oh, it’s terrible, shocking, far too much’ and presumably endorse whatever further tightening up the government is proposing,” Dame Anne Begg said in a Guardian Newspaper interview.

“My select committee has been very critical of the way the government, usually the DWP, presents its information about welfare, which gives people the impression the bulk of welfare goes to working-age unemployed people when in reality that is a very small proportion. The vast majority of the budget goes to people that includes people with severe disabilities and the poorest pensioners. Generally the public supports welfare going to those people who have the least.”

Osborne said it was a revolution in transparency. However, Osborne stressed that the figures were about being more transparent about how people’s money is being used by the government. Most people would argue that taxpayers are funding Coalition government propaganda at a cost of some five million pounds which is the cost of sending out these statements to the public.

“I promised that taxpayers would know much more about how much direct tax they pay and how that money is spent,” says Osborne. “Now we’re delivering on that promise by giving 24m taxpayers a new personal tax summary. It is a revolution in transparency and it will show how hardworking taxpayers have to pay for what governments spend.”

And in an email sent to Conservative supporters.

'From today, for the first time ever, hardworking taxpayers will start to receive a personalised Annual Tax Summary. This will set out how much direct tax they pay and how that money is spent. This is a revolution in transparency and it will show how hardworking taxpayers have to pay for what governments spend.'

Hardworking taxpayers is a phase in constant use by George Osborne, trying hard one might argue, to stoke up the public’s discontent and displeasure with the so called scroungers and shirkers - giving Osborne the leeway to cut spending once more.

All in all, Osborne’s initiative seems to have backfired, only those people not prepared to look at the actual figures in detail will belive that such a huge chunk of public spending will go on those of working age who are unemployed. It seems the vast majority of the public support much of 'welfare' spending, particulary on items like pensions, and help for the poorest in society, or those disabled. As Nelson Mandela pointed out 'the mark of a civilized society is how it treats its lowest members'.

Information Courtesy of Guardian Newspaper, Institute for Public Policy Research (IPPR).

Graph from www.economicshelp.org

Spread the Warmth

Age UK are running a Spread the Warmth campaign?

Age UK say that 1 older person dies needlessly every 7 minutes from the cold - that’s 200 deaths a day that could be prevented.

Of the winter deaths that happen every year, 9 in 10 are older people.

Age UK estimates that 1.7 million older people in the UK can’t afford to heat their homes, and over a third (36%) of older people in the UK say they live mainly in one room to save money.

Of course cuts in the real purchasing power of benefits are also affecting people. Fortunately this year so far the weather has been very mild. This could change of course.

Part of the Age UK guides say this:

Eating well

- Make sure you have at least one hot meal a day and regular hot drinks.

- Include a variety of foods in your diet to get the nutrients that you need.

- Keep basic food items in your cupboard or freezer in case it’s too cold to go shopping.

The latter is a very good idea. If you live in a remote region keeping some food in the car, a spare jumper, coat and sleeping bag and a shovel is not a bad idea too. An ice scraper is a great way to avoid breaking your Debit/Credit card clearing the windscreen on a frosty morning.

Do check out the Age UK website for some useful tips.

$20,000 Internship

There has been a rise recently in the amount of unpaid internships in America, with desperate job seekers willing to do anything to get hired. Some companies have even come under fire by the US Department of Labor for offering unpaid internships, saying they violate the law. In the UK the Conservative Party were auctioning internships at Hedge Funds as part of a summer fundraiser.

Versace took it further than anyone, actually asking $20,000 for the right to be her intern (though in fairness, she said she’d donate the money to charity).

We however are keen to offer Ms Versace an ABC internship at a mere $50,000+ extras (like taking the staff shopping). Donatella Versace has a net worth of $200 million, so that seems quite reasonable. Bit of loose change in fact.

When Donatella is next in Colchester we hope she will drop in for a job inteview, bringing her chequebook of course.

On a more serious note: our understanding at the ABC is that charging people for finding them work is unlawful, better check that one out ourselves.

ONS Latest Claimant Count Video

Office National Statistics (ONS)- Regional earnings

Below is the latest Claimant Count video from the ONS.

TUC 'Britain Needs a Pay Rise'

Workers in the North East would be over £55 a week better off if real wage growth had remained at its pre-recession rate, according to new analysis published by the TUC.

The analysis shows that even using the government’s preferred inflation measure (the consumer prices index), which excludes housing costs, workers in the region would be earning £56.70 a week more had pay had continued to rise at 1.9 per cent per year after the crash

The TUC says the analysis shows how much working people’s living standards suffered during the recession and how pay has failed to recover during the recovery.This is the seventh year that average weekly earnings have been falling – the longest period since records began in the 1850s.

The report alo explained:

In the North East workers would be nearly £3,000 a year better off had wage growth remained at its modest pre-recession rate.Instead, pay has fallen off a cliff and shows little sign of recovering any time soon. Ordinary households are not sharing in the recovery and are facing their seventh consecutive year of real wage cuts.People are increasingly being forced to use their credit cards and dwindling savings to make ends meet, and unless the North East gets a pay rise soon the region’s personal debt problem will get even worse

The TUC are continuing to pursue their Britain Needs a Pay Rise campaign. Low wages means less demand in the economy and that means fewr job opportunities.

The Northern TUC’s Fair Pay and Living Wage Seminar on the 6th November (see events) will include a high quality set of workshops and speakers from the public, private and voluntary sector along with those working in economic development, financial inclusion and child poverty.

If you want to know more about why Britain Needs A Pay Rise further details can be found at http://www.tuc.org.uk/northernBeth FarhatNorthern TUC Regional Secretary