Chancellor of the Exchequer, George Osborne has publically stated the Conservative Party is planning a massive slashing of benefits should the Conservative Party win the next General Election.

Electoral Calculus, predicts the next British General Election result using scientific analysis of opinion polls and electoral geography. They have been making election predictions for twenty years, and were the most accurate pre-poll predictor at the last General Election in May 2010.

Currently Electoral Calculus predicts a Labour majority of 34% against the likelihood of a Tory majority at just 12%. Labour are predicted to take 302 seats against 263 for the Conservatives with the Lib Dems trailing with just 16 seats. Prediction based on opinion polls from 10 Oct 14 to 31 Oct 14, sampling 9,823 people.

From Monday millions of households will get “annual tax statements” from George Osborne, showing that the biggest chunk of their contribution goes towards welfare.

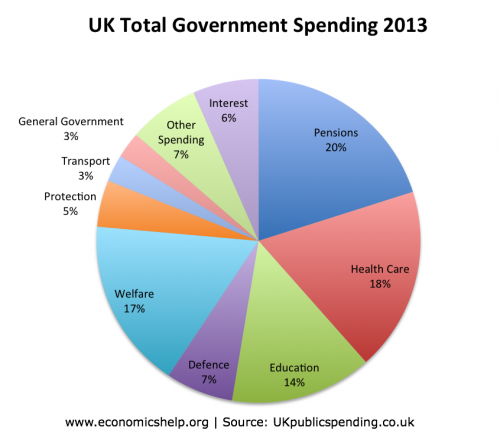

Main Areas of Government Spending 2013

- Pensions (old age and sickness) £138.1bn

- Health Care £125.9bn

- Education £34.2bn + £59.1bn (local) total education = £97.2bn

- Defence £46.4bn

- Social Welfare (income support, unemployment benefits) £117bn

- Protection (police, law, courts, fire) £33.4bn

- Transport £18.5bn

- General Government (e.g. civil service) £17.9bn

- Other Spending (mainly local, e.g. waste management, sports and leisure) – £48.6bn

- Interest payments on Government debt – £45.1bn

- Total Spending £683.bn

- Public Net Debt £1,159)

According to Richard Darlington of the head of news at the Institute for Public Policy Research (IPPR) two-fifths (42%) of welfare spending goes on pensioners: a whooping £77bn in total. And more than 15% – £31bn – goes on children, via child benefit and the child tax credit. That’s almost £6 out of every £10 of welfare spending accounted for.

There is another 10% going on support for disabled people – and this should not be confused with incapacity benefit, now called employment and support allowance, or ESA. A further 5% goes to carers and boosting the incomes of the working poor.

Only a shade over a 10th of the benefits bill – and a far smaller share of total public spending – is actually spent on directly replacing the incomes of those not in work, through jobseeker’s allowance, income support and ESA (£21bn in total). The remaining large items of spending are council tax benefit (£5bn) and housing benefit (£20bn) says Richard.

The annual tax statements, announced by the chancellor in March 2012, are going to provide more than 24 million people with a visual illustration of how their taxes are being spent.

However, Dame Anne Begg, the chair of the Commons work and pensions committee, said it appeared to be part of a trend in the presentation of figures as under the coalition had tried to “make the phrase welfare almost appear as a dirty word”.

“If they are presenting welfare in this statement as one homogeneous figure, it includes a lot of welfare spend that most people in the country agree with.

“To lump all of welfare together, given people’s understandable lack of knowledge about where it goes, is designed to make people think ‘oh, it’s terrible, shocking, far too much’ and presumably endorse whatever further tightening up the government is proposing,” Dame Anne Begg said in a Guardian Newspaper interview.

“My select committee has been very critical of the way the government, usually the DWP, presents its information about welfare, which gives people the impression the bulk of welfare goes to working-age unemployed people when in reality that is a very small proportion. The vast majority of the budget goes to people that includes people with severe disabilities and the poorest pensioners. Generally the public supports welfare going to those people who have the least.”

Osborne said it was a revolution in transparency. However, Osborne stressed that the figures were about being more transparent about how people’s money is being used by the government. Most people would argue that taxpayers are funding Coalition government propaganda at a cost of some five million pounds which is the cost of sending out these statements to the public.

“I promised that taxpayers would know much more about how much direct tax they pay and how that money is spent,” says Osborne. “Now we’re delivering on that promise by giving 24m taxpayers a new personal tax summary. It is a revolution in transparency and it will show how hardworking taxpayers have to pay for what governments spend.”

And in an email sent to Conservative supporters.

'From today, for the first time ever, hardworking taxpayers will start to receive a personalised Annual Tax Summary. This will set out how much direct tax they pay and how that money is spent. This is a revolution in transparency and it will show how hardworking taxpayers have to pay for what governments spend.'

Hardworking taxpayers is a phase in constant use by George Osborne, trying hard one might argue, to stoke up the public’s discontent and displeasure with the so called scroungers and shirkers - giving Osborne the leeway to cut spending once more.

All in all, Osborne’s initiative seems to have backfired, only those people not prepared to look at the actual figures in detail will belive that such a huge chunk of public spending will go on those of working age who are unemployed. It seems the vast majority of the public support much of 'welfare' spending, particulary on items like pensions, and help for the poorest in society, or those disabled. As Nelson Mandela pointed out 'the mark of a civilized society is how it treats its lowest members'.

Information Courtesy of Guardian Newspaper, Institute for Public Policy Research (IPPR).

Graph from www.economicshelp.org

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here