Simon Collyer

Northern Ireland Labour Market Survey

Labour Force Survey (LFS) employment rate decreased over the quarter while unemployment and economic inactivity rates remain unchanged.

There was a decrease in the employment rate (68.7%) over the quarter and over the year. The economic inactivity rate (27.4%) was unchanged over the quarter but increased by 0.7 pps over the year.

The latest NI seasonally adjusted unemployment rate for the period March - May 2017 was 5.3%, this was unchanged from the previous quarter and down 0.6 pps over the year (from 5.9%).

The latest NI unemployment rate (5.3%) was above the UK average of 4.5% however, it was below the European Union (7.8%) rate and Republic of Ireland (6.4%) rate for April 2017.

NI claimant count continues to fall

The more recent seasonally adjusted number of people claiming unemployment related benefits stood at 30,500 (3.3% of the workforce) in June 2017, representing a decrease of 600 from the previous month’s revised figure.

Confirmed redundancies decreased over the year

There were 66 confirmed redundancies in June 2017. Over the last year to 30th June 2017 there has been a 30% decrease in the number of confirmed redundancies: from 3,217 in the previous year to 2,267.

Commentary

Considered over a longer time frame the most recent results show a gradual decline in the unemployment rate and a gradual increase in the employment rate from 2013/14. Following a previously noted downward trend from 2013/14, the economic inactivity rate has increased over the last three quarters.

The claimant count series, which has fallen by 34,300 since its most recent peak in February 2013, also reflects a decline in unemployment.

Please note results from the Northern Ireland Composite Economic Index will be published on Thursday 20th July 2017 on the NISRA website. This will provide an overall measure of Northern

3. The official measure of unemployment is the Labour Force Survey. This measure of unemployment relates to people without a job who were available for work and had either looked for work in the last four weeks or were waiting to start a job. This is the International Labour Organisation definition. Labour Force Survey estimates are subject to sampling error. This means that the exact figure is likely to be contained in a range surrounding the estimate quoted. For example, the number of unemployed persons is likely to fall within 1.1% of the quoted estimate (i.e. between 4.2% and 6.4%).

4. Employee jobs figures are taken from the Quarterly Employment Survey a survey of public sector organisations and private sector firms.

5. This report will be of interest to policy makers, public bodies, the business community, banks, economic commentators, academics and the general public with an interest in the local economy.

Insecurity and Difficult Decisions: How Lone Parents Manage on Low Incomes

The Joseph Rowntree Foundation has released this report on Lone Parents on Low incomes

Single parents on low incomes are being hit hard by rising living costs and the benefit freeze. How do they cope with the impact of low pay and insecurity?

Insecurity and difficult decisions: how lone parents manage on low incomes

More than 2 million children with lone parents are living below what they need for a decent standard of living.

Almost three quarters of lone-parent households live below that standard, and our annual update of A Minimum Income Standard for the UK shows that lone parents are falling £640 a year – £67 a week – short of what they need.

But what does that mean in reality, both day to day and over the longer term?

Today we publish a new report that highlights what it’s like for lone mothers and their families to live on low incomes – their experiences of employment, how it affects family life, children’s transitions to adulthood, and the decisions they have to make.

This in-depth research has followed 15 families since 2002, and these are their experiences.

Employment

Most of the women interviewed had successfully maintained work. Three had progressed in their careers and were doing well, but most were earning wages that were below the median for women, and not much above the minimum wage.

For example, Sally was a care worker in 2004, holding two jobs totalling about 50 hours a week. She was earning about £5 an hour, at a time when the national minimum wage was £4.85 an hour. By 2016 she had completed some further training and was working full-time in health care in a hospital. She was earning about £16,000 a year, so her hourly rate was probably still around or just above the National Living Wage (£8.25 an hour in 2015). She worried about debts and about retirement and her lack of pension. But still she said: “I am on my feet. I do a job that I absolutely love and adore. I have people working with me that is absolutely fantastic and think really well of me… financially could obviously be a bit better…”

Wendy had spent three years on Income Support when she first separated but since the first interview she had had a steady job. After 14 or 15 years in work, and having spent two years studying part-time at university, she still felt that she had not quite managed to achieve financial security. Her hourly pay rate of £9.74 in 2016 was below the hourly median of £10.94 for all women in work in 2016. She expressed concerns about money and debts, and as she put it in 2016, “my financial circumstances are always just teetering on the edge”.

Decisions – going without and making do

Living on a low income is about coping day to day, and the lone mothers in this study gave examples of how they personally had gone without in order to protect and provide for their children.

Irene looked back to when her children were young and she was working part-time. “I remember there was a time when the kids were young … I would maybe have £6 and I would write a list of what I was going to buy. I would buy four apples, because you would have half an apple. So I’d always been used to trying, I’m not saying I always did – but trying to live within my means.”

Tracey also looked back to her time studying and working part-time. “In the main we did have to sort of make do and we did have clothes from charity shops and whatnot. I think I probably had two bras for about 10 years.”

But as their children became young adults, their mums often didn’t have enough resources to provide a buffer, protection or an opportunity to help them through.

Relationships and impact on children

In general, the mothers were proud of their children and how they had raised them, and the young people usually appreciated what their mums had achieved.

Lucy said: “I wouldn’t have changed anything. I think I’ve given them a lot of my time. I’ve organised my life around them, I think, but they’ve turned out great... I’m happy with what I’ve done.”

But relationships with children weren’t always easy and in some cases resulted in children moving out of the family home. Some could live with another family member; others went to hostels and/or were homeless.

For Sarah the breakdown in relationship with her children was in part driven by low income and more immediately by the loss of tax credits: “I was on Child Tax Credit and Child Benefit then, but when all that stopped I found it particularly hard … because it just stopped all of a sudden, but they still needed feeding… Basically we just couldn’t all afford to live here, so they branched out.”

Maia does not like to even mention money to her mother now. She feels that their money struggles growing up affected them. She said: “I think it added to a lot of the stress around the house and I, I hate speaking to my mum about money and like I won’t even enter a conversation with her about it.”

The mothers had a strong work ethic but some realised that having to work to keep money coming in had come at a cost – they couldn’t spend much time with their children.

I fitted it in but I’m sure there were times when, you know, I feel I’ve missed out with them and they maybe felt they’ve missed out with me a bit because … but then I think they always saw, because I was the sole provider, I didn’t really have an option. Tracey

Children played a key role in enabling their mothers to work, by:

- taking on extra responsibilities, such as doing chores or caring for younger sibling

- holding back on their own needs – trying not to put financial pressure on their mothers for things like new clothes, school trips and equipment, and social activities

- accepting situations they were not particularly happy with, including changes in their caring arrangements.

Tiffany had considerable demands placed on her when she was growing up. Her mother was working full-time and as the oldest child she was caring for her siblings. This was particularly stressful for her in her mid-teens when she was trying to balance her school work and care work at home. “I just feel that with everything that I’m getting from school, all the pressure and then with the things that I have to do that’s outside of school, like one of them is not going to be able to fit in and I worry that it’s going to be the work at school that I’m not going to be able to fit in.”

The young people also feel under pressure to earn and don’t always get chance to go back into education.

John wished he had done better at school; he has no qualifications and has had no real training. He started work as a bouncer in the security world when he was 16, initially following his father into unlicensed and dangerous work. He is still working for a private security firm. He lived in a hostel for several years, but is now on a rent-to-buy scheme and hopes to buy the flat he lives in one day. But he is struggling to manage on a low and insecure income, and is living and working in a hard world. He wants to get more training to get a better job but can’t afford to.

“To be blunt about it, it’s a dead-end job,” he said. “There’s no high positions. The only better positions there are, are in the control room, on the camera.”

Domestic abuse had strong long-term impacts on both mothers and children, affecting their confidence, self-esteem, trust and relationships. All the time the women and young people were dealing with work and managing their lives, they were often also carrying a heavy emotional and psychological weight.

Relationships with fathers varied, but they were often absent from their children's daily lives.

Low income and insecurity

Poor health and retirement worried several of the women, even those with good jobs. Many felt they were just managing, rather than being able to plan for the future.

In Bella’s case, things had been going well – she’d got a degree, was working four-and-a-half days, and had the most money she’d ever earned – but when ill-health forced her to reduce her working hours, she felt insecure, as she hadn’t got a pension.

“All my money went on the kids growing up – I couldn’t afford to pay a pension,” she said. “Really – if I’d started paying a pension when I started at this place, it would have been good but I never stayed anywhere long so I never bothered to start a pension.”

She describes the long-term impact of living on a low income:

It’s the grind that gets you down, every single day … I think what contributes to me being ill was having so many years of having to cope, basically.Bella

What would help?

It’s important to focus on the present with an eye on the future – single parent families on low wages or out of work have seen their living standards gradually get worse over the years, despite the introduction of the National Living Wage, which also means worse prospects for the now-grown children’s generation and likely their own children.

In the immediate future, we’re recommending that the Government lifts the freeze on working-age tax credits and Universal Credit, so that support keeps up with the rising cost of living.

Alongside this, the Government should reinstate Universal Credit Work Allowances, so that families can have a more secure platform to get back into work and keep more of their earnings. We also recommend ending the seven-day wait before people are allowed to claim, and monitoring the impact of payment one month in arrears.

To stem the rise in child poverty, we recommend lifting the limit on additional support for families with more than two children.

In the longer term, our strategy to solve poverty in the UK recommends:

For the families:

- delivering advice and support through integrated hubs, co-located with other services that people use. These would bringing together a range of services related to work and income, careers advice, advice on transport and childcare, advice on local welfare assistance schemes, benefits checks and debt advice.

For the children:

- high-quality, flexible and affordable childcare, which helps parents to share care and stay in work

- getting the best teachers into schools with the highest numbers of children in poverty and spending money from the Pupil Premium on the best-evidenced practice for improving outcomes

- supporting the transition of young people through high-quality careers advice while at school; high-quality apprenticeships and post-16 support through local hubs

- closing the gap in welfare protection for young people before adult protection begins, including raising the basic levels of benefits for young people under 18 living independently.

For the women:

- more employers paying the voluntary Living Wage – given that more women work in low-pay sectors, alongside better part-time jobs, flexible work and careers progression.

HMRC Accounts 2016-17 & Universal Credits Slow Progress

HMRC raised £574.9 billion of tax revenues this year1, an increase of £38.1 billion (7.1%) on 2015-16 and paid out £39.1 billion in benefits and credits (approximately one-fifth of the government's total benefit expenditure). The taxes that contributed to most of this increase were Income Tax and National Insurance Contributions which together increased by £14.9 billion (5.3%); Corporation Tax which increased by £5.6 billion (12.3%); and VAT which increased by £8.4 billion (7.2%). The annual cost of running HMRC was £3.3 billion in 2016-17.

HMRC’s estimated increase in error and fraud within Tax Credits is contrary to the significant reductions achieved in previous years, and the rate is expected to increase further. HMRC analysis shows that during 2015-16 the increase in estimated error and fraud was associated with the income, work and hours, childcare and undeclared partner risk categories. HMRC also expects the level of error and fraud to increase when reported for 2016-17, due to the impact of introducing the “Commercial with a view to a profit” self-employed test as well as the impact of the ending of the Concentrix contract.

HMRC will face further challenges in administering Tax Credits as claimants transfer to Universal Credit. Some 95,000 claimants have transferred to Universal Credit (62,000 in 2016-17), with a further 220,000 expected to transition in 2017/18. Full transition and migration of claimants to Universal Credit is not expected to be completed until 2022. Due to the long timeframe for the transition of Tax Credits claimants to Universal Credit, and relatively small numbers of cases transitioned so far, it is too early to conclude on HMRC’s performance in meeting the challenges this transition presents.

The 2016-17 estimate of error and fraud overpayments of 1.0% (£110m) of total spending on Child Benefit is a reduction from previous years (1.4% (£170m) in 2015-16). HMRC has carried out detailed analysis of the cases where claimants do not respond to contact and their award is counted as error or fraud. This work indicates that the rate of error and fraud may be lower than estimated. HMRC has identified further interventions that it is planning to introduce both over the next twelve months and in the longer term that will seek to reduce the rate of error and fraud further.

ABC Notes on the economy from UK Public Spending

In 2005 the UK “current budget deficit” was less that £20 billion. But then came the worldwide financial crisis of 2008 and subsequent recession. The budget deficit skyrocketed to £50 billion in 2009 and £103 billion in 2010. In the subsequent recovery the deficit has slowly declined, reaching £15 billion in 2017.

In terms of Gross Domestic Product, the UK “current budget deficit” in 2005 was less than 2 percent of GDP, and declined to about 0.6 percent GDP in 2007 and 2008. In the Great Recession the deficit ballooned, to 6.9 percent of GDP in 2010. Since then the deficit has steadily declined, to less than one percent GDP in 2017.

Public spending

Total UK public spending, central government and local authority, was increasing briskly, year on year, in the mid 2000s from about £400 billion in 2005 to £700 billion in the depths of the recession of 2009. But since the end of the recession total public spending has leveled out at a little over £700 billion per year.

Viewed from a GDP perspective, total public spending was steady at about 40 percent GDP in the mid 2000s and then jumped, in the recession, to over 45 percent GDP in 2009. But in the subsequent economic recovery total government spending has stead declined as a percent of GDP down to about 41 percent GDP in 2015.

European Union (Withdrawal) Bill Published

Commenting on the publication today (Thursday) of the European Union (Withdrawal) Bill, which brings EU laws — including workers’ rights — into UK law , TUC General Secretary Frances O’Grady said:

“This is a Downing Street power grab.

“The PM promised to protect all workers’ rights after Brexit. But there is nothing in this Bill to stop politicians shredding or watering down our rights in the future.

“Nobody voted for Brexit to make life harder for working people. That’s why any deal with the EU must ensure that workers’ rights in Britain don’t fall behind the rest of Europe.”

On proposals for the UK to be no longer subject to European Court of Justice rulings from the day the UK leaves the EU, O’Grady said:

“An early commitment to walk away from the ECJ will tie our hands in Brexit negotiations.

“The government should leave all options on the table, instead of creating yet more inflexible red lines.”

The TUC are arguing:

- There are no guarantees that employment protections derived from the EU will be protected in the long term.

- The repeal bill will give the government powers to repeal and amend existing rules – powers which will apply to employment and equality laws. There is a risk the government could seek to scrap or water down key workers’ rights. The Bill should include non-regression clauses guaranteeing that the new powers cannot be used to repeal or dilute employment and equality laws.

- The government has not committed to ensuring that UK employment laws will keep pace with new EU employment standards.

- Once we leave the EU, the UK Supreme Court could have the power to overturn key decisions from the European Court of Justice which protect workers’ rights – without the need to secure Parliamentary approval.

- In recent decades, the European Union has proved an important source of rights for working people in the UK, including:

- Key health and safety standards

- Rights to paid holidays and protection from excessive working hours

- Family friendly rights, including rights to paid maternity leave, protection from dismissal for pregnant women and rights to parental leave

- Equality rights, including rights to equal pay for work of equal value, and protection from discrimination on grounds of gender, race, sexual orientation, pregnancy, disability, age, and religion and belief

- Protections for young workers, part-time workers, agency workers and those on fixed-term contracts

- Protections for outsourced workers

- The right to be consulted on collective redundancies, and for unions to present an alternative

- Measures supporting information and consultation at a national and European level

- Rights to paid facility time for safety reps and workplace reps

- Protections for migrant and posted workers

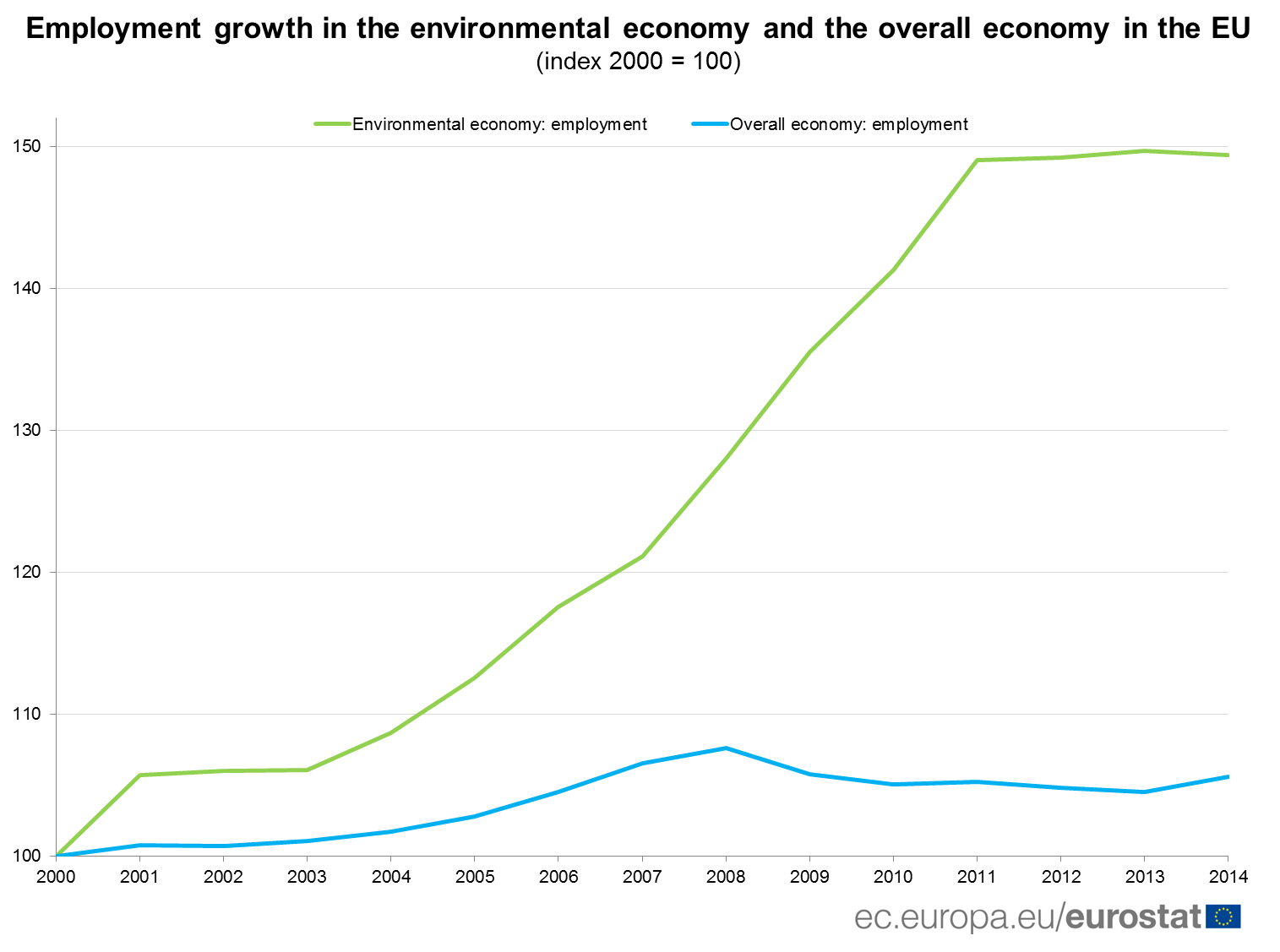

Employment Growth in the EU Economy

Nearly 4.2 million people (full-time equivalent - FTE) in the European Union (EU) were working in the environmental economy in 2014, almost 1.4 million more than fifteen years ago.

60% of these jobs concerned activities related to environmental protection, i.e. preventing, reducing and eliminating pollution and any other degradation of the environment. The remaining 40% were resource management activities, such as preserving and maintaining the stock of natural resources and safeguarding them against depletion.

Environmental employment outperformed overall employment

Between 2000 and 2014, employment in the environmental economy grew considerably faster (+49%) than employment in the overall economy (+6%). The rise in the number of jobs within the environmental economy is mainly caused by the growth in the management of energy resources. This is particularly the case for the production of energy from renewable sources (such as wind and solar power) and the production of equipment and installations for heat and energy saving.

Environmental activities were mainly concentrated in "Electricity, gas, steam and air conditioning supply; water supply; sewerage, waste management and remediation activities" (34% of total employment in the environmental economy, or 1.4 million FTE) and "Construction" (27%, 1.1 million FTE), followed by "Services" (17%, 0.7 million FTE), "Mining & quarrying and manufacturing" (14%, 0.6 million FTE) and "Agriculture" (8%, 0.3 million FTE).

This information is published by Eurostat on the occasion of the EU Green Week 2017 which takes place from 29 May to 2 June with the theme of 'Green jobs for a greener future'.

Working Families Are Getting Worse Off Under Theresa May

Working families who are "just about managing" are worse off than they were last year, despite Theresa May's pledge to focus her efforts on helping this group, new research has found.

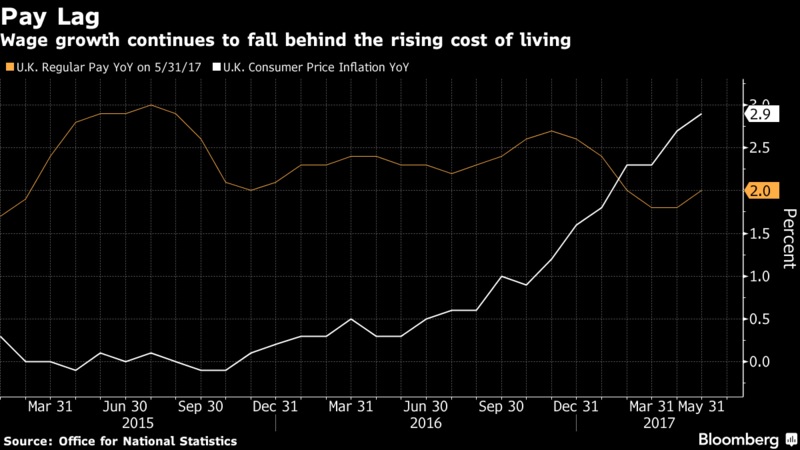

A report by the Joseph Rowntree Foundation, an anti-poverty charity, has found that higher inflation – boosted by the falling pound after the Brexit vote – plus the benefit freeze and other reforms mean many families working in low-paid jobs are getting further away from a liveable income.

A family in which one adult works full-time on the National Living Wage and another stays at home looking after children is now £870 a year – £17 a week – further away from what the JRF refers to as a "decent living standard", while a working single parent has slipped a further £640 a year behind that line.

The report doesn't look at an official measure of poverty, but instead what it calls a "minimum income standard", which is worked out in conjunction with academics who ask a panel every four years what people regard as necessities to live a normal life.

A single person now needs to earn £17,900 a year to reach the minimum standard, a couple who both work and have two children need total earnings of £40,800, and the line for a lone parent with a preschool child is £25,900.

This is the group of people referred to as "ordinary working families" and those "just about managing" by Theresa May, who pledged help when she became prime minister last July.

"If you’re from an ordinary working-class family, life is much harder than many people in Westminster realise," she said in a speech outside Number 10. "You can just about manage, but you worry about the cost of living and getting your kids into a good school.

"If you’re one of those families, if you’re just managing, I want to address you directly. I know you’re working around the clock, I know you’re doing your best and I know that sometimes life can be a struggle. The government I lead will be driven, not by the interests of the privileged few, but by yours."

However, the research shows that the gap between many of these families and a minimum income standard has actually grown substantially in recent years, under both Cameron and May, as a detailed case study provided to BuzzFeed News shows.

Donald Hirsch, director of the Centre for Research in Social Policy at Loughborough University and the JRF report's main author, calculated figures for a single parent with two young children and demonstrated how they'd changed over the last five years.

These figures showed that a family with one parent working full-time would be £33.02 a week short of the JRF's minimum standard in 2012, but by 2017 that had shot up to £67.50. The family is helped substantially by the introduction of the National Living Wage (the research assumes the parent is over 25), but is then hit slightly by tax and benefit changes, and much more substantially by the rising cost of living – ending up struggling to make ends meet.

How wage, tax, and benefit changes have affected a working single parent with two children

Significantly, Hirsch said it is the benefit freeze – which has not received the same public attention in recent weeks as the public sector pay cap – that's mainly responsible for the growing difficulties of low-income families.

"This year we have seen a return to inflation for the first time since the freeze in benefits and tax credits was introduced," said Hirsch. "It is clear from these results that this freeze is preventing better minimum wages from feeding through to improved family living standards.

"A particularly important feature of this is that for every extra pound earned, about 75p is typically lost by low earning families in additional tax and reduced tax credits or universal credit. Unless the amount that you can earn before these credits are withdrawn rises along with prices and earnings, it will be very difficult to deliver the improved living standards for struggling families that have been promised."

This view was echoed by Campbell Robb, the JRF's chief executive.

“Ordinary working families are facing bigger holes in their budgets worth hundreds of pounds, despite pay rises and tax cuts," he said. "It means millions of families are facing a struggle to make ends meet as the cost of getting by in modern Britain rises ever higher.

"We need the government to take action and ensure living standards do not fall backwards. Lifting the freeze on working-age benefits and tax credits must be the start along with allowing people to keep more of their earnings."

Liberal Democrat leader Tim Farron said the research showed the results of "cruel" Conservative policies.

“Millions of people are facing a squeeze because of the Conservatives’ cruel insistence on balancing the books on the backs of the working poor," he said.

"The just-about-managing are being hauled under the waterline. They are being forced to access food banks and live month-to-month. The government say the right things, but for once they should do the right thing."

25,000 More Scots in Work Welcomed. Unemployment at An All Time Low In Scotland

Jobs figures published today showing that unemployment is at a record low in Scotland and substantially lower than the UK average have been welcomed by the SNP.

Over the quarter of March to May 2017, the unemployment rate dropped to 3.8%. Meanwhile the employment rate went up to 74.1% and the inactivity rate fell to 22.9%.

Employment rose by 25,000 over the previous quarter.

Over the year, the youth unemployment rate decreased to 8.4%, the third lowest rate in the EU and youth employment increased to 57.7%.

Kirsty Blackman MP, the SNP’s Economy spokesperson and Depute leader in Westminster said:

“Today’s jobs figures are greatly encouraging and show that Scotland’s economy is performing well.

“With unemployment in Scotland at a record low, substantially lower than the UK average, and employment increasing – we have good reason to be optimistic.

“These latest labour market statistics figures - coupled with the fact that Scotland’s economy grew by 0.8% in the first quarter of 2017, the highest rate of quarterly growth in Scotland since the end of 2014 and four times higher than the UK - are a positive reflection of the SNP Scottish Government’s investment in our future.”

Taylor Report on The Gig Economy Released

The Taylor Report on the Gig economy is out today. There are seven recommendations, the main suggestion that has grabbed the headlines is ending paying people in cash. The idea Mr Taylor, Chief Executive of the RSA since 2006 is suggesting, is the use of website payment platforms.

However, some people might argue, once you take cash out of the economy altogether and go to electronic payments exclusively, none of your affairs remain private? The government would even know how many pints you drink on a Friday night, or if you smoke? How many condoms do you buy? Does the public want that level of scrutiny into their private lives? The thought that the government could simply ‘turn off your life’ with the flick of a switch is threatening.

A claimant desperate for a new pair of shoes might be tempted to mow his neighbour’s lawn for a spot cash payment?

True he would be said to be cheating the system if not declared, but with virtually all support being taken away such as Crisis Loans, for all but the most desperate… it is a way to survive? Jobcentre Plus is not helping some people with Travel-to-Interview support. Temporary workers are not being given help to get to job interviews. People are being 'parked'. This includes people who work in IT, an industry that makes extensive use of contractors.

Freezing benefits for four years has breached the social contract between tax payer and recipient. Tax payers are still paying the same amount of tax, but getting less and less it seems. The money is being used to subsidise tax reductions to the rich. There is a moral dimension to dishonesty. If people can see they are being cheated by the government, why should they be expected to follow the rules it could be argued?

Back to the report...

According to the BBC Mr Taylor's review found the UK has a "great record on creating jobs" but less so on the "quality" of those jobs.

"In my view, there is too much work particularly at the bottom end of the labour market that is not of a high enough quality," Mr Taylor told the BBC.

"There are too many people not having their rights fully respected.

"There are too many people at work who are treated like cogs in a machine rather than being human beings, and there are too many people who don't see a route from their current job to progress and earn more and do better," Mr Taylor said.

The trade unions say the report does not go far enough. In the UK, there are 4.5 million people in insecure work and a recent report pointed to a link between the stress and insecurity of working in the Zero Hours economy and mental health issues in young people.

The idea of 'dependent contactor' is a good concept. These workers should have the rights of an employed person and to a basic income, holiday and sickness pay, at the very least.

The government will relish an excuse to find a way to tax the cash economy and reduce people’s privacy…the Unions will argue almost certainly, that more needs to be done to end the scourge of insecure work and exploitation.

At the ABC, we want to see the end of commission only sales jobs in the Home Improvements industry. The ending of On Target Earnings (OTE) and the practise of massively over inflated earnings projections in job advertisements by companies seeking salespeople. We would like these OTE projections to be based on actual previous experience.

Young people get sucked into jobs offering fantastic promises and it destroys their faith in the world of work when they realize they have been conned. Some young people don’t want to work [although fewer than one may think] but is that laziness, or is it a simply a lack of willingness to be exploited in a corrupt, working environment?

A basic wage in sales would promote more ethical selling and less exploitation and stop companies in industries like double glazing from claiming that canvassers and salespeople are ‘running their own business’. Companies would be less inclined to ‘manage people out of the business’ by withholding sales leads if it was costing them. They would be motivated to help train people, not just replace them?

Companies in the Home Improvements field can be put into liquidation to avoid the guarantees given on products installed. With no redundancy to pay out, companies can rise 'Phoenix like' to trade again under a new name. It is common practise. We believe that proper employment practises would get rid of the cowboys in fields like glazing or renewable energy, wall coatings, kitchens, driveways etc. Consumers would be better protected from salespeople desperate to put food on the table.

There are many spin-offs from these suggested changes in working practises and it could also help consumers from being ripped-off.

The Taylor Report is a starting point and a welcome first-step.

Video: Dr Collins (81) who has dementia was sold almost £6K worth of doors by a Zenith Staybrite Ltd salesman when she just wanted a new door handle.

Her son Dominic MacMahon claims his 81-year-old mother was taken advantage of. Dr Collins, a grandmother of two, was persuaded to hand over a cheque for an eye-watering £5,743.73 for a new front door and backdoor which Mr MacMahon says were simply 'not needed'.

UK Productivity Languishes

UK labour productivity, as measured by output per hour, declined by 0.5% in the first three months of this year, according to new figures from the Office for National Statistics. It is the first fall since the end of 2015, commenting on the news Shadow Chancellor Vince Cable said:

“This should set off alarm bells in government. It confirms that we are nowhere near solving the UK’s productivity puzzle, which is holding back our economy and people’s living standards.

“Productivity fell following the financial crisis and has grown slowly since then, only returning to its pre-crisis level last year. After that fragile recovery, it looks like we are going backwards again.

“Without improvements in how much we all produce, workers will not earn more and we will be stuck in a world of stagnant or even falling wages.

“Productivity was sadly absent from the election debate, but we can’t ignore it any longer. Instead of being distracted by Brexit, we need to remain inside the Single Market while addressing the skills deficit and lack of investment that are the real cause of our problems.”

Bankruptcies Fall Under New Rules

It is now over a year since the government increased the minimum amount of debt necessary to petition for bankruptcy. The threshold is now £5,000 (it was previously £750).

This has led to a reduction in the number of people in England & Wales who have gone Bankrupt. The number of Debt Relief Orders has increased since that date. This is because the government also relaxed the eligibility criteria by increasing the total amount of debt which can be owed from £15,000 to £20,000. Many more people have therefore been able to access this form of insolvency procedure.

A debt relief order can be a low-cost alternative to bankruptcy. A DRO is only available if you owe less than £20,000 and live in England, Wales or Northern Ireland. You don't pay anything towards your debts for 12 months - and after that they will be written off.

According to Citizens Advice:

Your DRO will show up on your credit reference file. It can reduce your chances of getting credit from some lenders, as it shows you've struggled to keep up repayments before.

You're not allowed to get credit for £500 or more without telling the lender that you have a DRO. A lender might change their mind about offering you credit, when they see a DRO registered on your credit file.

The note of your DRO stays on your credit file for up to six years after the date the DRO was made. This means it could be some time before you can get credit in the future.

You might also struggle to open a new bank account during the DRO period and for some time after it has ended.

If you need a new home while you've got a DRO, you could find that your options are limited. Many private landlords and letting agencies will insist on credit checks when you apply for a tenancy, and because the DRO will show up on your credit report, you may be turned down or charged higher fees.

If you're not comfortable with how a DRO can affect your credit rating, you might want to think about a different debt solution.

Information with help from Goody Burrett.

Executives

-

Simon Collyer

Position: Founder & Director

Simon Collyer hails from Brightlingsea in Essex, a small town on the coast between Colchester & Clacton. Simon worked very successfully in the leisure marine industry in the UK and in Australia. Later in London Simon worked in the web development and publishing fields, founding a below-the-line sales promotion agency in the early nineties and then later a software company Red Banner in South Africa (2002-06). Here in South Africa, Simon became interested in the Third Sector and starting his own organisation.

-

Christopher Johnson

Position: Bookkeeping and Administration

Chris lived in Oxford for twenty years, having been educated at Magdalen College School. Chris sought a career with British Rail and spent twenty years in railway retail management ending with Virgin Trains at Euston Station. Christopher retrained in bookkeeping and accounts in 2000 and now works for Chelmsford Community Transport.

A strong, enthusiastic team player with a meticulous eye for detail, Christopher brings a range of skills to the ABC.

Team

-

Frances Rimmer

Position: Researcher

When not charming snakes Frances is a Modern History student at the University of Essex, focusing specifically on social history. The lives and experiences of the ordinary person rather than on politics or the military. Outside of her studies, Frances enjoys film and writing. As a keen roller skater who plays roller derby with the Kent Roller Girls, Frances secret wish would be to become a skating instructor and open her own rink, as she has always wanted to help people in some way, and feels it would be great to do so while also sharing her passion with like-minded people.

-

Stuart Meyers

Position: Researcher

Stuart Meyer, is a final year American Studies student at the University of Essex. Stuart focussed his academic life on global justice and the rights of migrants. Additionally Stuart has a passion for writing, both creatively and with the aim of providing accessible information to those who need it most Stuart has made a great contribution to our library of Advice Guides demonstrating his versatility by writing intelligently on a wide range of topics.

-

Louis Jones

Position: Film Maker

Louis is a 19 year old TV and film student studying at Colchester Institute. Along with hand-picked fellow students, Louis made the ‘Membership’ video that can be seen on the ABC website. Louis volunteers at, Hospital Radio Colchester, as a football commentator. A true fan of the ‘Great Game’ Louis insights have been sought after on occasions by key local media, the Colchester Daily Gazette & even BBC Essex.

-

Marcus Pierpont

Position: Film Director

Talented student film maker, Marcus Pierpoint, directed the ABC 'Membership' film which can be seen on the organizations website. Marcus has recently graduated from a BTEC course, studying Creative Media Production at Colchester Institute and he claims a true passion for films and filmmaking. Marcus also enjoys radio work and volunteers at the local hospital radio station, producing and presenting his own show. Marcus is enrolled at the University of Greenwich, and dreams of a career in the media industry.

-

Shane Mitchell

Position: Film Maker

Shane Mitchell, is another Colchester Institute Film and TV student that aspirers to be a Director of Photography in the future. Shane was the camera operator for the ABC Membership video, fun to make says Shane but it is also work he is very proud of. Shane loves all things ‘film’ and he makes videos even in his spare time.

-

Joe Corlett

Position: Film Director

Ex-student script writer/director, Joe Corlett, directed the ABC's corporate video (About Us) which is now viewable on the main website. Joe graduated from the Colchester Institute with a BTEC diploma in the field of media. Joe is passionate towards film making and hopes to continue making more that are constructed form his own material. On the side he's loves being out jogging in all terrains and when not out side he's writing scripts for future projects. Joe is now out in the world ready to start his life goal of working in the Media industry.

-

Jon Taylor

Position: Film Maker

Jonathan Taylor has been working in the media sector for 3 years and for our filming projects he worked as the production manager. John worked on graphical elements of our film, About Us for example, rendering images and making them look good on screen.

Jon is also experienced in animation and he made the logo and animation sequences in the ABC corporate videos.

Part of Jon’s brief was to also organise the administration side of filming, known collectively to admin experts the world over as ‘the paperwork’.

-

Thomas Hearn

Position: Film Maker

Thomas Hearn, has been involved in media, for about three years. Tom likes to work a lot at a computer, particularly the editing suite. For the ABC project, Tom worked on the edit itself; created and pieced together both the footage and the music, Tom created the visual elements of the ABC ‘About Us’ video and put most of the visual effects on the video.

I think we can agree that along with the rest of our youthful student team; Tom has done a very fine job indeed.

-

Max Gillard

Position: Film Maker

The last of our film team Max Gillard has recently finished college studying Creative Media Level 3 and Max hopes to continue the course on to University to someday gain a job in the media industry.

We wish Max the best of luck.

-

Harry

Position: Film Maker

My name is Harry Genge and I am an aspiring film maker. I have skills in the majority of film orientated jobs, though I am most interested in the creative roles such: Directing, Director of Photography and Writing. In my spare time I make short films, write, read, draw/paint and take the dog out for long walks.

-

Ned

Position: Producers

My name is Ned Woodcraft and I’m an aspiring Producer. As well as completing a diploma in media production I have also had a number of jobs in the professional market. I’m also a keen sailor and water sport enthusiast.

-

Brandon

Position: Producer

My name is Brandon and I’m an aspiring producer and actor. I enjoy bringing a production together with planning and preparations to create a great finished product. My hobbies also include street magic and bass playing.

-

Callum

Position: Writer and Director

My name is Callum Olive and I’m an aspiring writer and director. I’m always looking for a new project and love writing new stories and screenplays at home and on the move. My hobbies include playing the piano and street magic.

-

Joanie DeMuro

Joanie joined ABC team in early 2017. She was one of six student volunteers from the University of Essex in that cohort. The student team focused on a range of projects, including creation of Wikipedia page,‘training manual’ and most importantly, researching and adding entries to the website directory of organisations that assist the unwaged, or those on low incomes. “This placement was very helpful - thanks for the opportunity Simon.”

-

Cherry Lam

Cherry Lam has been volunteering for ABC for one month. Although it is a short period of time, she knows a lot more about the running of a charity organisation. Cherry is responsible for adding directories to the organisation website according to categories. Joining this placement helped her improving skills and gaining new experiences. Cherry says is extremely appreciative of the support she has received from ABC which allowed her to improve skills.

Join

FREE

Here