Simon Collyer

Thousands Of Scots Apply For Welfare Grants

Thousands of Scots were forced to apply for Crisis Grants last year due to delay in receiving their benefits, new figures show.

254,000 individual households have been supported through the Scottish Welfare Fund since it began in April 2013 to end of March 2017. Of the 165,000 applications for crisis grants in the past year 17,500 were due to a delay in benefit payments.

The shocking figures come as the UK government continues to roll out universal credit, which has a six week wait for the first payment.

86,000 vacancies in the NHS

There were over 86,000 vacancies in the NHS between January and March 2017, figures published by NHS Digital have revealed.

The Liberal Democrats said the figures show the cap on public sector pay must be lifted to help the NHS recruit the staff it needs.

Over 30,613 full-time equivalent vacancies in England were advertised in March 2017, the highest number since records began.

The highest shortages were amongst nurses and midwives, with almost 33,000 posts being advertised between January and March 2017.

Separate figures show that over 10,000 nurses and health visitors quit the NHS between December 2016 and March 2017.

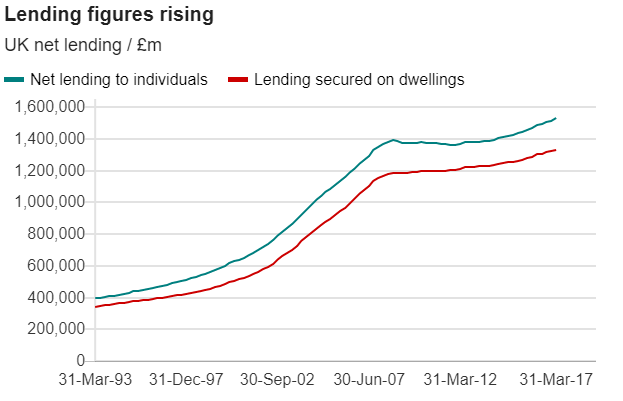

Personal Debt Rises Cause Concern

Bank of England officials have warned that a sharp rise in personal loans could pose a threat to the UK economy. Outstanding car loans, credit card balance transfers and personal loans increased by 10% over the past year, meanwhile incomes have only risen by 1.5%.

The Bank’s financial stability director Alex Brazier said “household debt - like most things that are good in moderation - can be dangerous in excess". In a speech to the University of Liverpool's Institute for Risk and Uncertainty, he added that this increase in debt was "dangerous to borrowers, lenders and, most importantly from our perspective, everyone else in the economy".

He warned of a “spiral of complacency” where lending from High Street banks could go from responsible to reckless very quickly, but hinted the BoE could, if deemed necessary, force banks to take further safeguards against these risks.

Just weeks ago, banks were told to beef up their finances against the risk of bad loans. Speaking last month, the Governor Mark Carney said lenders seemed to have forgotten some of the lessons of the financial crisis.

From The Bank of England

Image: Alex Brazier, Bank of England

In a speech to the University of Liverpool’s Institute for Risk and Uncertainty, Alex Brazier, Executive Director, Financial Stability, and a member of the Financial Policy Committee, considers the recent developments in household debt, how that debt can pose dangers to the wider economy, and the three lines of defence put in place by regulators to guard against those dangers.

Shrinkflation Gets ONS Attention - What Is It?

Shrinkflation is a term used to describe the business practice of changing the physical weight of a product, while keeping its price constant. The “shrink” part of the term refers to the change in package size, typically a reduction, whereas the latter part of the word refers to inflation – the rise in the general price level. If products “shrink” in size, inflation rises even if prices stay constant, as consumers pay the same amount of money for less of the good. In order to more accurately measure inflation, the ONS use quality adjustment processes to isolate price movements from the changes in product’s weight or quality.

We have been banging on about this issue for some while to Essex Universities, EUROMOD project.

EUROMOD is a unique tax-benefit microsimulation model for the European Union. The ABC want to show the effects of inflation in the real world, as opposed to the theoretic models from the world of academia.

The need to understand the real effect on UK welfare benefits that have been frozen, by a problem food manufactures have created, companies that are shrinking products in size and weight. This is in addition to monetary inflation, which is eroding the purchasing power of money itself.

If the Council stops emptying the bins once a week and reduces the service to every two weeks…that is a form of inflation, as your money is buying less and less service, for the same amount spent. Some Shrinkflation does little harm, but some does hurt people a great deal.

Shrinkflation is something we will be hearing more about. The government cutting welfare and services yet expecting the public to carry on paying the same amount of tax, except of course for companies that are having Corporation Tax cut still further. The actual effective rate of Corporation Tax, as one Scottish economist pointed out is just 2%.

It is good that the Office of National Statistics is tackling this issue, which we brought up with EUROMOD sometime ago.

We Complain to the BBC About David Attenborough’s Producer

BBC wildlife producer and director Fergus Beeley shocked a family on Saturday when he got out of his car and launched an angry tirade against them. Beeley was heard calling the family ‘wankers’ and ‘sluts’ and telling them to ‘get back in the car before you die’.

Mr Gale also claims Beeley grabbed hold of him around the throat and ‘raised his fist in a threatening manner’.

Mr Beeley, worked with Sir David Attenborough on many films including the landmark series, Life of Birds. He was Executive Producer and Presenter of many award-winning films for BBC Natural World, PBS and National Geographic Explorer. He was series producer of the award-winning series ‘Planet Earth – the future’ for BBC, Discovery and NHK. In 2014 - 2015 Fergus was Director of Fountain Digital Labs. Virry app won a Webby and BAFTA Award in 2015. As a Media Consultant Fergus advises on creative multi-platform strategies.

Beeley is an Ambassador for Steppes Travel, Fellow of the Royal Asiatic Society, President of the Wildlife Conservation Film Festival and Patron, Flamingo Conservation Rift Valley.

We complained to the BBC

Dear Sir/Madam

I have just witnessed David Attenborough’s BBC wildlife producer and director on Facebook, going ballistic in a road rage incident, making death threats, committing assault by grabbing another motorist by the arm and acting in a very intimidating and aggressive manner.

We can all have an off-day; however, this is unacceptable. The BBC have a duty to report this to the police and take disciplinary action. Working for the BBC comes with a sense of duty at work and off-duty employees still represent a national institution and should have a sense of responsibility.

The public does not pay a licence fee to support thugs. Mr Beeley should have had the intelligence to calm himself and step-back. This also shows a lack of judgement on Mr Beeleys’ part?

Many ordinary people in much less privileged position would expect the sack if they behaved like this. Mr. Beeleyon knew what he was doing, he knew he was being filmed.

The BBC must act to protect the integrity of the organisation and show that it will not turn a blind eye to this type of anti-social behaviour.

Sincerely,

Simon COLLYER

Founder & CEO

Association of Pension & Benefits Claimants CIC

Website: www.abcorg.net

Please see the video below.

If you want to complain to the BBC click here:

Zero-Hours Contracts Fall in Scotland – But Rise By 101,000 Across UK

These were the numbers of people in Zero-hours contracts from October – December 2016.

The SNP has today welcomed new figures showing that Scotland is leading by example in delivering fair work, and has called on Labour to support full powers over employment laws for the Scottish Parliament.

The figures obtained by George Adam MSP, provided by the Scottish Parliament Information Centre, show that Scotland has a lower proportion of workers on zero-hours contracts than the UK.

Per cent of people in employment on a zero hours contract

UK 905,000 2.8

Scotland 57,000 2.2

As the number of zero-hours contracts in Scotland dropped by 2,000, across the UK it has risen by 101,000 in the past 12 months.

The SNP back a ban on exploitative zero-hours contracts but the power remains reserved, and the UK government has yet to show any willingness to take the action required to deliver job security and fair conditions for all.

Commenting, George Adam MSP said:

“Zero-hours contracts can and are being used to exploit workers; I have had numerous constituents contacting me about this punitive practice that needs curbed.

“Employees are too often denied regular or sufficient working hours or penalised for not being available to work. This is a root cause of poverty and has a negative knock-on effect in households and communities across the country.

“The SNP believes the exploitative use of these contracts - where there is no specific justification for their use or where they are used to deny giving workers the protections they are due - should be banned.

“Every worker should have appropriate rights and protections, including holiday and sick pay.

“The SNP has consistently argued for the full devolution of employment and equalities law, including minimum wage powers. If the Tories won’t take action at Westminster, we’ll get on with the job in the Scottish Parliament.

“Labour might talk big about workers’ rights but they helped stop Scotland gaining full powers on employment; they should now welcome these figures and work with the SNP to help deliver stronger workers’ rights and conditions in Scotland and across the UK.”

About Zero-hours contacts. From RealBusines

The term precarious work is most commonly used to refer to individuals who perform labour without the long-term contracts that characterise 20th century employment. Whether such labour takes the form of fixed-term, agency, or undeclared employment, it’s a fact that today’s economy is increasingly using “exploitative” forms of work.

There is no better example of this tendency than the disclosures of Sports Direct and McDonald’s widespread use of zero-hour contracts. The year 2013 also famously saw the University of Liverpool propose to fire its then 3,000 strong workforce and re-employ them on flexible contracts.

In the UK, companies used to tie an individual to the business under an “exclusivity” clause. However, thanks to Vince Cable and the Small Business, Enterprise and Employment Act, such clauses have been banned from zero-hours contracts.

Further changing the laws, the UK government made it possible for staff to utilise a flexible employment agreement, whereby they can now work for more than one company without being disciplined or fired.

No Early Retirement for Those Between The Ages Of 39 And 47

Six million people in their early 40s will have to work a year longer, because of a change in the State Pension Age, the government has announced.

The rise in the pension age to 68 will now happen in 2039, rather than in 2046 as was originally proposed.

Those affected are currently between the ages of 39 and 47. The change will affect those born between 6 April 1970 and 5 April 1978.

The announcement was made by the Secretary of State for Work and Pensions, David Gauke. This will apply to both men and women equally.

Image: Jason Smith Consultant Surgeon

Jason Smith, Consultant Surgeon has produced this excellent caluulator showing life expectancy.

Please click on the logo below:

Boots Under Pressure To Reduce Contraceptive Prices

Boots urged to drop huge sexist surcharge on emergency contraception

- * Boots charges £28.25 for Levonelle emergency contraceptive and £26.75 for its own generic version

- * Tesco now charges £13.50 for Levonelle, Superdrug £13.49 for a generic version

- * Boots has refused to cut the cost, saying it fears criticism from those who oppose women using emergency contraception

The Women’s Equality Party today joins forces with the British Pregnancy Advisory Service (BPAS) to call on Boots to cut the high price of its emergency contraceptive pills. Progestogen-based emergency contraception can cost up to five times more in the UK than elsewhere in Europe.

Superdrug and Tesco have already reduced the cost of the contraceptives to £13.50 – half the price charged in Boots stores – after BPAS wrote to ask them to review their pricing and offer women a more affordable product.

But Boots has so far refused to follow the example of these two major retailers, with the chain believing there may be complaints from those who oppose women's access to this safe and essential medicine, which gives women a second chance of avoiding unwanted pregnancy.

“Women should be able to access emergency contraception without being ripped off,” said Sophie Walker, leader of the Women’s Equality Party. “We know that emergency contraception can be difficult to access for free on the NHS, with appointments at GP surgeries or family planning clinics hard to obtain. Many women will need to buy these pills over the counter, and it is irresponsible and exploitative for retailers to charge over the odds for them. This lack of consistency in the provision of women’s contraception threatens to undermine our reproductive rights and Boots’ approach to this concern is indicative of a society that prioritises profit over women’s health and wellbeing.”

Clare Murphy, Director of External Affairs at the British Pregnancy Advisory Service, said: “It’s brilliant to see Superdrug and Tesco leading the way on this issue, providing women with an affordable product which they can use when their regular method lets them down. Improving women’s access to emergency contraception – including by reducing the price – improves women's physical and mental wellbeing, enabling them to avoid an unwanted pregnancy, which can pose a serious risk to their health.”

BPAS and WEP are surprised that Boots, which has enlisted celebrated feminist names in recent advertising campaigns such as the author Chimamanda Ngozi Adichie, does not feel able to offer women a more affordable product on the basis that a small number of people who think women should face the consequences of an episode of unprotected sex might complain.

“Most people believe women should be able to access emergency contraception from pharmacies at an affordable price. We urge Boots to listen to them, reconsider their stance, and do the right thing by the women who shop in their stores everyday,” said Clare Murphy. “Boots needs to drop this hugely sexist surcharge.”

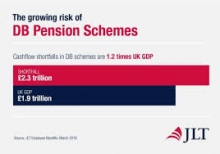

Ireland Removes Defined Benefits Protections from Welfare Bill

Proposed enhanced protections for Ireland’s defined benefit (DB) pension schemes have been removed from a bill put forward to parliament by Ireland’s minister for social protection.

Regina Doherty told Ireland’s parliament, the Dáil, last week that protections included in the bill’s earlier drafts had been removed and would be debated as amendments by the Committee on Social Protection.

“Given the complexities involved, it simply was not possible to have these included in the published bill,” Doherty said upon introducing the Social Welfare, Pensions and Civil Registration Bill 2017.

The protections included measures to force companies to give 12 months’ notice before ceasing contributions to a DB scheme, and a new power for the Pensions Authority to set a contribution schedule if none could be agreed between an employer and trustee board.

Despite Doherty’s assurances that the measures were still on the table, consultancy LCP warned that it meant important protections for DB members could be erased as the bill makes its way through parliament.

“While many companies may welcome the omissions of particular proposals from the bill, the inclusion of these proposals in the original heads followed by their subsequent removal is most unwelcome and leads to uncertainty,” said LCP. “This uncertainty makes it difficult for trustees and companies alike to manage their schemes.”

Although some measures could be reintroduced, LCP added, this was “unlikely” due to parliament’s summer recess, which begins on 22 July.

In her speech last week, Doherty said: “The best outcomes are achieved when trustees, employers and members negotiate to reach agreement on what is needed to secure the scheme’s viability. The amendments I will be tabling on committee stage seek to underpin this approach.”

Ireland’s DB system has been under intense scrutiny in recent years, in particular following the decision by Independent News & Media to walk away from its DB scheme.

In response to Doherty’s introduction of the bill, Labour Party politician Willie Penrose said the current system faced a “significant and worrying crisis” and was in danger of “meltdown”.

Giving the Pensions Authority the power to impose a contribution schedule on employers was “one of the most important amendments” put forward, Penrose said.

As well as discussing the 12-month notice period and the Pensions Authority’s powers, Doherty said the committee would look at provisions for same-sex couples and civil partners to receive a spouse’s pension.

Consumer Prices Slow - Food However Goes Up

Consumer price inflation slowed to 2.6% in June 2017, but the cost of everyday goods including food and household products all continued to rise, figures published today have revealed.

The slight slowdown in inflation was driven largely by a 1.1% fall in fuel prices. However, the cost of food, furniture and household goods all saw the highest 12-month increase since 2013.

Executives

-

Simon Collyer

Position: Founder & Director

Simon Collyer hails from Brightlingsea in Essex, a small town on the coast between Colchester & Clacton. Simon worked very successfully in the leisure marine industry in the UK and in Australia. Later in London Simon worked in the web development and publishing fields, founding a below-the-line sales promotion agency in the early nineties and then later a software company Red Banner in South Africa (2002-06). Here in South Africa, Simon became interested in the Third Sector and starting his own organisation.

-

Christopher Johnson

Position: Bookkeeping and Administration

Chris lived in Oxford for twenty years, having been educated at Magdalen College School. Chris sought a career with British Rail and spent twenty years in railway retail management ending with Virgin Trains at Euston Station. Christopher retrained in bookkeeping and accounts in 2000 and now works for Chelmsford Community Transport.

A strong, enthusiastic team player with a meticulous eye for detail, Christopher brings a range of skills to the ABC.

Team

-

Frances Rimmer

Position: Researcher

When not charming snakes Frances is a Modern History student at the University of Essex, focusing specifically on social history. The lives and experiences of the ordinary person rather than on politics or the military. Outside of her studies, Frances enjoys film and writing. As a keen roller skater who plays roller derby with the Kent Roller Girls, Frances secret wish would be to become a skating instructor and open her own rink, as she has always wanted to help people in some way, and feels it would be great to do so while also sharing her passion with like-minded people.

-

Stuart Meyers

Position: Researcher

Stuart Meyer, is a final year American Studies student at the University of Essex. Stuart focussed his academic life on global justice and the rights of migrants. Additionally Stuart has a passion for writing, both creatively and with the aim of providing accessible information to those who need it most Stuart has made a great contribution to our library of Advice Guides demonstrating his versatility by writing intelligently on a wide range of topics.

-

Louis Jones

Position: Film Maker

Louis is a 19 year old TV and film student studying at Colchester Institute. Along with hand-picked fellow students, Louis made the ‘Membership’ video that can be seen on the ABC website. Louis volunteers at, Hospital Radio Colchester, as a football commentator. A true fan of the ‘Great Game’ Louis insights have been sought after on occasions by key local media, the Colchester Daily Gazette & even BBC Essex.

-

Marcus Pierpont

Position: Film Director

Talented student film maker, Marcus Pierpoint, directed the ABC 'Membership' film which can be seen on the organizations website. Marcus has recently graduated from a BTEC course, studying Creative Media Production at Colchester Institute and he claims a true passion for films and filmmaking. Marcus also enjoys radio work and volunteers at the local hospital radio station, producing and presenting his own show. Marcus is enrolled at the University of Greenwich, and dreams of a career in the media industry.

-

Shane Mitchell

Position: Film Maker

Shane Mitchell, is another Colchester Institute Film and TV student that aspirers to be a Director of Photography in the future. Shane was the camera operator for the ABC Membership video, fun to make says Shane but it is also work he is very proud of. Shane loves all things ‘film’ and he makes videos even in his spare time.

-

Joe Corlett

Position: Film Director

Ex-student script writer/director, Joe Corlett, directed the ABC's corporate video (About Us) which is now viewable on the main website. Joe graduated from the Colchester Institute with a BTEC diploma in the field of media. Joe is passionate towards film making and hopes to continue making more that are constructed form his own material. On the side he's loves being out jogging in all terrains and when not out side he's writing scripts for future projects. Joe is now out in the world ready to start his life goal of working in the Media industry.

-

Jon Taylor

Position: Film Maker

Jonathan Taylor has been working in the media sector for 3 years and for our filming projects he worked as the production manager. John worked on graphical elements of our film, About Us for example, rendering images and making them look good on screen.

Jon is also experienced in animation and he made the logo and animation sequences in the ABC corporate videos.

Part of Jon’s brief was to also organise the administration side of filming, known collectively to admin experts the world over as ‘the paperwork’.

-

Thomas Hearn

Position: Film Maker

Thomas Hearn, has been involved in media, for about three years. Tom likes to work a lot at a computer, particularly the editing suite. For the ABC project, Tom worked on the edit itself; created and pieced together both the footage and the music, Tom created the visual elements of the ABC ‘About Us’ video and put most of the visual effects on the video.

I think we can agree that along with the rest of our youthful student team; Tom has done a very fine job indeed.

-

Max Gillard

Position: Film Maker

The last of our film team Max Gillard has recently finished college studying Creative Media Level 3 and Max hopes to continue the course on to University to someday gain a job in the media industry.

We wish Max the best of luck.

-

Harry

Position: Film Maker

My name is Harry Genge and I am an aspiring film maker. I have skills in the majority of film orientated jobs, though I am most interested in the creative roles such: Directing, Director of Photography and Writing. In my spare time I make short films, write, read, draw/paint and take the dog out for long walks.

-

Ned

Position: Producers

My name is Ned Woodcraft and I’m an aspiring Producer. As well as completing a diploma in media production I have also had a number of jobs in the professional market. I’m also a keen sailor and water sport enthusiast.

-

Brandon

Position: Producer

My name is Brandon and I’m an aspiring producer and actor. I enjoy bringing a production together with planning and preparations to create a great finished product. My hobbies also include street magic and bass playing.

-

Callum

Position: Writer and Director

My name is Callum Olive and I’m an aspiring writer and director. I’m always looking for a new project and love writing new stories and screenplays at home and on the move. My hobbies include playing the piano and street magic.

-

Joanie DeMuro

Joanie joined ABC team in early 2017. She was one of six student volunteers from the University of Essex in that cohort. The student team focused on a range of projects, including creation of Wikipedia page,‘training manual’ and most importantly, researching and adding entries to the website directory of organisations that assist the unwaged, or those on low incomes. “This placement was very helpful - thanks for the opportunity Simon.”

-

Cherry Lam

Cherry Lam has been volunteering for ABC for one month. Although it is a short period of time, she knows a lot more about the running of a charity organisation. Cherry is responsible for adding directories to the organisation website according to categories. Joining this placement helped her improving skills and gaining new experiences. Cherry says is extremely appreciative of the support she has received from ABC which allowed her to improve skills.

Join

FREE

Here