Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Dame Emma Thompson Tackles Government on Children’s Food Poverty Today at Westminster

Today the Children’s Future Food Inquiry Ambassador Dame Emma Thompson joins young ‘Food Ambassadors’ at Westminster to deliver a new report which calls for an independent Children’s Food Watchdog to lead the charge on tackling children’s food insecurity in the UK.

The Children’s Future Food Inquiry is the first attempt to directly and systematically seek the views of children and young people living in poverty across the UK. It has spent 12 months investigating children’s food insecurity in each of the four UK nations, and the project’s final report pulls together direct input from hundreds of young people, the frontline staff, academics and experts.

Dame Emma Thompson, Children’s Future Food Inquiry ambassador, said: “In a wealthy society that claims to value compassion and humanity, how can we tolerate the injustice of millions of children going hungry?

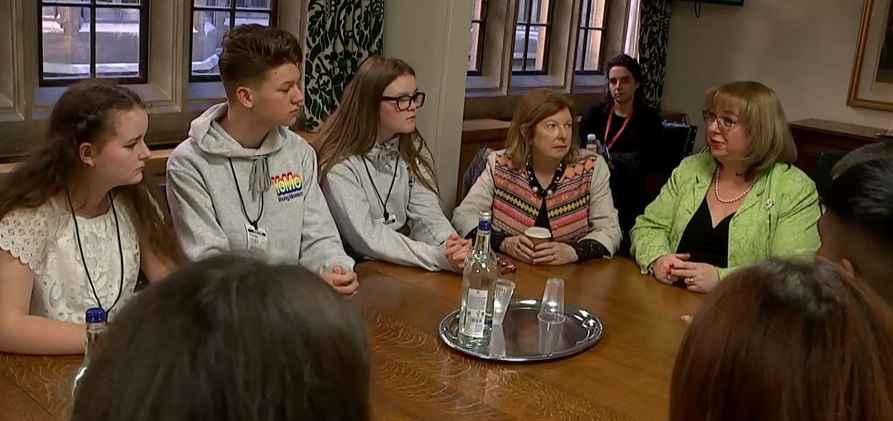

Image: Young Food Ambassadors speaking with Sharon Hodgson MP, Co-Chair of the Children’s Future Food Inquiry

ABC Comment, have your say below:

Irelands New Parental Leave Scheme

The Minister for Employment Affairs and Social Protection, Regina Doherty TD, the Minister for Justice and Equality, Charlie Flanagan TD and the Minister of State with responsibility for Equality, Immigration and Integration, David Stanton TD, today announced that from this November all new parents in employment or self-employment will be able to avail of a new Parental Leave scheme offering two weeks leave and benefit to spend with their new babies during their first year.

Image: David Stanton TD

Ultimately, parents will be able to benefit from seven weeks leave each under the scheme as it develops incrementally over the next three years.

Image: Charlie Flanagan TD

The Minister for Justice and Equality has secured the approval of Government for the priority drafting of the necessary legislation to introduce the leave entitlement. A General Scheme of the Bill is being published today. Arrangements are currently underway in the Department of Employment Affairs and Social Protection to ensure the necessary legislation is in place for the benefit and that the administrative and technical solutions are in place in advance of November for the operation of this scheme. It is estimated that up to 60,000 parents could benefit from the scheme in a full year.

ABC Comment, have your say below:

Tuesday 30 April Training and Upskilling Event In Its Intreo Centre At Hanover Street, Cork City

The Department of Employment Affairs and Social Protection will host a Training and Upskilling event in its Intreo Centre at Hanover Street, Cork city on Tuesday 30 April from 1.00pm to 4.00pm. The main focus of the event is to support for jobseekers with getting back into employment.

Over 20 local education providers will be attending the event including UCC, CIT, FIT, Skillnet, Innopharma Labs, local ETB Colleges and National Learning Network. Representatives from these and other training institutions and colleges will be on-hand to give course information and one-to-one career advice.

Visitors to the event will also have an opportunity to speak to representatives of the Cork Job Club, Dress for Success, Peil Progamme for Women Returners and the Cork Adult Guidance Service.

The Department strongly encourages jobseekers to avail of the opportunity to visit the event where they can meet directly with training providers and discuss the opportunities that would best suit them to upskill or retrain to get back into employment.

Commenting on the event, Marie O’Flynn, Department of Employment Affairs and Social Protection Divisional Manager, Cork said:

“There are currently many job opportunities in Cork and we welcome this event to work with education and training providers to train and upskill people who are interested in living and working in Cork. All age groups are welcome and together we can help families and individuals build diverse and sustainable futures.”

Those who wish to attend are asked to bring their PPS details with them for registration purposes on the day.

All are welcome and admission is free.

ABC comment, have your say below:

Middle Age Couples Act Now - New Entitlement to Pension Credit

Social Welfare Training has brought this to our attention.

Mixed Age Couples- Pension Credit Claims Cut Off Date

From 15/5/2019, mixed-age couples will be excluded from entitlement to Pension Credit. At present, and until that date, mixed aged couples can claim the more generous Pension Credit as long as the member of the couple above retirement age makes the claim. They can also claim Housing Benefit(without the Benefit Cap or the bedroom tax) rather than Universal Credit. There are no extra elements for being a pensioner under Universal Credit, making clients worse off.

Clients who claim either Pension Credit or Housing Benefit, before this date will remain on those benefits for as long as they are still entitled. They would also be able to claim the other benefit in the future as well.

Example of a typical couple who is affected by the change- one below and one above retirement age / Pension Credit age(currently around 65 and 3 months)-

age age

60 70

As both these benefits can be backdated for 3 months, then in effect couples may be able to make claims under the existing rules on or before 13/8/2019. DWP guidance confirms this. The guidance also confirms that if a couple are entitled to Pension Credit/ the more generous form of Housing Benefit on 15/5/2019, they can continue to be entitled as long the conditions for at least one of those benefits remain met.

AGE UK warn this could leave some couples £7,000 per year worse off. Advisers should consider looking out for clients who might be entitled and advise them to make a claim for Pension Credit/ Housing Benefit now.

DWP research predicts- how couples are affected.

Year numbers of couples savings

2019/20 15,000 £45m

2020/21 30,000 £130m

2021/22 40,000 £220m

2022/23 50,000 £315m

2023/24 60,000 £385m

ABC Comment, have your say below:

Free Lunch for Londoners Care of Elmlea Brought to You By The ABC

Food waste is a global issue with a wide variety of environmental, social and economic impacts.

New research today unveils that nearly three quarters of UK households are regularly throwing out food each week, with a staggering 40 per cent of their food shop on average destined for the bin.

The ABC supports any initiative that cuts food waste.

Regionally, it was revealed that those in London, Sheffield and Belfast are the worst offenders, however, the residents of Plymouth are setting an example on how we care for our food.

From the 1,500 adults polled, the study commissioned by Elmlea found that the top three ingredients most likely to be thrown out were lettuce, bread and bananas.

When questioned, 74 per cent of respondents said they are “left baffled” when it comes to knowing what to do with leftovers and ingredients approaching their use by date, even though a third of us are actively seeking inspiration online.

To raise awareness of this issue and inspire Brits to make a change on how we approach waste, a social-concept café is opening its doors in line with ‘Stop Food Waste Day’.

Open for one-day-only on Wednesday 24th April, the eatery dubbed the ‘Taste, Not Waste’ café will be serving hundreds of FREE lunches using the top 20 foods most likely destined for landfill.

The zero-waste menu concept has been cooked up by Elmlea who are doing their part to reduce, reuse and recycle.

Taking place in close proximity to Oxford Circus, Londoners need to simply turn up to the pop-up between midday and 3pm for their free lunch.

Homemade hearty and healthy sweet and savoury dishes will be up for grabs, with Elmlea at the heart of each dish, delivering that creamy taste the nation knows and loves.

Gemma Williams, Brand Strategy & Innovation Manager at Elmlea comments on the findings:

“The scale of the food waste problem is staggering, as a nation we need to unite in driving education, as well as make tangible changes to our culture around food that will help reduce these figures.

“With 90% of us throwing food away too soon, we hope the ‘Taste, Not Waste’ café will fuel inspiration and show attendees how you can make delicious recipes that will use up the food that’s about to go bad in your fridge or pantry.

“Thanks to Elmlea being a longer lasting cream alternative that stays fresher for longer, it is perfectly suited to making more of those sweet or savoury leftovers.”

TOP 20 FOODS MOST LIKELY TO BE WASTED

- Lettuce

- Bread

- Cucumber

- Milk

- Bananas

- Tomatoes

- Yoghurt

- Eggs

- Potatoes

- Carrots

- Cream

- Strawberries

- Cooked rice

- Apples

- Cheese

- Peppers

- Cooked Pasta

- Onion

- Chicken

- Broccoli

You can get a free meal:

Where: 22 Foley St, Fitzrovia, London W1W 6DT

When: Wednesday 24th April 2019

Time: Midday – 3pm

Please note lunches are available on a first come, first serve basis. Limited supply available.

ABC Comment, have your say below:

Newham Crowned London’s Most Overcrowded Borough for Property

The latest research by leading flatshare platform, ideal flatmate, has looked at where is home to the least number of homes to support the local population across each London borough.

Using data from the London Datastore, ideal flatmate looked at the population and the total number of dwellings for each borough before looking at which borough was home to the lowest percentage of homes in London, as well as which has the lowest ratio when it comes to homes per capita.

When it comes to the amount of straight up homes, the City of London is predictably home to the lowest with just 0.18% of all London properties located within its boundaries.

Kingston is home to the second lowest with just 1.9% of the capital’s total homes in the borough, with Barking and Dagenham, Sutton and Merton also amongst some of the lowest where volumes of housing are concerned.

However, while the amount of homes is one thing, the population of those reliant on housing in each borough is a main contributing factor to how crowded these local London property markets are.

With this considered, Newham is London’s most crowded borough with a population of just under 350,000 people reliant on just 112,628 dwellings in the borough, resulting in a dwellings per capita ratio of just 0.33 - in other words there roughly just one-third of a property available for every one person that resides in Newham.

Redbridge was the next most crowded borough with a dwellings per capita ratio of 3.4, with Barking and Dagenham, Brent, Harrow, Hillingdon, Hounslow, Waltham Forest, Enfield, Ealing, Kingston, Barnet and Tower Hamlets all home to a dwellings per capita ratio of less than 0.4.

While prime central London is used to topping tables around affordability, the higher price tags do mean they are some of the least crowded boroughs in London, with Kensington and Chelsea (0.56) and Westminster (0.51) home to a ratio of over half a property per person living in the borough. Hammersmith and Fulham, Wandsworth and Islington are also amongst some of the capita’s roomiest boroughs where property and population are concerned.

Co-founder of ideal flatmate, Tom Gatzen, commented:

“There’s obviously a clear correlation between the amount you pay either to buy or rent and the space you get for your money, but for those of us that don’t live in the high-end bliss of prime central London, it’s actually quite dire reading when it comes to the ratio of property available to people that need a roof over their head.

It’s no revelation that we aren’t building enough homes and while actual space is part of the issue in areas such as London, this research highlights just how overcrowded things are becoming in the capital.

No wonder then, that we’ve seen an increase in the acceptance of shared living, particularly in our major cities. While cost saving is the driving factor due to the price of renting or buying, coupled with the cost of living in general, there simply aren’t enough homes available to house everyone individually even if we wanted to.

While we’re big fans of co-living and the positives it brings, failure to address this lack of stock is going to see both house prices and the cost of renting continue to spiral out of reach for the average tenant or homebuyer.”

|

Borough |

Population |

Number of dwellings |

London total dwellings |

Percentage of dwellings |

Dwellings per capita |

|

Newham |

344,533 |

112,628 |

3,524,438 |

3.20% |

0.33 |

|

Redbridge |

301,328 |

103,462 |

3,524,438 |

2.94% |

0.34 |

|

Barking and Dagenham |

208,182 |

74,510 |

3,524,438 |

2.11% |

0.36 |

|

Brent |

326,427 |

118,013 |

3,524,438 |

3.35% |

0.36 |

|

Harrow |

248,697 |

89,980 |

3,524,438 |

2.55% |

0.36 |

|

Hillingdon |

299,899 |

108,935 |

3,524,438 |

3.09% |

0.36 |

|

Hounslow |

268,270 |

99,824 |

3,524,438 |

2.83% |

0.37 |

|

Waltham Forest |

274,222 |

102,317 |

3,524,438 |

2.90% |

0.37 |

|

Enfield |

332,127 |

125,369 |

3,524,438 |

3.56% |

0.38 |

|

Ealing |

344,802 |

132,094 |

3,524,438 |

3.75% |

0.38 |

|

Kingston upon Thames |

173,703 |

66,924 |

3,524,438 |

1.90% |

0.39 |

|

Barnet |

384,774 |

148,529 |

3,524,438 |

4.21% |

0.39 |

|

Tower Hamlets |

300,943 |

118,012 |

3,524,438 |

3.35% |

0.39 |

|

Haringey |

272,078 |

107,620 |

3,524,438 |

3.05% |

0.40 |

|

Greenwich |

279,139 |

110,983 |

3,524,438 |

3.15% |

0.40 |

|

Hackney |

273,239 |

108,770 |

3,524,438 |

3.09% |

0.40 |

|

Bexley |

245,095 |

97,628 |

3,524,438 |

2.77% |

0.40 |

|

Havering |

253,371 |

101,716 |

3,524,438 |

2.89% |

0.40 |

|

Merton |

206,706 |

83,649 |

3,524,438 |

2.37% |

0.40 |

|

Sutton |

201,945 |

82,281 |

3,524,438 |

2.33% |

0.41 |

|

Croydon |

383,301 |

157,394 |

3,524,438 |

4.47% |

0.41 |

|

Camden |

249,162 |

103,826 |

3,524,438 |

2.95% |

0.42 |

|

Lewisham |

298,903 |

125,961 |

3,524,438 |

3.57% |

0.42 |

|

Bromley |

327,580 |

138,422 |

3,524,438 |

3.93% |

0.42 |

|

Southwark |

311,655 |

132,152 |

3,524,438 |

3.75% |

0.42 |

|

Lambeth |

323,063 |

138,745 |

3,524,438 |

3.94% |

0.43 |

|

Richmond upon Thames |

195,187 |

84,759 |

3,524,438 |

2.40% |

0.43 |

|

Islington |

232,055 |

102,457 |

3,524,438 |

2.91% |

0.44 |

|

Wandsworth |

321,497 |

143,915 |

3,524,438 |

4.08% |

0.45 |

|

Hammersmith and Fulham |

181,783 |

86,609 |

3,524,438 |

2.46% |

0.48 |

|

Westminster |

241,974 |

123,366 |

3,524,438 |

3.50% |

0.51 |

|

Kensington and Chelsea |

156,773 |

87,276 |

3,524,438 |

2.48% |

0.56 |

|

City of London |

7,246 |

6,313 |

3,524,438 |

0.18% |

0.87 |

ABC Comment, have your say below:

Disability Fund Shows Strong Improvement Says US Social Security Administration

Social Security Combined Trust Funds Gain One Year Says Board of Trustees

The Social Security Board of Trustees today released its annual report on the long-term financial status of the Social Security Trust Funds. The combined asset reserves of the Old-Age and Survivors Insurance and Disability Insurance (OASI and DI) Trust Funds are projected to become depleted in 2035, one year later than projected last year, with 80 percent of benefits payable at that time.

The OASI Trust Fund is projected to become depleted in 2034, the same as last year’s estimate, with 77 percent of benefits payable at that time. The DI Trust Fund is estimated to become depleted in 2052, extended 20 years from last year’s estimate of 2032, with 91 percent of benefits still payable.

In the 2019 Annual Report to Congress, the Trustees announced:

- The asset reserves of the combined OASI and DI Trust Funds increased by $3 billion in 2018 to a total of $2.895 trillion.

- The total annual cost of the program is projected to exceed total annual income, for the first time since 1982, in 2020 and remain higher throughout the 75-year projection period. As a result, asset reserves are expected to decline during 2020. Social Security’s cost has exceeded its non-interest income since 2010.

- The year when the combined trust fund reserves are projected to become depleted, if Congress does not act before then, is 2035 – gaining one year from last year’s projection. At that time, there would be sufficient income coming in to pay 80 percent of scheduled benefits.

“The Trustees recommend that lawmakers address the projected trust fund shortfalls in a timely way in order to phase in necessary changes gradually and give workers and beneficiaries time to adjust to them,” said Nancy A. Berryhill, Acting Commissioner of Social Security. “The large change in the reserve depletion date for the DI Fund is mainly due to continuing favorable trends in the disability program. Disability applications have been declining since 2010, and the number of disabled-worker beneficiaries receiving payments has been falling since 2014.”

Other highlights of the Trustees Report include:

- Total income, including interest, to the combined OASI and DI Trust Funds amounted to just over $1 trillion in 2018. ($885 billion from net payroll tax contributions, $35 billion from taxation of benefits, and $83 billion in interest)

- Total expenditures from the combined OASI and DI Trust Funds amounted to $1 trillion in 2018.

- Social Security paid benefits of nearly $989 billion in calendar year 2018. There were about 63 million beneficiaries at the end of the calendar year.

- The projected actuarial deficit over the 75-year long-range period is 2.78 percent of taxable payroll – lower than the 2.84 percent projected in last year’s report.

- During 2018, an estimated 176 million people had earnings covered by Social Security and paid payroll taxes.

- The cost of $6.7 billion to administer the Social Security program in 2018 was a very low 0.7 percent of total expenditures.

- The combined Trust Fund asset reserves earned interest at an effective annual rate of 2.9 percent in 2018.

The Board of Trustees usually comprises six members. Four serve by virtue of their positions with the federal government: Steven T. Mnuchin, Secretary of the Treasury and Managing Trustee; Nancy A. Berryhill, Acting Commissioner of Social Security; Alex M. Azar II, Secretary of Health and Human Services; and R. Alexander Acosta, Secretary of Labor. The two public trustee positions are currently vacant.

ABC Comment, have your say below:

Death of DWP Claimant Highlights Deep Floors in The Governments Disability Strategy

Stephen Smith, 64 failed a Department for Work and Pensions (DWP) work capability assessment in 2017, which meant that his employment support allowance (ESA) payments were stopped. He was told to sign on to receive a £67 a week jobseeker’s allowance, visit the jobcentre once a week and prove that he was looking for work.

Mr Smith had multiple debilitating illnesses such as chronic obstructive pulmonary disease, osteoarthritis and an enlarged prostate that left him in chronic pain.

Pictures showed him emaciated in hospital with pneumonia as his weight dropped to six stone, leaving him barely able to walk.

Mr Smith never recovered from pneumonia and he reportedly has died.

ABC Comment, have your say below:

.

Australian Fabian Society Highlights Wealth Inequality

The level of wealth inequality in Australia is vastly underestimated by the public despite being a top priority for many, as new polling finds nearly three-quarters of Australians are unaware of the disparity in wealth distribution.

Research commissioned by the Australian Fabians reveals that 73% of people underestimate the level of wealth inequality in Australia, where the wealthiest 1% hold wealth equivalent to the poorest 70%.

Rectifying this inequality was nonetheless seen by many as a vitally important issue, with 43% claiming it should be a top priority for the Government and 69% believing that raising the minimum wage to a living wage would be an effective measure of achieving this.

The gap between rich and poor is damaging our society. Damaging economies around the globe. What is worse is that the gap is growing.

The world’s billionaires increased by 12 percent or almost $3.5 billion AUD a day last year (£1,926,789,441.61GBP). At the same time the poorest half of humanity saw their wealth shrink by 11 percent.

The facts as bullet points:

- The gap between rich and poor is damaging our society. Damaging economies around the globe. What is worse is that the gap is growing.

- The level of wealth inequality in Australia is vastly underestimated by the public despite being a top priority for many, as new polling finds nearly three-quarters of Australians are unaware of the disparity in wealth distribution.

- Our Research reveals that 73% of people underestimate the level of wealth inequality in Australia, where the wealthiest 1% hold wealth equivalent to the poorest 70%.

- Rectifying this inequality was nonetheless seen by many as a vitally important issue, with 43% claiming it should be a top priority for the Government and 69% believing that raising the minimum wage to a living wage would be an effective measure of achieving this.

ABC comments, have your say below:

Image: Dr Nicolas Herault, Melbourne Institute of Applied Economic and Social Research at the University of Melbourne.

Dr Nicolas Herault, Melbourne Institute of Applied Economic and Social Research at the University of Melbourne.

Nicolas is an expert on labour economics, tax and transfer policies, homelessness, and welfare economics. He will discuss who is affected by the economics of inequality and why.

Event Series: What do we mean by Equality?

Everywhere we are surrounded by indications of increased inequality in Australian society. But what does "inequality" mean? Are we strictly talking about economic differences in income and wealth? Or do other cultural forms of inequality, eg, class, race, gender, age or disability, also intersect with income and wealth, and if so, how? And what might be the keys to fixing such a complex and politically charged problem as inequality?

These questions form the basis of Victorian Fabians' Autumn Series of events.

Event 1: Inequality of Wealth and Income (Economic)

The causes and solutions to economic inequality are as varied as the number of economists there are to express them. However there is some consensus developing around the idea that disparities in wealth and income deferentially contribute to overall economic inequality, and that this inequality is growing.

Explanations for increasing economic inequality somewhat depend on the politics of the person explaining. Some see globalisation or neoliberal economics as the problem while others see the dismantling of trade unions and diminishing labour power as the culprit. Others have blamed increasing automation eating into routine occupations at many levels of the workforce, including and beyond manufacturing. Piketty suggests that wealth, not income per se, is the problem. Wealth has a tendency to concentrate into a few hands except during times of war and disaster. The wealthy can act to channel more wealth their way. The remedy he suggests, is active redistribution. However in a later essay he says the same causes do not explain income inequality.

Two prominent researchers whose work revolves around understanding economic inequality give insights on how can we explain economic inequality of wealth and income and what can we do to ensure it does not result in ever greater economic and social disparities.

The US Reports Lowest Level for Initial Benefit Claims Since September 6

In the week ending April 13, the advance figure for seasonally adjusted initial claims was 192,000, a decrease of 5,000 from the previous week's revised level. This is the lowest level for initial claims since September 6, 1969 when it was 182,000.

The previous week's level was revised up by 1,000 from 196,000 to 197,000. The 4-week moving average was 201,250, a decrease of 6,000 from the previous week's revised average. This is the lowest level for this average since November 1, 1969 when it was 200,500. The previous week's average was revised up by 250 from 207,000 to 207,250. The advance seasonally adjusted insured unemployment rate was 1.2 percent for the week ending April 6, unchanged from the previous week's unrevised rate.

The advance number for seasonally adjusted insured unemployment during the week ending April 6 was 1,653,000, a decrease of 63,000 from the previous week's revised level. The previous week's level was revised up 3,000 from 1,713,000 to 1,716,000. The 4-week moving average was 1,712,500, a decrease of 22,750 from the previous week's revised average. The previous week's average was revised up by 750 from 1,734,500 to 1,735,250.

ABC comments, have your say below: