Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Scotland - Have You Registered to Vote?

The SNP has urged Scots to register to vote by 7 May for the upcoming European Parliament elections, warning it’s the only way to ensure Scotland’s voice is heard in Europe.

Research published today revealed that 600,000 Scots who are eligible to vote in this month’s elections have not registered yet. Unlike the Brexit referendum, EU citizens living in the UK can vote in European parliamentary elections.

To be able to vote in the European Parliament elections, people must be registered to vote by midnight on 7 May. The elections will take place on 23 May.

ABC Comment, have your say below:

£2m EU Funds to Tackle In-Work Poverty In South East Wales

Nearly £2m of EU funding has been awarded to Newport Council to tackle in-work poverty and challenges faced by lower-skilled workers in south east Wales.

The Skills@Work scheme will support around 1,400 people over the next four years, with a range of community-based learning opportunities, to help learners gain qualifications, improve their job security and earning potential.

ABC Comment, Have your say below:

Northern Ireland Deloitte Academy Offers Almost 50 Further Graduate Training Opportunities

The latest Deloitte Assured Skills Academy is offering graduates industry-leading training opportunities to prepare them for working in the fast moving, cutting edge business consulting sector.

Supported by the Department for the Economy, the Transformation, Finance and Technology Assured Skills Academy will see 48 graduates receive high quality pre-employment training, with a guaranteed interview at Deloitte upon successful completion.

Covering the very latest areas in business consultancy, including project management, agile and creative working process, technology essentials and creating business processes, the training will be delivered over seven weeks by Belfast Metropolitan College.

Ann Williamson, Head of Employer Skills at the Department for the Economy, said: “This Assured Skills Academy offers an excellent opportunity to graduates who are looking to gain the skills they need to start a career in business consultancy.

“Building on the success of previous Academies, this latest Academy will see nearly 50 graduates receive industry-leading pre-employment training at Belfast Metropolitan College. Successfully completing the training secures them a guaranteed interview with Deloitte.”

Ms Williamson added: “The Department’s Assured Skills Academies are a result of business engaging with the Further and Higher Education sectors to upskill the local workforce. This successful model helps local employers access a pipeline of skilled people to enable them to continue growing.”

Kerrie Irvine, Senior Manager in Human Capital Consulting at Deloitte, said: “This Transformation, Finance and Technology Assured Skills Academy is an exciting opportunity for graduates seeking to get a flying start in the world of business consultancy by learning about the very latest technologies and methods.

“Through Assured Skills Academies we have employed over 200 people to date. We have 48 places available on this latest Academy and there will be more to come in the future, working with the Department for the Economy and Belfast Met. No experience is required – I urge anyone interested to apply now!”

Director of Curriculum at Belfast Met Jonathan Heggarty said: “Belfast Met has a proven track record of delivering pre-employment training to graduates that enables them to hit the ground running. We are delighted to once again work with Deloitte and the Department for the Economy in upskilling graduates and look forward to welcoming the next cohort.”

Applications for the Deloitte Transformation, Finance and Technology Assured Skills Academy are open until Friday 24 May 2019. Applicants must have a minimum 2:2 degree in any discipline and no experience is required.

For more information and to apply visit: www.nidirect.gov.uk/assured-skills

ABC Comment, have your say below:

Thinking of Renting In London - This Guide Might Help?

The London Underground Property Rundown - the most affordable sale and rental spots on the tube revealed

Leading independent London estate agent, Benham and Reeves, has looked at the cost of buying and renting across the London Underground, where is home to the most affordable and unaffordable spots and which line tops the table where the property market is concerned.

Using data from PropertyData.co.uk, Benham and Reeves crunched numbers on thousands of tube stops across the network looking at the average cost of buying and renting in the immediate area surrounding these stops.

Image: Benham and Reeve Letting Agents

By Line

There’s no doubt that a tube stop brings a price premium with the average house price across the 12 tube lines some 83% higher than the London average and the average rent some 34% higher.

For those looking to buy on the London tube network, the new kid on the block offers the most affordable foot on the ladder, with the average house price surrounding the DLR currently at £561,358. The Metropolitan line is the only other line with an average house price below the £700k mark.

The Waterloo and City line tops the table for unaffordability with an average house price of £1.4m, closely followed by the Circle line at £1.2m, the only other line to exceed the £1m mark.

Where rentals are concerned, the Met and DLR swap places to provide the most affordable options with the average monthly rent at £1,698 across the Met line and £1,788 on the DLR. Perhaps surprisingly, the Central line offers the third highest rental affordability of all lines at £1,964 a month.

By Station

When looking at the most affordable stations Barking and neighbouring Upney offer the best buy with an average house price of £309,366, closely followed nearby Dagenham East, Becontree and Dagenham.

For those looking to rent, Watford provides the cheapest option for tenants at £1,079 a month, with Hornchurch, Elm Park, Upminster Bridge and Northolt all ranking high for rental affordability.

The crown for most unaffordable stations where both buying and renting are concerned go to Gloucester Road and South Kensington, both with an average house price of £1.9m and an eye-watering average monthly rent of £4,207.

Director of Benham and Reeves, Marc von Grundherr, commented:

“The London Underground is so heavily entwined with the capital’s property market but we don’t often think what value each line holds from a property perspective. Most of the time, home sellers and landlords will assume a property price premium simply due to the close proximity of an underground station.

However, where buyer and tenant are concerned, there is certainly a preference when it comes to which station, on which line and some are willing to pay way over the odds for the convenience, so it pays to do your research and maximise your properties potential.

Of course, value along the tube network mirrors that of the terrain above with more central lines commanding a higher price tag, but there are plenty of pockets of value to be found on the outer stretches of the Metropolitan Line, the Hammersmith and City line and the Central line for example, where affordability doesn’t mean forsaking a direct link through the heart of the city.”

|

Average House Price by Line |

Average Rent by Line |

|||

|

Line |

Price |

Line |

Price |

|

|

DLR |

£561,358 |

Metropolitan |

£1,698 |

|

|

Metropolitan |

£686,179 |

DLR |

£1,788 |

|

|

Piccadilly |

£754,248 |

Central |

£1,902 |

|

|

Central |

£755,570 |

Piccadilly |

£1,964 |

|

|

Hammersmith & City |

£757,402 |

Jubilee |

£2,061 |

|

|

Jubilee |

£778,154 |

Northern |

£2,109 |

|

|

District |

£846,131 |

Hammersmith & City |

£2,131 |

|

|

Northern |

£856,654 |

Bakerloo |

£2,177 |

|

|

Victoria |

£875,470 |

Victoria |

£2,219 |

|

|

Bakerloo |

£883,158 |

District |

£2,221 |

|

|

Circle |

£1,181,773 |

Waterloo & City |

£2,782 |

|

|

Waterloo & City |

£1,405,883 |

Circle |

£2,848 |

|

|

Top 10 - Lowest average house prices by station |

|

|

Line |

Average House Price |

|

Barking |

£309,366 |

|

Upney |

£309,366 |

|

Dagenham East |

£311,642 |

|

Becontree |

£315,272 |

|

Dagenham Heathway |

£315,272 |

|

Heathrow Terminal 5 |

£330,511 |

|

Hatton Cross |

£330,511 |

|

Heathrow Terminal 4 |

£330,511 |

|

Heathrow Terminals 2 & 3 |

£330,511 |

|

Northolt |

£341,152 |

|

Top 10 - Lowest average rent by station |

|

|

Line |

Average Rent |

|

Watford |

£1,079 |

|

Hornchurch |

£1,200 |

|

Elm Park |

£1,200 |

|

Upminster Bridge |

£1,200 |

|

Northolt |

£1,231 |

|

Hounslow Central |

£1,235 |

|

Hounslow West |

£1,235 |

|

Hounslow East |

£1,235 |

|

Croxley |

£1,239 |

|

Chorleywood |

£1,239 |

|

Top 10 - Highest average house prices by station |

|

|

Line |

Average House Price |

|

Gloucester Road |

£1,934,610 |

|

South Kensington |

£1,934,610 |

|

High Street Kensington |

£1,881,258 |

|

Tower Gateway |

£1,830,176 |

|

Aldgate |

£1,830,176 |

|

Bank |

£1,830,176 |

|

Tower Hill |

£1,830,176 |

|

Green Park |

£1,792,800 |

|

Bond Street |

£1,792,800 |

|

Piccadilly Circus |

£1,792,800 |

|

Top 10 - Highest average rent by station |

|

|

Line |

Average Rent |

|

Gloucester Road |

£4,207 |

|

South Kensington |

£4,207 |

|

St. John's Wood |

£4,129 |

|

Knightsbridge |

£3,843 |

|

High Street Kensington |

£3,518 |

|

Hyde Park Corner |

£3,432 |

|

Sloane Square |

£3,432 |

|

Victoria |

£3,432 |

|

St James's Park |

£3,432 |

|

Pimlico |

£3,432 |

ABC Comment have you say below:

Universal Credit - A Lack of Transparency and Clear Information

Universal Credit is driving people to desperation.

We recieved this information today from the Child Protection Action Group. At the ABC we are finding that people have their Universal Credit stopped without explanation. DWP Freedom of Information requests can be evasive and fail to provide direct answers to clearly framed questions.

Universal Credit (UC) claimants are routinely in the dark about how much they should receive, how their awards are calculated and if and how they can challenge DWP decisions, because the Department’s communications with claimants are opaque and inadequate, new analysis from the Child Poverty Action Group (CPAG) finds.

One in five of the 1,110 UC cases referred to the charity’s Early Warning System - which gathers and analyses cases from welfare rights advisers across the UK - involve a DWP administrative error likely to result in a claimant getting the wrong amount. Because UC rolls six different ‘old’ benefits into one, often claimants cannot tell what its components are - and so cannot know if it is right. And since information provided by the DWP about how their award has been worked out is frequently inadequate, payments may be wrong, and go unchallenged. As a result, many claimants are at risk of sliding into debt, CPAG warns.

In a Foreword to CPAG’s report on the analysis, former Lord Justice of Appeal The Rt Hon Sir Stephen Sedley writes:

It’s a fundamental principle in a democracy that governmental bodies must have reasons for their decisions. It’s equally fundamental - or should be - that they should be able to explain what those reasons are. And if the explanation does not stack up, then, again on first principles, the decision should be open to review or appeal. Yet, as this publication demonstrates, the Department for Work and Pensions is repeatedly falling down on every element of these public law obligations in its administration of universal credit… People in need are left to guess at and grope for things which should be clear and tangible. The consequences…feed into the stress and worry that so many people managing on low incomes experience, which in turn can affect family life for children growing up in these environments.

The report says UC helpline staff are often unable to explain how a claimant’s award has been worked out because they don’t have access to payment calculations which in the vast majority of cases are processed automatically on UC’s digital system.

Claimants’ online monthly payment statements give only basic information on how their award has been calculated so spotting errors – such as the omission of allowances for children – can be difficult or impossible for claimants (see case studies below). And on housing costs, payment statements do not give an explanation when there is a discrepancy between the amount of rent allowed for in a UC calculation and the amount of rent actually due – often the discrepancy is because payments for rent within UC are capped by Local Housing Allowances or by the bedroom tax, but their payment statements leave claimants none the wiser (3).

CPAG wants more information to be given in claimants’ statements including a full breakdown of how awards have been calculated and a nil entry for allowances claimants are considered ineligible for so that errors can more easily be identified. And it wants the online UC account, via which claimants manage their claim and communicate with UC advisers, to be redesigned so that all decisions about a claimants’ award are clearly identified as formal decisions (and as such can be challenged) and stored in one place so that they are accessible. Currently DWP decisions are scattered in different parts of a claimant’s online account. Claimants have to trawl through old journal entries to find them and they may not be clearly labelled.

CPAG’s analysis also shows that the DWP’s written information on claimants’ appeal rights falls short of legal requirements because it suggests a first-stage reconsideration of a benefit decision (known as a Mandatory Reconsideration) is only possible where there is new information relevant to a claim or where a claimant believes the Department has overlooked something. In fact, disagreeing with a benefit decision is sufficient grounds for requesting a Mandatory Reconsideration (4). The Department’s standard-issue information also fails to tell claimants that there are time limits for requesting a reconsideration – this is also unlawful.

The government’s own survey of claimants’ experiences found that nearly a quarter of UC claimants (23%) felt that the decision about their claim either hadn’t been explained at all, or hadn’t been explained clearly, and 16% of UC claimants reported that they had been given incorrect or contradictory information by the Department for Work and Pensions (DWP) in relation to their claim. (1) Another government survey of UC claimants found that over 40% of claimants received a different award than they were expecting, and over 30% of claimants disagreed with the statement “My Universal Credit account makes it clear what entitlements I am being paid for.”(2)

Cases that have come to CPAG’s Early Warning System include:

- A working mother who had two part time jobs claimed universal credit but the award was much lower than she was expecting. Her UC statement showed the standard allowance, housing costs element and her earnings, plus the earnings taper, but she couldn’t see anything wrong with them. When she saw a welfare rights adviser, they picked up that there was no child element included for her daughter, and there was no work allowance included for a working parent. This meant that the woman and her daughter were approximately £400 worse off each month as a result of errors in their payment calculations.

- A grandmother, mother and children lived together in a three bedroom property; all of the bedrooms were occupied. The grandmother claimed universal credit but the housing costs element was very low. She didn’t know why and she didn’t obtain a full breakdown of the calculation until 6 months later. The breakdown showed that she had been wrongly subject to both the bedroom tax (on the basis that she was not entitled the third bedroom) and a non-dependant deduction, causing her to be underpaid for months on end.

- A disabled mother and her adult child moved into a new property and started a claim for universal credit. The first payment was very low and the mother was so distressed about affordability that she contacted her social landlord about ending the tenancy. The UC statement listed amounts for her standard allowance and her housing costs element. It was not clear to her that UC had not taken into account her eligibility for the limited capability for work (LCW) element, nor that her housing costs element was being incorrectly reduced by a non-dependant deduction (5). This only became apparent when her welfare rights adviser investigated the matter. Without the welfare rights adviser’s expertise, the claimant would never have been able to challenge the missing LCW element or the non-dependant deduction (from which she was exempt because she receives qualifying disability benefits).

Commenting on the Early Warning System analysis, Child Poverty Action Group Chief Executive Alison Garnham said:

“Transparency should be a the heart of a fair social security system but our research shows universal credit claimants do not always understand the amounts they’re getting so it’s harder for them to pick up on mistakes or to predict how their awards might change. That is all the more worrying as the number of universal credit claims is set to double this year to 3 million and the scope for misunderstandings, omissions and errors is vast. And because UC is an all-in-one benefit, with all your eggs in one basket, when things go wrong for claimants the financial fallout can be dire. But there are practical, inexpensive changes the DWP can make to clear the fog. The Department must improve the information it provides so that universal credit claimants are not floundering in the dark about their award. Clear and accessible information on how decisions are made and your right to appeal is the bare minimum we should expect from a modern benefit.”

ABC Comment, have your say below:

Colchester Rough Sleepers Bus Launch

Colchester Rough Sleepers are today showcasing their bus in Colchester High Street outside Colchester Town Hall.

With 14 months of effort a 12-strong team and a total of £50,000 in funding, the Chariot 180 is now roadworthy

Vic Flores, project manager, said it was a transformation beyond imagination.

The bus cost the group £23,000 - but in February last year a mystery benefactor donated £25,000 to pay for it.

It saved the group a year of fundraising, and meant they were ahead of schedule.

The group also had to pull together a team of eight for renovation works, a resident bus mechanic, and a marketing expert.

Thanks to a further £25,000 for the renovation via rants and fundraising events, the bus has been decked out with sleeping pods, showers, a lounge and relaxation area, a TV and sofas.

The aim is to take eight homeless people and rough sleepers off the street each night by picking them up in the town centre and driving to an out-of-town location.

Crucially, the bus will include several dog crates for the dogs of the homeless people and rough sleepers who do not want to part with their best friends.

Several rough sleepers have lost their lives this year in the Colchester area and this with be an excellent way of helping those without a place to call home.

Image: Colchester Rough Sleepers bus

Perhaps you might like to donate:

Colchester Rough Sleepers Contact Details:

PHONE & EMAIL

Phone: 07379987181

Email: hello@crsgroup.org

Web: https://crsgroup.org

Facbook: https://www.facebook.com/ColchesterHomelessBus/

ABC Comment: have your say below:

Northern Ireland - Pay Your Rates by Friday 10 May 2019 and Get a Discount

A 4% discount is available to Northern Ireland domestic ratepayers if they pay their rate bill in full by Friday 10 May 2019.

The discount is available to ratepayers of occupied or vacant domestic properties. If Land & Property Services (LPS) receives payment in full in a single transaction by the discount day, ratepayers will receive a 4% discount.

Pay online by debit or credit card to secure your discount. Ratepayers can also set up a single Direct Debit for full payment to avail of the discount. For further information on paying by Direct Debit, contact LPS on 0300 200 7801 or visit www.nidirect.gov.uk/rates

ABC Comment, have your say below:

We Publish For the First Time - The Local Government and Social Care Ombudsman, Benefits and Taxation Decisions

The Local Government and Social Care Ombudsman, formerly the Local Government Ombudsman (LGO) is a service that investigates complaints from the public about councils and some other bodies providing public services in England. The Ombudsman also investigates complaints about registered adult social care providers.

This is weekly update on benefits and taxation decisions. Transparency creates fairer decisions and better outcomes.

ABC Note: What to do if you are unhappy, First try and resolve the issue with the organisation involved. Put you grievance in writing. If you do not get a satisfactory response, then we suggest you take your complaint to the ombudsman.

Maidstone Borough Council (17 013 308)

Summary: The Ombudsman will not investigate Miss B’s complaint there was fault in the way the Council dealt with her claim for housing benefit. This is because, if her complaint remains unresolved, it is reasonable to expect her to use her right of appeal to an independent tribunal.

Reading Borough Council (18 013 219)

Summary: The Ombudsman will not investigate this complaint about a council tax exemption, and council tax dispute, because there is insufficient evidence of injustice.

Gloucester City Council (18 013 531)

Summary: Ms X complained about the Council’s handling of a Housing Benefit and Council Tax Benefit overpayment. The Ombudsman should not investigate this complaint. This is because Ms X had a right of appeal to a Tribunal.

East Riding of Yorkshire Council (18 013 585)

Summary: The Ombudsman will not investigate Mrs Y’s complaint that the Council will not add her son’s name to their council tax bill as there is no indication of fault by the Council.

London Borough of Southwark (18 009 789)

Summary: The Ombudsman exercised discretion not to further investigate Ms P’s complaint about the way the Council dealt with 2 housing benefit appeals against decisions to recover overpaid benefit. This is because we cannot provide the remedy she seeks.

Tameside Metropolitan Borough Council (18 013 449)

Summary: We will not investigate Mr X’s complaint about the Council’s handling of his claims for housing benefit and a discretionary housing payment. Part of the complaint is late. It is unlikely we would find fault with the Council on other parts of the complaint. Mr X may complain to the Information Commissioner about a data breach. And a body complained of is not within our jurisdiction.

Brighton & Hove City Council (18 002 960)

Summary: The Ombudsman will not investigate this council tax complaint. This is because there is insufficient evidence of fault by the Council and because he cannot investigate court decisions.

Sunderland City Council (18 007 826)

Summary: Mr X complained the Council’s Welfare Rights Service failed to support him in his benefit appeals. Mr X states the lack of support lost his appeals and resulted in him receiving lower benefits. The Council is not at fault.

Corby Borough Council (18 009 986)

Summary: Miss X complains about the Council’s recovery of council tax and its handling of her complaints. She also questions the certification of the enforcement agents. Miss X says she is struggling financially. The Ombudsman finds no fault in the Council’s recovery action. It finds the Council failed to follow its complaints process and recommends it takes action to remedy this. The Ombudsman will not investigate the background of the enforcement agency as the Court is better placed and because any fault did not cause Miss X injustice.

London Borough of Croydon (18 012 229)

Summary: A man complained about the Council’s inadequate response to his request for a council tax discount, and about the way an officer spoke to him on the telephone about this matter. But the Ombudsman does not have sufficient grounds to start an investigation of the complaint. This is because there is no sign of fault by the Council which has caused an injustice to warrant our involvement, and it is unlikely we could achieve a significantly different outcome.

Stockport Metropolitan Borough Council (18 012 944)

Summary: Mr X complains that the Council unreasonably instructed bailiffs to recover a council tax debt despite his regular payments to the Council. The Ombudsman will not investigate this complaint because the matter has been settled.

Birmingham City Council (18 013 385)

Summary: The Ombudsman will not investigate this complaint about the way the Council calculated the complainant’s council tax support. This is because the complainant could have appealed to the Valuation Tribunal.

Kingston upon Hull City Council (18 013 551)

Summary: Miss X complained about the Council recovering an overpayment of housing benefit. The Ombudsman should not investigate this complaint. This is because it was reasonable for Miss X to appeal against the overpayment to the independent benefits tribunal which is the proper authority to consider these complaints.

Royal Borough of Windsor and Maidenhead Council (18 013 639)

Summary: Miss X complained about the Council failing to return her driving licence which she says she posted for identification purposes. The Ombudsman should not investigate this complaint. This is because there is insufficient evidence of fault which would warrant an investigation.

London Borough Of Brent (18 013 673)

Summary: Mrs X complains that the Council has unreasonably sought to recover an overpayment of housing benefit. The Ombudsman will not investigate this complaint because she has appealed to a tribunal.

Summary: Miss X complained the Council failed to pursue her ex-partner for council tax arrears they were jointly liable for. The Council has pursued both parties for the debt. There is no evidence of fault.

Canterbury City Council (18 012 767)

Summary: Ms B complains about the wording used by the Council in letters sent to her about her Council Tax liability. The Ombudsman will not investigate the complaint because there is insufficient evidence of fault by the Council or injustice caused to Ms B.

Arun District Council (18 013 247)

Summary: Mrs X complains about the way the Council has dealt with her council tax account and discounts. The Ombudsman will not investigate this complaint because there is no evidence of fault and any disputes about discounts are matters for the Valuation Tribunal.

Solihull Metropolitan Borough Council (18 013 607)

Summary: The Ombudsman does not propose to investigate Mr X’s complaint about the way the Council has dealt with his Council Tax account. This is because we cannot investigate complaints where someone has appealed to a Tribunal. The Magistrates’ Court has considered Mr X’s Council Tax liabilities. The Ombudsman has no jurisdiction to consider the complaint.

Wakefield City Council (18 012 348)

Summary: The Ombudsman will not investigate Ms B’s complaint about the way the Council has handled her father’s council tax support and housing benefit. This is because it would be reasonable for her father to use his right to appeal against both issues to a tribunal.

Royal Borough of Greenwich (18 012 992)

Summary: The Ombudsman will not investigate this complaint about a housing benefit overpayment from 2011 to 2013. This is because it is a late complaint and because the complainant could have appealed to the tribunal.

London Borough of Haringey (18 013 262)

Summary: Mr X complained about the Council’s decision on his homeless application in 2014 and its decision to add overpayments to his housing benefit claim in 2016. The Ombudsman should not investigate this complaint. This is because he could have appealed against the homeless decision to the court and against the overpayment decisions to the Independent Benefits Tribunal.

Rotherham Metropolitan Borough Council (18 013 447)

Summary: The Ombudsman will not investigate this complaint about action the Council took because the complainant made late council tax payments. This is because there is insufficient evidence of fault by the Council.

Mid Devon District Council (18 013 584)

Summary: The Ombudsman cannot investigate this complaint about a decision by the Council on the complainant’s council tax reduction. The complainant has appealed to the Valuation Tribunal against the Council’s decision.

Brighton & Hove City Council (17 002 670)

Summary: There was minor fault by the Council in the information it gave a debtor about an Attachment of Earnings. It did not result in significant injustice. The Council’s actions in respect of debt recovery in this case were not otherwise affected by fault.

ABC Comment, have your say below:

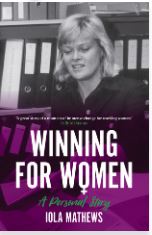

Winning for Women: A Personal Story Australian Iola Mathews Book Launch dates and Location

Australian Iola Mathews was one of the founders of the Women’s Electoral Lobby, a journalist at The Age, and later a leading ACTU advocate for women workers during the ‘Accord’ with the Hawke-Keating Government.

Iola was one of the first generations of women trying to ‘have it all’ with a career and children.

This new book is an honest and revealing memoir, she takes us inside the day-to-day groundwork required to bring about reforms in areas like affirmative action, equal pay, superannuation, childcare, parental leave, and work-family issues.

This is an important record of a pivotal time for women in Australia’s history. Iola brings wisdom and experience to it, reflecting on where we are today, with suggestions for further reform.

What people have said:

Iola’s story shows what can be achieved when passionate people commit to changing the rules and fighting for fairness. Her story shows the best qualities of the union movement – people working to make life better for others and to pursue equality and fairness.A great story of a moment of immense change for working women in Australia, and of the people in the movement who made that change possible.

Sally McManus

Iola Mathews has written a fascinating insider account of how she battled for major reforms for women, especially during her time at the ACTU, where she won landmark cases on parental leave and wage justice for child care and clerical workers. It is so important to know the stories behind these historic victories.

Anne Summers

The book it is claimed is a vital source for policymakers and all those interested in women, work and families.

Image: Winning for Women, A Personal Story

Paperback, 328 pages

Expected publication: June 3rd 2019 by Monash University Publishing

ISBN

1925835154 (ISBN13: 9781925835151)

These are the dates and locations of the book launch:

Melbourne

02.05.2019 - 06:00 pm

Media Portal at RMIT University

Melbourne

Brisbane

22.05.2019 - 06:00 pm

TLC Building, Level 2

South Brisbane

Adelaide

06.06.2019 - 06:00 pm

University of Adelaide

Adelaide

Sydney

13.06.2019 - 06:00 pm

Unions NSW Auditorium

Sydney

ABC Comment, have you say below:

The ABC Puts Forward an Idea To The Chancellor 'Spreadsheet' Phil Hammond MP

Today the ABC has put an idea to Chancellor 'Spreadsheet' Phillip Hammond MP. What do you think of the idea?

Cleaning Road Signs – while delivering training and work experience to young offenders and/or unemployed young people.

The ABC are exploring a project idea of getting unemployed people or young offenders cleaning road signs. With massive cuts to public spending in the UK - road signs, hazard signs, bollards and place, and street names have been left filthy dirty. My project idea will give young people something to put on their CV and an award certificate after four weeks of work and training. We can then take on another group and then use our ‘alumni’ as team leaders, thereby promoting responsibility and pride in achievement. This is a conceptual idea only right now, but this week I have approached Suffolk County Council and Essex Highways and my local MP Will Quince who has just been appointed a junior Department of Work and Pensions minister.

We have consulted window cleaning experts who are doing small scale road sign cleaning but do not have the trucks or the kit to clean a lot of the signage. Where you might need a hazard warning team with flags and signs to avoid accidents for example.

We do not believe in forcing people to work at the ABC, but organizing delicious packed lunches, fresh air and an award presented by the mayor [we hope] will be more attractive than sitting in a cell. The judiciary might assist offering offenders who participate in a ‘discount’ on their tariff. Motorway signs need to be cleaned at night and would need specialized equipment and may be out of our scope initially, but the smaller roads, lanes, and byways would be ideal cleaning material under the supervision of a team leader. Health and Safety would be at the forefront of all operations.

Cleaning road signs create a huge psychological difference to the electorate and impresses visitors. It creates a sense of order and promotes a ‘nudge’ effect on society and promotes good environmental behaviour. We are not competing with existing commercial companies and there would be a large benefit to society without a large cost to the public purse. If it helps get people into work who are a cost center currently, then that’s another benefit. The longer people are unemployed the harder it is to get them back into work.

Some hazard signs are so dirty that they are a threat to road safety and the local government could face the increasing risk of legal action. Faults and damaged signs could be reported also potholes.

Around the country, window cleaners are engaged in small local voluntary initiatives. Our idea is to do this activity in a more systematic, organized and structured way, where the initiative could benefit those taking part by demonstrating to potential employers our volunteer’s willingness to work, take instruction and graft. It would create a sense of civic pride in those doing the cleaning and litter picking. Our ‘roadrunner’ teams I (as I want to brand them) would be visible to the public and local employers looking for new hires and we hope they would be grateful we are improving their business environment. They would be encouraged to contact us when looking for new hires. We would teach those cleaning to interact positively with the public, and to represent the organization well.

We would need some Council funding but they would get the job done at a fraction of the true cost. Health and safety is one thing to think about and insurance, but parishes and local window cleaners are cleaning local street signs on a voluntary basis, but you need a team to do signs like this as you need a man with a flag and someone to move the ‘beware’ hazard sign. Washing is done with a motorized backpack and a pole, ideally from a flat bed truck or scissor lift. While your sign guys are doing the main signs other can be doing the smaller street signs and picking up litter. We would not tackle motorways initially. But the road signs on the highways and byways of Essex and Suffolk could use some loving care!

Image: Road signs badly need some TLC says the ABC

ABC comment, have your say below: