Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

UK Employment Still Growing What Could Possibly Go Wrong?

EMPLOYMENT - The new record high employment rate is at 76.3%, with the unemployment rate not lower since 1974.

Wage growth has outpaced inflation for the 22nd consecutive month.

The number in work has hit yet another record high and the unemployment rate remains at its lowest level since the mid-1970s as Britain’s jobs market continues to flourish, new figures released yesterday (Tuesday 21 January 2020) show.

All regions throughout the UK are benefiting from an upturn in employment since 2010. The number in work climbs to a record high in the North West to 3.55 million.

And, with weekly pay still rising, outpacing inflation for a 22nd month in a row, workers nationwide can expect their money to go that bit further.

Contributing to the plummet in overall unemployment, women continue to benefit most from the thriving UK jobs market – with 317,000 more entering work in the last year alone to reach a record high.

Today’s figures also show an uplift in people taking up quality careers offering real progression – as 3.1 million more people are in higher skilled work since 2010 – making up over 80% of the employment growth.

Image: Minister for Employment, Mims Davies.

Minister for Employment, Mims Davies said:

These figures show not only more people in work than ever before, but it’s also pleasing to see alongside this a rise in those working in higher skilled roles. It means at the dawn of the decade the opportunities to progress in work are out there, with people already benefiting from another month of rising wages.

This, coupled with business confidence turning a corner, is paving the way for an even stronger jobs market in 2020.

And with unemployment at its lowest since the 1970s, our jobcentres go beyond getting people into work – they are about community and progression. Reaching out to more people, and supporting those in work to get ahead.

Read the latest labour market statistics.

ABC Comment, have your say below:

Pensions Expert Say That Claiming Back Tax Relief on Pensions Too Complex

HMRC - Response from The People's Pension to the Which? report on tax return confusion (first issued under embargo yesterday)

Gregg McClymont, the director of policy at The People’s Pension and a former shadow pensions minister, said: “The Which? report highlights how difficult filling out a tax return can be for individuals. The complexity of claiming back pensions tax relief system via your tax return adds to the problems highlighted in the report. Previous research has shown that unclaimed tax relief sits at nearly £300 million a year or just over £1,000 per eligible worker.

“A universal flat rate of pensions tax relief would simplify the system as well as helping those on average earnings and below increase their retirement savings.

“There needs to be a full review of pensions tax relief, which the Government should announce as part of March’s Budget

ABC Comments, have your say below:

Universal Credit Bonus Payments Petition

PETITION RECORDED IN HANSARD - Universal Credit Bonus Payments.

David Linden (Glasgow East) (SNP)

Image:David Linden (Glasgow East) (SNP).

It is always a pleasure to see Elderslie’s most famous daughter in the Chair, Madam Deputy Speaker.

Hon. Members will have seen coverage in recent weeks that Greggs announced that its 25,000-strong workforce would receive payments of up to £300 each as part of a £7 million reward scheme. However, those of us more familiar with the flaws of the current universal credit system understand that some staff on universal credit will keep as little as £75 after tax and national insurance, and bonus earnings are clawed back by the Government at a rate of 63p in the pound. I am grateful to colleagues at Parkhead citizens advice bureau for helping to raise this as a social policy issue and hereby present the following petition to Government for consideration.

The petition states:

The petition of residents of Glasgow East,

Declares that current rules surrounding bonus salary payments to Universal Credit claimants are profoundly unfair and lead to unintended reductions in subsequent Universal Credit payments which perversely disincentivises work.

The petitioners therefore request that the House of Commons urges the Government to revise Universal Credit rules which would see one off bonus payments treated as capital rather than salary payments.

And the petitioners remain, etc

ABC Note: Hansard is the traditional name of the transcripts of Parliamentary debates in Britain and many Commonwealth countries. It is named after Thomas Curson Hansard, a London printer and publisher, who was the first official printer to the Parliament at Westminster.

ABC Comment, have your say below:

Scottish Unemployment Falls Slightly

SCOTLAND - Today’s highlight is that Scotland’s unemployment fell slightly (-7,000) and at 3.8% is down 0.3 p.p. from the three months before (June to August). This is slightly up from the year before (+4,000) and up from the record low of 3.2% at the beginning of the year 2019. Although, an unemployment rate of 3.8% indicates still a very strong and stable labour market performance by historic standards. There’s also a robust increase in employment over the last three months (+18,000). Note, that the UK overall experienced a marginal fall in unemployment too (-7,000 and its rate remained unchanged). These figures point to a strong labour market performance, however indicate a slight weakening of the labour market from one year ago.

For the three months to November, Scotland’s overall labour market is marginally strengthening: employment increased robustly (+18,000) and unemployment fell slightly (-7,000) and activity increased modestly (+12,000). In addition, monthly claimant count numbers are worsening marginally over the month of December, as there are 115,700 people in Scotland claiming Jobseeker’s Allowance and out-of-work Universal Credit (seasonally adjusted); this is up 900 on the month of November (revised) and 16,400 up on the year before.

As a result, Scotland’s unemployment rate at 3.8% is now slightly up on the rate of around 12 month ago and up on the recent record low at the start of the year 2019, when it was 3.2%. Also, Scotland’s unemployment rate is matching that of the UK as a whole, which remained unchanged over the last quarter. Furthermore, the number of people employed at 2,654,000 in Scotland is somewhat down on the recent record high at 2,702,000. This means that Scotland’s employment rate, at 74.3%, remains below the UK’s rate at 76.3%.

ABC Comment, have your say below:

ABC to Speak at Portsmouth Aspirations Week 24th January

PRESS RELEASE - Simon Collyer, the founder of the Association of Pension & Benefits Claimants CIC - called the ABC for short, has been asked to speak at two schools in Portsmouth on the morning of the 24th Jan; the Portsmouth Academy and Springfield school during Aspirations Week, 20-24th January.

Simon’s talk called - Human Potential - will share a range of ideas on how young people can plan and think about their futures, overcome life’s challenges and succeed.

Simon will also be talking about roles in the Third Sector and how he came to start the ABC.

A pupil of Brightlingsea Secondary School, Simon was successful in speech and drama in his early years, as a school sailing champion he went on and sailed with the British Olympic sailing squad attending many international regattas including pre-Olympics in the International 470 Dinghy Class. He has also lived and worked in South Africa and Australia and he was invited last year to Japan on a journalist’s familiarization trip supported by the Japanese authorities to promote two destinations Wakura Onsen and Nozawa Onsen.

In 2016 Simon was a core member of a team that journeyed along the lines of the Western Front as they were in 1916, an initiative called the Via Sacra Walk led by Sir Anthony Seldon, vice-chancellor of Buckingham University, Downing Street official historian and author - known in part for his political biographies of Margaret Thatcher, John Major, Tony Blair, Gordon Brown and David Cameron.

Simon also has a special treat for the kids.

British Americas Cup Team INEO’s led by Sir Ben Ainslie and based at Portsmouth’s historic waterfront has donated posters for the students. Colchester IT are also assisting Simon with a laptop especially for this presentation.

‘I hope that I can go on and do more talks in schools’ says Simon. ‘I jumped at the chance to help these school children and I very proud to have been asked to take part’. #aspirationsweek

For more information;

For more details, call Simon Collyer, the ABC on 01206 509623 or email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Website: www.abcorg.net

Notes to the Editor

The Association of Pensions & Benefits Claimants CIC is a worker’s association whose goal it is to provide help to those in receipt of pensions and state benefits.

The organisation’s main aim, is to give those receiving state pensions and state benefits formal representation, and to create programmes and initiatives, that would enable those on benefits to secure gainful employment in order to achieve a more rewarding meaningful and fulfilling lifestyle, and manage their circumstances better. To improve the image of those on state funding.

Early Conciliation in Northern Ireland For Employment-Related Tribunals

EMPLOYMENT TRIBUNALS - NI - Minister announces introduction of Early Conciliation in Northern Ireland for employment-related tribunals.

The Minister for the Economy, Diane Dodds, today announced that Early Conciliation in employment disputes will be introduced in Northern Ireland from 27 January 2020.Conciliation seeks to find a mutually agreeable solution to a workplace problem or disagreement where an individual has made, or could make, a claim to an employment tribunal. It is voluntary – both parties must voluntarily agree to participate in the process for conciliation to be able to work.From 27 January 2020, individuals who want to make a claim to a tribunal in Northern Ireland will first need to notify the Labour Relations Agency (LRA) of their dispute and consider whether Early Conciliation could resolve the issue, thereby removing the need for a tribunal.Announcing the initiative, the Minister said: “Disputes can arise between employees and employers.

The more quickly, cheaply and effectively that these can be resolved, the less emotional and financial risk to the individual employee and the lower business and economic costs to the employer.“While potential claimants will have to contact the LRA, and are likely to benefit from engaging in conciliation, they will not be compelled to take up the offer. If a settlement isn’t possible or conciliation is rejected, the claimant can then proceed to lodge a tribunal claim, if they so wish.“

I would encourage businesses and employees to familiarise themselves with this new measure and contact the LRA should they have any queries.”Following notification to the LRA, the statutory time limit for the claimant to lodge their case with a tribunal (usually three months) is paused for up to a calendar month, allowing the parties time to explore the possibility of an agreed settlement.

Tom Evans, Chief Executive of the Labour Relations Agency, added: “Early Conciliation is about more than just a change in process. It represents a valuable opportunity to bring cultural change in how workplace disputes are resolved in Northern Ireland. We know that early engagement is the most effective way to resolve workplace problems, before parties become embroiled in an often bitter, legal confrontation. All too often that approach destroys any hope of repairing the working relationship and can leave employers and employees alike significantly out of pocket.“Last year the Agency dealt with 4,500 cases about individual employment rights and only 8% proceeded to tribunal. For those that reach a conciliated agreement, there are numerous benefits compared with going through a tribunal, including the privacy of the process, lack of fees, speed and control over the content of the settlement. There are also benefits for the labour market and economy with fewer costs and losses in productivity."Early Conciliation is part of the introduction of a revised and consolidated set of tribunal rules of procedure which combine the previously separate Industrial and Fair Employment rules. The new rules better reflect the practical out-workings of the tribunals.

ABC Comments have your say below:

Making Work Pay - Greggs Workers Bonus Goes Mainly to the Government

UNIVERSAL CREDIT - The government has been urged to think again about its tax and benefit rules for low-paid workers after it emerged that some staff at the bakery chain Greggs could get to keep just a quarter of their £300 annual bonus as a result of universal credit deductions.

Greggs announced last week that its 25,000 workers would receive a windfall of up to £300 under a £7m reward scheme linked in part to the success of the company’s vegan sausage rolls.

However, benefits experts have pointed out that some staff who are on universal credit will keep as little as £75 after tax and national insurance (NI) are paid and bonus earnings clawed back by the government at a rate of 63p in the pound.

It beggs the question of why taxpayers are having to subsidise workers wages. Sales at Greggs have surpassed the £1bn mark for the first time in the company's history.

The bakery chain reported an increase in sales from £960m to £1,029m to the year ending 29 December.

The Newcastle-based firm posted a 15 per cent rise in pre-tax profits, which have risen to £82.6m.

Image: Greggs vegan sausage roll has boosted profits.

ABC Comment, have your say below:

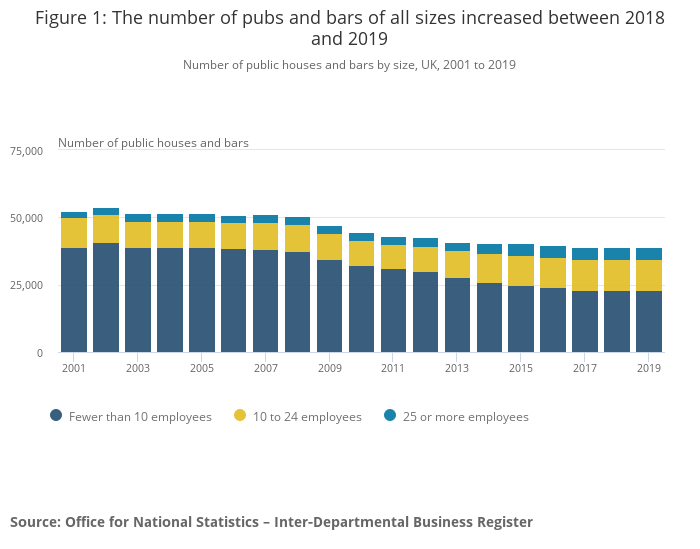

Number of Pubs Increase Slightly After Years of Decline

HOSPITALITY - The number of small pubs and bars in the UK has increased for the first time in more than 15 years.

The net closure of pubs in the UK has been well documented by several organisations, including the British Beer and Pubs Association and the Campaign for Real Ale. Economies of ale: small pubs close as chains focus on big bars, published by the Office for National Statistics (ONS) in November 2018, showed that turnover and employment in the sector were holding up, despite previously consistent pub and bar closures.

The latest ONS data show that the number of small pubs and bars (that is, those with fewer than 10 employees) increased by 85 (a 0.4% increase) in 2019. This follows more than 15 years of closures. The overall number of pubs and bars in the UK increased by 315 (a 0.8% increase) between 2018 and 2019, the first increase for a decade.

Figure 1: The number of pubs and bars of all sizes increased between 2018 and 2019

Number of public houses and bars by size, UK, 2001 to 2019

ABC Comment, have your say below:

Moms 4 Housing Evicted By Police As California Homeless Crisis Deepens

SAN FRANCISCO (AP) - Homeless women ordered by a California judge last week to leave a vacant house they illegally occupied in Oakland for two months were evicted before dawn Tuesday by sheriff’s deputies in a case that highlighted the state’s severe housing shortage and growing numbers of homeless people.

Alameda County Sheriff’s deputies, some dressed in military-style fatigues, escorted two women with the Moms 4 Housing group from the home and bound their hands with plastic ties as dozens of activists on the sidewalk chanted “Let the moms go! Let the moms go!” and recorded the chaotic scene with their cellphones.

Two men were also arrested. All four had been released by Tuesday afternoon.

Image: Moms 4 Housing police arrests.

Iamge: Moms 4 Housing protests.

Video showed one deputy slamming a battering ram against the house’s front door.

The women decried the show of force and declared their fight far from over in a city where a one-night count of homeless jumped 47% in two years to more than 4,000 last year and the median house sales price is about $750,000. Deputies boarded up the house with plywood, and a chain link fence was later erected around the property.

Deputies who carried out the eviction “came in like an army for mothers and babies,” said Dominique Walker, one of the mothers who was not arrested. “We have the right to housing. This is just the beginning.”

Image: Carol Fife (Right ) Moms 4 Housing.

ABC Comment, have your say below:

Have You Had a Mid-Life MOT?

GOVERNMENT INTIATIVE - The government have launched a new intiiative called the mid-life MOT.

This is what the UK government has to say.

What is the mid-life MOT?

The mid-life MOT is free online support to encourage more active planning in the key areas of work, wellbeing and finances. It is aimed at both individuals and employers and can support you to make decisions that will ensure the future retirement you want.

Why is this important to me?

At some stages in your working life, you could be at risk of falling out of work unexpectedly, including through redundancy. Additionally, health problems and caring responsibilities disproportionately affect people over 50. Once out of work, it can be difficult to get back in.

Many people underestimate what they will need in later life. Planning ahead can boost your resilience in crucial areas. Start your MOT journey now by asking yourself:

My work: Am I confident I can continue in my current job, or do I need to protect myself by reskilling? Will caring responsibilities or other priorities mean I need to work more flexibly?

My health: Am I taking the right steps to maintain or improve my health? Would workplace adjustments make it easier for me to stay in my job for longer?

My money: Do I have enough savings to maintain my current lifestyle? I’m confused about pensions, what are my options?

My work and skills

As your circumstances change as you get older, you may find that flexible working arrangements can make difference.

Workers often view flexible working as a good way of helping them to stay in work. You have a right to request flexible working arrangements from your employer. You may also consider becoming self-employed.

Read examples of people who have benefitted from flexible working.

Keeping up to date and learning new skills are important as you get older.

The National Careers Service provides information, advice and guidance to help you make decisions on learning, training and work. You can also take a free skills assessment to find out what kind of jobs could suit you.

Support is also available for those in Scotland and Wales.

My health

Many people have to give up work due to a health condition but good, appropriate paid work can be beneficial for your health and wellbeing. Giving up work might be avoidable if support is sought at the right time.

In addition to providing financial support, work can give you routine and the opportunity to develop social networks.

You may be entitled to a free NHS health check every 5 years. You can also get great tips and support on how to stay healthy by visiting the One You website, where you can take an interactive health quiz which will give you a personalised score.

You may also be eligible for support under the Access to Work scheme.

Support is also available for those in Scotland, Wales and Northern Ireland.

The peak age of caring is between 55-64 years. Managing caring for others with work responsibilities can sometimes be challenging, this can have a negative effect on your employment. Getting support at the right time could help you balance paid work and caring responsibilities.

Carers UK offer expert, tailored information and advice if you are caring for someone and are struggling to balance your responsibilities with work. They can offer help online and over the phone.

My money

How resilient are your finances if your circumstances change? Do you know when you will have built up enough pensions to retire and carry on doing the things you enjoy?

The Money and Pensions Service offers free information on your financial options, including workplace and personal pensions which could enable you to better manage your finances. If you are self-employed, you can have a free one-to-one mid-life MOT.

The Government are bringing out what the calla mid-life MOT.

You can get help to plan your retirement income. You can also check your State Pension online to find out how much you might get and when you can claim it. The full new State Pension is around £8,750 a year, but yours may be more or less, as it’s based on your National Insurance record.

Are you an employer?

Did you know that by the year 2021, one in three of the working-age population will be over 50? You can realise the benefits of an ageing workforce by supporting a mid-life MOT in the workplace. Toolkits are available for larger and smaller (pdf) employers alongside an employer guidance pack (pdf) which details changes you can make in the workplace.

ABC Note: Back in 2017 the Personal Finance Society (PFS) said this:

Advisers are sceptical the idea of a ‘mid-life MOT’, as proposed by Cridland and backed by the Personal Finance Society (PFS), would work in practice.

A number of advisers said they had doubts about the practicalities of the idea, not least because they were concerned about the take-up by the general public.

PFS chief executive Keith Richards (pictured) had first written to the Chancellor following the publication of the Cridland report to call for the implementation of the measure, which would work like a financial health check, encouraging people to take stock of their finances from age 50.

The facility could be incorporated as a trigger in the pensions dashboard and would allow people to consider their existing financial and lifestyle plans, as well as receive guidance on where to obtain help in the future.

Renewing his calls in response to the government’s plans to increase the state pension age to 68 by 2039, Richards said: “Yesterday’s announcement [of changes to the state pension age] was an inevitable step, but it needs to be backed by further action to mitigate the impact on thousands who will ultimately be affected in the future, including a campaign to educate consumers about the need to save for their life in retirement.

ABC Comment, have your say below: