Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Couple Lost Tenancy Deposit After Estate Agent's Email Account Is Hacked

DEPOSIT FRAUD - It’s been revealed that fraudsters are targeting vulnerable tenants during the deposit payment stage of the letting process, with the Islington Gazette reporting one couple were conned out of £1,385.

Full article here.

Jessica Redman and her partner found a rental property via a local letting agent and were then contacted via email by a ‘member of staff’ who was dealing with the rental. Although the email address was slightly different from previous exchanges with the agent, the couple made payment to the provided bank details without checking the validity of the communication.

The agent has since stated they would not reimburse the couple.

ABC Note: be very careful who you give you bank details to. Look at the e-mail address and contact the Company if you are not comfortable.

ABC Comment, have your say below:

Rogue Landlords Update as Homeless Crisis Deepens

ROGUE LANDLORDS ALERT - Is your tenancy deposit protected?

The latest research from Ome has highlighted the huge sums of tenant deposit money that are unaccounted for and could be unprotected as a result of rogue landlords or agents not depositing them in a deposit protection scheme.

The research shows that: -

- * There is an estimated 3.5m deposit that is protected across the rental market which equates to some £3.9bn in value!

- * This means that with 3.5m protected tenancy to a value of £3.9bn, the average tenant is paying £1,139 for a tenancy deposit.

- * The latest English Housing Survey report released last week, shows an estimated 4.60m tenancies in the private rental sector in 2019.

- * With only 3.5m of these tenancy deposits accounted for in protection schemes, there are some 1.1m tenancies that either have not had a deposit protected, do not have deposits, or are using deposit replacement products.

- * At worst, this means there could be as much as £1.2bn in deposit monies that are not protected.

- * However, the latest report into deposit protection compliance rates by the Center for Economics and Business Research (CEBR) estimates that 14.5% of all deposits held are not protected by landlords or agents.

- * This means of the estimated 1.1m tenancy deposits that are unaccounted for, just over 500,000 (14.5%) cash deposits could currently be unprotected, putting £578m at risk.

- * This suggests there are still some 586,000 tenancies in the private rental sector that are neither compliant nor unprotected, suggesting a growing preference amongst landlords to ditch the traditional cash deposit and opt for deposit alternatives or no deposit at all.

- * But those 500,000 landlords across the nation that have taken a deposit and failed to place it in a compliant protection scheme run the risk of fines of up to three times the deposit plus the deposit itself.

* At £1,139 for the average new deposit, it could cost them to the tune of £4,556 per unprotected deposit!

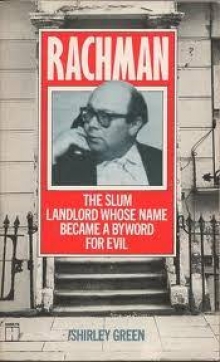

Image: Peter Rachman

ABC Note: Perec "Peter" Rachman (16 August 1919 – 29 November 1962) was a Polish-born landlord who operated in Notting Hill, London, England in the 1950s and early 1960s. He became notorious for his exploitation of his tenants.

ABC comment, have your say below.

Working Mother Challenges Universal Credit Childcare Provisions

LEGAL - Leigh Day are back in the news again today fighting for the rights of single mumms who want to work.

A single mother who had to cut her hours as an advisor and resort to borrowing from a ‘payday lender’ because of the way childcare benefits are provided through Universal Credit has launched a legal challenge against the government.

The childcare provisions under Universal Credit require parents to pay for childcare costs upfront if they then want to claim up to 85% of them back through Universal Credit. They have to submit receipts and can be made to wait two months or more to be reimbursed.

Nichola Salvato (image see left), represented by Tessa Gregory and Carolin Ott of law firm Leigh Day, has issued her claim in the High Court against the Department for Work and Pensions arguing that the current childcare provisions indirectly discriminate against women because they disproportionately affect single parents who are predominantly women. She also argues that the provision which provides that childcare payments can only be recovered if they are paid upfront is irrational because it undermines Universal Credit’s stated aim of encouraging and supporting parents seeking to move into or advance within the work place.

Nichola, 48, of Brighton, worked part-time during the early part of her daughter’s childhood but when her daughter turned 10-years-old decided to try to go back to full-time work. She secured a full-time job working as an advisor at a housing association, which required before and after-school childcare for her daughter, as well as school holiday childcare, in order for her to fulfil her contracted working hours.

Nichola struggled to pay for the childcare upfront and was forced to resort to using a ‘payday lender’ to meet the costs. This caused her to accrue high interest debt and she continued to find herself in constant arrears. In order to try and reduce the costs of childcare, Nichola had to take time off work and has ultimately had to reduce her working hours. Despite taking these steps, she continues to struggle to meet upfront childcare costs for the school holidays.

The government has argued that requiring parents to pay childcare costs upfront prevents fraud but has refused to adopt alternative measures that have been suggested that would address concerns about fraud, such as an arrangement which provides payment directly to childcare providers rather than requiring proof of payment from parents.

Nichola said:

“It seems completely ridiculous that a scheme designed to help parents into work is putting up a massive barrier by asking them to find the money for childcare upfront. I feel completely disheartened that I have had to reduce my working hours to be able to make childcare more affordable when my goal was to increase my income from work in order to be better able to support my family.”

Carolin Ott of law firm Leigh Day, said:

“Once again we see that Universal Credit seems to be working against its stated aims and is failing to ‘make work pay’. The government has refused to reconsider this policy despite clear evidence that it is a barrier to parents entering and progressing within the work place. Single parent families and therefore women are disproportionately affected and our client’s case is that the policy is both irrational and discriminatory."

Image: Becca Lyon, Save the Children.

Becca Lyon, Head of UK Child Poverty at Save the Children, said:

“The government supports families across the country with their childcare, but the way childcare is paid for through Universal Credit causes unnecessary hardship to parents on low incomes -- the majority of whom are single mothers. Universal Credit requires them to pay substantial bills of up to £1,000 upfront, before then waiting to be recompensed by the government. Mums tell us that this has left them constantly in arrears – they’ve had to take out loans to pay nursery bills, turn down job opportunities or even resort to food banks to feed their children.

“It’s just not right that parents who want to do the best for their children are being set up to struggle. Making sure Universal Credit supports all families to work must be a priority for this new government and we hope that by supporting this judicial review we will see positive action to ensure that Universal Credit is giving the poorest children the security they need.”

Image: Victoria Benson.

Victoria Benson, CEO of charity Gingerbread, said:

“Gingerbread fully supports the legal challenge brought by single parent, Nichola Salvato, against the government. Sadly, Nichola’s experiences with Universal Credit and the upfront costs of childcare are not uncommon. Many hard working single parents are forced into desperate financial circumstances due to the unfairness of the current welfare system. We echo Nichola’s call for changes to the current system which would allow single parents to work without being plunged into debt just to pay expensive upfront childcare costs.”

On 23 December 2018, the Work and Pensions Select Committee published its report ‘Universal Credit: childcare’ which found that:

“the design of Universal Credit childcare support directly conflicts with the aim of making it easier for claimants to work, or to work more hours… Too many will face a stark choice: turn down a job offer, or get themselves into debt in order to pay for childcare.”

“These upfront costs for childcare are not only a disincentive to work: for some Universal Credit claimants they will either make working unaffordable, or force them to take on debt in order to do so. The Department has chosen this approach despite alternative options, such as direct payments to providers, being available.”

Despite the committee’s findings the government confirmed on 11 June 2019 that it would not change the proof of payment structure.

Nichola’s claim is supported by evidence from Save the Children, Gingerbread, the Professional Association for Childcare and Early Years, and the National Day Nurseries Association

ABC Comment, have your say below:

Government Loses Universal Credit Appeals Against Claimants with Severe Disabilities

LEGAL RULING - The ruling upholds two successful High Court challenges brought by TP and AR, in which the courts found that individuals previously in receipt of the Severe Disability Premium (“SDP”) and Enhanced Disability Premium (“EDP”) are to be protected against a drop in their income when they move onto Universal Credit.

The first challenge brought by TP and AR was won in the High Court in June 2018. The men had been forced to move onto Universal Credit when they moved into a local authority area where the new benefit system had been rolled out. Under Universal Credit they lost out on the SDP and EDP, leaving them suddenly around £180 a month worse off. The judge found that this was unlawful because those that moved to a different local authority area were being treated differently to those who moved within their local authority area.

As a result of the first challenge the government attempted to rectify the situation by making regulations which stopped other severely disabled people from migrating onto Universal Credit and provided that those like TP and AR, (who had already moved onto Universal Credit), would receive retrospective and ongoing recompense. However, the Government chose to recompense TP and AR and those like them at a rate of only £80 per month rather than £180 per month which is what they had actually lost.

TP and AR mounted their second legal challenge along with a third claimant SXC (represented by Central England Law Centre) arguing that short-changing them was unlawful as they were being treated differently to those who remained on legacy benefits. The High Court found in their favour in May 2019.

The government, whilst appealing both judgments, increased the top-up payments but only provided recompense of £120 per month rather than the £180 lost. A third legal challenge regarding that decision is pending.

The Court of Appeal in an judgment handed down today agreed with the lower courts that the Government had unlawfully discriminated against this cohort of severely disabled claimants. The Court also found that the Government had breached its duty of candour by failing to disclose during the first hearing that it had already made a policy decision to stop more severely disabled people from being moved onto Universal Credit and to provide transitional payments for those that already had.

AR said:

“We hope that the Court of Appeal ruling will finally bring an end to our fight for severely disabled people not to be disadvantaged by Universal Credit. It is still so shocking to us that we have had to fight so long and so hard just to get the government to see that their policy is unfair.”

Image: Tessa Gregory, lawyer.

Tessa Gregory, from law firm Leigh Day added:

“Today’s finding that thousands of severely disabled people have been subject to unlawful discrimination should be a wake-up call for the Secretary of State for Work and Pensions.

“The Government states that Universal Credit is protecting the most vulnerable but that has not been the experience of our clients who faced a dramatic reduction in their monthly income when they moved onto the new benefits system and when that was found to be unlawful were offered a monthly top up which didn’t even cover half of that loss.

“We hope that the Government will waste no more time or resources fighting this legal case and will instead get on with what it should have been doing in the first place, protecting this acutely vulnerable cohort of claimants and overhauling Universal Credit to make it fit for purpose.”

ABC Note: Leigh Day is continuing to bring a separate group claim, on behalf of those who previously received SDP and/or EDP and moved to Universal Credit prior to 16 January 2019, for the full amount lost as well as compensation for any pain and distress caused by the move to UC. Leigh Day are still taking enquiries and more information can be found on their website.

Image: Carolin Ott, lawyer. Image: Lucy Cadd, lawyer.

TP and AR were represented by Tessa Gregory, Carolin Ott and Lucy Cadd from law firm Leigh Day. Jessica Jones and Zoe Leventhal of Matrix Chambers were instructed.

ABC Comment, have your say below:

Benefit Changes in 2020

BENEFIT CHANGES 2020 - Turn2Us have created this handy list of benefit changes. Turn2us won the Guardian’s 2019 Digital Innovation Award. Well done chaps.

In 2020 a number of changes are being made to welfare benefits and tax credits.

April

The benefits freeze is due to come to an end and working-age benefits will rise by 1.7%. The State Pension will also increase.

There will also be changes to the National Living Wage. The minimum rate for workers over 25 will rise to £8.72 an hour.

Additionally, the government will introduce a new legal entitlement to two week’s leave for employees who suffer the death of a child under 18, or a stillbirth after 24 weeks of pregnancy.

New surplus earnings rules come into effect.

June

The free TV license will no longer be available to all people 75 or over. From 1 June you will have to be aged 75 or over and getting Pension Credit.

July

Claimants will receive an additional fortnight’s worth of Income-based Jobseekers’ Allowance, Income-related Employment and Support Allowance or Income Support if they are on one of these benefits when they move over to Universal Credit.

September

Self-employed people, whose earnings are low, may have their Universal Credit worked out on higher earnings than they have. This is called the Minimum Income Floor. If you have started your business within the last 12 months then the minimum income floor does not affect you for the first 12 months of your Universal Credit claim. The government have announced that they will extend this 12-month ‘grace period’ to all people that are gainfully self-employed. Although this will be available to a few claimants that the government will transfer over to Universal Credit from July 2019; it will be fully implemented from September 2020.

Scotland

From Summer 2020 the Scottish government will take responsibility for disability benefits for children. The new Disability Assistance for Children and Young People benefit will have similar entitlement conditions to the existing Disability Living Allowance but will have different systems for applications and assessments.

The Scottish Child Payment scheme is intended to start making payments by Christmas 2020. Initially, the scheme will pay an additional £10 per week per child to families in receipt of Universal Credit, Pension Credit, or income-related JSA, ESA or Income Support, with children under the age of 6.

Northern Ireland

Northern Ireland transitional protection due to end from 31 March 2020, the Welfare Supplementary Payments scheme in Northern Ireland will stop making payments. This scheme supports anyone who is affected by the bedroom tax, the transition from DLA to PIP, the benefit cap, and other changes introduced to the benefits system since 2010.

ABC comment, have your say below:

Citizens Advice Prepares for The Busiest Time of The Year For Debt Advice

CITIZENS ADVICE - The last week of January is the busiest time for debt advice at Citizens Advice. Analysis of last year’s data revealed that on a single day, 29 January 2019, Citizens Advice offices helped 2,776 people with a debt problem- 24% above the daily average.

In 2017 and 2018, the busiest day for debt advice fell on 31 January, with 2,762 and 2,775 clients seeking help on this issue respectively.

This means over the past three years someone sought help from Citizens Advice every 10 seconds on our busiest days for debt advice.

Household debts remain the most common issues for people coming to Citizens Advice for debt advice. In 2019:

88,405 people sought help with council tax arrears

86,210 people came to us for advice on debts related to utilities including fuel, water, phone and broadband costs

72,358 had problems with rent arrears.

Image: Dame Gillian Guy.

Dame Gillian Guy, Chief Executive of Citizens Advice, said:

“There is typically a surge in demand for our debt advice towards the second half of January.

“Many of the people who come to us have fallen into debt because they can’t meet the cost of essential bills. Utility bills, rent arrears and debts owed on council tax are key reasons people seek our help.

"Citizens Advice can offer free and independent advice and support to help you deal with your debts and get back on your feet.”

To help people kick off 2020 on a stronger financial footing, Citizens Advice is sharing its six top tips to help people get their finances in order for the new year.

Citizens Advice’s six top tips to sort out your debts.

Work out how much you owe - Make a list of whom you owe money to and add up how much you need to pay each month. If you don’t have your most recent statements, contact your creditor to find out what you owe.

Prioritise your debts - Your rent or mortgage, energy and council tax are called priority debts as there can be serious consequences if you don’t pay them. These should always be paid first. Separate these and work out how much you owe.

Work out how much you can pay - Create a budget by adding up your essential living costs, such as food and housing, and taking these away from your income. Any money you have spare can be put towards your debts. The Citizens Advice budgeting tool can help.

Paying urgent debts - You might have to contact priority creditors quickly in urgent situations, like if you are about to be evicted. Tell them you're seeking debt advice so you can find a way forward. You could try to pay them something if you can afford to.

Paying non-urgent debts - If you have any money left after paying priority debts, consider getting a free debt-management plan. You’ll make one monthly payment to the plan provider, who will handle paying your creditors. Or contact your creditors and offer them what you can afford to pay.

If you can’t pay your debts - If you’ve got little or no money spare to pay your priority debts seek advice from us straight away.

ABC Comment, have your say below:

SNP Slam DWP For Clawing Back £50 Million From Universal Credit Claimants In Just One Month

UNIVERSAL CREDIT CLAWBACKS - Campaigning SNP MP, Chris Stephens, has slammed the Tory government for clawing back £50 million in Universal Credit loan repayments from some of the poorest in the UK in just one month – saying it is a clear sign of a flawed policy.

In a response to a Written Question submitted to the Department for Work and Pensions (DWP) by Mr Stephens, the appalling cost of the Tories’ five-week wait for Universal Credit was laid bare. In August 2019 – the latest period for which figures are available – the DWP deducted £50 million from Universal Credit claimants to pay back loans they had to take to cover basic living costs for the five weeks they have to wait before their first Universal Credit payment.

The DWP’s own figures show that in addition to the £50 million, a further £44 million is being deducted to repay previous overpayments, errors, arrears, or fines, leaving all too many claimants on the brink of destitution. Food banks report that the deduction of such eye-watering sums from Universal Credit payments is behind a growing number of referrals for food parcels.

Commenting, Chris Stephens, SNP MP for Glasgow South West, said:

“This is an incredible sum. The figures lay bare that the five-week policy simply isn’t working - it just drives people further into poverty.

“The DWP is removing £50 million from people each month to pay for its own ridiculous policy of making them wait weeks and weeks for Universal Credit payments.

“Unless the DWP moves to a policy where benefits are paid promptly the queues for food banks in Glasgow, and across the country, will continue growing.

“In Scotland, we are taking a different approach and building a social security system based on fairness, dignity and respect – it’s about time the Tories followed suit.”

Image: Chris Stephens MP.

ABC Comment, have your say below:

Read Speaker Launched at ABC Website

ABC WEBSITE CHANGES - Read Speaker, has been implemented on the ABC website. Now visitors can listen as well as read articles on our website.

We hope that this new innovation will enhance visitors experience.

All credit to the Read Speaker team and our very brilliant webmaster/programmer, Mike VEECKMANS, TRAVEEKA bvba - Joombiz

ABC Comment, have your say below:

Leeds Food Aid Network Meeting

LEEDS - Leeds Food Aid Network meeting.

Date: 28th January 2020

Venue: St. George's Centre, 60 Great George Street, Leeds, LS1 3DL

Time: 2.15pm to 4pm

Please sign up for free here: https://www.eventbrite.co.uk/e/leeds-food-aid-network-fan-meeting-28th-january-2020-tickets-88487964885

Andy Smith will be talking about the Council's Welfare Support Scheme and they will be discussing how they can collaborate more effectively to tackle the root causes of food insecurity.

You are welcome to attend the meeting if you are involved in food provision in a paid or voluntary capacity, if you come into contact with people experiencing food poverty or if you have a general interest in food security.

Image: Leeds Food Aid Network.

ABC Comment, have your say below:

Portsmouth Aspirations Week - Birth of a Great Idea

CAREERS ADVICE – The ABC was invited to speak at Portsmouth Aspirations Week 2020, a new initiative from the Economic Development Department at the Portsmouth City Council. Our remit was to talk about careers at the Portsmouth Academy on Friday 24th. Then go on to speak later that morning at Springfield School.

Portsmouth is the birthplace of Charles Dickens and we did not want to 'mess up' in front of such a literary icon.

The idea of Aspirations Week is to introduce pupils to the world of work early and although initially, it seemed mad to talk to very young people about a career in journalism and working in the Third Sector, introducing very young people to the idea that there is a purpose behind their education is a very good initiative.

Back in the day, six weeks before leaving school into the workplace you might have a chat with a career’s adviser. Consequently, you were plunged into the world of work age sixteen without the remotest idea of how to match your skills, ability and interest with an occupation that might be of some small benefit to society.

Today many more people go to university and higher education, but on our way back to the station, our taxi driver talked of the achievements of his son who never went to university but is training to be an F35 pilot.

Aspirations Week encourages students to think ahead. We were all learning together, even the teachers running the presentations - however, it is easy to see how the idea could be developed.

School is a little different from how we remember it with almost Fort Knox style security getting and out of the school gate and a very professional reception worthy of a City company. A very different experience from school days as we remember it. Lessons were rather quieter in those times and those who misbehaved would get the cane. Only given in most serious of cases, but a visit to ‘Sid’ our headmaster was a deterrent.

The skill of the teachers in managing their pupils is remarkable. The energy of the young people would light up a small town and managing young people today requires tremendous focus and dedication - you can only feel admiration for the teachers and their skill.

We have to say we were rather caught out believing we were talking to an intimate group of around 25 pupils when in fact we were speaking to a much larger cohort of young students - possibly over two hundred pupils at the Portsmouth Academy in the main hall. We were followed by the British Army and a local college with a film and media department representative.

Simon Collyer’s second talk went much...much better. This group of students was in a much smaller classroom setting. They were science students some of the brightest in the school. Simon had learned lessons from the first talk cut out a lot of peripheral detail and barrelled through fifty-one PowerPoint slides in a little over 40 minutes. We certainly could do it better, but following effort number one, we were talking to a much more suitable audience, whom for the most part sat and listened to the talk. And at the end, all agreed they had learned something, even including the Maths teacher in attendance! Praise indeed, and a moment of great relief.

We did get one good laugh.

This Jobs Potential matrix below was used or developed by Jimmy Saville.

It helped Saville move from being an injured miner to a Disc Jockey. Using lists of words that describe ‘personality’ – identify what you are good at and what you like doing. People generally like doing things they are good at. Then get a list of SOC (Standard Occupational Codes) and/or a list of careers and then start matching jobs to your skills and interest. The Office of National Statistics keeps data on each career type...so if you want to know what you can earn as an airline pilot or a plumber, this information is available.

The Jobs Potential Matrix

Portsmouth is a wonderful place and anyone who has never visited the City should consider doing so.

We were helped in our talk by Team INEOS the British Americas Cup Challenge, training in Sardinia currently with Olympic sailing medallist, Sir Ben Ainslie. Special thanks to Thizer Graham back at Team INEOS based in Portsmouth who organised posters of the yacht (or is it flying machine) Britannia. You can visit the STEM CREW here at www.stemcrew.org

Image: Team INEOS Americas Cup challenge base.

Our immediate contacts at the schools were Mahbuba Rahman at Portsmouth Academy and John Lomas at Springfield School and Claire Bartlett at the Portsmouth City Council, Economic Development Department. We must not forget others such as the Vice Principal at Springfield school and fellow speakers.

You can read more here: https://springfield.uk.net/index.php/school-life/latest-news/383-aspiring-portsmouth

ABC Note: Lessons learned, to tailor our talk to the audience better. KISS (keep it simple, stupid).

SPECIAL THANKS ALSO - to Colchester IT for their support. You can find them here: https://www.colchesterit.com