Simon Collyer

SPU Provides Opportunity to Build On Progress

Speech by Joan Burton T.D. Tanaiste and Labour Party Leader, Wednesday, 27 April 2016

Ceann Comhairle,

In light of the current political situation and ongoing attempts to form a new government, this annual SPU update has been prepared on a technical, no policy change basis.

Regardless, and in another very real way, the document tells a positive story of remarkable change.

In April 2011, shortly after Labour entered government, that year’s SPU told a grim story.

It spoke of the critical need to restore order to the public finances, ensure the sustainability of the Government’s debt position, haul the banking sector back to health, and get people back to work.

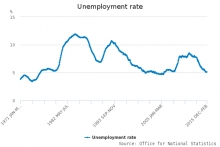

As grim as it was, it nevertheless proved to be overly optimistic in parts – forecasting that unemployment would peak at 14.4% when in fact it went on to exceed 15%.

Similarly, it predicted overall government debt would peak at 118% when in fact it eventually hit 120%.

In truth, the scale and depth of Ireland’s crisis was worse than anybody could accurately foresee.

And yet, the lost decade of growth so firmly on the cards at the time was prevented.

Just five years on, as this Government prepares to leave office, the situation has been utterly transformed.

In 2015, as this SPU shows, the economy grew by 7.8%, the strongest performance in Europe by a very wide margin and well ahead of expectations.

The number of people at work rose by more than 50,000, with unemployment falling below 9% for the first time since December 2008.

In 2015 and in each of the previous four years, Ireland over-achieved its targets for the public finances.

We comfortably exceeded our debt and deficit reduction targets.

Both the headline deficit, at 2.3% of GDP, and the underlying deficit, at 1.3%, were comfortably below the 3% reference rate for an excessive deficit under the Fiscal Treaty.

Accordingly, for the first time since 2009, Ireland will be outside the excessive deficit procedure.

The debt to GDP ratio fell to 93.8%, close to the European average and on a strong downward trajectory.

Effectively, therefore, the 2016 SPU sets out in unambiguous terms:

· the rescue of the Irish economy and our public finances from a state close to bankruptcy five years ago;

- the very strong performance over the last twelve months; and

- the very solid transformation in prospect over the next five years.

Now, none of this is to say that everything is rosy, because it isn’t.

Behind every new job is a person or family benefitting from recovery in their own lives.

But not everyone who wants a job has got a job yet.

Unemployment has fallen significantly, but it hasn’t fallen far enough.

For people who are at work, wages have increased in some sectors, but not all.

The housing crisis will take time to work out, but in the meantime, thousands of families need practical, affordable interim solutions.

The number of mortgage arrears has been steadily falling, but that’s no consolation for those families who remain in arrears, and need more help.

And while great strides have been made in terms of expanding the network of primary care centres, the health system as a whole remains under severe pressure.

I’m acutely conscious that on all these fronts and more, the effects of the crisis are still being felt and that many people are still struggling to see recovery in their own lives.

But what the 2016 SPU presents is the opportunity to build on the progress made to date, put sustainable solutions in place for outstanding problems, and change people’s lives for the better.

The outlook for the economy this year has improved since Budget Day and the public finances are again projected to beat targets.

Economic growth this year is projected to be close to 5%.

The deficit is expected to fall to 1.1%, and there’s a good chance this target will be beaten, given the prudent assumptions for tax revenue.

The issue of tax revenue itself has been the subject of global discussion in recent weeks following the revelations contained in the Panama Papers.

The details emerging from this leak point to two distinct but related problems.

Firstly, there is a global web of interlinked legal and financial firms that facilitates illegality, which is a matter for the relevant policing authorities to pursue.

Secondly, this web also supports legal but morally dubious tax planning that allows firms and wealthy individuals to minimise their tax liabilities at the expense of national exchequers and their citizens.

Much of this aggressive tax planning is carried out in secret behind the shield of the sort of paper companies identified in this leak.

Such tax planning is an international issue that requires a coordinated international response – because through such a response, all national exchequers would benefit.

Here in Ireland, we should urgently consider reforms such as the introduction of minimum effective tax rates to undermine the incentives for tax avoidance by wealthy individuals and firms.

This would ensure that every citizen pays their fair share of tax, no more and no less.

Ensuring such an outcome would boost our tax revenues even further in the years ahead.

Returning to the SPU projections, the budget will be close to balance next year with a prospective surplus of 3% of GDP by 2021.

And the debt to GDP ratio is set to fall to under 70% in 2021, in touching distance of the 60% target.

GDP in 2021 is now projected to be €15.5bn higher than the Budget Day estimate, given the upward revisions.

It will mean a prospective budget surplus, on a policy neutral basis, of more than €8 billion in 2021.

These are very strong figures and highlight the opportunity ahead of us to take strong economic growth and use it to people’s benefit – to make our society stronger, fairer, and more equal.

But opportunity has to be realised.

And the vital thing to recognise about the projections in this SPU is that the additional resources are contingent on the growth assumptions underlying them.

Given the risks facing the Irish economy, these assumptions cannot be taken for granted.

If the recovery in the economy falters, there will be a corresponding reduction in the resources available.

One very significant risk looming large is the prospect of Brexit, which, were it to materialise, would likely be very damaging to our economy.

Another risk is, of course, political instability at home.

While our ability to influence external risks is limited to say the least, we have the power to mitigate the risk of political instability.

In short, it is imperative that a new government is put in place as soon as possible – to guard against the risks on the horizon and, hopefully, maximise the opportunity ahead of us as a country

Audit Office and the Welfare Cap

The welfare cap is encouraging a greater understanding of spending across government, according to the National Audit Office, but it is important that processes for managing the cap are reliable.

The cap, introduced in 2014, has increased departments’ oversight of spending on benefits and tax credits. Since the spending is largely determined by individual entitlements, departments are not able to exercise in-year control in the way the might for other areas of spending. The level of attention to spending forecasts has increased across government and at the Office for Budget Responsibility (OBR).

Processes for managing the cap are evolving. Performance against the cap is assessed by the OBR at each autumn statement. The OBR announced last year that the cap was breached owing to the government’s decision to reverse some of its proposed reforms to tax credits. Failing to account correctly for the impact of tax credit reforms on other benefits led to an error at Summer Budget 2015.

The government has chosen to exclude the State Pension, as well as spending which is highly dependent on the state of the economy, including Jobseeker’s Allowance and related Housing Benefit payments. This reduces the level of uncertainty around unemployment assumptions in forecasts. According to the NAO, however, there is a risk that the current scope of the cap may create an incentive for government to keep claimants on Jobseeker’s Allowance instead of encouraging claimants into work and increasing entitlement to in-work benefits.

Today’s report found that while the cap builds on well-established forecasts of social security and tax credit spending, there are several areas in which analysis and forecasts could be improved. Interactions between benefits, for example, are not dealt with systematically. At the moment DWP’s forecasts are developed for individual benefit streams with separate manual adjustments to account for interactions between benefits. In addition, there is not always time for the OBR to fully review all elements of the forecasts – and in particular the Government’s policy costings – given the complicated reporting environment.

The NAO recommends that HM Treasury should better support the OBR by increasing access to departmental experts and increasing the time that the OBR has to consider the impacts of new policies; that departments should improve some aspects of their modelling of future benefit spending; and that HM Treasury should set out clearer cross-departmental arrangements as plans for benefit spending at one department often affect spending in another department.

Amyas Morse, head of the National Audit Office, said today:

“Forecasts will always be uncertain but when spending is projected to be close to or over the cap, weaknesses in forecasts may affect policy or operational decisions.

“All departments involved should therefore move quickly to improve their processes.”

|

£115.2bn welfare cap for 2016-17 |

£119.8bn welfare cap forecast for 2016-17 at Budget 2016 |

£98.4bn Benefit spending that is not included in the cap 2016-17 |

Key facts

| Aim of the welfare cap | To increase control over future spending on some benefits - by encouraging the government to make decisions that will keep future spending within the cap. |

| Lead departments | DWP and HMRC produce forecasts of spending on benefits and tax credits. HM Treasury monitors the cap. DWP is accountable to Parliament for the cap. |

| Scrutiny |

At each autumn statement the OBR assesses forecast spending against the cap and decides whether it has been breached – if so then this must be debated in Parliament and with a vote on the government’s response. |

About the welfare cap

- The current cap was set at the Summer Budget 2015 for a rolling five-year period: in 2016-17 it is £115.2 billion falling to £114.9bn in 2020-21.

- The welfare cap covers most social security spending apart from the State Pension, Jobseeker’s Allowance and Housing Benefit for jobseekers (and equivalent payments under Universal Credit).

- The welfare cap should not be confused with the household benefit cap, which limits the amount of benefit a non-working household can receive each week.

SNP Makes Politics More Accessible For The Disabled

The SNP has today published a series of accessible manifestos - in line with a campaign by the One in Five group to make politics more accessible for disabled people and those with sensory impairments.

The accessible manifestos published today by the party include Large Print, BSL with Audio and Subtitles and Braille versions.

Commenting, SNP Business Convener Derek Mackay said:

“I am very pleased that the SNP has today published accessible versions of our manifesto. This is a move which organisations like the One in Five campaign have long called for and it is right that we have taken this on board.

“We are deeply committed to ensuring politics is as accessible as possible – holding Scotland’s first disabled member’s conference earlier this year to help address the underrepresentation of disabled people in politics and the SNP in government has invested in a new fund to support disabled candidates in putting themselves forward for election.

“Our manifesto sets out our ambitious vision to keep Scotland moving forward – and I am delighted this positive message will be as accessible to as many people as possible.”

Note from the ABC: The accessible manifestos are published here: http://www.snp.org/manifesto_2016_accessible

BHS Pension Liabilities in the Spotlight

Work and Pensions Committee to look into Pension Protection Fund, impact of BHS pension liabilities

The Chair of the Work and Pensions Committee Frank Field MP has today announced that the Committee will be investigating the Pension Protection Fund, and in particular how the receipt of the pension liabilities from BHS, which has been placed into administration and has a £571 million deficit in its pension scheme, will affect the Fund and its users.

“We need as a Committee to look at the Pension Protection Fund and how the receipt of pension liabilities of BHS will impact on the increases in the levy that will now be placed on all other eligible employers to finance the scheme. We will then need to judge whether the law is strong enough to protect future pensioners’ contracts in occupational schemes.”

Work and Pensions Select Committee Committee to quiz Ros Altman

Committee questions Ros Altman on the triple lock and women’s state pensions

At 9.30 tomorrow morning, Wednesday 27 April 2016, the Committee will hear from Pensions Minister Baroness Ros Altman on major current pension policy issues.

Intergenerational fairness

After compelling evidence from economic experts on Monday the Minister will be asked about the sustainability of the state pensions “triple lock”. She will also be asked about other pensioner benefits, such as the Winter Fuel Allowance, as part of the Committee’s Intergenerational fairness inquiry.

Women’s state pensions

In the second report of their inquiry Understanding the new State Pension the Committee suggested an “actuarially neutral” option might allow people affected by changes in the state pension age to draw a lesser pension amount, earlier. This was in response to concerns among women planning to retire that they had not been informed in sufficient time about changes to the state pension age. That proposal led to the opening of this inquiry Early drawing of state pension. In a recent media interview Baroness Altman said she was “hoping” to help women born in the 50s who have been particularly affected by the pension age changes.

Auto-enrolment

The Committee will also question the Minister on whether the Lifetime ISA, announced in the Budget and due to be introduced in 2017, is compatible with pensions automatic enrolment.

Watch the session: http://www.parliamentlive.tv/Event/Index/1575f9de-08ce-4f9f-900f-c33c8c8df1e8

Committee Membership is as follows:

Frank Field (Labour, Birkenhead) (Chair); Heidi Allen (Conservative, South Cambridgeshire); Mhairi Black (Scottish National Party, Paisley and Renfrewshire South); Ms Karen Buck, (Labour, Westminster North); Neil Coyle (Labour, (Bermondsey & Old Southwark); John Glen (Conservative, Salisbury); Richard Graham (Conservative, Gloucester); Craig Mackinlay (Conservative, South Thanet); Steve McCabe (Labour, Birmingham Selly Oak); Jeremy Quin (Conservative, Horsham); Craig Williams (Conservative, Cardiff North).

Rising Housing Costs Equal a .10p Increase in Tax

Rising housing costs since the 1990s equivalent to 10p increase in basic rate of tax for a typical family

Post-crash fall in housing costs softened living standards squeeze but recent increases risks holding back the recovery

The rising share of income spent on housing over the last two decades is equivalent to a 10p increase in the basic rate of tax for a typical family, according to new Resolution Foundation analysis published today (Tuesday).

The analysis, which forms part of the Foundation’s forthcoming housing audit, finds that the share of income spent on housing costs was stable for most of the 1990s and early 2000s at around 17 per cent. However, a wedge opened up in the mid-2000s as rising housing costs outstripped income growth. By the eve of the financial crash, the average working age household spent around a fifth of their income on housing.

This housing affordability wedge then shrank in the wake of the crash as interest rates were cut to record lows and house prices fell. For many households this fall helped soften the post-crash living standards squeeze by reducing mortgage costs. However with rising housing costs once again outstripping income growth, the Foundation warns that housing risks being a major brake on the UK’s living standards recovery.

The Foundation notes that the extra share of income being spent on housing over the last 20 years – up from 17 per cent in 1995 to 21 per cent in 2015 – is equivalent to a 10p rise in the basic rate of tax (or £1,500 per year) for a typical dual-earning couple with a child. In London and Scotland the rise in housing costs has been equivalent to a 13p increase in the basic rate.

The analysis shows that households on low and middle incomes have been most affected by housing costs growing faster than incomes. Among these households, the share of income spent on housing has increased by almost a half over the last 20 years, from 18 per cent to 26 per cent. A far smaller increase took place for higher income households (up from 14 to 18 per cent) and the poorest households (up from 21 to 25 per cent).

Londoners have experienced the biggest increase in housing costs as a share of income over the last 20 years, though Scotland and the North West have also experienced sharp rises.

Londoners currently spend around 28 per cent of the income on housing costs, up a third since the mid-1990s (21 per cent). Recent increases in housing costs have caused typical London households to experience the biggest post-crash fall in disposable incomes anywhere in the UK.

Scotland has seen the second sharpest increase (up from 12 per cent to 18 per cent), followed closely by the North West (up from 15 per cent to 20 per cent). Housing affordability in the North West today is comparable to London 20 years ago.

The Foundation warns that these increases have pushed too many households into spending a perilously high share of their income on housing. Its analysis shows that around 3.3 million households spend at least a third of their income on housing costs – up from 1.6 million in the mid-1990s.

The analysis follows recent RF research on the shift from home ownership to private renting, which has been particularly acute for lower income households, young people and those living in London.

The analysis published today shows that private renters spend a greater share of their income on housing (30 per cent) than mortgage owners (23 per cent) or social renters (20 per cent).

The Foundation says that while housing costs outpacing income growth is severely impeding people’s living standards, policy action to stem rising housing costs and promote stronger income growth could help to bring the UK’s looming housing affordability crisis back under control.

Lindsay Judge, Senior Policy Analyst at the Resolution Foundation, said:

“The share of income working people spent on housing was fairly stable throughout the 90s and early 2000s. But spiralling house prices and stagnating wage growth created a growing wedge between housing costs and incomes, which peaked on the eve of the crash.

“Falling housing costs helped soften the living standards squeeze for many households during the downturn. But these costs are rising again and risk holding back the living standards recovery. This is particularly the case in London where any benefit from rising incomes is being wiped out by steeper housing cost increases.

“There is a risk that housing could do to future living standards what falling earnings did to recent living standards. Avoiding this will require decisive policy action over decades to get housing costs back under control.

“The government must be more ambitious. It should look beyond simply giving a few people a leg up onto the housing ladder and tackle the bigger issues of supply that is the root cause of rising housing costs. As home ownership moves out of reach for ever more families the government should also reform a private rented sector that is simply too insecure for many finding themselves dependent on it.”

Employment at Record Levels but Growth Has Stalled

The UK employment rate remains at a record high but has plateaued in the last five months, the Resolution Foundation said today in response to the latest ONS labour market statistics. The headline employment rate stayed at 74.1 per cent in the three months to February 2016, its third month running at this record high level. Below the headlines, employment has been flat for the last five months – signalling a plateau in the remarkable employment growth of the past four years. The Foundation says that fresh impetus will be needed to spark significant further increases in employment. It calls for a new approach to employment focused on getting the economic inactivity rate, which has fallen to at a record low of 21.7 per cent, down even further.

Real pay growth remained at two per cent, slight below its pre-crisis trend. The Foundation warns that with inflation starting to rise again, nominal wage growth will need to increase in order to maintain the UK’s pay recovery.

Research published earlier this week by the Resolution Foundation showed that moving jobs was a key spur for stronger pay growth. Between 2007 and 2014 pay growth among 18-29 year olds who switched jobs was 2.7 times higher than those who stayed put (11.8 per cent vs 4.4 per cent in cash terms).

The Foundation is concerned by the subdued level of job switching today, particularly among young people, which risks stunting their careers and earnings potential.

Laura Gardiner, Senior Policy Analyst at the Resolution Foundation, said:

“Employment remains at a record high but jobs growth appears to have stalled in recent months. A new approach is needed to bring fresh impetus and get employment rising again. “Real pay growth also remains flat at around two per cent. Having lost so much ground during the recent squeeze, it’s a concern we’re not seeing any sign of catch-up during this period of unprecedented low inflation.

“One of the key routes to stronger pay growth is moving jobs, particularly for young people at the start of their careers. The current lack of job mobility – which may reflect a lack of confidence among both young people and employers – risks holding back their careers and earning potential.”

Meanwhile in Wales

“The drop in unemployment is welcome, but it’s not just about the number but the quality of jobs in Wales. We know that Wales’ low-wage economy is a longstanding problem that we need to tackle. The average wage in Wales is significantly lower than the UK average. Plaid Cymru wants to introduce a large-scale investment project, to invest in rail, road and green infrastructure, and our plans to establish a new WDA for the 21st century will sell Wales to the world. We want to sell our ideas and products to the world, and bring investment to Wales. We need fresh thinking and a new direction for the economy, and Plaid Cymru will deliver that change.”

Every Little Counts for Irish Tescos Employees

Willie Penrose TD has written to Tesco Ireland seeking them to withdraw their threat to unilaterally change their workers conditions of employment, including pay cuts.

“I am calling upon Tesco to accept the invitation of the Unions representing workers to attend the Labour Court in order to resolve this dispute. They should also fully implement the terms of the Labour Court recommendation issued on the 19th February which said all workers in Tesco are entitled to a 2% pay increase and a share bonus payment. This pay increase has not been paid to those loyal workers who were employed before 1996.

Tesco is a highly profitable company largely due to the hard work of their loyal and long serving staff members. Issuing threats to change the conditions of long term employees who have been employed before 1996 without their agreement is a retrograde step in the conduct of industrial relations, and shows scant regard for the loyalty of the workforce, and sets a dangerous precedent. It would also mean that workers would lose a substantial amount of disposable income, which impacts upon their ability to meet financial commitments and pay essential bills.

I am calling upon Tesco, to withdraw this threat to change the conditions of employment without agreement, and to meaningfully engage with the workers representatives, their trade unions, and utilise the States industrial relations machinery, the Labour Court, if necessary. It is the least these loyal employees deserve, and there is an opportunity of doing so now before the 15th May next” Deputy Penrose Concluded

DWP Select Committee

DWP Select Committte

Wednesday 20 April 2016 Meeting starts at 9.30am

Subject: Early drawing of state pension

Witnesses: Chris Curry, Director, Pensions Policy Institute, and Alan Higham, PensionsChamp

Witnesses: Martin Clarke, Government Actuary

Youth Lack of Job Moves Cut Wages

Falling job moves among young people deepened their pay squeeze by a third

Think Tank warns a ‘new normal’ of low job mobility could have scarring effects for wages of future generations

Less frequent job moves among young people deepened their pay squeeze by a third during the downturn and could permanently reduce their earning potential if it becomes part of a ‘new normal’ in the labour market, according to the latest Earnings Outlook from independent think tank Resolution Foundation.

Job mobility – the frequency at which people move from one job to another – is a strong predictor of faster earnings growth. The Foundation’s analysis finds that this ‘switching premium’ – the relative pay boost from changing jobs compared to staying put – is particularly strong for young people.

Between 2007 and 2014, pay growth among 18-29 year olds who switched jobs was 2.7 times higher than those who stayed put (11.8 per cent vs 4.4 per cent in cash terms). Among older age groups the ‘switching premium’ was below 2.

However, despite this lucrative ‘switching premium’, the frequency with which people move jobs has been falling over the last decade, particularly among young people. The mobility rate for 18-29 year olds is currently over a third below its early-2000s peak, despite the impressive jobs growth of recent years.

The Foundation’s Earnings Outlook suggests that had job mobility not slowed in this way, young people’s hourly pay would be around 30p (or 3 per cent) higher than it is currently, reducing the scale of the pay squeeze by a third from 11 per cent to 8 per cent.

Instead, young people experienced a deeper pay squeeze than anyone else. Last year hourly pay for a typical 22-29-year-old had only recovered back to its 2000 level.

If young people and businesses fail to regain the confidence to take risks on one another and job switching remains low, there is a danger that one of the legacies of the recession will be lower earnings potential for generations to come.

Laura Gardiner, Senior Policy Analyst at the Resolution Foundation, said:

“Frequent job moves are the main route to the rapid pay increases young people should experience as they begin their working lives. So it is a real concern that job switching slowed down for all groups, and particularly for young people, even before the recession hit.

“Unpicking the reasons why young people are staying put in their jobs for longer is crucial to understanding whether job switching can return to its previous level, or whether we are seeing a ‘new normal’ of fewer job moves and subsequent slower pay growth for generations to come.

“Unless we want to see a long term scarring effect on the wages of future generations, Millennials must regain confidence and increase the frequency with which they move jobs, and firms must be more willing to take them on.”

Executives

-

Simon Collyer

Position: Founder & Director

Simon Collyer hails from Brightlingsea in Essex, a small town on the coast between Colchester & Clacton. Simon worked very successfully in the leisure marine industry in the UK and in Australia. Later in London Simon worked in the web development and publishing fields, founding a below-the-line sales promotion agency in the early nineties and then later a software company Red Banner in South Africa (2002-06). Here in South Africa, Simon became interested in the Third Sector and starting his own organisation.

-

Christopher Johnson

Position: Bookkeeping and Administration

Chris lived in Oxford for twenty years, having been educated at Magdalen College School. Chris sought a career with British Rail and spent twenty years in railway retail management ending with Virgin Trains at Euston Station. Christopher retrained in bookkeeping and accounts in 2000 and now works for Chelmsford Community Transport.

A strong, enthusiastic team player with a meticulous eye for detail, Christopher brings a range of skills to the ABC.

Team

-

Frances Rimmer

Position: Researcher

When not charming snakes Frances is a Modern History student at the University of Essex, focusing specifically on social history. The lives and experiences of the ordinary person rather than on politics or the military. Outside of her studies, Frances enjoys film and writing. As a keen roller skater who plays roller derby with the Kent Roller Girls, Frances secret wish would be to become a skating instructor and open her own rink, as she has always wanted to help people in some way, and feels it would be great to do so while also sharing her passion with like-minded people.

-

Stuart Meyers

Position: Researcher

Stuart Meyer, is a final year American Studies student at the University of Essex. Stuart focussed his academic life on global justice and the rights of migrants. Additionally Stuart has a passion for writing, both creatively and with the aim of providing accessible information to those who need it most Stuart has made a great contribution to our library of Advice Guides demonstrating his versatility by writing intelligently on a wide range of topics.

-

Louis Jones

Position: Film Maker

Louis is a 19 year old TV and film student studying at Colchester Institute. Along with hand-picked fellow students, Louis made the ‘Membership’ video that can be seen on the ABC website. Louis volunteers at, Hospital Radio Colchester, as a football commentator. A true fan of the ‘Great Game’ Louis insights have been sought after on occasions by key local media, the Colchester Daily Gazette & even BBC Essex.

-

Marcus Pierpont

Position: Film Director

Talented student film maker, Marcus Pierpoint, directed the ABC 'Membership' film which can be seen on the organizations website. Marcus has recently graduated from a BTEC course, studying Creative Media Production at Colchester Institute and he claims a true passion for films and filmmaking. Marcus also enjoys radio work and volunteers at the local hospital radio station, producing and presenting his own show. Marcus is enrolled at the University of Greenwich, and dreams of a career in the media industry.

-

Shane Mitchell

Position: Film Maker

Shane Mitchell, is another Colchester Institute Film and TV student that aspirers to be a Director of Photography in the future. Shane was the camera operator for the ABC Membership video, fun to make says Shane but it is also work he is very proud of. Shane loves all things ‘film’ and he makes videos even in his spare time.

-

Joe Corlett

Position: Film Director

Ex-student script writer/director, Joe Corlett, directed the ABC's corporate video (About Us) which is now viewable on the main website. Joe graduated from the Colchester Institute with a BTEC diploma in the field of media. Joe is passionate towards film making and hopes to continue making more that are constructed form his own material. On the side he's loves being out jogging in all terrains and when not out side he's writing scripts for future projects. Joe is now out in the world ready to start his life goal of working in the Media industry.

-

Jon Taylor

Position: Film Maker

Jonathan Taylor has been working in the media sector for 3 years and for our filming projects he worked as the production manager. John worked on graphical elements of our film, About Us for example, rendering images and making them look good on screen.

Jon is also experienced in animation and he made the logo and animation sequences in the ABC corporate videos.

Part of Jon’s brief was to also organise the administration side of filming, known collectively to admin experts the world over as ‘the paperwork’.

-

Thomas Hearn

Position: Film Maker

Thomas Hearn, has been involved in media, for about three years. Tom likes to work a lot at a computer, particularly the editing suite. For the ABC project, Tom worked on the edit itself; created and pieced together both the footage and the music, Tom created the visual elements of the ABC ‘About Us’ video and put most of the visual effects on the video.

I think we can agree that along with the rest of our youthful student team; Tom has done a very fine job indeed.

-

Max Gillard

Position: Film Maker

The last of our film team Max Gillard has recently finished college studying Creative Media Level 3 and Max hopes to continue the course on to University to someday gain a job in the media industry.

We wish Max the best of luck.

-

Harry

Position: Film Maker

My name is Harry Genge and I am an aspiring film maker. I have skills in the majority of film orientated jobs, though I am most interested in the creative roles such: Directing, Director of Photography and Writing. In my spare time I make short films, write, read, draw/paint and take the dog out for long walks.

-

Ned

Position: Producers

My name is Ned Woodcraft and I’m an aspiring Producer. As well as completing a diploma in media production I have also had a number of jobs in the professional market. I’m also a keen sailor and water sport enthusiast.

-

Brandon

Position: Producer

My name is Brandon and I’m an aspiring producer and actor. I enjoy bringing a production together with planning and preparations to create a great finished product. My hobbies also include street magic and bass playing.

-

Callum

Position: Writer and Director

My name is Callum Olive and I’m an aspiring writer and director. I’m always looking for a new project and love writing new stories and screenplays at home and on the move. My hobbies include playing the piano and street magic.

-

Joanie DeMuro

Joanie joined ABC team in early 2017. She was one of six student volunteers from the University of Essex in that cohort. The student team focused on a range of projects, including creation of Wikipedia page,‘training manual’ and most importantly, researching and adding entries to the website directory of organisations that assist the unwaged, or those on low incomes. “This placement was very helpful - thanks for the opportunity Simon.”

-

Cherry Lam

Cherry Lam has been volunteering for ABC for one month. Although it is a short period of time, she knows a lot more about the running of a charity organisation. Cherry is responsible for adding directories to the organisation website according to categories. Joining this placement helped her improving skills and gaining new experiences. Cherry says is extremely appreciative of the support she has received from ABC which allowed her to improve skills.

Join

FREE

Here