Simon Collyer

Post BREXIT - Presents a Worrying Scenario for Business

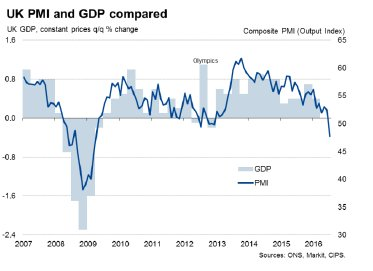

Following the BREXIT vote British businesses are already taking a major hit according to business information provider Markit.

Factory and services activity in July revealed the sharpest decline in output since the height of the global financial crisis, new data from IHS Markit on Friday.

Chris Williamson, chief economist at Markit, called the plunge "a dramatic deterioration in the economy." Not since 2009 have things been this bad.

"A truly horrible survey -- pointing to the Brexit vote immediately giving the economy a good kicking as uncertainties and concerns set in," said Howard Archer, chief European & U.K. economist at IHS.

Two New Work and Pensions Committee Inquiries

The Work and Pensions Committee launches an inquiry into employment opportunities for young people

Aim of the inquiry

The Committee considers whether current provision for young people is sufficient to enable their full access to and participation in the labour market and identify ways of improving this. This will focus on support in the transition from education to employment, the support offered to young people via Jobcentre Plus, and issues around progression and quality of work for young people.

Call for written submissions

The Committee invites written submissions addressing one or more of the following areas:

Services for young people

- To what extent does getting young people into work and supporting them in work require an approach distinct from that of other groups?

- What is the likely impact of the end of the Youth Contract on labour market prospects for young people who are NEET (not in education, employment or training), and is action required to mitigate this impact?

- Is current mainstream Jobcentre Plus provision adequate to meet the needs of all young people, including NEETs and unemployed graduates?

- What do employers look for from their younger employees and potential employees, and how can Jobcentre Plus support them in finding this?

Jobcentre Plus Support for Schools

- How effective is Jobcentre Plus Support for Schools likely to be in enhancing young people's career prospects?

- Are there any areas of potential tension between Jobcentre Plus advisors in schools and current school career advice provision, and if so, how could these be overcome?

- How can DWP ensure that schools engage with the initiative, and how should its impact be monitored?

Support beyond Jobcentre Plus

- How can Jobcentre Plus services for young people be more effectively integrated with other local services, especially around education and skills?

- What broader measures, especially those aimed at employers, should be Government prioritise to improve the employment rates of young people?

Longer-term labour market prospects

- How do changes in job quality and availability since the crisis affect young people? How is the decision to exempt young people from the National Living Wage affecting their experiences of employment?

- What is likely to be the impact of any forthcoming economic uncertainty on young people, and how should the Government best seek to protect them from this?

Submit your views through the Employment opportunities for young people inquiry page.

Deadline for written submissions is Monday 5 September 2016.

Inquiry background

Youth unemployment began rising sharply following the financial crisis, peaking at around one million in 2011/12. Since then it has dropped to similar levels as before the crisis, at around 600.000

UK unemployment rates (%)

Despite this, at 14.9% in 2015 (House of Commons Library, Briefing Paper, PDF 535KB), the youth unemployment rate remains significantly higher than the overall unemployment rate of 5.4%. The number of young people who are NEET (not in employment, education or training) has also returned to levels that are comparable to before the crisis. However, as of Q1 2016, 105.000 young people were long-term unemployed (out of work for twelve months or more), down 7.000 from the previous quarter, and 69.000 from the previous year. This represents 16.6% of all unemployed 16-24 year olds.

As such, although young people's employment rates have somewhat recovered since the crisis, there are still areas of concern.

For young people in work, increased job stability and tenure may also be having a negative impact on them at the start of their careers, creating promotion and progression blockages. These risk having a 'scarring' effect on their future employment prospects.

A number of recent and forthcoming developments will affect young people's experiences of the labour market, both in and out of work. These include:

- The end of Youth Contract provision

- The introduction of the Jobcentre Plus 'Support for Schools' initiative

- The expansion of apprenticeships in England (English Apprenticeships: Our 2020 Vision, PDF 1.25MB)

- Changes in young people's experiences of the labour market, including prospects for career advancement and exemption from the National Living Wage

- The impact of any forthcoming economic uncertainty related to the Brexit vote

Chair's comment

Frank Field MP, Chair of the Work and Pensions Committee, said:

"The transition between school and work can make or break a young person's job prospects. For those who struggle to find and keep their first job, every day brings with it the prospect of merely existing, rather than living a fulfilling life. I therefore hope the Committee will be able to gain substantial evidence on how best to prevent anybody failing through the cracks and drifting towards long-term unemployment before their adult life has even begun."

Committee Member, Mhairi Black MP, said:

"Many young people are struggling to transition into the workplace, and it is so important to assess the role of the Jobcentre in this situation. This is a many facetted issue, and I am hopeful that the Committee will be able to accrue the relevant evidence to address it, and prevent any young person falling into the trap of economic and social uncertainty that comes with being unemployed."

Child maintenance inquiry launched

The Work and Pensions Committee launches an inquiry into the Child Maintenance Service (CMS) and its effectiveness in ensuring regular payments for children, and considers recommendations to improve the service overall.

Call for written submissions

The Committee invites written submissions addressing the following points:

- How well is the CMS performing for children and parents? How could it be improved?

- What problems do parents face – both for the parent with care and the non-resident parent?

- Are levels of child maintenance set correctly?

- What powers does the CMS have and how effectively are they used? How effective is enforcement action?

- What will happen to CSA arrears or unresolved cases when parents move to the new CMS?

- How might the CMS deal with any weaknesses or loopholes in the old CSA system?

- Are there any opportunities for Government departments to work together to ensure regular payment?

- Is there any international evidence on ways of ensuring parents regularly contribute to their children’s maintenance payments?

Submit your views through the Child Maintenance Service inquiry page.

Deadline for written submissions is Monday 5 September 2016.

Inquiry background

Separated families have several options for arranging child support. Some rely on statutory government-run schemes that assess, collect and make payments, while other families set up their own (family-based) arrangements or use the court system. The DWP introduced the statutory Child Maintenance Service (CMS) in July 2012 to arrange child support payments from one parent to another, replacing the Child Support Agency (CSA). The Department also introduced parental charges for parents wishing to use the statutory service.

New rules for calculating payments were brought in along with a new power to report child maintenance debtors to credit reference agencies. Legal action can be expensive, with the proportion of cases taken to court fallen by nearly three quarters since 2012-13 (See Commons questions 2862 and 2863, June 2015). At December 2015, arrears across the child support schemes were almost £4 billion (Client Funds Account 2014/15, Department for Work and Pensions, PDF 270KB).

Committee Comments

Frank Field MP, Chair of the Work and Pensions Committee, said:

"The current maintenance system appears to be failing parents in receiving regular payments, demonstrated through the level of outstanding of arrears, which stands at £4 billion. Some individuals described to us the importance of the courts if they were to get any justice at all. Our inquiry considers recommendations towards the current issues with the service faced by parents with care and non-resident parents."

Heidi Allen MP said:

"While many parents do pay what they owe, a group of my constituents drew to my attention concerns with receiving regular payments. In such cases, the Child Maintenance Service have a range of options for taking enforcement action, from contacting non-paying parents to legal enforcement, but the time to get results can be very lengthy. The fact that some cases rely on legal enforcement suggests that the system is not fully effective in ensuring regular and timely payments. Our inquiry plans to look at weaknesses in the old CSA system, particularly around self-employed parents, and assess whether the new CMS can deliver an improved outcome for parents and children"

Steve McCabe, Committee Member, said:

"I am really concerned about the recent report from Gingerbread which revealed that there is millions of pounds missing in child maintenance payments, which is unlikely ever to be recovered as a result of the introduction of the Child Maintenance Service."

Committee Membership is as follows:

Frank Field (Labour, Birkenhead) (Chair); Heidi Allen (Conservative, South Cambridgeshire); Mhairi Black (Scottish National Party, Paisley and Renfrewshire South); Ms Karen Buck, (Labour, Westminster North); Neil Coyle (Labour, (Bermondsey & Old Southwark); John Glen (Conservative, Salisbury); Richard Graham (Conservative, Gloucester); Craig Mackinlay (Conservative, South Thanet); Steve McCabe (Labour, Birmingham Selly Oak); Jeremy Quin (Conservative, Horsham); Craig Williams (Conservative, Cardiff North).

Labour Supporters Swell By 180,000

Jeremy Corbyn born May 26, 1949 (age 67)attracting 183,000 paid supporters in just 48 hours. This must be some sort of record in political history.

Jeremy Bernard Corbyn' has been the Member of Parliament for Islington North since 1983 and was elected Labour Leader in 2015.

EU Wage Disparity

Western European countries complain their workers are subject to unfair competition from low-salaried eastern European competitors — an average hour of work costs an employer €40 in Denmark but only €3.80 in Bulgaria, according to Eurostat. Eastern European governments complain Commission efforts to enforce equal pay for equal work would unfairly block their workers from doing their jobs and trying to get ahead.

In one law, the incongruities of the so-called EU single market are laid bare.

Universal Credit Roll-out Falls Further Behind

According to the BBC full roll-out of the welfare reform is now forecast in March 2022, an extension of a year - and 11 years after it was first announced.

Universal Credit, which replaces six current benefits with a single payment, is being rolled across the country.

It was originally scheduled to be completed in 2017 but has been beset by IT delays and costs have spiralled.

There have been significant tensions between the Treasury and the DWP over its cost.

Last year the government announced funding cuts to the universal credit "work allowance" - reducing the amount people can earn before benefit payments are withdrawn.

New DWP Team announced

The new team at the Department for Work and Pensions is:

Secretary of State – Rt Hon Damian Green MP

-Minister of State for Employment – Damian Hinds MP

-Minister of State for Disabled People, Work and Health – Penny Mordaunt MP

-Minister of State for Welfare Reform – Rt Hon Lord David Freud

-Parliamentary Under-Secretary for Pensions – Richard Harrington MP

-Parliamentary Under-Secretary for Welfare Delivery – Caroline Nokes MP

Secretary of State for Work and Pensions, Damian Green said:

I’m delighted to be leading one of the most important departments in government. What we do here directly affects millions of people, from all parts of the country, and at all stages of their lives.

I’d like to welcome the new ministerial team to the department – Damian, Penny, Richard, Caroline – and welcome back David. Together we will work hard to continue reforming welfare, supporting disabled people, ensuring older people have a secure retirement, and making sure everyone who can work has the opportunities they need to get on in life, whatever their background.

Minister for Employment, Damian Hinds said:

This government is determined to make Britain a country that works for everyone, and employment has a central role to play. We are in a position of strength with a record number of people in work, including more women than ever before, and behind the statistics are countless stories of individual hard-work and determination.

I look forward to working closely with my colleagues across government and industry to ensure this positive trend continues and more people of all ages and abilities get into, and stay, in work.

Minister for Disabled People, Work and Health, Penny Mordaunt said:

It is a privilege to be given the chance to improve the social and employment opportunities for the millions of disabled people across the UK. I will do all I can to improve support for people with disabilities and health conditions, help more people into work and ensure they have every opportunity to thrive.

Minister for Welfare Reform, Lord Freud said:

Our reforms are revolutionising welfare and ensuring we have a system which provides the opportunity for people to take control over their own lives.

The rollout of Universal Credit is well underway and it is already changing people’s lives for the better, with people moving into work faster and staying in work longer than under the old system. So it is a privilege to be back in government to continue with our vital reforms.

Minister for Pensions, Richard Harrington said:

I am delighted to take responsibility for this important ministerial post, and I look forward to tackling the full range of state and private pension matters, including the new Bill and automatic enrolment, among so many others.

Minister for Welfare Delivery, Caroline Nokes said:

We’re delivering some of the biggest reforms in generations, which are already improving people’s lives for the better. It is vital that these are delivered safely and securely, so I’m looking forward to continuing this important work – restoring fairness to the system while ensuring we help as many people as possible to reach their potential.

Pay Squeeze on Young People

Millennials facing ‘generational pay penalty’ as their earnings fall £8,000 behind during their 20s

Fresh evidence of the growing intergenerational inequality that new Prime Minister has warned of

Britain’s longstanding promise of ‘generational pay progress’ could turn into a ‘pay penalty’ for millennials, who are at risk of being the first generation to earn less than their predecessors over the course of their working lives, the Resolution Foundation says today (Monday) as it launches its flagship Intergenerational Commission (IC).

The Commission’s launch report, which analyses the living standards of different generations, offers fresh evidence of the “growing divide between a more prosperous older generation and a struggling younger generation” that the new Prime Minister warned of in her leadership speech last week.

It shows that millennials (aged between 15 and 35) have been hit hardest by the recent pay squeeze. As a result a typical millennial has earned £8,000 less during their 20s than a typical person in the previous generation – generation X.

While much of this pay squeeze is due to some young people having the bad luck of entering the labour market in the midst of a downturn, the report shows that Britain’s ‘generational pay progress’ actually stopped before the start of the financial crisis.

Looking at the pay of a typical 25 year old the report finds that older millennials, who are now in their early-mid 30s and therefore turned 25 before the financial crisis hit, are the first workers to earn less than those born five years before them. The Foundation adds that younger millennials who entered work into the pay squeeze will have had their pay hit even harder.

The report warns that having experienced a poor start to their careers, which has the potential to permanently scar their lifetime earnings, current economic uncertainty could put further downward pressure on their future pay.

It shows that even an optimistic scenario, in which the future pay of millennials improves rapidly and follows the same path as the baby boomers, their lifetime earnings would be around £890,000. This would reduce their generational pay progress to just 7 per cent over generation X – a third of the size of the pay progress that generation X are set to enjoy over the baby boomers.

However a more pessimistic scenario, in which the future pay of millennials instead follows the path of generation X, would reduce their lifetime earnings to around £825,000. This would make the millennials the first ever generation to face a generational pay penalty by earning less than their predecessors over the course of their working lives.

The Foundation notes such a pessimistic scenario could emerge if the short-term economic outlook worsens as a result of Brexit, the weak productivity outlook forecast by the OBR earlier this year persists, and if pay growth continues to fall behind productivity gains, as it has done for much of the last two decades.

The Foundation warns that this potential generational pay penalty comes on top of a bleak outlook for home ownership among millennials. It notes that baby boomers were 50 per cent more likely to own their home by the time they were 30 compared to millennials today. This shift towards renting and higher rents has meant that millennials have spent £44,000 more on rent by the time they reach 30 compared to the baby boomers.

The Foundation today launches a flagship Intergenerational Commission to explore growing inequality between generations. It says that repairing the fraying social contract between generations should be at the heart of the new Prime Minister’s task of unifying the country in the aftermath of the referendum.

The Commission’s members are: Vidhya Alakeson (Power to Change), Dame Kate Barker (ex-Bank of England), Torsten Bell (Resolution Foundation), Carolyn Fairbairn (CBI), Lord Geoffrey Filkin (Centre for Ageing Better), Sir John Hills (LSE), Paul Johnson (IFS), Sarah O’Connor (Financial Times), Frances O’Grady (TUC), Ben Page (Ipsos MORI), David Willetts (Commission chair and Resolution Foundation) and Nigel Wilson (Legal & General).

David Willetts, Executive Chair of the Resolution Foundation and Chair of the Intergenerational Commission said:

“Fairness between the generations is something public policy has ignored for too long. But it is rising up the agenda with the Prime Minister, politicians of all parties, business leaders and others rightly identifying it as a growing challenge. That is why the Intergenerational Commission is being set up to provide the most comprehensive analysis of the living standards challenges faced by different generations – and recommendations for action.”

“This is about taking seriously the social contract between the generations that underpins our society and state, and recognising that everyone is worried about the future of younger generations. In the real world there is no such thing as generational war – instead there are parents, grandparents, families and communities all sharing the same hopes for younger generations.”

Torsten Bell, Director of the Resolution Foundation, said:

“Generational inequality risks becoming a new inequality for our times, and nowhere is that clearer than on pay. We’ve taken it for granted that each generation will do much better than the last – earning more and enjoying a higher standard of living. But that approach risks looking complacent given the realities of recent years and prospects for the future.

“Far from earning more, millennials have earnt £8,000 less during their 20s than the generation before them. The financial crisis has played a role in holding millennials back, but the problem goes deeper than that. Even on optimistic scenarios they look likely to see much lower generational pay progress than we have become used to, and there is even a risk that they earn less over their lifetimes than older generations, putting generational pay progress into reverse.”

- * The Commission will be officially launched at an event with Frances O’Grady, Carolyn Fairbairn and Ben Page on Monday 18 July at the Skyloft in Millbank.

- * In her leadership speech last Monday Theresa May warned of “a growing divide between a more prosperous older generation and a struggling younger generation”.

- * Embargoed copies of the launch document for the Intergenerational Commission are available from the press office.

SNP Say Theresa May’s Voting Record a Stark Contrast With Her Mission Statement

The SNP has warned that Theresa May’s sweeping proclamations on fighting for social justice in her recent remarks both before and after becoming Prime Minister should be taken with a large pinch of salt, with her voting record since entering government in 2010 painting a starkly different picture of Ms May’s priorities.

Comparisons have been drawn with Margaret Thatcher’s speech upon becoming Prime Minister in 1979, which was followed by 11 years of discord and despair.

Ms May’s comments on VAT, jobs, affordable housing, wages and household bills have been particularly highlighted, with her statements this week being entirely contradicted by the voting record of the new PM and her new Cabinet.

Speaking on Theresa May’s voting record, SNP MSP for Hamilton, Larkhall and Stonehouse and Convener of the Equal Opportunities Committee, Christina McKelvie, said:

“The new Prime Minister’s comments in the last few days have been nothing short of remarkable and the bold claim that she is some sort of champion for social justice is simply laughable when you take even a cursory glance at her voting record.

“Her upset at the rise in VAT doesn’t stand up to any scrutiny when you consider that she has voted for this policy at every opportunity. Ms May’s records on jobs and wages are no better - these actions show her true colours, and prove how little she has fought for social justice.

“The cuts to benefits that her government has enforced alongside an enforced austerity agenda have been instrumental in people’s incomes falling behind inflation, making her claims on wanting to ensure people are able to afford their energy seem rather hollow.

“It doesn’t end there. Ms May has decried how difficult it is for young people to buy their own homes - yet when she’s had the chance to improve this, she has rejected a plan to build 100,000 affordable homes and implemented and defended the disgraceful bedroom tax.

“Does her rhetoric mean we can expect the new PM to stop plans to cut housing benefit for those under 21, imposing a 90% cut to devolved employability programmes, and reintroducing the weekly £30 that was cut from unemployed disabled people?

“It would seem wise to ignore the hype around Ms May’s apparent desire to fight for social justice. As we saw in 1979, Margaret Thatcher came to power pledging to bring the country together in an atmosphere of hope – but 11 years of her governance provided a very different picture.

“Given the doublespeak Theresa May is currently engaged in, promising vague ideas of social justice against a backdrop of a disastrous voting record in Parliament and the appointment of a Cabinet significantly to the right of David Cameron’s, it would be very wise to treat the new Prime Minister’s comments with great suspicion.”

Full text of Theresa May’s speech in Birmingham is available here: http://www.theresa2016.co.uk/we_can_make_britain_a_country_that_works_for_everyone

Theresa May’s statement after becoming Prime Minister is available here: https://www.gov.uk/government/speeches/statement-from-the-new-prime-minister-theresa-may

Theresa May’s full voting record is available here: https://www.theyworkforyou.com/mp/10426/theresa_may/maidenhead

Jobcentre Plus Plaistow Misuse of Funds

The National Audit Office has today published its investigation into misuse of the Flexible Support Fund in Plaistow jobcentre. In November 2015, the Rt Hon. Stephen Timms MP contacted the NAO with concerns about misuse of the Fund in the East London jobcentre as well as concerns about pressures on its staff to falsely inflate performance measures. These concerns were prompted by two former jobcentre staff members who had been dismissed for misusing the Fund. They also raised concerns with the NAO about the Department for Work and Pensions’ response to these issues.

The NAO report covers:

- how the Department for Work & Pensions responded to allegations of misuse in Plaistow jobcentre;

- how the Department has managed the risk of more widespread abuse of the Fund; and

- how the Department has monitored wider incentives and pressures within jobcentres.

The NAO found:

- Following a customer complaint in August 2013, the Department dismissed two members of staff for misuse of the Fund in Plaistow jobcentre. After investigating, the Department concluded the staff members were involved in falsely awarding Fund payments to inflate off-flow, a measure of jobcentre performance. Five claimants were affected across the two cases. The Department dismissed both members of staff for gross misconduct in May 2014.

- The Department based its decisions on investigations into the actions of both dismissed members of staff. The members of staff raised concerns about the Department's approach. In particular they questioned whether investigators: followed correct procedures; fully considered evidence; and recognised mitigating circumstances. The Department's internal investigators spent an average of 94 hours on each of the two cases, compared with an average of 83 hours for all investigations that led to a dismissal in 2014-15.

- The dismissed members of staff raised concerns that misuse of the Fund was widespread and the Department had not investigated fully. They claimed that managers encouraged aggressive approaches to improve off-flow, including falsely signing claimants off benefits and using the Fund to cover gaps in benefit payments.

- An employment tribunal upheld the Department's decision when challenged by one of the dismissed members of staff. One of the two dismissed staff members took the Department to an employment tribunal alleging unfair dismissal. The judge in the case concluded in March 2015 that the dismissal was procedurally and substantively fair.

- The Department investigated several other staff members for misuse of the Fund. In total it investigated ten members of staff in Plaistow and found that six had contributed to the misuse of the Fund.

- Plaistow jobcentre staff have raised concerns about pressures in jobcentres during and since 2013. They raised concerns about staff capacity and pressures to improve off-flow. Some alleged that managers encouraged advisers to misuse the Fund to increase off-flow. The dismissed members of staff reported other practices including deliberately booking jobcentre appointments at inconvenient times of day to increase missed appointments and trigger sanctions.

- Following whistleblower concerns, the Department investigated allegations about Plaistow jobcentre managers putting pressure on staff to misuse the Fund. It conducted internal and human resources investigations into a number of allegations, including bullying and harassment. None resulted in disciplinary action.

- Missing documents meant the Department could not fully investigate all allegations. The jobcentre's finance officer who performed checks on Fund applications during part of 2013 told us about missing documents. The Department's investigators also noted that some documents were missing in one of its investigations. The investigation led to the Department taking disciplinary action. It is unknown what impact the missing documents would have had on the severity of that disciplinary action.

- The Department carried out an intelligence exercise looking at Fund payments in other jobcentres. The Department took a sample of 1,845 payments made by Plaistow and two other East London jobcentres in 2013-14. The exercise identified two further cases of misuse in Plaistow. No misuse was identified at the other jobcentres. There was no documented methodology for the exercise.

- The Department's internal audit team has highlighted limitations in the Department's control of Fund payments. The Department has introduced several changes aimed at strengthening control over payments.

- The Department’s investigations did not directly review wider cultural issues or pressures on staff in Plaistow. The Department believes its use of targets for off-flow is appropriate and that they create no significant perverse incentives. The Department's investigations concluded that the misuse of the Fund identified in Plaistow jobcentre was not widespread.

- The Flexible Support Fund allows jobcentre staff to make payments to benefit claimants to help reduce barriers to work.

- The report does not reconsider individual employment decisions and does not evaluate the original dismissal decisions or subsequent employment tribunal findings.

- The National Audit Office scrutinises public spending for Parliament and is independent of government. The Comptroller and Auditor General (C&AG), Sir Amyas Morse KCB, is an Officer of the House of Commons and leads the NAO, which employs some 785 people. The C&AG certifies the accounts of all government departments and many other public sector bodies. He has statutory authority to examine and report to Parliament on whether departments and the bodies they fund have used their resources efficiently, effectively, and with economy. The Department studies evaluate the value for money of public spending, nationally and locally. Recommendations and reports on good practice help government improve public services, and their work led to audited savings of £1.21 billion in 2015.

Department for Work and Pensions Accounts 2015-16

The Comptroller and Auditor General, Amyas Morse, has qualified his audit opinion on the regularity of the 2015-16 accounts of the Department for Work and Pensions. This is owing to the unacceptably high level of fraud and error in benefit expenditure, other than State Pension where the level of fraud and error is lower.

The accounts of the Department, and those of predecessor departments administering this expenditure, have been similarly qualified each year since 1988-89.

The Department estimates total overpayments due to fraud and error in 2015-16 to be 1.8%, which equates to £3.1 billion of the total forecast benefit expenditure, maintaining the previous year’s lowest recorded level. The Department estimates the total underpayments in 2015-16 to be 1%, or £1.8 billion of total benefit expenditure (increasing from 0.9%, or £1.4 billion from 2014-15), the highest level to date.

The Comptroller and Auditor General qualified his regularity opinion due to material levels of fraud and error in benefit expenditure, excluding State Pension. State Pension continues to demonstrate a very low level of fraud and error, while overpayments in other benefits decreased slightly to 3.6% but underpayments rose to a highest ever level of 1.8%. The headline level of fraud and error overpayments across all benefits of 1.8% indicates that a step change and sustained reduction in fraud and error has not been realised.

The Department estimates some fraud and error based on previous years’ percentage rates. However it is difficult to infer trends from these in some cases as it has been a long time since any measurements have been taken. For, example, Disability Living Allowance, which accounted for £13.3 billion of expenditure in 2015-16, has not been measured for fraud and error since 2004-05. The absence of up to date information on error rates in such a large benefit stream creates a risk that the Department is making decisions based on out of data measurements.

Since last year, the Department has significantly refined its approach to fraud and error with its new overarching Fraud, Error and Debt Strategy and underpinning benefit strategies and cross cutting work. The Department is also working on using Real Time Information on earnings as well as improving its forecasting and modelling activities to make fraud detection more accurate. It remains essential that DWP continues to address fraud and error given overpayments increase costs to taxpayers and reduce public resources available for other purposes, while underpayments mean households are not getting the support they are entitled to.

The Comptroller and Auditor General’s report examines Pension Credit as a case study of how the Fraud, Error and Debt Strategy is delivered at a benefit level. For Pension Credit, the Department’s provisional 2015-16 estimates showed that fraud and error overpayments were 5.6% (£350 million), an increase from 4.6% in the final 2014-15 estimates (£310 million). Underpayments were 2.3% (£140 million), an increase from 1.7% in the final 2014-15 estimates (£110 million). As for all benefits, the Department has not set a target for Pension Credit underpayments and rejected recommendations from the Public Accounts Committee to do so.

Universal Credit is administered through two systems: the first, Universal Credit Live Service (UCLS), is currently rolled out nationally for new single claimants, while the second, Universal Credit Full Service was in four jobcentres in London in 2015-16, and is planned to expand slowly during 2016, until roll out expands to 50 jobcentres per month from February 2017. The Department has estimated overpayments due to fraud and error in UCLS for the first time in 2015-16, at a level of 7.3% (£36 million) of forecast benefit expenditure of £500 million. Estimated underpayments due to fraud and error in 2015-16 are 2.6% (£13 million). The Department is still developing its methodology to assess fraud and error in Universal Credit and it is not possible, given the benefit’s limited roll out, to draw inferences from these initial results.

The publication of the first fraud and error estimates for UCLS will provide vital information to develop the Department’s Fraud, Error and Debt strategy further, including the approach to the roll out of the new Universal Credit Full Service, where the level of fraud and error to date is unknown.

The Department needs to develop and implement controls to tackle the inflow of fraud and error to Universal Credit claims, (as well as removing the fraud and error already identified within claims). It will require continued commitment and focus on behalf of the whole Department to implement and fully embed these initiatives on a sustainable basis if the Department is to reduce the level of fraud and error in Universal Credit to the lowest feasible level.

The Department has reported against a new “net loss indicator” in its Annual Report, and also announced a new “net loss target” of 1.6% by 2017-18. These measures look at estimated overpayments made in year, less actual and estimated benefit recoveries in year, regardless of the age of the overpayment recovered. Underpayments are not considered. At present, net loss does not compare like with like: recoveries may date back many years due to delays in identifying and recording overpayments or because the Department is able to recover benefit overpayments which occurred in the past from future State Pension payments; and some recoveries may relate to benefits no longer in payment or benefits where current year expenditure is very low for example the gross overpayment of Income Support in 2015-16 was estimated to be £100m, but the estimated recoveries were £120m. Netting off recoveries may therefore mask the accuracy of benefit administration in year.

Amyas Morse, head of the National Audit Office, said today:

“Issuing an audit qualification is a serious matter, and the fact that this is another in a long line of qualifications does not make it any less serious. The value of fraud and error in benefit expenditure remains unacceptably high. The Department has made good progress in understanding causes of fraud and error to develop new strategies, but has some way to go to put these into effect and achieve sustainable reductions fraud and error.”

Executives

-

Simon Collyer

Position: Founder & Director

Simon Collyer hails from Brightlingsea in Essex, a small town on the coast between Colchester & Clacton. Simon worked very successfully in the leisure marine industry in the UK and in Australia. Later in London Simon worked in the web development and publishing fields, founding a below-the-line sales promotion agency in the early nineties and then later a software company Red Banner in South Africa (2002-06). Here in South Africa, Simon became interested in the Third Sector and starting his own organisation.

-

Christopher Johnson

Position: Bookkeeping and Administration

Chris lived in Oxford for twenty years, having been educated at Magdalen College School. Chris sought a career with British Rail and spent twenty years in railway retail management ending with Virgin Trains at Euston Station. Christopher retrained in bookkeeping and accounts in 2000 and now works for Chelmsford Community Transport.

A strong, enthusiastic team player with a meticulous eye for detail, Christopher brings a range of skills to the ABC.

Team

-

Frances Rimmer

Position: Researcher

When not charming snakes Frances is a Modern History student at the University of Essex, focusing specifically on social history. The lives and experiences of the ordinary person rather than on politics or the military. Outside of her studies, Frances enjoys film and writing. As a keen roller skater who plays roller derby with the Kent Roller Girls, Frances secret wish would be to become a skating instructor and open her own rink, as she has always wanted to help people in some way, and feels it would be great to do so while also sharing her passion with like-minded people.

-

Stuart Meyers

Position: Researcher

Stuart Meyer, is a final year American Studies student at the University of Essex. Stuart focussed his academic life on global justice and the rights of migrants. Additionally Stuart has a passion for writing, both creatively and with the aim of providing accessible information to those who need it most Stuart has made a great contribution to our library of Advice Guides demonstrating his versatility by writing intelligently on a wide range of topics.

-

Louis Jones

Position: Film Maker

Louis is a 19 year old TV and film student studying at Colchester Institute. Along with hand-picked fellow students, Louis made the ‘Membership’ video that can be seen on the ABC website. Louis volunteers at, Hospital Radio Colchester, as a football commentator. A true fan of the ‘Great Game’ Louis insights have been sought after on occasions by key local media, the Colchester Daily Gazette & even BBC Essex.

-

Marcus Pierpont

Position: Film Director

Talented student film maker, Marcus Pierpoint, directed the ABC 'Membership' film which can be seen on the organizations website. Marcus has recently graduated from a BTEC course, studying Creative Media Production at Colchester Institute and he claims a true passion for films and filmmaking. Marcus also enjoys radio work and volunteers at the local hospital radio station, producing and presenting his own show. Marcus is enrolled at the University of Greenwich, and dreams of a career in the media industry.

-

Shane Mitchell

Position: Film Maker

Shane Mitchell, is another Colchester Institute Film and TV student that aspirers to be a Director of Photography in the future. Shane was the camera operator for the ABC Membership video, fun to make says Shane but it is also work he is very proud of. Shane loves all things ‘film’ and he makes videos even in his spare time.

-

Joe Corlett

Position: Film Director

Ex-student script writer/director, Joe Corlett, directed the ABC's corporate video (About Us) which is now viewable on the main website. Joe graduated from the Colchester Institute with a BTEC diploma in the field of media. Joe is passionate towards film making and hopes to continue making more that are constructed form his own material. On the side he's loves being out jogging in all terrains and when not out side he's writing scripts for future projects. Joe is now out in the world ready to start his life goal of working in the Media industry.

-

Jon Taylor

Position: Film Maker

Jonathan Taylor has been working in the media sector for 3 years and for our filming projects he worked as the production manager. John worked on graphical elements of our film, About Us for example, rendering images and making them look good on screen.

Jon is also experienced in animation and he made the logo and animation sequences in the ABC corporate videos.

Part of Jon’s brief was to also organise the administration side of filming, known collectively to admin experts the world over as ‘the paperwork’.

-

Thomas Hearn

Position: Film Maker

Thomas Hearn, has been involved in media, for about three years. Tom likes to work a lot at a computer, particularly the editing suite. For the ABC project, Tom worked on the edit itself; created and pieced together both the footage and the music, Tom created the visual elements of the ABC ‘About Us’ video and put most of the visual effects on the video.

I think we can agree that along with the rest of our youthful student team; Tom has done a very fine job indeed.

-

Max Gillard

Position: Film Maker

The last of our film team Max Gillard has recently finished college studying Creative Media Level 3 and Max hopes to continue the course on to University to someday gain a job in the media industry.

We wish Max the best of luck.

-

Harry

Position: Film Maker

My name is Harry Genge and I am an aspiring film maker. I have skills in the majority of film orientated jobs, though I am most interested in the creative roles such: Directing, Director of Photography and Writing. In my spare time I make short films, write, read, draw/paint and take the dog out for long walks.

-

Ned

Position: Producers

My name is Ned Woodcraft and I’m an aspiring Producer. As well as completing a diploma in media production I have also had a number of jobs in the professional market. I’m also a keen sailor and water sport enthusiast.

-

Brandon

Position: Producer

My name is Brandon and I’m an aspiring producer and actor. I enjoy bringing a production together with planning and preparations to create a great finished product. My hobbies also include street magic and bass playing.

-

Callum

Position: Writer and Director

My name is Callum Olive and I’m an aspiring writer and director. I’m always looking for a new project and love writing new stories and screenplays at home and on the move. My hobbies include playing the piano and street magic.

-

Joanie DeMuro

Joanie joined ABC team in early 2017. She was one of six student volunteers from the University of Essex in that cohort. The student team focused on a range of projects, including creation of Wikipedia page,‘training manual’ and most importantly, researching and adding entries to the website directory of organisations that assist the unwaged, or those on low incomes. “This placement was very helpful - thanks for the opportunity Simon.”

-

Cherry Lam

Cherry Lam has been volunteering for ABC for one month. Although it is a short period of time, she knows a lot more about the running of a charity organisation. Cherry is responsible for adding directories to the organisation website according to categories. Joining this placement helped her improving skills and gaining new experiences. Cherry says is extremely appreciative of the support she has received from ABC which allowed her to improve skills.

Join

FREE

Here