Simon Collyer

Are You Claiming the Correct Benefits?

Universal Credit has replaced a range of existing benefits, including housing benefit.

But critics of UC say it could drive people into debt because they must wait six weeks for their first payment.

It's already available to single people who would previously have claimed Jobseeker’s Allowance, but the ‘full service’ roll-out means that new claimants eligible for a wide range of benefits, such as housing benefit, child tax credit, working tax credit and some benefits for people with disabilities, will now get Universal Credit instead.

The social security system is extremely confusing, but benefits are NOT just for the unemployed.

Many families are entitled to cash from the Government but are unaware of their eligibility.

It's always worth checking what you're entitled to - so look below:

Family

Child Benefit

You may be eligible for help with your learning costs if you:

- are a full-time higher education student

- have children under 15, or under 17 if they have special educational needs

The grant:

- doesn’t have to be paid back

- is paid on top of your other student finance

- You must be eligible for student finance to apply for a Childcare Grant.

Guardian's Allowance

You could get Guardian’s Allowance if you’re bringing up a child whose parents have died. You may also be eligible if there’s one surviving parent.

The Guardian’s Allowance rate is £16.70 a week. You get it on top of Child Benefit and it’s tax-free.

Maternity

Maternity Allowance is usually paid to you if you don’t qualify for Statutory Maternity Pay.

The amount you can get depends on your eligibility.

You can claim Maternity Allowance as soon as you’ve been pregnant for 26 weeks. Payments can start 11 weeks before your baby is due.

Marriage Allowance

A way for married couples or civil partners to transfer a proportion of their personal allowance between them.

Couples must be living together, and one partner needs to not be using their full personal allowance while the other must be a basic-rate taxpayer.

Widowed Parent

- your husband, wife or civil partner died before 6 April 2017

- you’re under State Pension age

- you’re entitled to Child Benefit for at least one child and your late husband, wife or civil partner was their parent

- your late husband, wife or civil partner paid National Insurance contributions, or they died as a result of an industrial accident or disease

- You may also claim WPA if you’re pregnant and your husband has died, or you’re pregnant after fertility treatment and your civil partner has died.

- If your husband, wife or civil partner died on or after 6 April 2017 you may be eligible for Bereavement Support Payment instead.

You can’t claim WPA if you:

- were divorced from your husband, wife or civil partner when they died

- remarry or are living with another person as if you’re married to them or as if you’ve formed a civil partnership

- were over State Pension age when you were widowed or became a surviving civil partner – you may be able to get extra State Pension

- are in prison

- The workplace

Tax Credit

You’ll need to answer a few questions before you can order a tax credits claim form. You can do this by:

- using the online tool

- calling the Tax Credit Office

- If it looks like you qualify, you’ll be able to order a claim form. It will take up to 2 weeks for the form to arrive.

Low income

Income support

You may be able to get Income Support if you meet all the eligibility criteria.

JSA

There’s a maximum amount you can get - but how much you’re entitled to depends on things like your age, income and savings.

Use a benefits calculator to check how much JSA you can get, and how your other benefits will be affected.

| Age | JSA weekly amount |

| 18 to 24 | up to £57.90 |

| 25 or over | up to £73.10 |

| Couples (both aged over 18) | up to £114.85 |

Employment support allowance

If you’re ill or disabled, Employment and Support Allowance (ESA) offers you:

- financial support if you’re unable to work

- personalised help so that you can work if you’re able to

- You can apply for ESA if you’re employed, self-employed or unemployed.

- You might be transferred to ESA if you’ve been claiming other benefits like Income Support or Incapacity Benefit.

- You must have a Work Capability Assessment while your ESA claim is being assessed. This is to see to what extent your illness or disability affects your ability to work.

- You’ll then be placed in one of 2 groups if you’re entitled to ESA:

- work-related activity group, where you’ll have regular interviews with an adviser

- support group, where you don’t have interviews

How much ESA you get depends on:

- your circumstances, such as income

- the type of ESA you qualify for

- where you are in the assessment process

Pension credit

Pension Credit is an income-related benefit made up of 2 parts - Guarantee Credit and Savings Credit.

Guarantee Credit tops up your weekly income if it’s below £159.35 (for single people) or £243.25 (for couples).

Savings Credit is an extra payment for people who saved some money towards their retirement, for example a pension.

Housing benefit

You could get Housing Benefit to help you pay your rent if you’re on a low income.

Housing Benefit can pay for part or all of your rent. How much you get depends on your income and circumstances.

You can apply for Housing Benefit whether you’re unemployed or working.

Council tax support

You could be eligible if you’re on a low income or claim benefits. Your bill could be reduced by up to 100%.

You can apply if you own your home, rent, are unemployed or working.

What you get depends on:

- where you live - each council runs its own scheme

- your circumstances (eg income, number of children, benefits, residency status)

- your household income - this includes savings, pensions and your partner’s income

- if your children live with you

- if other adults live with you

- Free school meals

All KS1 children (reception, year one and year two) are entitled to free school meals but once they reach KS2 they will have to pay.

However, your child might be able to get free school meals if you get any of the following:

Income Support

- income-based Jobseeker’s Allowance

- income-related Employment and Support Allowance

- support under Part VI of the Immigration and Asylum Act 1999

- the guaranteed element of Pension Credit

Child Tax Credit (provided you’re not also entitled to Working Tax Credit and have an annual gross income of no more than £16,190)

Working Tax Credit run-on - paid for 4 weeks after you stop qualifying for Working Tax Credit

Universal Credit

Mortgage support

If you’re a homeowner getting certain income-related benefits you might be able to get help towards interest payments on:

- your mortgage

- loans you’ve taken out for certain repairs and improvements to your home

Budgeting loan

A Budgeting Loan can help pay for:

- furniture or household items (for example, washing machines or other ‘white goods’)

- clothes or footwear

- rent in advance

- costs linked to moving to a new home

- maintenance, improvements or security for your home

- travelling costs within the UK

- costs linked to getting a new job

- maternity costs

- funeral costs

- repaying hire purchase loans

- repaying loans taken for the above items

You’re only eligible for a Budgeting Loan if you’ve been on certain benefits for 6 months.

Funeral payment

To get Funeral Expenses Payment you must:

- get certain benefits or tax credits

- meet the rules on your relationship with the deceased

- be arranging a funeral in the UK, the European Economic Area (EEA) or Switzerland

Local council support schemes

From April 2013 each local authority is responsible for providing help to its residents struggling with an emergency,

Cold weather payments

These are to help with gas and electricity costs during cold weather.

They are automatically paid if the average temperature where you live is recorded as, or is forecast to be, zero degrees Celsius or below over seven consecutive days between November and March.

Healthcare

Attendance Allowance

If you're over 65 and need frequent help with personal care, or someone to supervise you, Attendance Allowance can help.

You'll need to provide full details of how you need help, eg, toileting, dressing, washing, eating or supervision to avoid harm to yourself and others. But it can help with physical problems (including sensory, such as blindness), mental problems (including learning difficulties), or both.

Disability Living Allowance

Disability Living Allowance (DLA) is a tax-free benefit for disabled people who need help with mobility or care costs.

If you’re aged 16 to 64 and not currently getting DLA, you may be able to claim Personal Independence Payment (PIP) instead.

If you were born after 8 April 1948 and you’re already claiming, you’ll continue to get DLA until the Department for Work and Pensions (DWP) writes to tell you when your DLA will end and invites you to apply for Personal Independence Payment (PIP).

Unless your circumstances change, you don’t need to do anything until you hear from DWP about your DLA.

Carer's Allowance

You could get £62.70 a week if you care for someone at least 35 hours a week and they get certain benefits.

You don’t have to be related to, or live with, the person you care for.

You won’t be paid extra if you care for more than one person.

Contribution-based Employment Support Allowance

You may be able to get new style Employment and Support Allowance (ESA) if you’re ill or unable to work and meet the entry conditions for Universal Credit (UC) in the area you live. UC is available for single people throughout Great Britain, it is also available to couples and families in some jobcentre areas.

You may get new style ESA if you have a fit note and have paid or been credited with enough National Insurance Contributions.

New style ESA can be claimed instead of, or as well as, UC depending on your circumstances. If you claim both benefits your new style ESA payment will be deducted from your UC payment.

Work Capability Assessment

You must have a Work Capability Assessment while your claim for new style ESA is being assessed.

This is to understand how your illness or disability affects your ability to work. If you’re claiming both UC and new style ESA, you’ll only attend one Work Capability Assessment.

The Department for Work and Pensions will arrange this for you.

Initially you can claim new style ESA for up to 365 days. After 365 days, your entitlement will end and your work coach will advise you of your options.

This time limit does not apply if you’re assessed to have limited capability for work and work related activity.

You’ll be informed of the outcome of your assessment and what to do next.

Statutory Sick Pay

This is paid to employees if they are off sick from work for more than four days, for a period of up to 28 weeks.

State Pension

The Basic State Pension is a Government-administered scheme, funded by National Insurance contributions, to give those who have reached the Government-defined retirement age a guaranteed weekly income.

Bereavement Allowance

You may get Bereavement Allowance if all the following apply:

- your husband, wife or civil partner died before 6 April 2017

- you were 45 or over when your husband, wife or civil partner died

- you’re under State Pension age

- your late husband, wife or civil partner paid National Insurance contributions, or they died as a result of an industrial accident or disease

You won’t get Bereavement Allowance if you:

- are bringing up children - you can claim Widowed Parent’s Allowance instead

- remarry or form a new civil partnership

- live with another person as if you’re married or in a civil partnership

- were divorced from your husband, wife or civil partner before their death

- were over State Pension age when you were widowed or became a surviving civil partner - you may be able to get extra State Pension

- are in prison

Bereavement Payment

You may be able to get a £2,000 Bereavement Payment if your spouse or civil partner died before 6 April 2017. This is a one-off, tax-free, lump-sum payment.

If your spouse or civil partner died on or after 6 April 2017 you may be eligible for Bereavement Support Payment instead.

You may be able to get Bereavement Payment if, when your husband, wife or civil partner died, you were either:

- under State Pension age

- over State Pension age and your husband, wife or civil partner wasn’t entitled to a State Pension based on their own national insurance contributions

Additionally, your husband, wife or civil partner must have either:

- paid enough National Insurance contributions

- died because of an industrial accident or disease

- When you can’t get Bereavement Payment

- You can’t get Bereavement Payment if any of the following are true:

- you were divorced from your husband, wife or civil partner

- you’re living with another person as husband, wife or civil partner

- you’re in prison

Winter Fuel

If you were born on or before 5 August 1953 you could get between £100 and £300 to help you pay your heating bills. This is known as a ‘Winter Fuel Payment’.

You usually get a Winter Fuel Payment automatically if you’re eligible and you get the State Pension or another social security benefit (not Housing Benefit, Council Tax Reduction, Child Benefit or Universal Credit).

If you’re eligible but don’t get paid automatically, you’ll need to make a claim

Image: Jobcentre Plus

HMRC Having to Make Tough Decisions Due To Lack of Resources

MPs have warned HMRC’s attempts at modernising amount to a ‘precarious high-wire act’ that threatens welfare claimants.

A report from the Public Accounts Committee (PAC) published today warns HM Revenue & Customs has to make ‘tough decisions’ on how it allocates limited resources to its operations.

HMRC is currently undertaking 15 major transformation programmes, all while preparing for Brexit.

The committee is concerned this will have a negative impact on the taxpayer and, in particular, questioned whether HMRC is doing enough to support vulnerable Tax Credits recipients, especially as they transfer to Universal Credit.

The MPs also said there was a lack of incentive for HMRC to reduce Tax Credits fraud and error in the transition period to the benefits system.

‘HMRC's transformation programme would have been less risky had it not attempted to do everything at the same time,’ said the committee chair Meg Hillier MP.

‘What was already a precarious high-wire act is now being battered by the winds of Brexit, with potentially catastrophic consequences.’

‘HMRC accepts something has to give and it now faces difficult decisions on how best to use its limited resources—decisions that must give full consideration to the needs of all taxpayers,’ continued Ms Hillier.

‘In particular we are concerned about the effect on people simply trying to pay their fair share. HMRC’s customer service has improved on the appalling levels of recent years but its claims about call-answering times don’t stack up. Any new deterioration would be wholly unacceptable.

‘There are concerns too about the impact of changes in the welfare system, which could increase the financial risks faced by vulnerable Tax Credits claimants. At the same time, the level of Tax Credits fraud and error has gone up and is only going to get worse.

‘These are serious, pressing challenges for HMRC, requiring swift and coordinated action in Government. As a matter of urgency the authority must set out a coherent plan and demonstrate it is fit for the future.’

Joseph Rowntree Foundation Says 2018 Will Be a Difficult Year

2018 is set to be a difficult year for low-income households, as average price inflation for the UK stands at its highest since April 2012. But it’s not just price inflation that’s hitting low-income families hard, says Laurie Heykoop.

For most of last year, price rises outpaced wages, especially in sectors such as retail and hospitality which employ many low-income workers. The financial pressure is even worse for low-income families receiving working-age benefits and tax credits, frozen since April 2016, and they are paying more in five key areas:

1 Paying more for public transport

Train price rises have received a great deal of media attention, but bus and coach transport are often more important for low-income households, especially outside London and the South East. The cost of bus and coach travel has increased by a huge 13.9% in the last year. Low-income households that regularly use buses will pay an average additional £116.15 per year for their fares in 2018. Transport costs or availability can have knock-on effects if they restrict people’s ability to reach better-value shops, jobs or services. Keeping bus travel affordable is vital to enable people on low incomes to buy low-price food, get and keep jobs and access health and other services.

2 Paying more for food and energy

In addition the cost of some essential goods and services has been rising even faster than average inflation. Energy bills have increased by 6.4% since last year, with electricity alone increasing by a massive 11.4%. Typical households in the bottom fifth of incomes will now be paying £61.86 more compared to last year for the same energy use. Food prices have also been rising faster than average, at 4.3% over the past year. It will cost an additional £67.81 per year for a family in the poorest fifth for the same weekly shop in 2018.

These price rises hit poorer households especially hard. Households in the bottom fifth of income spend twice as much of their income on food and fuel compared with households in the top fifth. Just to cover those food and energy basics, families will need to find an extra £130 this year.

Infographic showing the increases in the price of food and fuel costs to the UK's poorest households cost an extra £130 per year.

3 Paying the 'poverty premium'

But in addition to price rises, many low-income households end up paying more for basic goods and services than households on higher incomes (known as the ‘poverty premium’). Some low-income households pay their bills through pre-payment meters as a strategy to manage finances: they're worse value but offer more certainty over the ability to pay. Other coping strategies involve low-income parents cutting back on spending for themselves in order to prioritise money for their children’s needs.

4 Dealing with debt

Rising prices and stagnating incomes combine to place unsustainable pressure on family finances. For those already struggling to get by it can lead to falling behind with bills or building up debt. A fifth of low-income households experience ‘problem debt’. Our research on destitution found that most people experiencing destitution had been behind on bills within the year, most frequently cited were rent or council tax, followed by energy and water.

5 The benefit freeze

In April the Government’s freeze on working-age benefits and tax credits will enter its third year. In 2018, a couple with children claiming Universal Credit will be up to £500 worse off, and a lone parent with children will be up to £400 worse off, due to the benefit freeze. In 2020/21, nearly 400,000 more people are likely to be in poverty due to the benefit freeze, the vast majority in working households. After a disappointing lack of action in 2017, the Spring Budget brings another opportunity to ease the pressure on low-income families by ending the freeze.

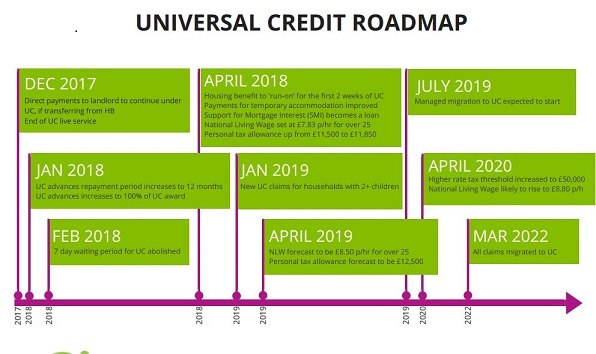

Universal Credit Roadmap, DWP Failings and Campaign to Sack Ester McVey First Day In The Job

Policy in Practise have produced this useful UC Roadmap.

More than a million calls to Universal Credit helpline have gone unanswered in the past year.

New figures uncovered by a Labour MP said the sheer number of calls going without answer could mean many claimants were giving up and will not get the support they need.

The roll-out of Universal Credit has been delayed and this latest news is further evidence of a failed system.

Meanwhile the campaign to sack Ester McVey is growing in strength. Click on the image to go to the Campaign on 38 Degrees.

Image: Sack Esther McVey from the recently appointed post as the Department of Work and Pensions secretary.

Support for Carers Live DWP Select Committee

Work and Pensions Committee

Wednesday 10 January 2018 Meeting starts at 9.30am

Agenda

Subject: Support for carers

Witnesses: Emily Holzhausen OBE, Carers UK, Sarah Jackson OBE, Chief Executive, Working Families, and Moira Wilkinson, Network Manager, Carers Trust

Witnesses: Nicola Best, Building Better Opportunities Project Mentor, Northamptonshire Carers, Fiona Malpas, Project Manager, Carers Support Centre (Bristol and South Gloucestershire), and Joanne Speed, Former CEO, Dove Service (Staffordshire)

Witnesses: Laurence Beckett, People Business Partner, Savings and Retirement, UK, Aviva, and Arthur Allen MBE, Founder, Listawood.

Live Wednesday The Eleventh - Welsh Assembly Inquiry into Rough Sleeping In Wales

This week, Plaid Cymru will hold a debate in the National Assembly to urge the Welsh Government to change the ‘priority need’ system so that there is a duty to secure safe accommodation for all homeless people.

This would be part of a move towards adopting a ‘housing first’ philosophy that regards housing as a basic right, and regards it as the basic necessity that must be met before other needs can be successfully addressed or supported.

Not only will this increase the protection for people who are facing homelessness, but adopting a preventative approach is also far more cost-effective.”

Image: The Welsh Assembly.

Equality, Local Government and Communities Committee

11 January 2018

You can watch the debate live here:

UC Changes Please Landlords

Government changes to Universal Credit which will make it easier for direct payments to be made to landlords have been welcomed by the Residential Landlords Association (RLA).

The Department for Work and Pensions (DWP) has confirmed to the trade body that landlords will no longer need tenants’ consent when applying for Alternative Payment Arrangements, or APAs.

Justine Greening Turns Down DWP

Justine Greening has resigned from the government after refusing a job as work and pensions secretary in Theresa May's cabinet reshuffle.

In her resignation statement she said: "Social mobility matters to me and our country more than a ministerial career.

"I'll continue to work outside of government to do everything I can to create a country for the first time that has equality of opportunity for young people wherever they are growing up."

Ms Greening's resignation comes less than a month after she launched the government's social mobility strategy.

Image: Justine Greening resigns.

Responding to Justine Greening stepping down as Education Secretary, Vince Cable, Leader of the Liberal Democrats, said: "Justine Greening has been pushed out of government. The only rational explanation would be that this is an acknowledgement that the Conservatives have a failed schools policy".

Live from Westminster - The Effect of Universal Credit on The Private Rented Sector

The Conservative's roll out of Universal Credit risks driving up homelessness, Stephen Lloyd, Liberal Democrat Work and Pensions Spokesperson, will warn in his Westminster Hall debate this morning.

Lloyd is leading calls for the reform of the housing benefit element of Universal Credit before a “disaster occurs in an already dysfunctional housing market”.

He will call on the Department for Work and Pensions to make some further changes to the way they administer the housing element of Universal Credit before it is too late.

Speaking ahead of the debate Stephen Lloyd warned:

"If further urgent changes are not made to the Government’s new benefit, Universal Credit, homelessness will skyrocket and the private rental sector will prove even more resistant to tenants on benefits.

"The government has the opportunity to improve the chronic housing shortage across the country by making Universal Credit payments to landlords the default option.

"Despite the chaos created by the shambolic rollout of Universal Credit, opportunities for positive action remain if the government actually listens to those trying to make the system work."

The Westminster Hall Debate will take place at 0930 this morning (Tuesday 9 January) and can be viewed live below

AGENDA

The effect of universal credit on the private rented sector - nominated by the Backbench Business Committee. Stephen Lloyd MP (Eastbourne, Liberal Democrat)

A recent study carried out by the Residential Landlords Association shows that almost 87% of landlords would not be willing to let their properties to claimants of Universal Credit, while 38% have already experienced UC tenants going into arrears. A separate study commissioned by Crisis and the Joseph Rowntree Foundation found that 90% of local authorities were concerned that UC would increase homelessness.

Luton airport expansion. Bim Afolami MP (Hitchin and Harpenden, Conservative)

Esther McVey appointed as new Secretary of State for Work and Pensions

Tatton MP Esther McVey has been appointed as the new secretary of state for work and pensions, Downing Street has confirmed. McVey is the first new female cabinet minister announced since Theresa May started her January reshuffle and she is an extremely controversial appointment.

McVey lost her seat in the Wirral West constituency following the 2015 general election but was re-elected as MP for Tatton in 2017.

Esther McVey was ditched by the electorate, it is alledged, because of her work with the DWP and she is strongly associated with the multiple deaths associated with DWP policies at the time. The harm being done to the disabled.

Esther McVey has been deputy chief whip since November 2017. Solicitor David Gauke, former work and pensions minister, will take over as Lord Chancellor and justice secretary, a notable promotion. With the Universal Credit roll-out struggling, hard-liner, McVey with be taking on a challenging task.

Labour's John McDonnall, shadow chancellor, once described Esther McVey as a 'stain on inhumanity'.

Executives

-

Simon Collyer

Position: Founder & Director

Simon Collyer hails from Brightlingsea in Essex, a small town on the coast between Colchester & Clacton. Simon worked very successfully in the leisure marine industry in the UK and in Australia. Later in London Simon worked in the web development and publishing fields, founding a below-the-line sales promotion agency in the early nineties and then later a software company Red Banner in South Africa (2002-06). Here in South Africa, Simon became interested in the Third Sector and starting his own organisation.

-

Christopher Johnson

Position: Bookkeeping and Administration

Chris lived in Oxford for twenty years, having been educated at Magdalen College School. Chris sought a career with British Rail and spent twenty years in railway retail management ending with Virgin Trains at Euston Station. Christopher retrained in bookkeeping and accounts in 2000 and now works for Chelmsford Community Transport.

A strong, enthusiastic team player with a meticulous eye for detail, Christopher brings a range of skills to the ABC.

Team

-

Frances Rimmer

Position: Researcher

When not charming snakes Frances is a Modern History student at the University of Essex, focusing specifically on social history. The lives and experiences of the ordinary person rather than on politics or the military. Outside of her studies, Frances enjoys film and writing. As a keen roller skater who plays roller derby with the Kent Roller Girls, Frances secret wish would be to become a skating instructor and open her own rink, as she has always wanted to help people in some way, and feels it would be great to do so while also sharing her passion with like-minded people.

-

Stuart Meyers

Position: Researcher

Stuart Meyer, is a final year American Studies student at the University of Essex. Stuart focussed his academic life on global justice and the rights of migrants. Additionally Stuart has a passion for writing, both creatively and with the aim of providing accessible information to those who need it most Stuart has made a great contribution to our library of Advice Guides demonstrating his versatility by writing intelligently on a wide range of topics.

-

Louis Jones

Position: Film Maker

Louis is a 19 year old TV and film student studying at Colchester Institute. Along with hand-picked fellow students, Louis made the ‘Membership’ video that can be seen on the ABC website. Louis volunteers at, Hospital Radio Colchester, as a football commentator. A true fan of the ‘Great Game’ Louis insights have been sought after on occasions by key local media, the Colchester Daily Gazette & even BBC Essex.

-

Marcus Pierpont

Position: Film Director

Talented student film maker, Marcus Pierpoint, directed the ABC 'Membership' film which can be seen on the organizations website. Marcus has recently graduated from a BTEC course, studying Creative Media Production at Colchester Institute and he claims a true passion for films and filmmaking. Marcus also enjoys radio work and volunteers at the local hospital radio station, producing and presenting his own show. Marcus is enrolled at the University of Greenwich, and dreams of a career in the media industry.

-

Shane Mitchell

Position: Film Maker

Shane Mitchell, is another Colchester Institute Film and TV student that aspirers to be a Director of Photography in the future. Shane was the camera operator for the ABC Membership video, fun to make says Shane but it is also work he is very proud of. Shane loves all things ‘film’ and he makes videos even in his spare time.

-

Joe Corlett

Position: Film Director

Ex-student script writer/director, Joe Corlett, directed the ABC's corporate video (About Us) which is now viewable on the main website. Joe graduated from the Colchester Institute with a BTEC diploma in the field of media. Joe is passionate towards film making and hopes to continue making more that are constructed form his own material. On the side he's loves being out jogging in all terrains and when not out side he's writing scripts for future projects. Joe is now out in the world ready to start his life goal of working in the Media industry.

-

Jon Taylor

Position: Film Maker

Jonathan Taylor has been working in the media sector for 3 years and for our filming projects he worked as the production manager. John worked on graphical elements of our film, About Us for example, rendering images and making them look good on screen.

Jon is also experienced in animation and he made the logo and animation sequences in the ABC corporate videos.

Part of Jon’s brief was to also organise the administration side of filming, known collectively to admin experts the world over as ‘the paperwork’.

-

Thomas Hearn

Position: Film Maker

Thomas Hearn, has been involved in media, for about three years. Tom likes to work a lot at a computer, particularly the editing suite. For the ABC project, Tom worked on the edit itself; created and pieced together both the footage and the music, Tom created the visual elements of the ABC ‘About Us’ video and put most of the visual effects on the video.

I think we can agree that along with the rest of our youthful student team; Tom has done a very fine job indeed.

-

Max Gillard

Position: Film Maker

The last of our film team Max Gillard has recently finished college studying Creative Media Level 3 and Max hopes to continue the course on to University to someday gain a job in the media industry.

We wish Max the best of luck.

-

Harry

Position: Film Maker

My name is Harry Genge and I am an aspiring film maker. I have skills in the majority of film orientated jobs, though I am most interested in the creative roles such: Directing, Director of Photography and Writing. In my spare time I make short films, write, read, draw/paint and take the dog out for long walks.

-

Ned

Position: Producers

My name is Ned Woodcraft and I’m an aspiring Producer. As well as completing a diploma in media production I have also had a number of jobs in the professional market. I’m also a keen sailor and water sport enthusiast.

-

Brandon

Position: Producer

My name is Brandon and I’m an aspiring producer and actor. I enjoy bringing a production together with planning and preparations to create a great finished product. My hobbies also include street magic and bass playing.

-

Callum

Position: Writer and Director

My name is Callum Olive and I’m an aspiring writer and director. I’m always looking for a new project and love writing new stories and screenplays at home and on the move. My hobbies include playing the piano and street magic.

-

Joanie DeMuro

Joanie joined ABC team in early 2017. She was one of six student volunteers from the University of Essex in that cohort. The student team focused on a range of projects, including creation of Wikipedia page,‘training manual’ and most importantly, researching and adding entries to the website directory of organisations that assist the unwaged, or those on low incomes. “This placement was very helpful - thanks for the opportunity Simon.”

-

Cherry Lam

Cherry Lam has been volunteering for ABC for one month. Although it is a short period of time, she knows a lot more about the running of a charity organisation. Cherry is responsible for adding directories to the organisation website according to categories. Joining this placement helped her improving skills and gaining new experiences. Cherry says is extremely appreciative of the support she has received from ABC which allowed her to improve skills.

Join

FREE

Here