Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Rich Should Expect a 'Bloody Nose' In The Budget Says deVere Group CEO

AUTUMN BUDGET PREDICTIONS - Nigel Green, CEO and founder of deVere Group is warning the rich that the Chancellor will be after their cash in the buget.

Higher earners should take steps now to mitigate the considerable financial hit they could face from Chancellor Rishi Sunak’s “major tax hikes,” warns the boss of one of the world’s largest financial advisory and fintech organisations.

The warning from Nigel Green, CEO and founder of deVere Group, comes following reports that Mr Sunak is looking to boost taxes in an effort to pay for Britain’s coronavirus recovery.

According to the front pages on Sunday, the Treasury is drawing up fresh plans to raise at least £30bn a year to help cover the cost of massive public spending triggered by the pandemic.

The blueprint says the Chancellor is considering a range of possible new measures to collect the cash, including raising capital gains tax, corporation tax and income tax, slashing pension tax relief, raising fuel duty, bringing in a new online sales tax and shaking-up the inheritance tax system.

Mr Green says: “Major tax raids and relief cuts are on their way – and it is higher earners who are going to be targeted.

“Even a Treasury source admitted that the political reality is that ‘the only place you get the money is from the better-off’.

“It’s clear the Budget will deliver a considerable financial hit for higher earners.”

He continues: “As such, these people would be wise to take steps now – ahead of the November Budget - to mitigate the impact.

“They should be considering all the available and legitimate financial planning options available to them, including international options, in order to grow and protect their wealth.”

Earlier this month, a deVere Group poll revealed that six out of 10 higher earners in the UK, or those living overseas who have financial links to Britain, are concerned about the adverse impact on their assets of the 2020 Budget.

Mr Green continues: “Mr Sunak should resist the simple ‘soak-the-rich’ measures.

“He should not try to tax his way out of the downturn – instead, he must drive long-term sustainable economic growth policies.

“Whilst this way would be more effective, it is harder to do both economically and politically, and is, therefore, unlikely to happen.”

The deVere CEO continues: “Higher earners should expect to get a bloody nose from the Budget and should take action sooner rather than later to mitigate the burden.”

ABC Comment: 1 April 2020. The charge to Corporation Tax and the main rate will also be set at 19% for the financial year beginning 1 April 2021 not reduce to 17% as had been talked about. 1 April 2020. The charge to Corporation Tax and the main rate will also be set at 19% for the financial year beginning 1 April 2021. Ordinary folk pay around 40% in Tax and NI. An average worker pays £11,000 a year in tax to the Government - around £30 a day. ... National Insurance and income tax account for the remaining £6,000, with the total bill equating to 40pc of average earnings.

Looking at a new job? This calculator should assist:

ABC Comment, have your say below:

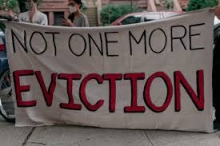

The Eviction Moratorium Has Changed Once More - Both Tenants and Landlords Claiming a Win

EVICTIONS – Boris has changed his stance yet again regarding the eviction moratorium. The changes have been announced over the Bank Holiday and will come into force Saturday 29 August. The ABC has been speaking on the radio recently about the Eviction Moratorium and interestingly it appears our voice and the voice of others lobbying on this matter has been heard. Landlords associations are also claiming victory in that they can evict anti-social tenants, domestic abuse cases and those with substantial arrears.

Nearly two in five of the country’s 2.4 million private landlords have experienced rent arrears over the past year. According to the Times 600,000 tenats have stopped paying rent or are paying it at a reduced rate.

ARLA Propertymark is the UK’s foremost professional and regulatory body for letting agents; representing over 9,000 members.ARLA Propertymark, along with five other leading organisations representing tenants, landlords and letting agents. These organisations have united to urge the UK Government to provide financial help to private renters plunged into rent arrears during the pandemic through no fault of their own. ARLA Propertymark is arguing the UK Government must turn its attention to supporting tenants who have built up arrears specifically through COVID-19 related issues and deliver a package of emergency measures to help maintain tenancies

The government has changed the law so most renters have a 6 month notice period however, some renters have had their eviction term reduced.

Legislation has now been introduced, so landlords must now give tenants 6 months’ notice before they can evict until March 2021, except in the most serious of cases, such as incidents of anti-social behaviour and domestic abuse perpetrators.

The stay on possession proceedings has been extended until 20 September, meaning that in total no tenant can have been legally evicted for 6 months at the height of the pandemic.

The package of support for renters includes the extension of notice periods and the extension to the stay on possession proceedings. For the most egregious cases, notice periods have returned to their pre-coronavirus levels, and landlords will be able to progress serious rent arrears cases more quickly.

These changes mean that from 29 August, landlords must provide at least 6 months’ notice period before seeking possession through the courts in most cases, including section 21 evictions and rent arrears under 6 months.

Notices served on and before 28 August are not affected by these changes, and must be at least 3 months.

Image: The Prime Minister is feeling the heat from back benchers as the governments populariity slumps.

The government is also helping landlords affected by the worst cases to seek possession; these are:

- anti-social behaviour (now 4 weeks’ notice)

- domestic abuse (now 2 to 4 weeks’ notice)

- false statement (now 2 to 4 weeks’ notice)

- over 6 months’ accumulated rent arrears (now 4 weeks’ notice)

- breach of immigration rules ‘Right to Rent’ (now 3 months’ notice)

In addition, new court rules have been agreed, which will come into force on 20 September meaning landlords will need to set out in their claim any relevant information about a tenant’s circumstances, including information on the effect of the COVID-19 pandemic. Where this information is not provided, judges will have the ability to adjourn proceedings.

Image: Secretary of State for Housing, Rt Hon Robert Jenrick MP.

Secretary of State for Housing, Rt Hon Robert Jenrick MP said:

We have developed a package of support for renters to ensure they continue to be protected over winter. I have changed the law so that renters are protected by a 6 month notice period until March 2021.

No tenant will have been legally evicted for 6 months at the height of the pandemic as the stay on possession proceedings has been extended until 20 September. For the most egregious cases, for example those involving anti-social behaviour or domestic abuse perpetrators, notice periods have returned to their normal level, and landlords will be able to progress serious rent arrears cases more quickly.

These changes will support landlords to progress the priority cases while keeping the public safe over winter. We will keep these measures under review and decisions will continue to be guided by the latest public health advice.

The new legislation applies to both the private and social rented sectors in England, and to all new notices in relation to assured, assured shorthold, secure, flexible, introductory and demoted tenancies and those under the Rent Act 1977, but not to any notices issued before the legislation comes into force.

Courts will carefully prioritise the most egregious cases, including anti-social behaviour, fraud, and domestic abuse, ensuring landlords are able to progress the most serious cases, such as those involving anti-social behaviour and other crimes.

Further information

If a landlord made a claim to the court before 3 August, they must notify the Court and their tenant that they still intend to seek repossession before the case will proceed, including in section 21 cases.

More detailed guidance on using the courts and the new arrangements will be made available in advance of possession proceedings starting again.

We are conscious of the pressure on landlords during this difficult time and do not want to exacerbate this. Of course, it is important that tenants who are able to do so must continue to pay their rent.

The government has put in place an unprecedented support package to support tenants to pay their living costs, such as the Coronavirus Job Retention Scheme, £9.3 billion of additional support through the welfare system, and increasing the Local Housing Allowance rate to the 30th percentile.

We are committed to bringing forward the Renters Reform Bill to abolish section 21 and deliver a fairer and more effective rented sector in due course. However, such legislation must balance greater security of tenure with an assurance that landlords are able to recover their properties where they have valid reasons to do so.

We have been working closely with the judiciary through a Master of the Rolls led Working Group to finalise the arrangements on the prioritisation of cases, for when the stay on possession proceedings lifts from 20 September.

29 August, landlords must provide at least 6 months’ notice period prior to seeking possession through the courts in most cases, including section 21 evictions and rent arrears under 6 months. We have also extended the validity of a section 21 notice from 6 to 10 months to accommodate this change.

ABC Comment, have your say below:

Virgin Media Essential Broadband Launches

BROADBAND - Virgin Media has announced a new broadband service targeted specifically at customers facing financial difficulty and uncertainty in these challenging times.

The broadband-only plan, called “Virgin Media Essential Broadband”, will be available to those receiving Universal Credit and will come with a speed of 15 Mbps and a fixed price of £15 per month, with no fixed-term contract length and no price changes while benefit payments are being received. The service will launch in the Autumn.

Available initially for existing Virgin Media customers, they will be able to take the new service by simply filling out an online form and providing proof of their Universal Credit status.

The introduction of this new product is the latest initiative from Virgin Media following previous proactive steps designed to help and support vulnerable customers.

Continued support for vulnerable customers

Last year Virgin Media was the first provider to announce measures that help overcome some of the obstacles that vulnerable customers can face in the marketplace. This included introducing annual package reviews, more flexible bill management through a specialist team and bespoke engineer visits. In 2016, the provider introduced its Talk Protected phone-only plan.

This gave those customers over the age of 65 or those with additional accessibility needs a fixed-price home phone plan, with inclusive evening and weekend calls to UK landlines and mobiles alongside other benefits.

Virgin Media has also taken action during the Covid crisis to give customers the connectivity, data, entertainment and flexibility needed. This included providing 10GB of mobile data at no extra cost; introducing more kids and entertainment programming; removing data caps on any broadband plans that still had them, and giving customers more flexibility over their services such as the ability to temporarily pause sports subscriptions when live events were suspended.

Jeff Dodds, Chief Operating Officer at Virgin Media, said: “We know that these are tough times and that there are many people finding it more difficult to make ends meet and facing financial uncertainty. At the same time, the role of broadband in helping people to stay connected has never been clearer. Whether it’s keeping in touch with friends and family, finding advice and support or searching for jobs and working remotely – broadband underpins it all.

“With this all in mind, we wanted to make sure that those customers receiving benefit payments were able to access reliable, hassle-free connectivity with enough speed to carry out essential online activities.

“Building on the industry-leading initiatives we’ve already launched for vulnerable customers, we’ll continue to work tirelessly to keep the country connected and support our customers in whatever way we can.”

Matt Warman, Minister for Digital Infrastructure, said: “Having affordable access to the internet can improve people's quality of life, connecting them with friends and family and giving them a tool to build a brighter future. That is why the government brokered major deals with broadband companies to support those struggling to pay bills right now.

“I want to see continued efforts to protect consumers beyond the pandemic and welcome Virgin Media offering a permanent package giving vulnerable and low-income families the flexibility to continue to benefit from reliable connectivity.”

Universal credit recipients rose during lockdown

The latest official figures show that there were 5.6 million people on Universal Credit at 9 July 2020 – which is an increase of 2% from June 2020. Of those, 42% of claimants were in the ‘searching for work’ conditionality group, an increase of 6% from March 2020.

The economic pressures of lockdown did see an increase in claimants with 2.4 million starts to Universal Credit between 13 March and 14 May 2020, with young people making up a greater proportion of starts compared to pre-lockdown. However, benefit claims made have reduced to 240,000 in the 4 weeks to 9 July 2020.

Virgin Media’s network passes 15.1 million premises which is more than half of the UK.

ABC Comment - The ABC suggested reduced rates for broadband for customers on benefits some time ago.

ABC Comment have your say below:

Government Promotes New Service Targeted At Those Moving Home

MOVING HOME - New figures released by DVLA show that around 66% of all customers who change the address on their driving licence now do so online. With August traditionally being the peak house moving month in the UK, DVLA is today (27 August) reminding motorists how simple it is to keep their address up to date online, to avoid pitfalls including missed reminders.

As well as driving licences, around 1.5 million vehicle log books are also updated with a new address every year. Following the housing market opening up post-lockdown, DVLA launched the new online service for motorists to update the address on their vehicle log book (V5C) without needing to post documents to DVLA. Over 130,000 log books have so far been updated and sent to customers using this service, which speeds up the process to receive a new log book – reducing waiting times from 6 weeks to just 5 working days.

DVLA’s online service to update the address on a driving licence has been available for several years but has never been more popular, with DVLA processing around 2.2 million changes of address from customers who used this service last year alone. Now, with the addition of the new online service, customers can update the address on both their driving licence and log book in less than 5 minutes on GOV.UK.

ABC Comment, have your say below:

DWP Issues Recruitment Guidance For Employers

DWP - The DWP has published guidance to support employers through the recruitment process. This is to promote re-entry into employment for the many employees whose jobs may unfortunately be impacted by the pandemic.

Recruitment support and information for employers offers tips for virtual recruiting and onboarding and also sends a message to look at applicants’ transferable skills and not just their work history.

The DWP comments that “This is particularly important at the moment as many people will need to move from one sector to another”. This is likely to be an increasing trend and Personnel Today, has published a report showing that already half of new starters during the pandemic moved from another industry.

Inclusive recruitment support offers guidance about employing people from a variety of backgrounds. It is notable as, rather than focusing on high profile diversity challenges such as BAME, it has sections on groups who may not be at the forefront of diversity campaigns such as returners (after extended career breaks), homeless people and ex-offenders.

ABC Note: Information supplied courtesy of solicitors Pinset Masons.

ABC Comment, have your say below:

DWP Minister Thérèse Coffey Appears Reluctant to Meet Scotland's Social Security Committee Say Scots

SCOTLAND - DWP Minister Thérèse Coffey seems reluctant to appear in front of Scotlands Social Security Committee. The Tory Work and Pensions Secretary is set to visit Stranraer and Glasgow this week.

In a letter to Work and Pensions Secretary Thérèse Coffey, Holyrood’s Social Security Committee convener Bob Doris extended an invitation to appear before the committee.

Mr Doris also critisized the cabinet minister, saying three similar invitations since the beginning of this year were not acknowledged by her or her department.

Image: Holyrood’s Social Security Committee convener Bob Doris.

Holyrood’s Social Security Committee has hit out at the UK Tory government’s decision to dodge scrutiny from MSPs.

Now, it has been announced that Coffey will arrive in Scotland later this evening to pose for photographs as part of Boris Johnson’s flag waving tour north of the border.

This isn’t the first time UK Ministers have chosen to snub Holyrood – earlier this year Scottish Secretary Alister Jack pulled out of an appearance in front of the Parliament’s Europe Committee at the 11th hour with no substantial explanation given.

Famously, David Davies also assured MSPs he would face scrutiny during his time as Brexit Secretary – but failed to do so in his two years in the job.

Earlier this year, Coffey was widely criticised for comments relating to Marcus Rashford’s campaign for Westminster to provide free school meals for children in England during the coronavirus lockdown.

Image: SNP MSP Shona Robison.

Commenting, SNP MSP Shona Robison said:

“Thérèse Coffey should be taking the economic crisis faced by Scotland’s economy seriously – instead she’s choosing to completely ignore MSPs.

“While the Minister lacks the decency to even respond to the devolved governments, she can still find the time to fly up to Scotland for a flag waving exercise and cheap photo opportunity.

“It’s totally unacceptable for any government to try and dodge scrutiny in the midst of a global pandemic, but that seems to be the approach of Boris Johnson and his Tory colleagues.

“We’ve seen this before from Westminster – the Tories’ contempt for Scotland and our parliament knows no bounds.

“Colleagues from all parties are sick of this UK government’s reluctance to engage with Holyrood’s stringent committee process. It’s time these ministers were held accountable.”

ABC Comment, have your say below:

The Cycle to Work Scheme Explained

CYCLING - The Cycle to Work scheme was introduced in 1999—the aim being to encourage people to make healthier and more environmentally friendly lifestyle choices.

The scheme allows employees to spend on bikes and equipment, tax-free, making a claimed saving of up to 42 per cent on the overall value.

You can get gym membership by asking your doctor if obesity is an issue, alas this cycling scheme is only for employees.

Local Authorities have been adding cycle lanes to road developments during the Covid-19 crisis. There has been a backlash against this in some places. Motorists who fund the roads via car tax are being excluded from driving on some of the roads they have paid for. Huge fines for driving on Bus Gates and Bus Lanes are resented. In Berlin, there has been a rash of deaths of cyclists as cycle lanes have been ignored by negligent motorists.

ABC Comment, have your say below,

ABC Note: This document below explains the scheme:

Simon Collyer, ABC Founder Appeared on Future Radio This Morning

MEDIA - Special thanks to Future Radio for having me on this morning. A really good interview and we covered a lot of ground. A few lighter moments too.

To people who want more information our website is a directory but just e-mail us if you need any help. We do respond to everyone.

I will be adding more to this later and I hope we will have a clip of the show on-line.

ABC Comments, have your say below:

Child Trust Funds & The NEW Help To Save Scheme

SAVING - Child Trust Funds (CTFs) were originally set up for children born between 1 September 2002 and 2 January 2011, with a live Child Benefit claim in the UK, providing them with a pot of money at 18 to encourage a savings habit.

Approximately 6 million CTF accounts were opened during this time. The earliest recipients of the funds will be able to claim from September 2020. People can find out whether they have a CTF, and where it is held, on GOV.UK.

HELP TO SAVE

You can open a Help to Save account if you are any of the following:

- receiving Working Tax Credit

- entitled to Working Tax Credit and receiving Child Tax Credit

- claiming Universal Credit and your household earned £604.56 or more from paid work in your last monthly assessment period

If you get payments as a couple, you and your partner can apply for your own Help to Save accounts. You need to apply separately.

You also need to be living in the UK. If you live overseas, you can apply for an account if you’re either a:

- Crown servant or their spouse or civil partner

- member of the British armed forces or their spouse or civil partner

What you will get

You can earn 2 tax-free bonuses over 4 years. You’ll get any bonuses you’ve earned even if you withdraw money.

After your first 2 years, you’ll get a first bonus if you’ve been using your account to save. This bonus will be 50% of the highest balance you’ve saved.

After 4 years, you’ll get a final bonus if you continue to save. This bonus will be 50% of the difference between 2 amounts:

- the highest balance saved in the first 2 years (years 1 and 2)

- the highest balance saved in the last 2 years (years 3 and 4)

- If your highest balance does not increase, you will not earn a final bonus.

The most you can pay into your account each calendar month is £50, which is £2,400 over 4 years. The most you can earn from your savings in 4 years is £1,200 in bonus money.

Your bonus is paid into your bank account, not your Help to Save account.

Example

You pay in £25 every calendar month for 2 years. You do not withdraw any money. Your highest balance will be £600. Your first bonus is £300, which is 50% of £600.

In years 3 and 4 you save an extra £200 to grow your highest balance from £600 to £800. Your final bonus is £100, which is 50% of £200. Even though you withdrew some money after your balance was £800, this does not affect your bonus.

What happens if you withdraw money?

If you withdraw money it will be harder for you to:

- grow your highest balance

- earn the largest possible bonuses

Withdrawing money could mean you are not able to earn a final bonus - depending on how much you withdraw and when.

ABC Comment, have your say below:

Simon Collyer, ABC Founder Appears On talkRADIO

RADIO APPEARANCE - Simon Collyer ABC founder has appeared on talkRADIO with the Weekend Breakfast Show host, presenter Penny Smith.

Our remit was to talk about the eviction moratorium changes and the Renters Reform Bill, but also at short notice, potential changes to the state pension.

The Chancellor Rishi Sunak and Boris Johnson have conflicting views about what to do to repay the record borrowing caused in part by the Covid-19 pandemic.

PM Boris knows that much of his support comes from senior citizens and these are the people who showed so much support for Brexit as opposed to the younger voters who in the main wanted the UK to stay part of the EU.

According to the Times, The Chancellor has publicly raised concerns about the “anomaly” caused by the “triple lock”, which is used to calculate rises in state pensions, and wants to tackle the issue in his autumn budget. He is considering temporarily suspending the mechanism to help to bolster the public finances, in breach of the Conservative manifesto.

Mr Johnson has pushed back. “The prime minister hates it [pausing the triple lock] because it was a manifesto pledge,” a government source said. “He really doesn’t want to do it. The optics are terrible for older voters.”

Tory strategists are concerned that Labour could accuse them of betraying pensioners. A YouGov poll published this week found that the Conservatives retained a 24-point lead over Labour among people aged above 65.

The problem is this - the government pledged in their manifesto to raise the state pension in-line with whichever was higher: wages, inflation or 2.5 per cent. Because the furlough scheme has depressed wages along with the current recession, average wages are set to jump next year. According to an analysis by the Resolution Foundation that could see pensioners getting an increase of 7.4 per cent over the next two years and give taxpayers a bill for £2 billion annually.

Image: talkRADIO Presenter Penny Smith with comedian, Ricky Gervais.

'Dishy Rishi' as he is being called is very popular with the public. We may even see him in a bid for the top job one day.

Construction is riding high and the cheap meals scheme has proved immensely popular, though not necessarily with regular customers who find that their local eatery is getting fully booked out. Boris knows that he is not someone seen as entirely reliable and going back on a key manifesto pledge to a major cohort of supporters will be a public relations disaster and an own goal. With the Labour Party being ably led by Keir Starmer these days, handing Labour a stick to bash the PM with...Boris knows he will be in for a lot of humiliation.

Pensions are far from generous in the UK compared to Europe. Senior citizens, growing in number as former baby boomers retire are not going to be happy if this manifesto pledge goes in the bin. Many retirees started work at age sixteen and fifteen in some cases. They have paid in for many years in their eyes.

At the ABC we are concerned that too many changes are being made simultaneously. The Brexit negotiations are not going well, the full effects of the recession are yet to be felt and furloughed worked do not count as unemployed. All that could change in October. To us, it seems better to wait and let things settle before making dramatic changes.

We may see a second wave of Covid-19 and we live in a joined-up world...the speed we come out of recession will depend on the global situation.

Special thanks to producer Cass Hoe, whom we had a wonderful conversation with as Cass really knows her history and current affairs. It looks as if we will be asked back and in this first interview we certainly aimed to avoid controversy.

Being interviewed on TV or radio is like a game of Tennis – you know a ball is coming at you, but not from where, or at what speed and with how much imparted spin. Avoiding being made to look a fool is a good strategy.

Sticking to sensible answers that do not require long complex development of arguments works. As we get better known we can present more detailed and complex responses, but as a piece of advice to our readers who may appear on TV or radio, you have to stick to the knitting and avoid wandering off-topic. Donald Trump, to use a golfing analogy, ends up in the weeds all the time.

As one expert presenter said...'Tell people what you are going to say, say it and then tell them what you have said'. Keep it simple and succinct (KISS).

ABC Comment, have your say below:

Simon on talkRADIO, with presenter Penny Smith.