Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Specialist Employability Support

Specialist Employability Support (SES) is a new tailored support service for unemployed disabled people that will help them move closer to the labour market.

This new service began last month and is being delivered by six national SES providers. Four of them - Shaw Trust, Remploy, Kennedy Scott and Steps to Employment - will cater for people with a range of disabilities. People with a visual impairment will be supported by the Royal National College for the Blind and those with a hearing impairment, by Doncaster Deaf Trust.

Tory Conferance Wraps Up.

The next few years could spell trouble for the Tories. Huge cuts have to be made in public spending. Then there’s the referendum on membership of the European Union, probably in 2017, which cause all kinds of dissent in the party. Meanwhile, the world economy is faltering. This conference, in which the Tories have walked tall, may turn out to be the high point of their Parliament.

Cameron has said that he will resign before the next election, which was probably a mistake as many potential candidates have been vying for position at the conferance trying to capture the 'common' - as it is now to be known- not 'centre' ground.

People earning between £20,000 (€27,200) and £50,000 (€68,000) have been barely touched financially by austerity.

Pensioners, who are guaranteed a 2.5 percent rise each year even if inflation is zero. Pensioners are now, on average, better off than working people.

The biggest cuts will hit the working poor, as their tax credits are reduced. So much for Cameron’s words, “the party of working people, the party for working people — today, tomorrow and always.” It is just not true.

Boris Eyes the Main Chance

The Tories "cannot ignore the gulf in pay packets that yawns wider" every year, Boris Johnson has told the Conservative Party conference.

He said the government must support the "hardest working and lowest paid" as "we reform welfare and we cut taxes".

Johnson pointed out; "one person's forward progress drives another person's forward progress" but warned that it would not work "if the economic gap between us is allowed to grow too big".

He said that "in 1980 a chief executive of a FTSE 100 company earned about 25 times the average salary of his or her employees" - but that had now grown to 130 times and there were some who paid themselves 780 times more.

A split may well be coming in the Conservative Party - it ceratinly looks as if Boris is limbering up for a leadership bid as David Cameron departs.

MEANWHILE:

Plaid Cymru calls for Tax Credit U-Turn

120,000 working people due to be stung by Tory cut

Plaid Cymru has called on the UK Government to ditch plans to cut the earnings of working people through slashing working tax credits. The party’s calls follow a speech by the Tory Mayor of London at his party’s conference which included a thinly-veiled attack on the plans.

The Welsh Foodbank has warned that the cuts to tax credits will mean that more people are dependent on foodbanks.

According to the Welsh Foodbank Network, benefit changes are a main driver for foodbank use, and this could be exacerbated by the changes to working tax credits.

Almost 120,000 families in Wales receive working tax credit.

Plaid Cymru’ leader Leanne Wood said:

“There are around 120,000 families in Wales who depend on working tax credits to make ends meet, but instead of tackling the causes of low pay, the Tory government has decided to target the incomes of low-wage workers.

“Welfare issues account for nearly half of all referrals to foodbanks, as confirmed in my meeting with Wales’ foodbank coordinator today, and this will only increase as families are forced to do without working tax credits.

“The UK Government needs to take the first possible opportunity to perform another U-turn and Plaid Cymru MPs will be urging it to do so.”

Tony Graham, Foodbank co-ordinator for Wales, said:

“If people on low incomes lose up to £1,000 a year from their tax credits then inevitably more and more will find themselves in poverty and having to use food banks.

“We agree with the Institute for Fiscal Studies who say that the minimum wage increase promised by the UK Government will in no way compensate ordinary working families for the impact of the cuts they will face.”

Tax Credit cuts could spell disaster for the Tories and Boris Johnson obviously sees an opportunity to position himself as a champion of the low paid however unlikely that might seem.

Ian Duncan Smith - Tory Conference Speech

Iain Duncan Smith, the work and pensions secretary, told the Tory Conference in his speech that under Labour disability benefits treated the disabled as “passive victims” and that his reforms were designed to change this. Duncan Smith kicked off:

"Let me start with sickness benefit.

This is Labour’s last great legacy.

Almost half of people on ESA [employment and support allowance] have been on the benefit for more than 2 years.

This is despite the majority of ESA claimants saying that they would like to work.

The ESA has Labour’s essential mistake at its heart – that people are passive victims.

Of course if you treat people as passive that’s what they’ll become.

It’s no wonder, when the system makes doctors ask a simplistic question: are you too sick to work at all?

If the answer is yes, they’re signed off work – perhaps for ever.

So we look to change the system – and the assumptions that underpin it.

Conservatives philosophy is rooted in human nature – not in Utopianism or in empty pity but in the yearning of people to make a better life for themselves and their children.

That’s why we don’t think of people not in work as victims to be sustained on government handouts. No, we want to help them live lives independent of the state".

In his speech Iain Duncan Smith claimed tax credits were a 'bribe' as he launched a vicious attack on the 'tears' of 'ranting and screaming' anti-cuts protesters.

Duncan Smith congratulated himself for scrapping the 'nonsense' of Labour's poverty target and said: "Being poor isn't just because the Government doesn't give you enough money".

And he said parents should choose not to have offspring if they can't afford them. His comments came despite research that has left his claims in tatters -showing a minimum-wage family will be £2,000 worse off from tax credit cuts even with the new 'national living wage'.

ABC Comment - Duncan Smith does not seem to realialize just how out of touch his views are becoming, MPs across the party spectrum feel that cutting Tax Credits without wages having risen will be be a disaster. Workers have to get to work, and there are many people who are going to be struggling to do that.

Plaid Cymru Oppose Tax Credit Cuts

Plaid Cymru has said the Chancellor’s trickery on tax credits is beginning to unravel as senior Conservative politicians begin to realise the damaging implications of the cuts, and has once again called on George Osborne to abandon the policy.

Member of Parliament Jonathan Edwards said the Conservative party’s plan to cut working tax credits from 13 million people across the UK will have a disproportionately negative effects on Wales where wages are generally lower.

Plaid Cymru MPs have been staunch opponents of the UK Government’s welfare reduction policies, often being the only political party in Wales to oppose such budget cuts since the Conservative party took office in 2010.

Following comments from Conservative Mayor of London, Boris Johnson at the party’s conference in Manchester today, Jonathan Edwards MP said the thinly-veiled attack from within the Chancellor’s own party shows that Tory politicians themselves are awakening to the repercussions tax credit cuts will have.

Plaid Cymru’s Treasury spokesperson Jonathan Edwards MP said:

“What is very clear now is that political support for the Chancellor’s tax credit trickery is beginning to unravel.

“As Plaid Cymru warned in the aftermath of the emergency budget, cuts to tax credits will leave some of the poorest working households worse off, and will have a direct impact on spending in local economies. This is a position also supported by the Institute for Fiscal Studies.

“With around 120,000 families in Wales dependent on working tax credits to make ends meet, the Conservative party’s plans will have a disproportionate impact in our communities where wages are generally lower.

“If the Chancellor wants to reduce the costs of working tax credits, then such efforts must be supported with other tax changes and the introduction of a genuine living wage. George Osborne’s cynical rebranding of the living wage doesn’t cut the mustard and will not fill the financial black hole families will face in losing their tax credits.

“The contemptuous politics of the Chancellor has been exposed with even Tory politicians themselves awakening to the repercussions these cuts will have. The Treasury must radically rethink this policy before the incomes of hard-pressed working people are depressed.”

The Sun Opposes Tax Credits Changes

The Sun are campaigning against the changes to Tax Credits. This issue could turn out to be Camerons Poll Tax.

Tax Payers Alliance

The Taxpayers' Alliance are recommending cuts to pensioner’s benefits.

Many of those hit by a cut to the winter fuel allowance might "not be around" at the next election, said Alex Wild of the Taxpayers' Alliance.

And others would forget which party had done it, he added.

At the group's meeting at the Conservative conference in Manchester Mr Wild said the Tories could not wait until a year before the next election to make the necessary cuts to the winter fuel allowance, free bus passes, the Christmas bonus and other pensioner benefits.

The Taxpayers Alliance have been described as a bunch of posh 'right wing' Conservatives, parading as an independent think tank. They have seemed to have forgotten that these benefits they want to abolished, have been paid for by hard working taxpayers all of their lives as opposed to the ‘Non-doms’ and other serial tax avoiders who can afford to live an Monaco, and may not need the Winter Fuel Allowance.

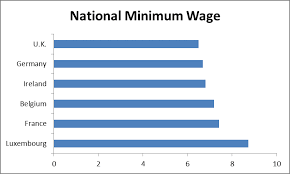

Minimum Wage -We Almost forgot to Mention

From Thursday 1 October 2015, the adult rate of the National Minimum Wage (NMW) will rise by 20 pence from £6.50 to £6.70 per hour, as recommended by the Low Pay Commission (LPC) in March 2015 this year.

From 1 October 2015:

the adult rate will increase by 20 pence to £6.70 per hour

the rate for 18 to 20 year olds will increase by 17 pence to £5.30 per hour

the rate for 16 to 17 year olds will increase by 8 pence to £3.87 per hour

the apprentice rate will increase by 57 pence to £3.30 per hour

the accommodation offset increases from the current £5.08 to £5.35

This is the largest real-terms increase in the National Minimum Wage since 2007, and more than 1.4 million of Britain’s lowest-paid workers are set to benefit says the government. Others point to the National Minimum Wage of other countries.

Self-Employment The New Rules Explained

Thinking of starting your own business?

From 6 April 2015, all new claimants who are using self-employed work to meet the qualifying remunerative work test for WTC, must show that they are trading on a commercial basis and their business is done with a view to achieving profits. The self-employment should also be structured, regular and ongoing.

For example, if their business activity is a hobby it is not likely to be considered commercial or have an expectation of realising a profit.

These checks are about ensuring HM Revenue and Customs (HMRC) only pay tax credits to those who are entitled. WTC will continue to support those who are carrying on a genuine business activity. These changes will not affect the rules for claiming Child Tax Credit.

How the changes will apply

Self-employed WTC claimants with earnings below a threshold (this will be based on working hours and the National Minimum Wage) will be asked by HMRC to provide evidence that they are in a regular and organised trade, profession or vocation on a commercial basis and with a view to achieving a profit.

The information we ask for should be available as part of normal business activity, for example receipts and expenses, records of sales and purchases. We may also ask for supporting documents such as a business plan, planned work, cash flow and profit projections.

During the early stages of self-employment it may prove difficult to make a profit. If someone in this situation claims WTC they may be asked to show that they have a commercial approach and how their business would become profitable. This could be demonstrated in a business plan.

HMRC will use the information provided to reach a decision about the claimants’ currentWTC award.

Claimants may lose their WTC if they cannot provide the evidence we ask for and may have to repay any tax credits they are not entitled to.

Claimants who disagree with our decision can ask HMRC to look at the decision again.

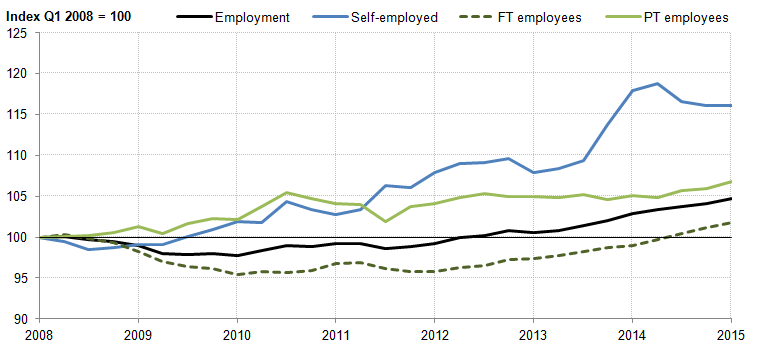

Employment Figures Analysed

Index of employment since Q1 2008, seasonally adjusted, Q1 2008 = 100

Fig 1.

Fig 1. Figures from the ONS shows the initial recovery in employment has been largely a result of increases in the number of self-employed and part-time employees. The latter in particular is seen to be an indicator of a flexible labour market. The level of full-time employees (shown as the dashed line on the graph) only reached its pre downturn peak in mid-2014 but has been recovering strongly over the last three years.

As well as increases in employment, the number of hours worked in the economy continued to grow. The total number of hours worked per week increased by 0.2% on the quarter, falling just short of the 1 billion mark at 998.6 million hours.

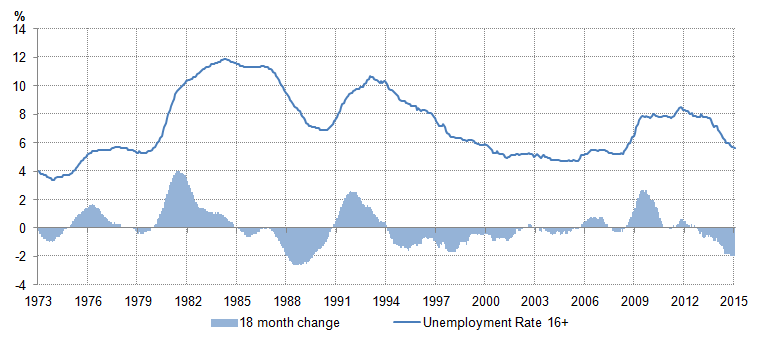

Fig 2.

Unemployment rate and the rolling 18-month change in the unemployment rate, 16+ (%, percentage points)

Fig 2. The relative strength of the labour market has been one of the most interesting characteristics of the UK’s recent economic performance. Higher unemployment accompanied the sharp fall in GDP in 2008 and 2009, but the rise in the number of people seeking work was less than might have been expected given historical experience. The output contractions which began in 1979 and 1990 of 5.6% and 2.2% respectively, resulted in unemployment rates of more than 10%, yet by contrast the 6.0% fall in GDP between Q1 2008 and Q2 2009 was accompanied by an unemployment rate of just over 8%. The fall in the unemployment rate since the start of the economic recovery has also been relatively sharp (Figure 3). Over the past eighteen months, the unemployment rate has declined almost 2 percentage points to 5.6% in the three months to February 2015 – among the fastest reductions in the past forty years – and is approaching its 2001 to 2007 average.

Fig 3.

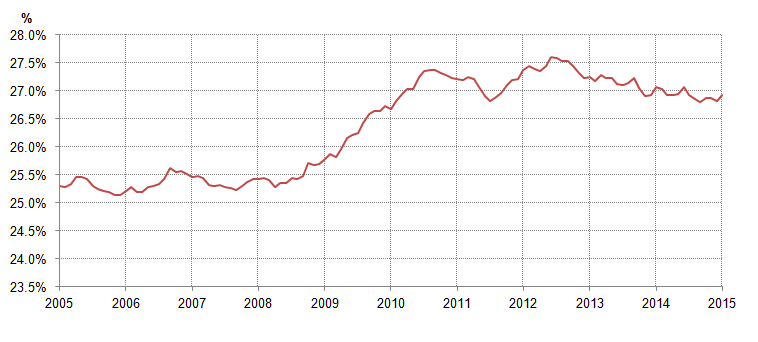

Share of total employment accounted for by part-time employment (%)

Fig 3. Both of these recent features of the UK’s economic performance are partly a consequence of flexibility in the labour market, which operates through several mechanisms. First, following an adverse shock, firms may seek to limit their costs of labour to remain in business by reducing the size of their workforce. Secondly, firms may reduce the number of hours worked – either by increasing the number of part-time workers that they employ, or by reducing the number of hours that existing employees work. Finally, if firms cannot reduce the quantity of labour they employ, they may seek to reduce the price of that labour by reducing wage growth. Each of these three channels appears to have played a role – but the latter two mechanisms may have helped to limit the extent to which firms responded to the economic downturn by reducing the size of their workforces.

In Summary

Employment has stayed higher than expected through flexibility. Self-employment has increased and so has part-time working.

Source: ONS.