Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Irish Economic Growth - 7% last Year

Figures released by the CSO today reaffirm the strength of the Irish domestic economy, and arrive just one week after tax receipts came in €3 billion ahead of target. Ireland remains the fastest growing economy in the European Union - a hugely significant feat given the position Ireland was in just five short years ago.

Labour TD Arthur Spring has said the Government needs to have a ‘laser-like focus’ on regional growth to make the recovery more real for people.

“We need to support this growth with stronger job creation policies for rural areas. My main priority remains the creation of jobs and improvement of families’ lives in Kerry – and as a Labour TD I will continue to work with Tánaiste Joan Burton in standing up for families so that the recovery can make it to the kitchen table.”

Ireland’s debt peaked at 125% of GDP in 2013 as it completed a three-year bailout programme after a burst property bubble wrecked its economy and banking sector. One in eight mortgages is in arrears, but the economy has grown in part due to the low Euro.

DWP Postal Addresses

One of our most popular posts this year was the list of DWP postal addresses.

So Santa does not go down the wrong chimney - when you send Iain Duncan Smith his Christmas present – we have included this very useful list which can be downloaded below. It is 81 pages in total. To save ink search and use: Ctrl + F (for Find) on your keyboard and type in your Jobcentre Plus office. It would certainly save you time.

We hope that helps. Santa seems to think so!

WASPI - Women Against State Pension Inequality Campaign

This morning Simon Collyer (the ABC's Head Dish Washer) visited his GP for the annual MOT. Simon started chatting to nurse Jan Warren. Jan is involved in the WASPI Campaign. WASPI stands for Women Against State Pension Inequality. As we heard more about this injustice, we can only say we wish these ladies the best of luck, and hope we can bring you more (positive) news in future.

This is what WASPI campaigners have to say…

1950’s women unfairly prejudiced by State Pension Age changes

The 1995 Conservative Government’s State Pension Act included plans to increase women’s state pension age from 60 to 65 so that it was the same as men’s.

But because of the way the increases were brought in, hundreds of thousands of women born in the 1950’s (on or after 6th April 1951) have been hit particularly hard (including us!!!!). We are angry that we have been treated unfairly and unequally just because of the day we were born.

Significant changes to the age we receive our state pension have been imposed upon us with a lack of appropriate notification, with little or no notice and much faster than we were promised – some of us have been hit by more than one increase.

As a result, hundreds of thousands of us are suffering financial hardship, with not enough time to re-plan for our retirement. Women are telling us that they can’t believe their retirement age has increased by 4, 5 or 6 years and they didn’t even know about it!!

With no other source of income (until the 1990s many women weren’t allowed to join company pension schemes, many of us are carers or in poor health) securing work is proving impossible and zero contract hours or Job Seekers’ Allowance is the only alternative for many.

We want to put this right – the next step is to find out if we have a legal case. But we need your help!

So how have 1950’s women been treated unfairly and unequally?

1950’s women have been singled out for unfair and unequal treatment because of the way the increases to our state pension age have been brought in.

In fact, Anne started a campaign and petition on this issue after receiving a letter from the Department of Work & Pensions to say that her expected retirement age had been increased - only 18 months before her 60th birthday!

Issues that have come to light after we looked into the matter include:

Recommendations to give fair notice were ignored

- The Turner Commission recommended 15 years notice, and Saga recommended 10 years. Yet many women report receiving little or no notice.

We weren’t appropriately or personally notified of the first changes in 1995

- Steve Webb said to Anne in an email that: “ …many women were not aware at the time of these changes (1995). Although there was – not surprisingly – widespread media coverage of the issue, for women in their mid 40s at the time, pensions might not have been a subject of great interest. Unfortunately, this means that when we contact people now to let them know their state pension age they are often learning for the first time about the 1995 Act”

- Ros Altmann, current Pensions Minister, said in Money Observer in May 2013: "until recently, many of these women were expecting to receive their state pension at age 60, since they were unaware of the changes made in 1995”

- but, MPs, Judges & Civil Servants received 10 years’ transitional protection from any rise in their Occupational Pension age

and

- In future, at least 10 years’ notice will be given for changes to State Pension Age (Pensions Review 2014)

Some of us have been “hit” for a SECOND time – when in 2011 further increases to our state pension age were brought in faster than the Coalition had promised – again with little or no notice to re-plan for our retirement.

Women of a similar age have to wait disproportionately longer for their pension - a ONE year difference in birthday can make an almost THREE year difference to state pension age

What are WASPI trying to achieve?

We are doing everything we can to achieve a just outcome for ourselves and other women like us. We are hoping to be able to use the law to protect our rights and achieve fairness and equality.

What issues are WASPI raising and why?

We believe that the Government has a duty of care to its electorate and that it is reasonable to expect to be personally notified and given sufficient notice about matters which have such far-reaching consequences to people’s lives.

So morally we know we have a strong case, but we’re not sure whether we have a legal case. The odds are stacked against us!

Folks you can find them on facebook: https://www.facebook.com/WASPI-Women-Against-State-Pension-Inequality-Campaign-877054125688402/

My Money My Life

Refuge, in partnership with The Co-operative Bank, has launched a powerful new campaign “My money, my life” to raise awareness of financial abuse and call for industry-wide agreement to support people who experience financial abuse in their relationships.

Nearly one in five British adults say they have experienced financial abuse in an intimate relationship, according to a new report launched today by The Co-operative Bank and Refuge.

The “My money, my life” campaign raises awareness of the true scale of financial abuse for the first time, as it occurs within intimate relationships, where financial control, exploitation or sabotage are used to control a person’s ability to acquire, use and maintain financial resources. Refuge and The Co-operative Bank have joined forces to carry out the UK’s largest study to date in this area in order to understand the prevalence of financial abuse in intimate relationships in the UK.

Sandra Horley CBE, chief executive of Refuge, says: “Money is a constant worry for many of us at the moment. For women who report that they have experienced financial abuse, money can be a matter of life and death. It can mean the difference between being trapped with a violent and dangerous abuser, or escaping to a place of safety.

“Financial abuse is a form of domestic violence and the consequences of this type of abuse can be both devastating and long-lasting. Some women are forced to hand over their wages or benefits to their partner every month. Others are prevented from going out to work or completing their education. Many victims are forced to provide receipts, accounting for every single penny they spend or are given such ridiculously small ‘allowances’ they can’t afford to buy food for themselves and their children. Some are forced into debt, shackled to a past relationship through a churn of constant bills and repayments. This is why Refuge is delighted that The Co-operative Bank is working with us to shine a light on this often overlooked form of abuse. Together, we want to make people realize that these behaviors are not OK and highlight that there is support available.”

Laura Carstensen, chair of The Co-operative Bank’s Values and Ethics Committee, comments: “This study lifts the lid on the true extent of financial abuse in relationships in the UK. While other types of domestic abuse are well-documented, the impact of this kind of coercive control where money is used as a weapon within an intimate relationship is not yet fully understood. Two-thirds of consumers who took part in our study thought this was an issue that banks should raise awareness of and that is exactly why we’ve joined forces with Refuge to launch this new campaign.

“We are calling on the Government to support an industry-wide agreement to identify and address banking practices that fail to help victims of financial abuse in relationships, and more importantly, support those trapped in relationships with abusive partners. Victims of financial abuse are often unable to open bank accounts due to lack of relevant identification documentation post-separation. The lack of, or poor credit history as a result of partner behavior, or paper-based account management processes put victims at risk of being unintentionally found. Our “My money, my life” campaign aims to bring the banking industry together to break down those barriers.”

Workie - You Cannot Miss Him

Workie. He’s the larger than life character the DWP developed as part of an exciting new campaign calling on people not to ignore workplace pensions. You can’t fail to notice him goes the DWP blurb! They are not wrong their!

With so much activity in the world of pensions at the moment, the DWP have to make sure they grab people’s interest and attention.

The DWP need all employers to understand their legal responsibility to their staff when it comes to the provision of workplace pensions as well as ensuring that people know they are entitled to a workplace pension. Therefore, the Government has to keep promoting Automatic Enrolment.

The DWP have already made great strides forward. The successful “I’m in” campaign was aimed at employees of large firms and ensured that more than 60,000 of Britain’s larger employers automatically enrolled almost 5.5 million employees into a workplace pension. Nevertheless, only the UK’s largest employers (less than 5% of UK employers) have started the Automatic Enrolment process, so reaching out to the smaller employers – even those with just one employee, like a carer or nanny for example - is an essential part of making the policy work.

Therefore, the DWP's next challenge is to engage with these 1.8 million small and micro employers – many of whom don’t consider themselves “businesses”!

From next year, these employers will be approaching the date when their workplace pension duties come into effect. The time is right for a new approach.

The DWP must reach out to help small employers realize they have duties under Automatic Enrolment. They need to set up a pension scheme if they have eligible workers to enroll and tell their workers what is happening (though in practice many of the schemes provide this for employers). This is so important because if small and micro employers do not comply it will mean that their employees miss out on the opportunity to save for a pension. It may also mean that they face financial penalties, but our first approach is always to help employers comply with their duties.

As numbers of employers, and their employees, embarking on the Automatic Enrolment journey reach unprecedented levels, the DWP need a campaign with real impact to drive engagement and raise awareness of Automatic Enrolment across all audiences. Just as it is important that we ensure workers stay enrolled, it is also vital to ensure the employers set up a scheme for their eligible employees in the first place. The DWP wanted to find a way to reach out in a more friendly, engaging manner like many other campaigns which have used a character route in this way successfully (Meerkats, Churchill dog, Buzby bird etc.)

In development, the “Don’t ignore the Workplace Pension” campaign proved to have high impact in highlighting how ridiculous it is to ignore something as big and important as the Workplace Pension and making people realize that if they were an employer they had to take action – checking with the Pensions Regulator to start with.

So the campaign has been designed to raise awareness, encourage more employers to recognize their responsibilities and help as many as possible avoid the fines they may face if they do not comply with the law.

With so many millions of workers set to benefit from a more secure financial future, the cost of this campaign is money well spent.

The Government committed to providing security for working people at every stage of their lives, including giving people the chance to plan for a financially secure retirement. Automatic Enrolment is a big part of that. Don’t ignore it say the DWP! We agree.

Headstone Guide

We do get some interesting people contct us at the ABC

This arrived this week. If your not planning to survive Christmas this could help.

****

We have been working to produce a guide aimed at helping those unfortunate enough to be arranging a funeral, and thought that it would be helpful to visitors of your website.

The passing of a loved one is an extremely stressful and emotional time, and the last thing that anyone wants to think about is arranging a funeral, which is why we have helped to produce a guide to try and help during this time.

Here is the guide below: http://headstoneguide.co.uk/

Community Christmas

Are you on a state pension and on your own this Christmas?

Community Christmas believes that no elderly person in the UK should be alone on Christmas Day unless they want to be.

Communities are encouraged to provide companionship to older people on Christmas Day by running a community Christmas Lunch event, joining up with others at a local pub or restaurant, popping round for tea and cake, perhaps organizing a film viewing or anything else that can be enjoyed by all those that take part. This should be a chance to meet up with old friends and make new friends creating bonds in the community that last well beyond the single day.

Doi check out the website for a lit of events:http://communitychristmas.org.uk

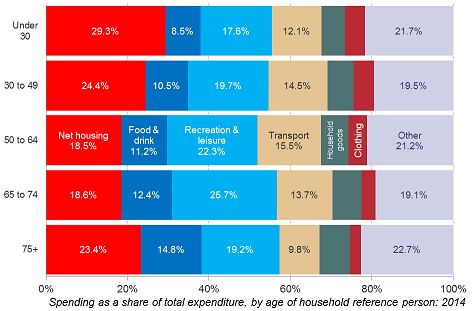

Almost A Third of All Spending By Under-30s Goes On Housing

Housing accounts for almost a third of all spending in households headed by someone under 30, compared to less than 20 per cent for those aged 50 to 74, the Resolution Foundation said in response to the latest Office National Statistics (ONS) Family Spending Survey published recently.

The RF analysis of the latest ONS figures shows that:

- The essentials of housing and food account for 43% of spending among the poorest fifth of households, compared with 29% among richest fifth.

- Despite having disposable incomes more than six times higher than those in the poorest 20%, the richest fifth of households only spend just over three times as much.

This ratio drops to just 1.6 in relation to food & drink and 2.6 in relation to housing (even after accounting for Housing Benefit). But higher income households spend significantly more on household goods (4.1 times as much), recreation and leisure (4.5) and transport (4.9).

Matthew Whittaker, Chief Economist of the Resolution Foundation said:

“Given the scale of the income gap that exists between the richest and poorest households in the country, it will strike many as surprising that the top fifth only spend a little over three times as much as the bottom fifth.

“This reflects the unavoidable and sizeable costs associated with housing and food that all households face. As a result, poorer households spend a much higher share of their income overall and allocate far more of their spending to these essentials.

“The picture is more complicated across age groups. But housing expenditure weighs heaviest at younger ages, with the under-30s directing almost a third of their overall spending towards property.

“These spending patterns show that for many low-to-middle households, as well as young people, the cost of housing is as big a driver of living standards as wages.

“They also have important implications for how households experience inflation. Disproportionate increases in the costs of many essentials over the last decade or so have meant lower-income households facing higher inflation levels than the headline rate – compounding the squeeze on their incomes.”

“Today’s findings remind us again of the importance of moving beyond an over-reliance on a single headline measure of inflation when measuring living standards.”

Breakdown of household expenditure by age group

Bankruptcy Ireland

Tanaiste Joan Burton has welcomed today’s Cabinet approval for the Bankruptcy Amendment Bill 2015, which will reduce the term of bankruptcy from three years to one in line with proposals put forward by Labour TD Willie Penrose.

The Bill is now expected to become law before Christmas.

Joan Burton said: “While a strong economic recovery is now under way, there are still many people struggling with unsustainable debt. Reducing the bankruptcy term from three years to one is another important step in the range of measures introduced by Government to assist people with debt-related issues.

“I want to thank Deputy Penrose for championing this measure and developing the initial legislation which paved the way for this Bill. His contribution will reduce the ordeal for people facing bankruptcy and allow them to start over sooner, which is a good thing for individuals, for the economy and for society.

“I also want to thank Justice Minister Frances Fitzgerald for taking Deputy Penrose’s proposals on board and bringing forward the Bill that will now go before the Oireachtas.”

Irish Car Sales Point to an Improving Economy

The Irish Central Statistics Office which show that new car license figures have increased substantially this year.

Dominic Hannigan TD commented: “The new car license figures from the CSO are an important means of measuring economic growth and consumer sentiment. During the recession car sales slumped which was bad for jobs in the industry and government tax revenue.

“The fact that 120,263 new cars have so far been licensed in 2015 - which represents an increase of almost 32% compared to 2014 - is proof that people are now feeling more confident about the economy and their own personal finances".