Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

New Research Shows Link Between Sanctions and Mental Health

The SNP has today renewed its call for a halt to all benefit sanctions until a full independent review is carried out, as new research shows that there is a “striking” link between benefit sanctions and mental health.

New research published by NHS Health Scotland has found that “the association between trends in mental health problems among low-income working-age adults and the level of sanction activity is striking.”

In 2012 a new sanctions regime was introduced by the Tory government which increased the severity of the sanctions available for those on Jobseeker’s Allowance or Employment Support Allowance who do not meet the conditions of their benefit.

Commenting, SNP MSP Joan McAlpine said:

“This finding is very worrying but, unfortunately, it is not at all surprising. Sanctions leave a person with no benefit entitlement, in some cases for as much as three years, and often leave them reliant on foodbanks – it is no wonder this has an impact on their mental health.

“The UK Government must halt all benefit sanctions until a full independent review is carried out. The SNP has long called for this to happen as the only way we can ensure a fairer system is put in place that does not leave people pleading penury.

“Unless and until such a review is carried out, the UK Government must ensure that people with mental health conditions get automatic access to hardship payments when they are sanctioned – no one should be at risk of destitution because their benefit has been stopped.”

The ABC also agrees. Sanctions are causing a lot of distress and intense anxiety. Following the large number of deaths highlighted during the Oakley Review - sanctioning people should be put on hold until the situation has been properly considered by mental health professionals.

Cities At Work: Mayors to Discuss Employment with EU Commissioners

Mayors from major European cities are meeting Commissioners Thyssen and Bieńkowska on 22 February to discuss employment.

The mayors will emphasise the vital role that cities play in addressing Europe's employment crisis, and how engaging cities in partnership can help shape more effective EU policies on employment and job creation. The meeting is part of the implementation of the EUROCITIES Declaration on Work, a commitment by the mayors of major European cities to work with the EU institutions in their efforts to create jobs and inclusive labour markets.

With jobs and growth at the top of the Juncker Commission's agenda, the mayors are keen to emphasise the contribution that cities can make to shaping more effective EU policies on job creation and employment. Local governments have the knowledge, experience, insight and expertise to help shape better European employment policies. The Commission is also expected to launch its Agenda on Skills this year, and we believe that cities' insight and knowledge can help close the skills gap in Europe.

Mayors will also share their experiences of addressing pressing challenges such as youth and long term unemployment, and will stress their willingness to contribute to the design and implementation of future EU initiatives.

We believe that Europe will be better equipped to address the employment crisis with cities on board. Europe's competitiveness depends on our urban economies being dynamic, innovative, inclusive and creating new jobs.

See our video below to find out more about why cities are crucial partners for addressing Europe's employment challenges. You can also follow the discussion on Twitter via #citiesatwork.

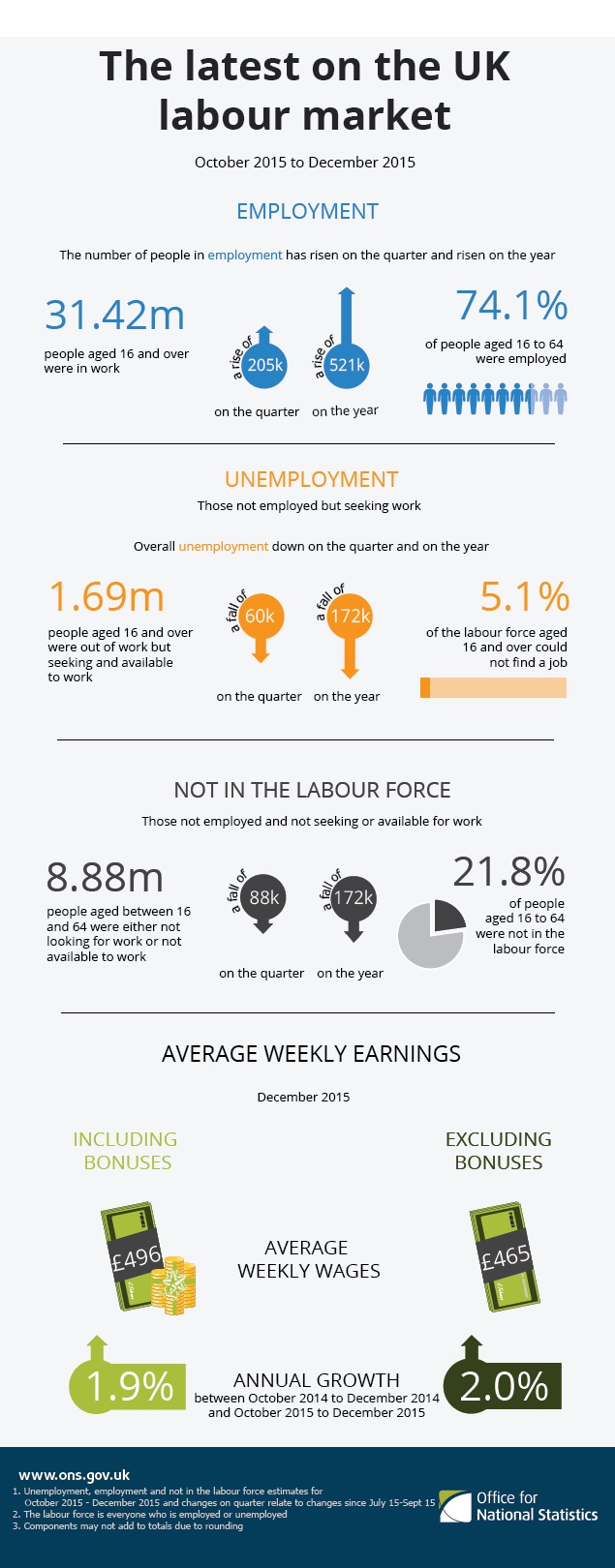

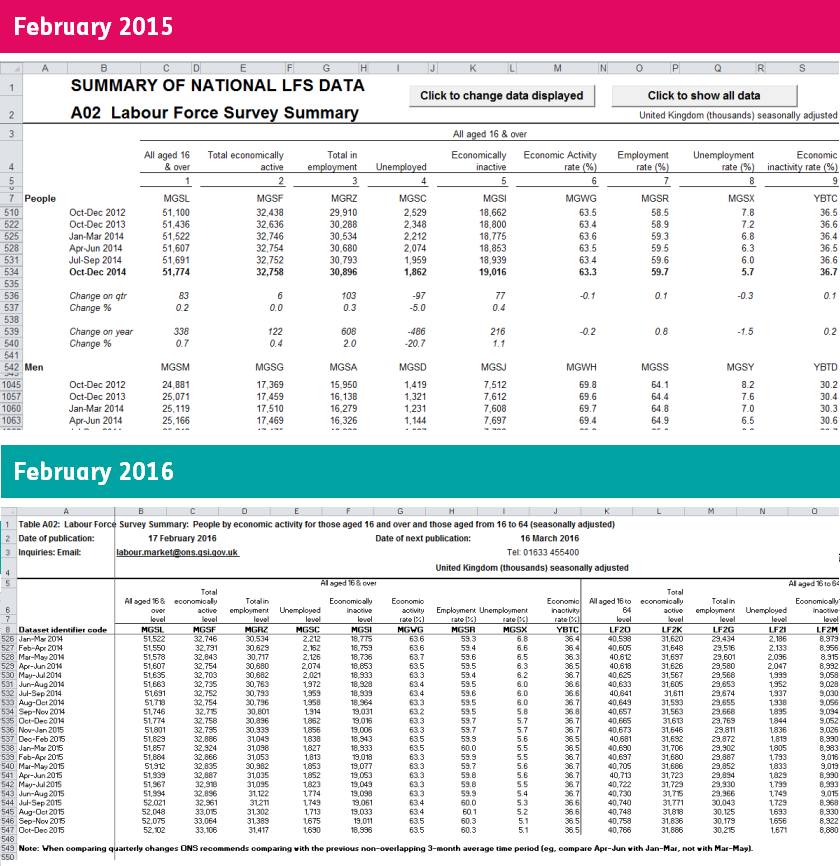

ONS Improve Statistical Reporting

The Office of National Statistics has been under pressure to improve the statistics that the public get. We are very pleased therefore to reproduce this article from Full Fact.

Anyone should be able to easily access, understand and use the most basic of factual information about the UK.

For years this wasn't the case with one of our most influential set of numbers: how many people are in and out of work in the UK.

Yesterday the Office for National Statistics (ONS) completed a small step to improve its data tables on employment, and in doing so took a giant leap towards making its information more readily usable.

Gone are headaches such as hidden data, redundant lines and columns, as well as a lack of clear contact details and caveats to the figures. This will save time for people like journalists and researchers who frequently use the figures.

It follows a process of improvement which has involved consultations with Full Fact and others.

Secondees working at Full Fact from the Government Statistical Service have also produced good practice guidance for government spreadsheets. This has been adopted by the Good Practice Team.

The changes this week won't make national headlines, and there’s more to be done on the other labour market statistics outputs, such as earnings figures. But this will make life easier for anyone who wants to learn more about what's happening to employment in the UK.

Situations Vacant

For £267,946 a year, you get to be a deputy governor of the Bank of England and lead Britain’s efforts to regulate its banks. In return, you have to ensure that the PRA [The Deputy Governor for Prudential Regulation] “maintains and builds on its reputation as a highly credible and effective regulator.” Applications close on March 4 and interviews end on March 18, so there is a chance we could have a new PRA head by April/May.

Vacancy Description

The Deputy Governor for Prudential Regulation is the Chief Executive of the PRA, and sits on the board of the Prudential Regulation Authority (PRA) alongside the Governor (who chairs the PRA), the Deputy Governor for Financial Stability, the Chief Executive of the Financial Conduct Authority (FCA) and other members appointed by the Bank with the approval of HM Treasury.

Under the Bank of England and Financial Services Bill, the new Prudential Regulation Committee (PRC) will additionally include the Bank’s Deputy Governor for Markets and Banking and will make the Chancellor responsible for the appointment of most other members. The Deputy Governor for Prudential Regulation will continue to be the Chief Executive of the PRA and will have several of his/her roles, including preparing the prudential regulation strategy and the day to day management of the PRA, written into statute.

The new Deputy Governor will take up post in a time of considerable challenge and uncertainty for the global and domestic economy. The new Deputy Governor will help lead the Bank of England through a time of change, as the Bank’s internal structure undergoes significant transformation. In particular, the new Deputy Governor will have a key role in ensuring that throughout the coming period the Prudential Regulation Authority (PRA) maintains and builds on its reputation as a highly credible and effective regulator.

Working with the Governor, the Deputy Governors for Monetary Policy, Financial Stability and Markets and Banking and the wider executive team, the new Deputy Governor for Prudential Regulation will play a central role in:

• guiding the regulatory decisions of the PRC and ensuring that continues to be regarded as a credible and effective regulator

• commanding credibility in the markets and communicating regulatory decisions to the market;

• setting the Bank’s overall strategy to deliver financial stability in the UK;

• the formulation of macro-prudential policy by the Financial Policy Committee (FPC); and

• supporting the Bank through the further reforms, including the transfer of responsibilities for the prudential regulation of banks, other deposit-takers and certain investment firms (via the Prudential Regulation Authority) from the PRA to the PRC.

The new Deputy Governor will also need to:

• represent the Bank of England both domestically and internationally; and

• establish and maintain a regular dialogue with high-level contacts in the private sector and work closely with other regulators, including the FCA and international organisations to improve the international regulatory framework.

Person Specification

The successful candidate must demonstrate that he or she can successfully lead, influence and manage the PRA, inspiring confidence and credibility both within the PRA, throughout financial markets and in the wider public arena.

Prior Experience

The successful candidate will have substantial experience in one or more of the following:

• working in, or involvement with, the financial sector (for example a central bank, a financial regulator, or similar institutions);

• working at the most senior levels of a major bank or other financial institution (for example an insurance company).

Role requirements

• Financial market and economic knowledge. The successful candidate will have extensive knowledge and experience of financial markets and the risk cultures therein, and be credible on both micro- and macro-economic issues domestically and internationally.

• Leadership and management skills. The ability to be an effective leader within the senior management team, to encourage teamwork and to develop talent; given the breadth of the PRA’s responsibilities, the ability to delegate will be particularly important. The successful candidate will have had experience at the most senior levels of a large organisation and will demonstrate personal effectiveness, determination and resilience.

• Communication, influencing and interpersonal skills. The ability to build good relationships with colleagues within the PRA, Bank of England and with other partners, such as the Chancellor of the Exchequer and HM Treasury, market participants, and international counterparts. To be able to communicate with authority and credibility to Parliament, the media, the markets and the wider public.

• Policy skills. The ability to design frameworks and develop policies that will be appropriate for multiple scenarios, and the ability to implement those new policies in a fast-moving environment. This will require significant understanding of the workings of government and regulators – gained through membership of relevant public sector boards, industry bodies or working groups if not through direct experience in policy leadership roles. Awareness of the public context in which the Bank is operating will be crucial.

• Undisputed integrity and standing. The ability to maintain discretion and engender trust in staff, peers and stakeholders. A willingness to abide by necessary conflict of interest constraints.

Additional Information

Applications must arrive at HM Treasury no later than 5pm on 4 March 2016. Addition information regarding the role can be found in the candidate pack.

How to Apply

The preferred method of submission is by email to This email address is being protected from spambots. You need JavaScript enabled to view it. and This email address is being protected from spambots. You need JavaScript enabled to view it..

If you are unable to submit your application by email or need any further assistance, including information in other formats, please contact:

Derek Dunne

HM Treasury

1 Horse Guards Road

London

SW1A 2HQ

Tel: 020 7270 4358

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

DWP Charging UC Claimants For Calls Wrong Say SNP

The Scottish National Party has today called for a freephone number to be established immediately following reports that individuals applying for Universal Credit will be charged up to 45p a minute to make a claim.

Neil Gray MP has written to Work and Pensions Minister Iain Duncan Smith to ask that he set up a no-charge number "as soon as possible" for Universal Credit.

Neil Gray MP, SNP spokesperson for Fair Work and Employment, said:

"Charging an individual who is applying for benefits is simply wrong and shows just how faulty Iain Duncan Smith's moral compass is.

"Currently, there is no cost to make a claim over the phone for those applying for JSA and ESA so why should there be a charge for Universal Credit?

“People who need to call these numbers can be left on hold for long periods of time and will often need to discuss complicated issues so these calls could end up costing those on little to no income an extortionate amount.

"Not everyone has access to the internet and getting online can also be a problem in rural areas where connectivity isn't as good.

"Ministers recognised the destructive nature of this policy a few years ago so it is baffling that the idea of charging those in need of support up to 45p a minute just to access welfare is back on the table. IDS must establish a freephone number for Universal Credit as soon as possible."

David Cameron at the EU

Cameron’s opening bid — a 13 year benefit ban: Having spent all week telling other leaders they can’t change the text, that’s the first thing David Cameron tried to do in the UK summit discussion, but suggesting that his request for a seven-year benefit ban come with the option of two three-year extensions. The British Prime Minister came to the Parliament to seek support for his EU reform demands but he might well be up against it with demands like that.

Meanwhile in a snap poll 43 percent of Londoners are in favor of remaining in the EU while 41 percent are in favour of exiting; 14 percent are undecided. The poll by Marketing Metrix shows middle class and more prosperous areas of London are in favor of staying in the EU, while lower socio-economic groups favor exit.

The view from British Eurosceptic groups: They pre-prepared their response before the debate actually happened. Vote Leave Chief Executive Matthew Elliott said: “David Cameron is in Brussels for a row about a trivial set demands none of which will return control back to Britain. Despite all the bluster, the arguments today will be inconsequential … The PM set the bar incredibly low for his renegotiation and he’s missed even that. The only safe option is to Vote Leave.” Nigel Farage was equally scathing. All very predictable.

Cameron could still stage a referendum by the expected date of 23 June.

ASDA Foodbanks

ASDA has removed charity and food bank collection points from all of its stores. Food banks throughout the UK rely on these donations and this decision could leave Britain's poorest families going hungry. 38 Degrees Member Clare, who shops at ASDA is outraged by this and is calling for ASDA to bring back its collection points.

ASDA, which is now owned by American megacorp Wallmart have tried to sneak this change through. But, they’re a public facing company and so a huge petition could kick enough fuss to force them to back down, before too much damage is done.

If you think that feeding hungry people is more important than a tiny profit increase for one of the world's largest companies, sign Clare’s petition. It only takes 20 seconds:

SIGN THE PETITION

BREXIT Debate at the European Council Meeting

Debate on the Preparation of the European Council Meeting of 18 and 19 February 2016, and particularly on the UK referendum, during the EP plenary session in Strasbourg. Statements by Bert KOENDERS, Minister of Foreign Affairs of the Netherlands, Jean-Claude JUNCKER, President of the EC, Manfred WEBER (EPP, DE), Giovanni PITTELLA (S&D, IT), Syed KAMALL (ECR, UK), Guy VERHOFSTADT (ALDE, BE), Gabriele ZIMMER (GUE/NGL, DE), Rebecca HARMS (Greens/EFA, DE),and Nigel FARAGE (EFDD, UK).

| 00:04:44 | SOUNDBITE (English), Nigel FARAGE (EFDD, UK), It's people power that will win this referendum, and after we've won this referendum, I hope in many other countries too. |

People Renting Increased by a Million

Number of families in private rented sector has increased by almost a million in last decade

The long-established decline in homeownership rates in England appeared to pause last year. However, rates again fell among families with children, continuing a longer-term shift into the private rented sector, the Resolution Foundation said today (Thursday) in response to the 2014/15 English Housing Survey.

The survey showed a welcome pause in the long-term decline in the overall proportion of owner occupiers, with home ownership among Londoners and those aged 25-35 actually increasing slightly. Longer-term however, ownership rates have fallen from 71 per cent at the turn of the century to 64 per cent in the latest figures.

Latest Employment Figures - Good News

For October to December 2015, 74.1% of people aged from 16 to 64 were in work, up 0.4 percentage points from July to September 2015 and up 0.9 from a year earlier.

The unemployment rate for October to December 2015 was 5.1%, down from 5.7% for a year earlier.