In November 2015 the OECD projected growth of 2.39% for UK GDP in 2016 and 2.26% for 2017 – it has now revised these down to just 1.7% for 2016 and 1.96% for 2017.

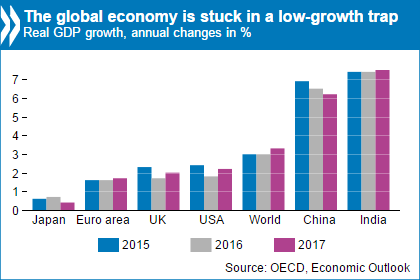

The OECD Global Economic Outlook released today. The global economy is stuck in a low-growth trap that will require more coordinated and comprehensive use of fiscal, monetary and structural policies to move to a higher growth path and ensure that promises are kept to both young and old, according to the OECD.

| Growth projection | 2016 | 2017 |

| November 2015 | 2.39 | 2.26 |

| June 2016 | 1.70 | 1.96 |

The UK economy has been effective in creating jobs since the recession. Unemployment is low relative to other countries and total employment is at an all-time high. But productivity growth has been low, and this is reflected in low wage growth putting lower-income households at risk of poverty.

The UK government is committed to balancing the budget in the medium term, aiming to achieve an absolute surplus by 2018/19. The main opposition party (Labour) are also committed to reducing the deficit, but more slowly. In that context, the UK government has embarked on an ambitious programme of reform of the benefits systems, aiming simplify the system, align incentives and reduce costs. The Coalition aims to achieve this through spending cuts, rather than tax rises. This focus on spending cuts is one of the key drivers of reductions in social security spending, although the government would also argue that they are reforming systems to improve incentives and fairness. Some areas of government spending (e.g. health and education) have been protected from cuts, meaning that very large reductions are required elsewhere.

In the UK, the average income of the richest 10% is almost 10 times as large as for the poorest 10%.

The OECD average is 9.5, in France and Germany it is around 7 and in the US 16.

Between 2005 and 2011 the average income of the poorest 10% in the United Kingdom fell 2% in real terms.

While the average household income in the UK is slightly lower than in Germany and France, the average income of the bottom 10% in the UK is much lower.

The share of the top 1% of income earners increased from 6.7 % in 1981 to 12.9% in 2011. At the same time, the top marginal income tax rate saw a marked decline: dropping from 60% in the 1980s to 45% today.

The level of income inequality among the total population in the United Kingdom has been well above the OECD average in the last three decades. From a peak in 2000 and subsequent fall, it rose again since 2005. Recent data up to fiscal year 2012/13 suggests inequality has been constant since 2010.

Taxes and benefits reduce income inequality by a quarter in the UK. This is in line with the OECD average, but below other European countries such as France, Germany or the Nordics.

Changes in taxes and benefits combined have reduced household income on average in the UK since 2007. The reduction has not been as large as in Ireland, Portugal, Iceland and Spain, but on the other hand, in United States, Germany, Estonia and France, tax-benefit changes increased household incomes over the same period. While in other countries income tax changes played an important role, in the UK fiscal consolidation was driven mainly by changes in benefits.

Families earning around the average wage tended to gain, particularly due to the increase in the income tax basic allowance. The impact on families in unemployment and with low earnings was dependent on the family composition: Families without children tended to lose, mainly due to changes in housing benefits. Families with children tended to gain through the rise in the child tax credit. Policy changes also reduced the income of higher earnings families due to the withdrawal of child benefit and higher social contributions.

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here