The new secretary of state for work and pensions Stephen Crabb in his first outing in his new postion has argued that - "behind every statistic is a human being and perhaps sometimes in government we forget that" – and he has promised no "planned" extra cuts - rather than ruling out taking the axe to the benefits budget in future.

Commenting on the announcement this afternoon by the new Secretary of State for Work and Pensions, Stephen Crabb MP, that there would be “no further plans to make welfare savings beyond the very substantial savings legislated for by parliament two weeks ago”, Torsten Bell Director of the Resolution Foundation said:

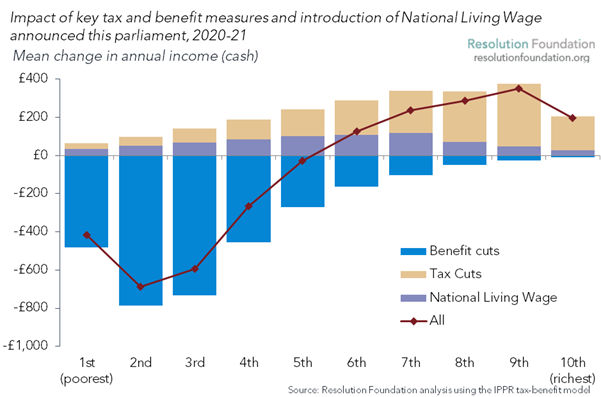

“This is welcome news if it means the government has ruled out low-and-middle income families being asked to make-up the £4bn shortfall from the u-turn on disability benefit cuts through further reductions to in-work support.

“But very significant cuts to Universal Credit are already due to take place over the course of the parliament. These cuts will reduce how much work pays for millions of families and leave some thousands of pounds out of pocket.

“If meaningful today’s announcement also further reduces the flexibility the Chancellor has to respond to any further deterioration in the public finances. Tax rises, further departmental spending cuts, or rethinking the scale of any surplus, would have to take the strain instead. The first port of call should be reversing recent tax cuts that disproportionately benefit the richest households."

“But very significant cuts to Universal Credit are already due to take place over the course of the parliament. These cuts will reduce how much work pays for millions of families and leave some thousands of pounds out of pocket.

“If meaningful today’s announcement also further reduces the flexibility the Chancellor has to respond to any further deterioration in the public finances. Tax rises, further departmental spending cuts, or rethinking the scale of any surplus, would have to take the strain instead. The first port of call should be reversing recent tax cuts that disproportionately benefit the richest households."

Graph courtesty of the Resolution Foundation

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here