Inflation Risks in 2016 Sees Potential Wages Setback

Monday 14 December, 2015 Written by Simon Collyer

Pick-up in productivity needed to maintain pay rebound into 2016

Return of inflation risks pay growth falling back below trend, following welcome progress this year

Having shown signs of rebounding in 2015, real-terms typical pay growth looks set to fall back in 2016 unless there is a significant pick-up in productivity, according to the Resolution Foundation’s latest quarterly earnings outlook published this week.

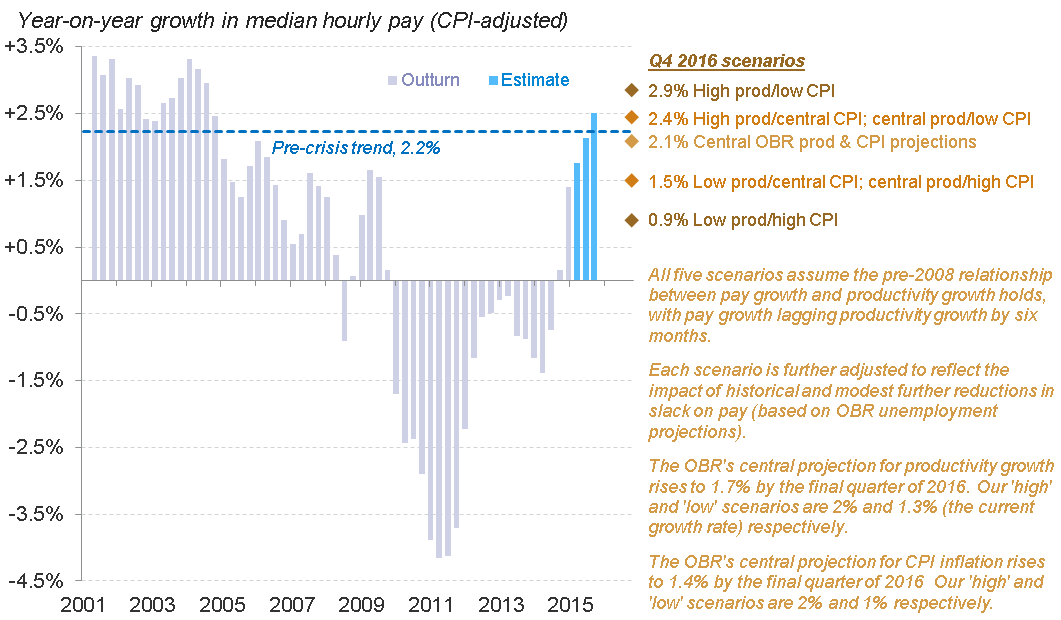

With uncertainty surrounding the outlook for productivity and inflation, the Foundation’s modelling – which is based on the pre-crisis relationship between output per hour worked and pay – considers the impact of five different scenarios for productivity and prices on median hourly wage growth in 2016.

The Foundation’s analysis shows that the central OBR projection for productivity growth of 1.7 per cent (by the final quarter of 2016) and CPI inflation of 1.4 per cent would mean typical wages increasing at around 2.1 per cent – less than the current rate of 2.5 per cent, and slightly below the trend pace of pay growth before the crash (2.2 per cent).

Faster-than-expected productivity growth – edging up to 2 per cent, but still below the long-term expectation of 2.2 per cent – coupled with prolonged low inflation (rising to just 1 per cent by the end of the year) could result in typical wages rising by around 3 per cent next year – the fastest growth in over a decade.

However, should productivity growth fail to progress beyond its current rate of 1.3 per cent, the pace of real wage growth could fall by a quarter (to 1.5 per cent). It could fall even further to less than 1 per cent should inflation also grow more quickly than forecast (to 2 per cent by the end of the year).

The Foundation adds that other factors, such as the amount of spare capacity in the labour market, will also help to determine what happens to pay next year.

However, with key slack indicators such as long-term unemployment, under-employment and job mobility all stabilising in recent months – though still at levels above their pre-crisis trend – they are likely to have less of a role in the strength of real wage growth in 2016 compared to the past year.

Laura Gardiner, Senior Policy Analyst at the Resolution Foundation, said:

“2015 marked the long-awaited return of rising real pay, following a six-year squeeze. But the recent pay rebound owed much to ultra-low inflation, which we’re unlikely to see again next year.

“Pay growth in 2016 will ultimately be determined by whether the recent upturn in productivity is enough to offset rising inflation. On the upside, strong output growth and prolonged low inflation could result in the highest level of real wage growth in over a decade.

“But equally, a failure to build on the early signs of a productivity recovery, combined with a swifter-than-expected return to target inflation, could send real wage growth tumbling to less than 1 per cent. Such a scenario could mean typical pay not returning to its pre-crash level until the next decade.

“There is plenty that businesses and government can do to drive productivity growth. The introduction of the new National Living Wage should help to focus minds on boosting output, particularly in low-paying sectors who are most affected by the new higher wage floor.”

RF typical pay growth projection for Q4 2016, based on different productivity and inflation scenarios

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here