Universal Credit and Christmas Pay - Don't Lose Out

Monday 18 November, 2019 Written by Simon Collyer/Citizens Advice/Social Welfare Training

CHRISTMAS PAY - This information came from a DWP partnership manager. We thank Social Welfare Training for pointing out a well known floor with Universal Credit and the solution found by Citizens Advice.

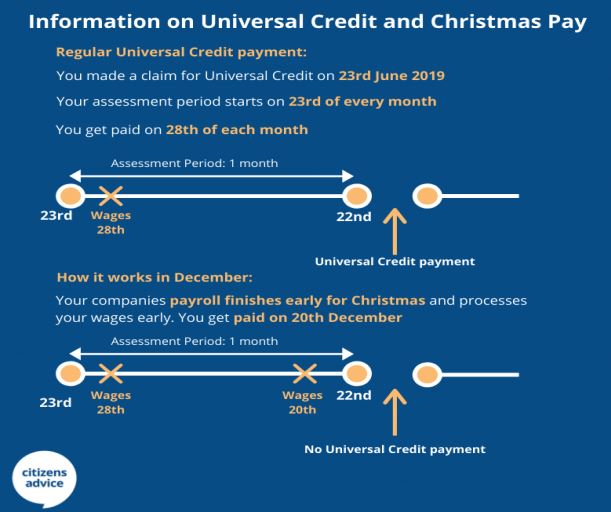

It is regarding a problem where a client loses out on Universal Credit because they are paid twice in one assessment period.

This is because the employer may pay the client's monthly pay early for Christmas.

Solution - Essentially, the employer should notify the payment date as the contractural date and not the earlier date it is paid. This would then mean that Universal Credit is paid as normal, with only one payment of wages taken into account.

From a DWP partnership manager-

'HMRC have issued guidance for employers-

Guidance for employers on reporting PAYE information in real time when payments are made early at Christmas

In December 2018, we wrote to employers to advise a temporary easement on reporting PAYE information in real time, as we know some employers pay their employees earlier than usual over the Christmas period. This can be for a number of reasons, for example during the Christmas period the business may close, meaning workers need to be paid earlier than normal.

Following feedback from employers and the Department for Work and Pensions (DWP) we have received approval to make this easement permanent. HMRC’s employer guidance will be updated shortly.

If you do pay early over the Christmas period, please report your normal (or contractual) payday as the payment date on your Full Payment Submission (FPS) and ensure that the FPS is submitted on or before this date.

For example: if you pay on Friday 20 December 2019 but the normal/contractual payment date is Tuesday 31 December 2019, please report the payment date on the FPS as 31 December and ensure the submission is sent on or before 31 December.

Doing this will help to protect your employees’ eligibility for Universal Credit, as reporting the payday as the payment date may affect current and future entitlements.

The overriding PAYE reporting obligation for employers is unaffected by this announcement and remains that you must report payments on or before the date the employee is paid, i.e. payday'

ABC comment, have your say below:

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here