Planning billions in welfare cuts George Osborne is planning to use his first Conservative budget to lift all but the very richest households out of inheritance tax.

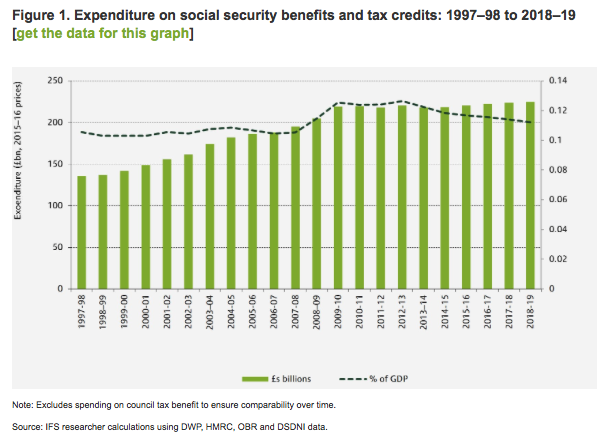

Meanwhile he is going to announce billions of pounds in welfare cuts. The Institute for Fiscal Studies noted that, while spending is forecast to fall as a percentage of GDP, it is still set to rise in real terms during the next parliament. Even with a growing economy, benefits will still be a larger proportion of GDP at the end of the decade than they were before the recession.

What other working age benefits could be cut to save £10 billion? You cannot do it by making benefits for unemployed people tougher. They are already too small for that and abolishing Jobseeker’s Allowance would only cut spending by £2.4 billion, Far less than the Chancellor is aiming for.

Cameron has strongly hinted that one of the cuts will be reductions to tax credits. According to the TUC a further option will be cutting the support for low-paid earners. This would run counter to the government’s aim of “making work pay” and undermine claims to be on the side of hard-working families, but it could produce substantial savings. The proportion of Housing Benefit claims that are by people in work has been rising steadily and is now about one-in-four.

There have also been reports that Osborne would like to go even further than his plan to reduce the benefit cap from £26,000 to £23,000 and perhaps cut it to £20,000 outside London.

Another target is Child Benefit but this is likely to be very unpopular. Bashing the Disabled is waering thisn also.

The Catholic Church has argued that the government's welfare reforms are 'not compatible with Christian values' - and urge him to rethink plans to slash welfare in next week's budget.

One of the clearest pledges in the Conservative Manifesto was £30 billion of “fiscal consolidation”, made up of:

- £13 billion cuts to public services,

- £5 billion from reduced tax evasion, and

- £12 billion of benefit cuts.

In 2013/14 nearly one JSA claimant in five was sanctioned; more ESA claimants than ever before are being sanctioned. Vulnerable people are disproportionately likely to be sanctioned, including 100,000 children and 100 people with mental health problems every day. Food banks report that benefit sanctions are one of the main reasons families need to turn to this support.

60,000 have demanded that the Tories reveal how many people died after being found 'fit for work'

Whatever happens poor people are going to lose out.

Welfare Spending by Flip Chart Steve. How ever much they cut welfare spending will still b e higher

Source TUC,

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here