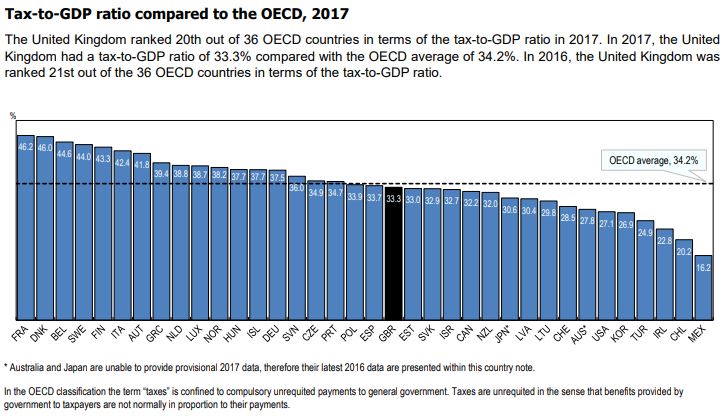

No one likes paying tax for sure, but ABC founder Simon Collyer has argued in a television channel, RT UK interview recently - a section not yet shown - that benefits and state pensions are not particularly generous in the UK. Our problem is that the amount of tax we are bringing in compared to GDP is on the low side, having fallen in recent years.

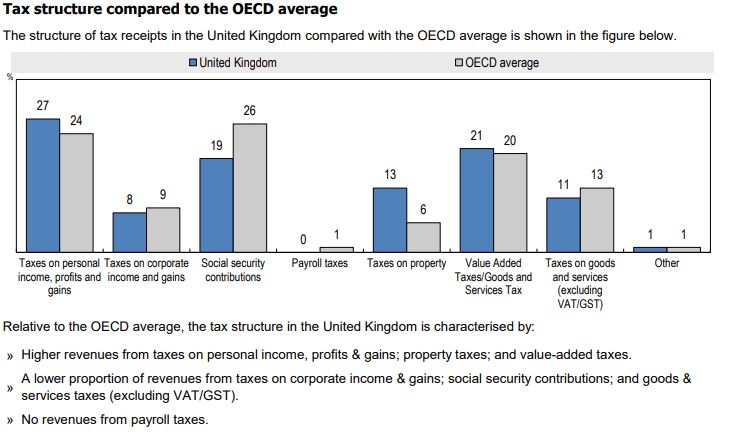

Looking at the OECD graphs one can clearly see that out taxation is skewed towards the individual both in income taxes and VAT. The latter hits everyone, especially those on low incomes.

The rich are increasingly avoiding paying tax through the use of offshore accounts in low tax jurisdictions. The list of tax haven countries includes Andorra, the Bahamas, Belize, Bermuda, the British Virgin Islands, the Cayman Islands, the Channel Islands, the Cook Islands, Hong Kong, The Isle of Man, Mauritius, Lichtenstein, Monaco, Panama, and St. Kitts, and Nevis.

Image: The UK's tax take is not excessive compared to ther countries.

The Tax Foundation have this to say:

In 1980, corporate tax rates around the world averaged 38.84 percent and 46.63 percent when weighted by GDP. Since then countries have recognized the impact that corporate taxes have on business investment decisions so that in 2018, the average is now 23.03 percent and 26.47 when weighted by GDP for 208 separate tax jurisdictions.

Declines have been seen in every major region of the world including in the largest economies. The recent tax reform in the United States brought the statutory corporate income tax rate from among the highest in the world closer to the middle of the distribution. Whereas in 2017 the United States had the fourth highest corporate income tax rate in the world, it now ranks towards the middle of the 208 countries and tax jurisdictions surveyed.

European countries tend to have lower corporate income tax rates than countries in other regions, and many developing countries have corporate income tax rates that are above the worldwide average.

Image: Companies that already set-off capital equipment and brought forward losses, pay much lower rates of tax.

Today, most countries have corporate tax rates below 30 percent.

In general, large industrialized nations tend to have higher statutory corporate income tax rates than developing countries.

The worldwide average statutory corporate income tax rate, measured across 208 jurisdictions, is 23.03 percent. When weighted by GDP, the average statutory rate is 26.47 percent.

The average top corporate rate among EU countries is 21.68 percent, 23.69 percent in OECD countries, and 27.63 percent in the G7.

Europe has the lowest regional average rate, at 18.38 percent (25.43 percent when weighted by GDP). Conversely, Africa has the highest regional average statutory rate, at 28.81 percent (28.39 percent weighted by GDP).

The worldwide average statutory corporate tax rate has consistently decreased since 1980, with the largest decline occurring in the early 2000s.

The average statutory corporate tax rate has declined in every region since 1980.

The rich it seems, really do get the pleasure while the poor get the pain.

ABC Comments, have your say below:

1 comment

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here