Policy in Practise Point out Benefit Changes April 2018

Tuesday 03 April, 2018 Written by Policy in Practise

This April will see the introduction of some significant changes to the benefit system.

For the most part, attention has been focused on the continuation of a freeze in most benefit rates for working-age households for the third year in a row. This freeze will continue for another year and is expected to save £13 billion by 2019/20. The measure will affect nearly all low income working-age households who will lose, on average, about £450 a year.

The benefits freeze has rightly received most of the media attention in the run up to April, however this has meant other changes that have implications for advice and support services are in danger of slipping under the radar. We look at three of these imminent changes in this post.

As welfare reforms continue, relevant benefit changes are incorporated into our award winning Benefit and Budgeting Calculator as they occur. This means that our local authority, housing association and charity sector clients can continue to give accurate support and advice to people uninterrupted, and give them the knowledge they need to budget and make informed decisions.

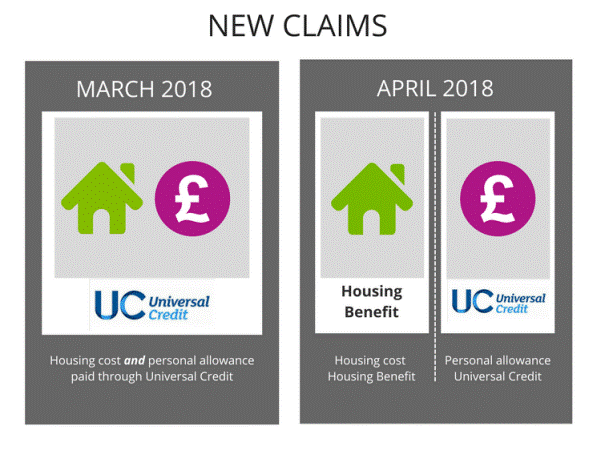

1. Tenants in temporary accommodation will have their rent covered by Housing Benefit

From 6 April 2018, all Universal Credit claims by people in temporary accommodation will have the housing support met through Housing Benefit, in a similar manner to people in supported housing. This is a reversal of the current position and has been broadly welcomed by local authorities who found that the higher costs of short-term temporary accommodation were not being met through Universal Credit.

Local authorities were facing difficulties recouping all rental costs for three reasons:

- The housing element is restricted to the Local Housing Allowance in the same manner as for private tenants.

- A tenancy often would not span a full assessment period, with people moving into more stable and lower cost accommodation. In this case, Universal Credit would pay the lower amount for the entire assessment period.

- Finally, Universal Credit housing costs has until recently been paid directly to the tenant by default, with alternative payment arrangements taking at least eight weeks to setup.

The Government appears to have listened to these concerns with the result that the administration of support for those in temporary housing returns to the Housing Benefit regime. At least for the short-term.

Image: Courtesy Policy in Practise:UC New Claims.

In a reversal of how households move to Universal Credit, those in temporary accommodation who currently receive their housing support through Universal Credit will revert back to Housing Benefits if they make a new claim or have a significant change in circumstances.

Whilst councils will broadly welcome this change, the spread of people in temporary accommodation across two benefit systems may mean they will find it tricky to forecast rental income and have a full understanding of costs for temporary accommodation support.

In addition, the move from other rental properties to temporary accommodation can leave a tenant without any support for housing costs for a period. This is because if the tenant moves to temporary accommodation on any date before the last day of the Universal Credit assessment period, they will not be eligible for the housing costs from the start of that assessment period, nor will they be eligible for Housing Benefit until they move to the new temporary tenancy. Regulations have been amended to allow local authorities to use DHPs to cover the shortfall, which may put pressure on local authority’s DHP budgets.

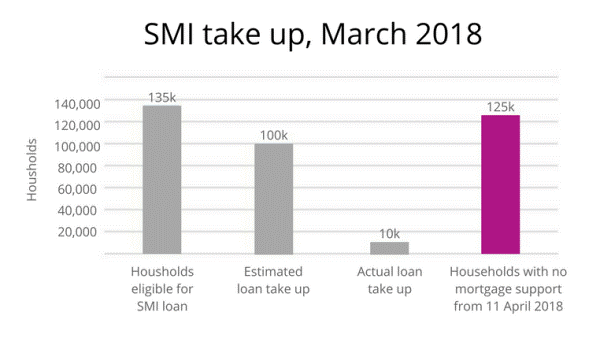

2. Support for Mortgage Interest (SMI) becomes a loan for all

To date, home owners receiving certain benefits or receiving Universal Credit with no earned income have had their mortgage interest paid by the DWP. However, from Friday 6 April, this Support for Mortgage Interest (SMI) will be converted to a loan. Unusually for a welfare reform, this will apply immediately to all claimants of SMI, not just new claimants or those with a change of circumstances. Interest will be charged on the loan at 2.61% and it will be repayable when the property is sold. For those who want to pay the loan back earlier, there is provision for earlier voluntary repayments.

This is one of the very few welfare reform measures that will affect pension-age claimants as well as working-age claimants. The numbers affected are significant; current support will cease for 135,000 households, 65,000 of which are pensioners.

Of particular concern is the impact on those with interest-only mortgages who will need to pay back the SMI loan, as well as capital borrowed, when the mortgage comes to an end. This will have the greatest impact on pensioners as they are unlikely to have the option of extending mortgages to cover the repayment of SMI.

Perhaps of greater concern is the poor take-up of the loans. The Office for Budget Responsibility (OBR)’s Economic and Fiscal Outlook paper this month indicated that only 10,000 claimants have so far agreed to take up the loans. This is only 10% of the 100,000 that were expected to do so.

Image: Courtesy Policy in Practise:SMI take up.

It is unclear whether this reluctance to take the loan is due to a lack of awareness of the changes or whether those already with loans are wary of taking additional loans.

The impact of the conversion of SMI to a loan, and the reluctance of claimants to accept a loan, is likely to have a particular impact on those owner occupiers who are unable to re-enter the job market due long-term sickness or age. The interest payable on the loan is low and doesn’t have be repaid immediately, so should be considered by people concerned about how they will make future payments. The long term impact on households affected will only be known from longitudinal analysis further down the line.

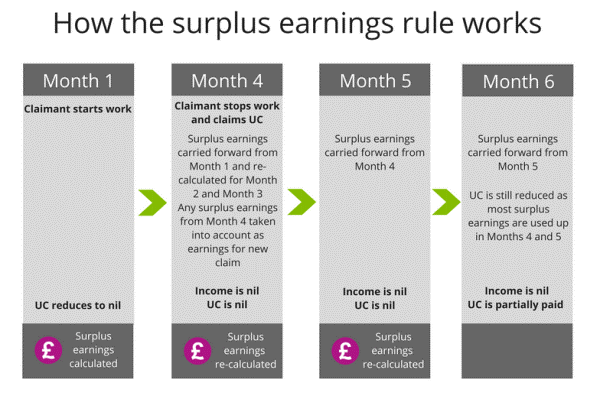

3. Surplus earnings rules are introduced

In 2015 the Government introduced regulations to take account of ‘surplus earnings’. These provisions will affect households whose earnings are high enough in some assessment periods to reduce their Universal Credit award to zero.

The purpose behind the regulations is to prevent so called ‘gaming’ of the benefit system. As an illustrative example, if a person were to change pay dates to being paid on a quarterly basis, they would receive one nil award of Universal Credit, but full Universal Credit in the other months, in some instances this could maximise benefit income. Surplus earnings limits the impact of such gaming, were it to happen.

Whilst the introduction of the provisions has been continually delayed to allow for further examination of the likely impacts, they will now be implemented from 11 April 2018.

In its examination of the regulations, the Social Security Advisory Committee questioned whether gaming of the system was likely. In response, the DWP could not evidence that this would occur, but has amended the regulations to include a higher threshold and to allow irregularly paid self-employed to offset losses against the surplus.

The regulations introduce an unusual level of complexity into the Universal Credit assessment process.

One of the benefits of Universal Credit is the simplicity of having one calculation, thereby making things easier for both claimants and advisors to understand. The surplus earnings regulations introduce complex regulations that require historical earnings information which will be tricky for advisors to obtain and explain, let alone claimants to understand.

How surplus earnings rules work

Any earned income that is above the amount that would reduce the Universal Credit award to nil is counted as surplus.

- The claimant is allowed to retain some of this surplus. In response to concerns from the SSAC and others, the amount that can be ignored is currently £2,500 per month. This is expected to fall to £300 following an initial trial period.

- If a claimant reclaims Universal Credit within 6 months, any surplus above this allowance is added to earnings in month 2, reducing their Universal Credit award, and the surplus is recalculated. The surplus is carried on to month 3 until the surplus is used up, or after 6 months.

- The regulations include provisions for dividing and reconstituting surpluses when couples separate or live together, transitional protection measures, and for the offset of self-employed losses.

For many people this will result in no Universal Credit for many months, resulting in those on higher earnings facing uncertainty about their level of entitlement. They may see little benefit from claiming Universal Credit and therefore be unlikely to do so.

Image: Courtesy Policy in Practise:The surplas earnings rule.

Families with irregular income and working patterns, including retail workers and others who have steady earnings but are paid every four weeks, will be affected by these regulations. At one point in the year, people in this group will experience a calendar month assessment period that will contain eight weeks of wages. This may reduce their Universal Credit award to £0, generate surplus earnings and require them to reclaim the following month.

These regulations also make managing finances harder for the self-employed as surplus earnings are applied in addition to the Minimum Income Floor. So the surplus from higher income months is carried forward to low or nil earning months, whilst for low or nil income months Universal Credit is based on the notional Minimum Income Floor.

For advisors, the calculation of surplus earnings will involve a complex longitudinal calculation over a period of up to 6 months. They will need to provide forward-looking estimates in order to show the impact to claimants to help them to budget. If claimants leave benefits, they will need to know when to reclaim, and how much they should put aside in case they return to Universal Credit within 6 months.

Our Benefit and Budgeting Calculator includes a Universal Credit Calendar feature that shows how Universal Credit awards change in each assessment period, in which months the Universal Credit award falls, and when it falls to zero. The calculator also shows the level of earnings that will trigger surplus amounts that are carried forward, and warns clients if this is likely to occur.

The complexity of these new regulations, and the need to warn claimants of the possible reduction in support should they later return to claim Universal Credit, underlines the importance of the role of advice and support services.

Policy in Practice also helps local authorities to model the impact of imminent and future changes in order to examine the cost and social implications.

ABC Note: This is superb video that explains austerity and the thinking behind it. As the tax take drops, borrowing increases and instead of borrowing falling it has been going up. The other strategy is to grow the economy and shrink the debt in relation to income. This requires higher productivity.

1 comment

-

Comment Link

Tuesday 03 April, 2018

posted by

Simon Collyer

Tuesday 03 April, 2018

posted by

Simon Collyer

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here