ACAS the employment arbitration service are working hard to get employers to be aware of the new National Minimum Wages levels.

The National Minimum Wage (NMW) is the minimum pay per hour most workers under the age of 25 are entitled to by law.

The government's National Living Wage (NLW) is the minimum pay per hour most workers aged 25 and over are entitled to by law.

The rate will depend on a worker's age and if they are an apprentice.

HMRC (HM Revenue & Customs) can take employers to court for not paying the NMW/NLW.

- Current rates

- Changes to the rates

- Exemptions to the rates

- Apprentices

- Agricultural Workers

- Family members

- Non-payment of the NMW or NLW

- The difference between the National Living Wage and the Living Wage

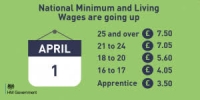

Current rates

- £7.50 per hour for ages 25 and over.

- £7.05 per hour for ages 21 to 24.

- £5.60 per hour for ages 18 to 20.

- £4.05 per hour for school leaving age to 17.

Changes to the rates

| Date of rate | 25 and over | 21 to 24 | 18 to 20 | Under 18 | Apprentice |

| From April 2018 | £7.83 | £7.38 | £5.90 | £4.20 | £3.70 |

| From April 2017 to March 2018 |

£7.50 | £7.05 | £5.60 | £4.05 | £3.50 |

| From October 2016 to March 2017 |

£7.20 | £6.95 | £5.55 | £4.00 | £3.40 |

| From April 2016 to September 2016 |

£7.20 | £6.70 | £5.30 | £3.87 | £3.30 |

A new rate will apply to the next pay reference period that begins on or after the date:

- a rate increase begins

- an employee reaches a new age bracket.

For example: an employee paid on the 20th of each month will start to receive the new rate of minimum wage from 21 April onwards.

These rates are reviewed annually by the Low Pay Commission.

If a worker receives above NMW there is no legal obligation on an employer to increase their pay when the NMW rate increases.

Exemptions to the rates

There are a number of people who are not entitled to the NMW or NLW.

The NMW and NLW do not apply to:

- self-employed people

- volunteers or voluntary workers

- company directors

- members of the armed forces

- family members, or people who live in the family home of the employer who undertake household tasks

- work experience students, depending on the length of their placement.

All other workers including pieceworkers, home workers, agency workers, commission workers, part-time workers and casual workers must receive at least the NMW or NLW.

Some people may need to have adjustments made to their NMW if they live in accommodation which is linked to their employment or owned by their employer. For further information, go to www.gov.uk/national-minimum-wage-accommodation.

Apprentices

The apprenticeship rate only applies to apprencties aged:

- under 19

- 19 or over who are in the first year of their apprenticeship.

Apprentices aged 19 or over in their second year of apprenticeship must receive the national minimum wage or national living wage rate their age entitles them to.

Agricultural Workers

Agricultural and horticultural workers in England employed after 1st October 2013 must be paid the appropriate NMW or NLW rate (see above).

If they were already employed before 1 October 2013, they will still be entitled to the same terms and conditions set under their contract of employment. This can include overtime rates, agricultural wages, sick pay or dog allowance. DEFRA will continue to handle complaints about non-payment or non-compliance for up to six years after the breach occurred.

Agricultural and horticultural workers in Scotland must be paid the highest rate that applies to them from the Agricultural Minimum Wage, the NMW or the NLW.

Agricultural and horticultural workers in Wales must be paid the highest rate that applies to them from the Agricultural Minimum Wage, the NMW or the NLW.

Family members

A worker is not eligible for the NMW or the NLW if they are a member of the employer's family and:

- resides in the family home of the employer

- shares in the tasks and activities of the family.

A worker is not eligible for the NMW or the NLW if they reside in the family home of the employer and:

- is not a member of that family, but is treated as such in regards to the provision of living accommodation, meals and the sharing of tasks and leisure activities

- is not liable to any deductions and does not make any payment to the employer, or any other person in respect to the provision of the living accommodation or meals

- if the work had been done by a member of the employer's family, it would not have been treated as work.

Non-payment of the NMW or NLW

It is against the law for employers to pay workers less than the NMW or NLW, or to falsify payment records.

If an employer doesn't pay the correct rate, a worker should talk to their employer and try to resolve the issue informally first. If an informal approach does not work an employee has the option of raising a formal written complaint (also known as a grievance).

If the situation cannot be resolved internally a worker could choose to make a complaint to an Employment Tribunal. For most tribunal claims there is a three-month time limit a claim to be submitted. However this time limit does pause if Early Conciliation is taking place. For more information, go to Employment tribunals.

Alternatively, a worker can make a complaint to HMRC who will investigate. This can be done anonymously if the worker wishes. If HMRC find that an employer hasn't paid at least the NMW, they can send a notice of arrears plus a penalty for not paying the correct rate of pay to the worker.

The maximum fine for non-payment will be £20,000 per worker. However, employers who fail to pay will be banned from being a company director for up to 15 years.

A worker can either pursue the issue through the Employment Tribunal or a complaint to HMRC. They cannot do both.

The difference between the National Living Wage and the Living Wage

The government's NLW is different from the Living Wage, which is an hourly rate of pay and updated annually.

The Living Wage is set independently by the Living Wage Foundation and is calculated according to the basic cost of living in the UK. Employers choose to pay the Living Wage on a voluntary basis.

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here