Workers Feeling the Squeeze As Inflation Bites

Monday 26 June, 2017 Written by ONS

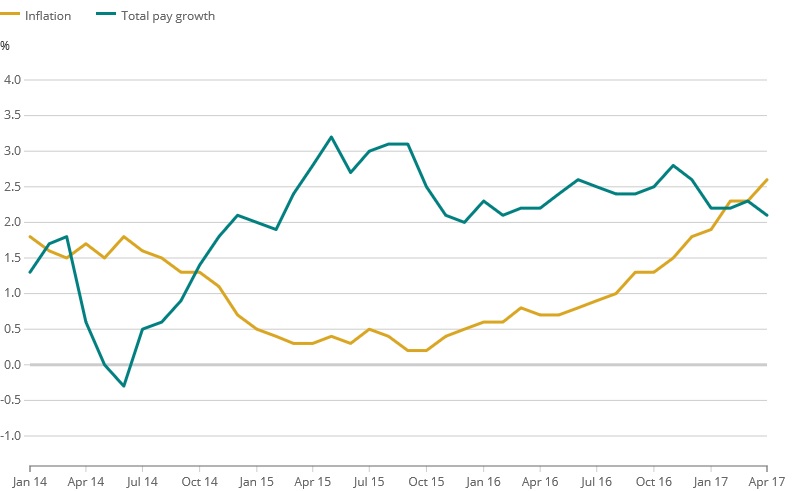

Workers have started to feel the squeeze in their finances, after wage growth recently fell below inflation for the first time since 2014. Benefit claimants have had their incomes frozen and they are now really feeling the squeeze.

In April 2017, inflation rose to 2.6% year-on-year, while three-month average wage growth was 2.1% over the same time-period.

At the same time last year, wage growth was similar (2.2%) but workers enjoyed the benefits of a low rate of inflation (0.7%).

The recent increase in inflation is, in part, due to a fall in the value of sterling after the EU referendum, but the fall in wage growth is unusual as it occurs at a time when employment is at a record high. A high employment rate is an indicator of a strong economy, and wage growth is usually expected.

It is important to note that inflation affects everyone differently – even employees who have the exact same wage growth – as it depends on what items you buy and whether those prices have risen or gone down.

Private and public sector employees experience different pay changes:

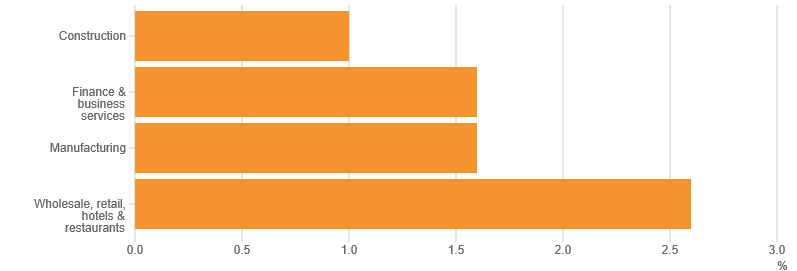

While workers across nearly all industries are experiencing pay growth beneath inflation levels, it differs between industries and sectors.

The private sector is experiencing pay growth at a higher level than the public sector (2.3% and 1.1% respectively). This means public sector workers are likely to be more affected, on average, as inflation rises.

To illustrate this, you can look at the fictional examples of Ali and Becca.

Ali is in the public sector, and Becca is in the private sector. Both of them earned £28,200 – the average median salary for full-time employees in the financial year 2015-16. Let’s suppose that in April 2017 their pay increased in line with public (1.1%) and private (2.3%) sector pay growth:

Note: The inflation rate in this chart differs to that in the calculator as it is based on the April 2017 inflation rate whereas the calculator uses the current inflation rate.

Total pay growth by industry sector, GB, April 2017

In the wholesale, retail, hotel and restaurant industry, pay growth was highest, with growth of 2.6% in April 2017, whereas in the construction industry workers saw their pay increase by 1.0%.

What will the future bring?

It’s impossible to predict with certainty what will happen to pay growth in the future, but the Office for Budget Responsibility have forecast that real earnings will not have returned to pre-downturn levels by 2020 to 21, despite record employment and a more skilled workforce.

Note: Pay growth can be affected by a number of factors other than pay rises. The wage growth figures in this article are from the average weekly earnings (AWE) series, which takes into account money paid to employees before tax and other deductions. The estimates also reflect changes in the mix of high and low earning jobs in the economy, bonuses, changes in the number of paid hours worked and the impact of employees paid at different rates joining and leaving individual businesses. The estimates do not include earnings of self-employed people.

See how much your salary would need to rise next year, in order to keep up with the current rate of inflation.

Leave a comment

Make sure you enter all the required information, indicated by an asterisk (*). HTML code is not allowed.

Join

FREE

Here