Simon Collyer

New to Universal Credit - Here Is How to Calculate Your Award

UNIVERSAL CREDIT - The first Universal Credit payments are expected around 22 April for those who applied during the first week of the stay-at-home measures.

These are the five steps to follow to understand how Universal Credit is calculated:

Look up your standard amount. This varies by age and if you are making a joint claim. Someone who is single and aged 25 or over, for example, will get £409.89 a month.

Add any other amounts that can be claimed. These are called ‘elements’ and include things such as housing or childcare. How much you get will depend on your circumstances, e.g. a ‘child element’ for your oldest child if they were born before 6 April 2017 is £281.25 a month.

Factor in wages and savings. You will get less Universal Credit if you’re earning wages, have other income, or if you have more than £6,000 in savings.

For each full £1 you earn, your Universal Credit reduces by 63p. But you may be allowed to earn a certain amount without reducing your Universal Credit payment, such as if you are responsible for a child. This is called a ‘Work allowance'.

Take away any other reductions. This could include repaying an advance payment, which is a loan that you can ask for if you will not have enough money to get by until your first payment. Other deductions could include paying back debt, such as utility bills.

Check if the Benefit Cap applies. There is a limit on the amount of benefits you can get. E.g. if you are single and live outside of London it’s £257.69 a week.

We have covered the Benefit Cap in a previous article.

How much is the Benefit Cap?

The current cap is: https://www.abcorg.net/item/3330-tips-when-claiming-universal-credit

- £442.31 per week (£1,916.67 per month or £23,000 per year) for couples and lone parents in Greater London

- £384.62 per week (£ 1,666,67 per month or £20,000 per year) for couples and lone parents outside Greater London

- £296.35 per week (£1,284.17 per month or £15,410 per year) for single adults in Greater London

- £257.69 per week (£1,116.67 per month or £13,400 per year) for single adults outside Greater London

The Benefit Cap calculator: https://www.gov.uk/benefit-cap-calculator

ABC comment, have your say below:

ONS Labour Force Survey Results for February 2020 Look Almost Surreal

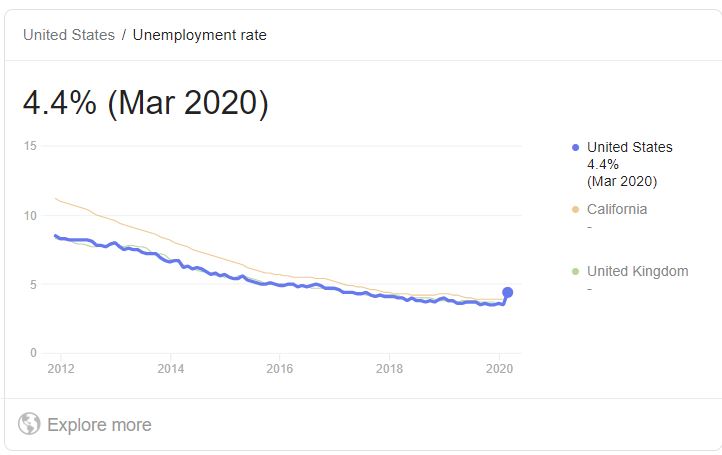

UNEMPLOYMENT - The ONS Labour Force Survey Figures look surreal prior to the COVID-19 pandemic. How fast the situation changed.

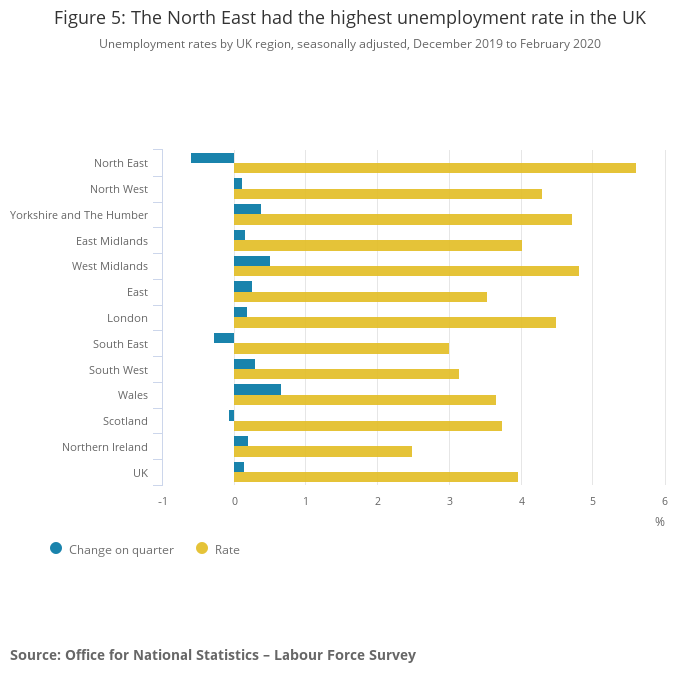

For the three months ending February 2020, the highest employment rate estimate in the UK was in the South East (80.1%) and the lowest was in both the North East and Northern Ireland (72.5%).

For the three months ending February 2020, the highest unemployment rate estimate in the UK was in the North East (5.6%) and the lowest was in Northern Ireland (2.5%).

For the three months ending February 2020, the highest economic inactivity rate estimate in the UK was in Northern Ireland (25.6%) and the lowest was in the South East (17.4%).

Between September and December 2019, the largest estimated increase in workforce jobs in the UK was in London at 43,000, while the largest decrease was in the North West at 53,000.

In December 2019, the region with the highest estimated proportion of workforce jobs in the services sector was London at 91.5%, while the East Midlands had the highest proportion of jobs in the production sector at 13.2%.

The highest average estimated actual weekly hours worked, for the 12 months ending December 2019, was in London at 33.8 hours and the lowest was in the North East at 30.9 hours; for full-time and part-time workers, it was highest for both in Northern Ireland, at 38.4 hours and 17.0 hours respectively.

ABC Comment, have your say below:

Speculation of A Property Value Decline Following Lockdown

PROPERTY MARKET - Research by leading peer to peer lending platform Sourced Capital has found that the UK property market could see a double-digit rate of property value decline, with the market taking over five years to recover, while the number of property repossessions could also soar as a result of a COVID-19 induced recession.

Currently, the market has ground to a halt as both buyers and sellers remain unable to transact due to government-imposed restrictions and while it is unclear as to how this will hit the housing market, there are wider fears that a recession is on the horizon.

Sourced Capital analysed market data from previous recessions to look at the potential decline caused to the UK property market due to the economic impact of the current COVID-19 pandemic, should COVID-19 bring about another recession.

Early 1980s Recession

Duration: 1.25 years

Property Price Change: +8.6%

Repossession Change: +440%

Brought on due to deflationary government policies including spending cuts, the pursuance of monetarism to reduce inflation and a switch from a manufacturing economy to a service-based economy, the recession of the early 1980s saw GDP fall over five consecutive quarters.

However, the property market remained resolute where house prices were concerned at least, with an increase of 8.6%

But while prices continued to climb, the number of homes being repossessed across the UK spiked by a huge 440% between Q1 of 1980 and Q1 of 1981.

Early 1990s Recession

Duration: 1.25 years

Property Price Change: -1.4%

Repossession Change: +616%

The recession seen in the early 1990s was largely a result of the US savings and loan crisis, which brought about high rates of interest from the banks due to the Lawson Boom and attempts to maintain British membership of the European Exchange Rate Mechanism.

Again lasting five quarters, property prices fell marginally by -1.4% however, the number of homes being repossessed soared by +616%, those highest increase during any recession. When the recession ended in quarter three of 1991, it took five and a quarter years for house prices to recover and exceed the pre-peak highs of £58,773.

Great Recession of 2008-2009

Duration: 1.25 years

Property Price Change: -13.8%

Repossession Change: +445%

The global financial crisis seen in the late 2000s as a result of rising global commodity prices and the subprime mortgage crisis infiltrating the British banking sector is the most recent recession to date with arguably the biggest impact on the UK housing market.

Again lasting five quarters, this economic downfall saw prices drop by 13.8% on average, while the number of homes being repossessed again climbed by 445%. As with the recession that preceded it, it took five years for prices to recover to £185,362 in Q2 of 2014, marginally higher than the pre-crash peak of £183,082 in Q2 of 2008.

Founder and Managing Director of Sourced Capital, Stephen Moss, commented:

“The current state of the market may bring cause for concern to many but at present, it sits in limbo and any impact of the current pandemic will be easily rectified once normality returns.

However, the real worry is that any prolonged period of national lockdown could bring about a recession and it is at this point the market could begin to struggle.

We know from market data on previous recessions that such an event will cause property prices to drop and with current market conditions and values most similar to that of the previous recession, this could mean a drop of ten per cent and upwards.

Not only this, but those taking such a hit will be looking at a lengthy recovery time before their property regains its current value, a recovery that could stretch until 2025.

That said, a decline in property values would be the preferable option when you consider that for tens of thousands of homeowners, the reality could be the repossession of their home.

With uncertainty and fears around the pandemic impact on the property market rife, many investors are turning to peer to peer lending platforms for a safer option when investing. Not only do they generally offer a higher annual return when compared to most property investment options, but they also allow a lower risk in terms of the sum of money invested, as well as the opportunity to diversify across a number of sectors and options. Something that is always advised.”

Average UK house price and repossessions during recessions

|

Early 1980s recession (duration 1.25 years / 5 Quarters) |

||||||

|

Recession period |

Average house price |

AveHP change % |

AveHP point to point change |

Average repossessions |

Cumulative repossessions |

Repossessions point to point change % |

|

1980 Q1 |

£19,273 |

- |

8.6% |

870 |

870 |

440% |

|

1980 Q2 |

£20,044 |

4.0% |

870 |

1,740 |

||

|

1980 Q3 |

£20,857 |

4.1% |

870 |

2,610 |

||

|

1980 Q4 |

£20,897 |

0.2% |

870 |

3,480 |

||

|

1981 Q1 |

£20,938 |

0.2% |

1218 |

4,698 |

||

|

Recovery Period |

N/A |

|||||

|

Early 1990s recession (duration 1.25 years / 5 Quarters) |

||||||

|

Recession period |

Average house price |

AveHP change % |

AveHP point to point change |

Average repossessions |

Cumulative repossessions |

Repossessions point to point change % |

|

1990 Q3 |

£58,773 |

- |

-1.4% |

10,975 |

10,975 |

616% |

|

1990 Q4 |

£57,901 |

-1.5% |

10,975 |

21,950 |

||

|

1991 Q1 |

£57,086 |

-1.4% |

18,875 |

40,825 |

||

|

1991 Q2 |

£56,853 |

-0.4% |

18,875 |

59,700 |

||

|

1991 Q3 |

£57,959 |

1.9% |

18,875 |

78,575 |

||

|

Recovery Period (Q3, 1996) |

£58,854 |

5 Years |

||||

|

Great recession of 2008-09 (duration 1.25 years / 5 Quarters) |

||||||

|

Recession period |

Average house price |

AveHP change % |

AveHP point to point change |

Average repossessions |

Cumulative repossessions |

Repossessions point to point change % |

|

2008 Q2 |

£183,082 |

- |

-13.8% |

10,000 |

10,000 |

445% |

|

2008 Q3 |

£175,866 |

-3.9% |

10,000 |

20,000 |

||

|

2008 Q4 |

£164,193 |

-6.6% |

10,000 |

30,000 |

||

|

2009 Q1 |

£155,701 |

-5.2% |

12,225 |

42,225 |

||

|

2009 Q2 |

£157,806 |

1.4% |

12,225 |

54,450 |

||

|

Recovery Period (Q2, 2014) |

£185,362 |

5 Years |

||||

|

Sources |

|

|

Repossessions statistics |

|

|

Gov.uk: Mortgage and landlord possession statistics: October to December 2019 |

|

|

Average house price |

|

ABC Comment, have your say below:

Scotland - Additional 110,000 Universal Credit Claims Since Coronavirus Outbreak

CITIZENS ADVICE - Household claims for Universal Credit in Scotland have increased from an average of 20,000 per month in 2019 to over 110,000 between 1 March and 7 April, highlighting the impact the pandemic is having on people’s finances.

That is why the Scottish Government, in partnership with the Citizens Advice network, is launching a new campaign to raise awareness of the financial support available to people.

The campaign will provide information and advice on issues including rent and mortgage payments, energy bills, council tax, and benefits people may be entitled to.

People will be able to access this advice online, by phone or by contacting their local Citizens Advice Bureau.

Image: Scottish Cabinet Secretary for Social Security and Older People Shirley-Anne Somerville.

Cabinet Secretary for Social Security and Older People Shirley-Anne Somerville said:

“This huge increase in claims for Universal Credit demonstrates just how many people across the country are struggling financially due to the coronavirus pandemic.

“These are difficult and worrying times for everyone, with many people requiring financial support for the first time and even more pressure on those who were already struggling to make ends meet.

“It is welcome that people are claiming the support that they are entitled to from the DWP, and I would encourage people to look into what additional help is available. Even if you are not entitled to Universal Credit, there could be other assistance that you can access so it is worth checking.

“That’s why we’ve been working with the Citizens Advice network in Scotland to create this central source of information - with everything from guidance on benefits, right through to what you can do if you are worried about paying your mortgage or rent.”

Image: Citizens Advice Scotland Chief Executive Derek Mitchell.

Citizens Advice Scotland Chief Executive Derek Mitchell said:

“The Citizens Advice network in Scotland is known for always being there to help and the support we give will be more important than ever to help people avoid getting into crisis. There may also be lots of people who have never used our services before and it’s crucial that they know our information and advice is there for them too.

“Our national network of Citizens Advice Bureaux is still operating for those who need it – if you have been financially impacted by the coronavirus outbreak your local Citizens Advice Bureau can help make sure you have access to all the income you are entitled to, as well as giving tailored advice about what’s on offer within local communities across Scotland.

“There’s increased demand for our advice on financial services, that’s why we’ve created dedicated COVID-19 content online so people get the information they need 24/7 and from the comfort of their own homes.

“We’ve also got a dedicated helpline for people who might not be able to access our services online. If you have been financially impacted by the coronavirus outbreak and require free, confidential, financial support, please visit cas.org.uk or call 0800 028 1456.

“Local Citizens Advice Bureaux are situated around the country. To find your local service, simply enter your postcode at cas.org.uk/bureaux”

ABC Comment, have your say below:

South Africa To Increase Welfare Provision Over Coronavirus: Ramaphosa

JOHANNESBURG (Reuters) - South Africa will increase welfare provision to help poor households suffering because of a nationwide lockdown aimed at containing the country’s coronavirus outbreak, President Cyril Ramaphosa said on Monday.

In a weekly newsletter to the nation, Ramaphosa said that the lockdown had revealed “a very sad fault line in our society that reveals how grinding poverty, inequality and unemployment is tearing the fabric of our communities apart”.

He cited images of desperate people clamouring for food parcels at distribution centres as the lockdown leaves millions of people who are unemployed, working in the informal sector or in low-paid jobs struggling to support themselves.

Ramaphosa did not specify how the government would lift welfare provision, but some economists and labour unions have called for social grant payments to be topped up.

Africa’s most industrialised country is one of the world’s most unequal, with starkly different living conditions for those at the top and bottom of the income pyramid.

It has the most confirmed coronavirus cases in sub-Saharan Africa, at 3,158, with 54 deaths from the COVID-19 disease caused by the virus. Ramaphosa said the government was preparing for a probable surge in infections in the coming weeks and months.

Ramaphosa’s cabinet is due to meet on Monday to discuss new measures to cushion the economic and social impact of COVID-19, among them whether to close down ailing South African Airways, a major drain on state resources in recent years.

He said in the newsletter that the government would this week announce interventions to shield people from starvation.

“Even when the nationwide lockdown is lifted, its effects will continue to be felt for some time,” Ramaphosa said.

“Food support is a short-term emergency measure. It will need to be matched by sustainable solutions that help our most vulnerable citizens weather the difficult times that are still to come.”

ABC Comment, have your say below:

Tips When Claiming Universal Credit

UNIVERSAL CREDIT - A lot of people claiming Universal Credit get caught out the way the system works.

Your first assessment period will start on the date that you make your claim. The assessment period will last one calendar month. You will usually receive your first payment 7 days after the end of your first assessment period. Universal Credit will then be paid on the same date each month.

What happens is people lose their job and then rush to claim Universal Credit. UC adjusts not to how much work you do but to how much you earn. HMRC inform the DWP what this is, if you were on PAYE. Companies on the Real Time information. In April 2012 HM Revenue and Customs (HMRC) began the phased introduction of Real Time Information (RTI). The Income Tax (Pay As You Earn) Regulations 2003 (PAYE Regulations) were amended to reflect reporting in real time. Under RTI, information about tax and other deductions under the PAYE system is transmitted to HMRC by the employer every time an employee is paid. If your employer is not on this system they may take longer to inform HMRC you have been paid.

The problem is that people stop work and then get their final pay and this falls in the assessment period. So they can find that their payment is far less than they expected.

It pays to get paid first and then claim UC.

The other big problem is that people who get paid month-end who get paid early because of a Bank Holiday (as an example). They can have two wage payments in one assessment period, stopping UC or reducing it substantially. A serious matter if you are in part-time low paid work.

Another issue is that with these benefits increases announced by the government, these can cause claimants to exceed the Benefit Cap. The benefit cap is a limit on the total amount of benefit you can get. It applies to most people aged 16 or over who have not reached State Pension age.

The government has sounded very generous in their support for those on benefits, struggling companies and furloughed employees. Getting this help is another thing altogether. Don't 'count your chickens' as the saying goes. Certainly managing your Universal Credit claim and when you apply can make a big difference.

There is a five-week wait and naturally people claim as soon as they can. Once on UC your relationship can run smoothly. Intially though, it can seem quite a hurdle to sign onto UC and keep all the bills paid.

The amount your household gets from some benefits might go down to make sure you do not get more than the cap limit. The benefit cap affects:

- Bereavement Allowance

- Child Benefit

- Child Tax Credit

- Employment and Support Allowance

- Housing Benefit

- Incapacity Benefit

- Income Support

- Jobseeker’s Allowance

- Maternity Allowance

- Severe Disablement Allowance

- Widowed Parent’s Allowance (or Widowed Mother’s Allowance or Widow’s Pension if you started getting it before 9 April 2001)

- Universal Credit

How much is the Benefit Cap?

The current cap is:

• £442.31 per week (£1,916.67 per month or £23,000 per year) for couples and lone parents in Greater London

• £384.62 per week (£ 1,666,67 per month or £20,000 per year) for couples and lone parents outside Greater London

• £296.35 per week (£1,284.17 per month or £15,410 per year) for single adults in Greater London

• £257.69 per week (£1,116.67 per month or £13,400 per year) for single adults outside Greater London

ABC Comment, have your say below:

Help For Claimants & Useful Websites

HELP FOR CLAIMANTS - Every Mind Matters campaign update.

Public Health England have launched a new phase of their Every Mind Matters campaign, to encourage more people to take steps to improve their mental wellbeing while at home. You can access it here: Every Mind Matters

Update on Universal Credit

The first claims received relating to the pandemic were on 16 March. From 15 April, these first new claimants were able to see how much they would receive, to be paid to them on 22 April. As people are new to Universal Credit and face different circumstances, they are being encouraged by the DWP to visit the Understanding Universal Credit website for further information and guidance.

When making a claim, people should do this online where possible. Claimants will be asked to input basic information about their personal circumstances and then the DWP will verify their identity. The Department have switched to a ‘don’t call us, we’ll call you’ system now so people do not need to try to contact the DWP after they have completed their online claim.

Since 16 March, the DWP have had more than 1.4 million new claims. Please bear thius in mind if you do not get the speedy service you hoped for.

ABC Comment, have your say below:

Another 5.2 Million U.S. Workers Filed for Unemployment Benefits Last Week

USA - Another 5.2 million workers filed for unemployment benefits last week, raising the total in a month of coronavirus shutdowns to more than 20 million.

“It might take until mid-May or longer before we see claims declining” to much lower levels, said University of Michigan labor economist Daniil Manaenkov. “It could take until we see the economy partially reopen.”

Image: Jobseekers in the US.

ABC Comment, have your say below:

US Social Security Administration Announces Economic Impact Payments Direct From the Treasury Department

USA - The Social Security Administration announced today that Supplemental Security Income (SSI) recipients will receive automatic Economic Impact Payments directly from the Treasury Department. Treasury anticipates these automatic payments no later than early May.

SSI recipients with no qualifying children do not need to take any action in order to receive their $1,200 economic impact payment. The payments will be automatic.

SSI recipients who have qualifying children under age 17, however, should not wait for their automatic $1,200 individual payment. They should now go to the IRS’s webpage at www.irs.gov/coronavirus/non-filers-enter-payment-info-here and visit the Non-Filers: Enter Your Payment Info section to provide their information. By taking proactive steps to enter information on the IRS website about them and their qualifying children, they will also receive the $500 per dependent child payment in addition to their $1,200 individual payment. If SSI beneficiaries in this group do not provide their information to the IRS soon, they will have to wait until later to receive their $500 per qualifying child.

“This is great news for SSI recipients, and I want to remind recipients with qualifying children to go to IRS.gov soon so that you will receive the full amount of the Economic Impact Payments you and your family are eligible for,” said Andrew Saul, Commissioner of Social Security. “I also want to thank the dedicated employees of the Treasury Department, the Social Security Administration, and the Internal Revenue Service for making this happen and working non-stop on this issue.”

Social Security retirement, survivors, and disability insurance beneficiaries (who don’t normally file taxes) will also qualify for automatic payments of $1,200 from Treasury. These payments are anticipated to start arriving around the end of April.

The Treasury Department, not the Social Security Administration, will make these automatic payments to beneficiaries. Recipients will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as they would normally receive their SSI or Social Security benefits.

For those SSI and Social Security retirement, survivors, and disability insurance beneficiaries, with dependent children, who use Direct Express debit cards, additional information will be available soon regarding the steps to take on the IRS website when claiming children under 17.

Please note that the agency will not consider Economic Impact Payments as income for SSI recipients, and the payments are excluded from resources for 12 months.

For more information about Social Security retirement, survivors, and disability insurance beneficiaries, please see the agency’s April 10th press release: New Guidance about COVID-19 Economic Impact Payments for Social Security and Supplemental Security Income (SSI) Beneficiaries from Social Security Commissioner Andrew Saul.

The eligibility requirements and other information about the Economic Impact Payments can be found here: www.irs.gov/coronavirus/economic-impact-payment-information-center. In addition, please continue to visit the IRS at www.irs.gov/coronavirus for the latest information.

The agency will continue to update Social Security’s COVID-19 web page at www.socialsecurity.gov/coronavirus/ as further details become available.

ABC Comment, have your say below:

Freelance Journalist Seeks Homeless Young People For a Confidential Interview

MEDIA - A Freelance journalist is looking to speak to the following:

Hello,

I'm a freelance journalist and I'm researching a potential feature on young people who are homeless and accessing services, and are struggling with isolation during the pandemic.

I'm looking to speak to young people in this situation - on the basis of full anonymity - and I'm just wondering if there's anyone you might be able to put me in touch with?

Many thanks,

Jessica

Sign up to my newsletter, The Grey Area.

If you are someone in that situation, or you know of someone, please contact Jessica.

ABC Comment, have your say below:

Executives

-

Simon Collyer

Position: Founder & Director

Simon Collyer hails from Brightlingsea in Essex, a small town on the coast between Colchester & Clacton. Simon worked very successfully in the leisure marine industry in the UK and in Australia. Later in London Simon worked in the web development and publishing fields, founding a below-the-line sales promotion agency in the early nineties and then later a software company Red Banner in South Africa (2002-06). Here in South Africa, Simon became interested in the Third Sector and starting his own organisation.

-

Christopher Johnson

Position: Bookkeeping and Administration

Chris lived in Oxford for twenty years, having been educated at Magdalen College School. Chris sought a career with British Rail and spent twenty years in railway retail management ending with Virgin Trains at Euston Station. Christopher retrained in bookkeeping and accounts in 2000 and now works for Chelmsford Community Transport.

A strong, enthusiastic team player with a meticulous eye for detail, Christopher brings a range of skills to the ABC.

Team

-

Frances Rimmer

Position: Researcher

When not charming snakes Frances is a Modern History student at the University of Essex, focusing specifically on social history. The lives and experiences of the ordinary person rather than on politics or the military. Outside of her studies, Frances enjoys film and writing. As a keen roller skater who plays roller derby with the Kent Roller Girls, Frances secret wish would be to become a skating instructor and open her own rink, as she has always wanted to help people in some way, and feels it would be great to do so while also sharing her passion with like-minded people.

-

Stuart Meyers

Position: Researcher

Stuart Meyer, is a final year American Studies student at the University of Essex. Stuart focussed his academic life on global justice and the rights of migrants. Additionally Stuart has a passion for writing, both creatively and with the aim of providing accessible information to those who need it most Stuart has made a great contribution to our library of Advice Guides demonstrating his versatility by writing intelligently on a wide range of topics.

-

Louis Jones

Position: Film Maker

Louis is a 19 year old TV and film student studying at Colchester Institute. Along with hand-picked fellow students, Louis made the ‘Membership’ video that can be seen on the ABC website. Louis volunteers at, Hospital Radio Colchester, as a football commentator. A true fan of the ‘Great Game’ Louis insights have been sought after on occasions by key local media, the Colchester Daily Gazette & even BBC Essex.

-

Marcus Pierpont

Position: Film Director

Talented student film maker, Marcus Pierpoint, directed the ABC 'Membership' film which can be seen on the organizations website. Marcus has recently graduated from a BTEC course, studying Creative Media Production at Colchester Institute and he claims a true passion for films and filmmaking. Marcus also enjoys radio work and volunteers at the local hospital radio station, producing and presenting his own show. Marcus is enrolled at the University of Greenwich, and dreams of a career in the media industry.

-

Shane Mitchell

Position: Film Maker

Shane Mitchell, is another Colchester Institute Film and TV student that aspirers to be a Director of Photography in the future. Shane was the camera operator for the ABC Membership video, fun to make says Shane but it is also work he is very proud of. Shane loves all things ‘film’ and he makes videos even in his spare time.

-

Joe Corlett

Position: Film Director

Ex-student script writer/director, Joe Corlett, directed the ABC's corporate video (About Us) which is now viewable on the main website. Joe graduated from the Colchester Institute with a BTEC diploma in the field of media. Joe is passionate towards film making and hopes to continue making more that are constructed form his own material. On the side he's loves being out jogging in all terrains and when not out side he's writing scripts for future projects. Joe is now out in the world ready to start his life goal of working in the Media industry.

-

Jon Taylor

Position: Film Maker

Jonathan Taylor has been working in the media sector for 3 years and for our filming projects he worked as the production manager. John worked on graphical elements of our film, About Us for example, rendering images and making them look good on screen.

Jon is also experienced in animation and he made the logo and animation sequences in the ABC corporate videos.

Part of Jon’s brief was to also organise the administration side of filming, known collectively to admin experts the world over as ‘the paperwork’.

-

Thomas Hearn

Position: Film Maker

Thomas Hearn, has been involved in media, for about three years. Tom likes to work a lot at a computer, particularly the editing suite. For the ABC project, Tom worked on the edit itself; created and pieced together both the footage and the music, Tom created the visual elements of the ABC ‘About Us’ video and put most of the visual effects on the video.

I think we can agree that along with the rest of our youthful student team; Tom has done a very fine job indeed.

-

Max Gillard

Position: Film Maker

The last of our film team Max Gillard has recently finished college studying Creative Media Level 3 and Max hopes to continue the course on to University to someday gain a job in the media industry.

We wish Max the best of luck.

-

Harry

Position: Film Maker

My name is Harry Genge and I am an aspiring film maker. I have skills in the majority of film orientated jobs, though I am most interested in the creative roles such: Directing, Director of Photography and Writing. In my spare time I make short films, write, read, draw/paint and take the dog out for long walks.

-

Ned

Position: Producers

My name is Ned Woodcraft and I’m an aspiring Producer. As well as completing a diploma in media production I have also had a number of jobs in the professional market. I’m also a keen sailor and water sport enthusiast.

-

Brandon

Position: Producer

My name is Brandon and I’m an aspiring producer and actor. I enjoy bringing a production together with planning and preparations to create a great finished product. My hobbies also include street magic and bass playing.

-

Callum

Position: Writer and Director

My name is Callum Olive and I’m an aspiring writer and director. I’m always looking for a new project and love writing new stories and screenplays at home and on the move. My hobbies include playing the piano and street magic.

-

Joanie DeMuro

Joanie joined ABC team in early 2017. She was one of six student volunteers from the University of Essex in that cohort. The student team focused on a range of projects, including creation of Wikipedia page,‘training manual’ and most importantly, researching and adding entries to the website directory of organisations that assist the unwaged, or those on low incomes. “This placement was very helpful - thanks for the opportunity Simon.”

-

Cherry Lam

Cherry Lam has been volunteering for ABC for one month. Although it is a short period of time, she knows a lot more about the running of a charity organisation. Cherry is responsible for adding directories to the organisation website according to categories. Joining this placement helped her improving skills and gaining new experiences. Cherry says is extremely appreciative of the support she has received from ABC which allowed her to improve skills.

Join

FREE

Here