Simon Collyer

HMRC’s Contract with Concentrix Under the National Audit Office Spotlight

The National Audit Office has today published its findings from its investigation into HM Revenue & Customs’ (HMRC) contract with Concentrix. The three-year contract, signed in May 2014, was to provide additional capacity and analysis to review and correct personal tax credit payments. The contract did not work as HMRC intended and, in November 2016 HMRC and Concentrix agreed to terminate it and a number of Concentrix staff transferred over to HMRC.

The investigation looks at the aims and management of the contract; the decision to terminate it; and the impact of the contract termination.

The key findings of this investigation are as follows:

- HMRC expected its contract with Concentrix to provide good customer service standards for claimants. It required Concentrix to follow the same procedures as HMRC when investigating tax credit claims, after training provided by HMRC. Concentrix collected and assessed evidence on claimants' circumstances and determined whether the award was accurate, and made amendments or stopped awards altogether where it believed the award to be incorrect. It then made amendments to those claimants' tax credits or stopped them altogether. HMRC continued to manage awards, recover any overpayments and deal with claimants' appeals.

- HMRC estimated in November 2013 that its contract with Concentrix would save £1 billion over the life of the contract. HMRC estimated that Concentrix would provide additional capacity to investigate up to a further 1.5 million awards per year. Savings would come from stopping incorrect claims, reducing overpayments, and the recovery of money already paid out. HMRC expected to pay Concentrix between £55 million and £75 million over the three-year life of the contract.

- In March 2016, HMRC had reduced its forecast of expected savings to £405 million. HMRC analysis identified two main factors that led to the reduction: a two month delay to the contract start date because of delays in developing the IT infrastructure to transmit and manage cases and Concentrix working fewer cases than HMRC originally expected. Concentrix, however, believes that the reduced level of savings was as a result of less fraud and error in the system and changes in the mix of cases it was given to work.

- The contract included incentives for Concentrix to meet customer service and quality targets. HMRC’s business case recognised the risk of the supplier increasing profits at the expense of customer service. To mitigate this risk, HMRC reviewed a sample of cases each month to measure the quality of compliance decisions by Concentrix and also required them to meet key performance indicators for customer service which Concentrix reported its performance against on a daily, weekly and monthly basis.

- Between November 2014 and September 2015 Concentrix consistently failed to achieve over half of its performance targets, meeting only 104 of a total 242 applicable monthly performance indicators. Its performance was worst during the peak renewals period in mid-2015 when in July it answered an average of 4.8% of calls within five minutes (target 90%).

- HMRC reduced Concentrix's commission payments by a total of £3.5 million over the life of the contract, after it missed quality and customer service targets. HMRC paid Concentrix only for the percentage of cases meeting quality standards and in October 2015, introduced a further penalty that reduced the commission paid to Concentrix when it failed to meet customer service targets for handling calls and post.

- In October 2015, HMRC and Concentrix agreed to vary the contract, introducing a revision to the performance management arrangements and an increase in the level of commission payments. Concentrix's level of commission increased to 11%, compared with 3.9% (with a possibility to earn 6.9% if savings reached particular thresholds) in the initial contract.

- After some improvement, the performance of Concentrix fell again during the 2016 renewals process. Concentrix’s failure to process compliance cases in accordance with its plan meant resourcing in call centres was not sufficient to meet the resulting increase in customer calls. Higher than expected terminations where claimants failed to renew their tax credit awards and IT issues in August further increased call volumes and delayed processing.

- By 20 September when the high-risk renewals process was scheduled to complete, there was a backlog of 181,000 open cases. Although Concentrix opened 324,000 compliance investigations on high-risk renewal cases, as was planned, it did not conclude its enquiries and close the cases as expected. This backlog of cases contributed to the higher than expected call volumes and award terminations when claimants failed to renew.

- Concentrix was unable to cope with the volume of calls from claimants during August 2016, which were significantly above forecast. It had estimated weekly call volumes at around 8,000 during August 2016 but volumes reached six times this level. For example, in the week commencing 15 August, Concentrix received a peak of 48,000 calls, of which 19,000 were unanswered. Concentrix redeployed staff to call centres but it was insufficient to cope with the volume of calls and meet service standards, and was below the resourcing set out in its plan. This meant that some claimants were unable to contact Concentrix to discuss their award.

- More awards were terminated as a result of the renewals process than were expected, increasing demand on the call centre. HMRC stops making provisional awards to tax credits claimants where they fail to renew their claim by 31 July. In 2016, the number of provisional awards terminated as part of the high risk renewals process conducted by Concentrix was significantly higher than expected, at 45,000 against 21,800 anticipated in its plan. These higher than expected terminations would have been lower if Concentrix had processed more cases prior to 31 July.

Concentrix's performance in August 2016 was also affected by IT failures. A routine technical update to Concentrix’s systems on 11 August 2016 prevented its staff from accessing or updating claimant details for a total period of 26 hours. This lack of access led to higher call volumes from 12 August onwards. There is evidence that some claimants had to call multiple times to get in contact with Concentrix. Concentrix cites two further IT failures in its and HMRC's systems as contributing factors.

- HMRC took steps to mitigate the impact on customers after the problems were escalated to its senior management on 5 September 2016. HMRC reallocated a weekly average of 670 (full time equivalent) staff between 12 September and mid-November 2016 to work on clearing 181,000 cases returned from Concentrix and to answer calls.

- In November 2016 HMRC and Concentrix agreed to terminate the contract with immediate effect. In September 2016, HMRC announced that it would not use the option to extend the contract beyond May 2017. Following discussions, and consideration of options, HMRC and Concentrix agreed to terminate the contract.

- In total, Concentrix stopped or amended tax credit awards in around 12% of cases investigated, of which 32% of these decisions were overturned following a mandatory reconsideration. Concentrix has stated that the average length of time for which claimants had their tax credits stopped and then subsequently reinstated was between six and eight weeks. Between November 2014 and mid-December 2016, HMRC had paid a total of £86,815 in compensation for complaints relating to cases handled by Concentrix.

- The contract with Concentrix delivered estimated savings of £193 million against a payment of £32.5 million. Estimated savings are assessed as £223 million net of opportunity costs of £30 million relating to the diversion of HMRC staff to complete Concentrix cases. The payments to Concentrix included £23.1 million in commission and £6.9 million that related to mandatory reconsiderations where decisions were overturned and HMRC agreed as part of termination not to adjust payments to Concentrix, along with amounts for partly worked cases and sub-contractor costs following termination, and additional IT-related costs. HMRC did not meet any severance costs for staff leaving Concentrix following the agreement to terminate the contract. Concentrix told us that it made a loss of £20.5 million on the contract.

- HMRC will not replace Concentrix with another third-party provider and has transferred 243 staff from Concentrix under TUPE regulations to work on tax credit error and fraud interventions. HMRC concluded that the risks of a third-party arrangement to customer service outweighed the benefits, notwithstanding the 'net positive' savings against costs it reports.

About information in this report

- Tax credits are an annual award (NAO report Figure 2). Because a household's income is liable to change during the year, the Tax Credits Act 2002 requires HMRC to make a provisional award and calculate payments based on estimated income. At the end of the tax year, claimants are required to renew by reporting actual income and circumstances. Error occurs when claimants do not give HMRC accurate information on their circumstances before their award is finalised, or provide inaccurate information that they believe to be correct, or when HMRC makes a mistake when processing the claim. Fraud occurs when claimants knowingly give HMRC inaccurate information or deliberately conceal information to increase the value of their award.

- Mandatory reconsiderations are the process by which claimants can ask to review a decision on their awards made by HMRC or Concentrix. It allows the claimant to provide further evidence to assess the correct award. Claimants can appeal following mandatory reconsideration. Concentrix handled reconsiderations of its decision during the contract, HMRC retained responsibility for handling appeals and complaints.

- TUPE refers to the Transfer of Undertakings (Protection of Employment) Regulations, which preserve employees' terms and conditions when a business or undertaking, or part of one, is transferred to a new employer.

The National Audit Office scrutinises public spending for Parliament and is independent of government. The Comptroller and Auditor General (C&AG), Sir Amyas Morse KCB, is an Officer of the House of Commons and leads the NAO, which employs some 785 people. The C&AG certifies the accounts of all government departments and many other public sector bodies. He has statutory authority to examine and report to Parliament on whether departments and the bodies they fund have used their resources efficiently, effectively, and with economy. Our studies evaluate the value for money of public spending, nationally and locally. Our recommendations and reports on good practice help government improve public services, and our work led to audited savings of £1.21 billion in 2015.

Scots Win Valuable Housing Benefit Changes

Third sector groups have today welcomed the Scottish Government’s introduction of flexibilities to the system of Universal Credit (UC) brought about by the Tories.

The increased choice on how UC payments are made in Scotland, including the option to have payments made direct to landlords and the option of twice monthly payments, was commended by stakeholders.

Mary Taylor, chief executive of the Scottish Federation of Housing Associations, has said:

“Even before our involvement in the Smith Commission Stakeholder Group, we had been campaigning for the housing element of Universal Credit to be able to be paid directly to our members, as has been the case with housing benefit...

“Together with our members, we stand ready to work with the Scottish Government and others to shape Scotland’s new social security system and ensure that the most vulnerable people in our country are treated with dignity, fairness and respect.”

John Downie, director of public affairs at the Scottish Council for Voluntary Organisations, has said:

“The decision to increase the frequency of Universal Credit payments and to offer the option of paying the housing element direct to landlords is a welcome one and reflects suggestions SCVO made in both our consultation response and the evidence we gave to the Social Security Committee."

Commenting Social Security Committee member in Holyrood, George Adam MSP, said:

“The SNP Government has been busy gathering views to better understand the issues facing those affected by the Tories’ punitive welfare system - with the aim of doing as much as possible with the devolved powers in Scotland to shape an informed and effective social security system. The consultative approach of the Scottish Government to ensure the right measures are in place is a really sensible approach.

“The new flexibilities on when Universal Credit payments are made and the very welcome news that payments can be made direct to all landlords is very welcome - and reflects a government that listens and responds to people.

“This Government’s attitude to social security is in sharp contrast to the Tory government’s shameful and thoughtless attitude to welfare.”

Image: George Adam MSP

Government Adopts DWP Select Committee Recommendation on Bereavement Support

Chair's comment

Frank Field MP, Chair of the Work and Pensions Committee, said:

"We are pleased the Government has today announced an extension of the period for which BSP will be paid from 12 to 18 months. This is a very important change for families at what is invariably a traumatic time; not least because it means payments will no longer stop on the anniversary of the death. The Government should be applauded for listening to the evidence that we were so moved by."

Committee Membership is as follows:

Frank Field (Labour, Birkenhead) (Chair); Heidi Allen (Conservative, South Cambridgeshire); Mhairi Black (Scottish National Party, Paisley and Renfrewshire South); Ms Karen Buck, (Labour, Westminster North); James Cartlidge, (Conservative, South Suffolk); Neil Coyle (Labour, Bermondsey & Old Southwark); Richard Graham (Conservative, Gloucester); Luke Hall, (Conservative, Thornbury and Yate); Craig Mackinlay (Conservative, South Thanet); Steve McCabe (Labour, Birmingham Selly Oak); Royston Smith, (Conservative, Southampton Itchen)

For more information:

- Read the Committee's report: Support for the bereaved

- Read the Committee's report: Support for the bereaved (PDF 835,4KB)

- Letter from Caroline Nokes MP to Chair re Committee's recommendations on bereavement support ( PDF 36 KB)

- Work and Pensions Committee

ABC Comment. For the record the Committee found that the costs of a simple cremation funeral are:

Disbursements

Oxford Crematorium - £943

Doctor’s cremation fee - £164 (only payable if the Coroner is not involved)

Total - £1,107

Professional charges

Coffin - £120

Hearse - £265

Removal and storage of the deceased - £295 (time to collect the deceased, vehicle, staff and storage)

Three bearers to carry the coffin - £90

Minister’s fee - £200

Total - £970

Grand total - £2,077

National Citizen Service According to the National Audit Offce

National Citizen Service has had some early successes but it is too soon to assess its long-term impact, according to the National Audit Office.

Young people have been positive about the NCS experience, with 84% of participants in 2015 saying they would recommend NCS to others. External evaluations on how a sample of young people feel and perceive themselves three to five months and 16 months after the programme also show NCS has an initial positive impact on participants. It is too early to say, however, whether the programme is going to meet its long-term objectives of contributing to a more responsible, cohesive and engaged society.

NCS has grown rapidly since the programme was piloted in 2011 and 2012, and an estimated 93,000 16- and 17-year-olds took part in NCS in 2016. Participation in NCS is not, however, increasing as fast as the Office for Civil Society or the NCS Trust hoped, with none of the annual participation targets being met since 2010. If the number of participants continues to increase at the current annual rate of 23%, there would be 213,000 participants in 2020-21 against an aim of 360,000. According to the NAO, the OCS and the Trust can do more to overcome the barriers to participation. Funding has been available for all those who want to participate in NCS, with the government committing £1.26bn of grant funding between 2016-20, but young people do not attend for a range of reasons.

The Trust was set up in 2013 to manage NCS outside of government and with the intention of better supporting the long-term sustainability of NCS. It has taken time for the Trust to develop some of the capability necessary to deliver a programme the scale of NCS. In its first year, the Trust set up processes to manage its contracts with NCS providers and responded to poor performance. The NAO found that weaknesses in governance, cost control, and the overall management of the programme need to be addressed. During 2016, the Trust has made a number of senior appointments to bring in greater management and commercial capability.

The OCS and the Trust have created a market of providers and are on their second round of contracts. The contracts have a payment by results structure aimed at encouraging providers to fill the number of contracted places for NCS participants. Commercial terms aim to incentivise growth, but providers have not achieved the desired level of growth, and terms do not explicitly encourage them to innovate or meet all the NCS societal aims.

According to the NAO, the OCS and Trust have not, so far, prioritised reducing costs, although the Trust told the NAO that reducing costs is now one of four main priorities. Today’s report found that the cost per participant to date has been higher than anticipated and needs to fall. Funding made available as part of the autumn 2015 spending review implied a unit cost of £1,562 per participant in 2016. The OCS and Trust currently expect to spend £1,863 for each of the 93,000 participants to complete the programme in 2016. The cost per participant needs to fall by 29% to £1,314 in 2019 for the Trust to provide 300,000 places and stay within the funding envelope. A focus on growth also encouraged the Trust to use certain media channels, such as television, in addition to social media. It also led the Trust to pay providers an estimated £10 million, in line with the contract, for places that were not filled. It plans to recover these costs.

Amyas Morse, head of the National Audit Office, said today:

“NCS is now at a critical stage. The OCS and the Trust have shown that NCS can attract large numbers of participants, and participation has a positive effect on young people. These are no small achievements, but it remains unclear whether these effects are enduring and whether NCS can grow to become 'a rite of passage' available to all 16- to 17-year-olds.

“The OCS and the Trust now need to think radically about the aspects of the current programme that work and how best to achieve NCS's aims at a more affordable cost to the taxpayer.”

Key facts

- 93,000 - estimated National Citizen Service participants (NCS), 2016

- 23% - current annual growth rate in participants, 2015 to 2016

- 360,000 - aim for NCS participants, 2020-21

- £10 million estimated amount paid to providers for 2016 NCS places that were not filled

- 40% required annual growth from 2016 NCS participants to provide spaces for 360,000 in 2020.

- 55% percentage of young people aware of NCS, July 2016

- 9 months estimated lead-in time for setting up an NCS programme

- 32% percentage of participants from minority ethnic groups, 2016

About

An NCS programme is normally four weeks and involves groups of 12 to 15 young people undertaking an outward bound residential to improve team building skills; a residential to learn life skills and prepare for independent living; and a community project, such as planting a communal garden or arranging a family fun day. All 16- to 17-year-olds across England and Northern Ireland can participate.

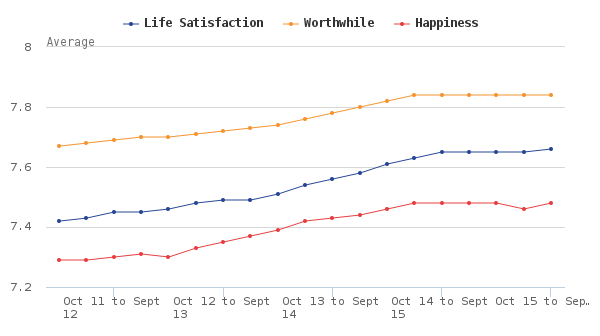

ONS Now Measure How Happy People Feel

"At a time when economic measures are generally improving, this is not necessarily reflected in how people tell us they are feeling about their lives. Whilst it is too early to say why anxiety ratings have increased slightly and why life satisfaction, happiness and worthwhile ratings have levelled off in the past 12 months, we know from our previous research that factors impacting most on people’s personal well-being include health, work situation and relationship status. Publishing this data quarterly, rather than annually, means we can monitor these trends more closely."

Matthew Steel, Office for National Statistics.

During the year ending September 2016, the unemployment rate has continued to fall and GDP per head has increased. There has been a mixed picture in health outcomes for the period 2013 to 2015. Life expectancy has continued to increase for both males and females. However, both the proportion of life spent disability-free and the proportion of life spent in good health have fallen between 2009 to 2011 and 2013 to 2015, for both males and females.

ABC Comment - well that it then we must all be happy...

Are You an 18-25 Year Old in Colchester or Braintree Looking for Work?

There is an amazing opportunity coming up for young people aged 18-25, who are not in training, education or employment.

You can get a free 6 week Get into Adult Support Services programme in partnership with Colchester Institute and TLC Limited is available to young people living in or around the Colchester and Braintree area. This programme involves 3 weeks training at Colchester Institute and 3 weeks work placement with TLC care service.

This excellent opportunity is a chance for young people to gain qualifications and work experience which will help them gain the skills they need to progress into further training or employment.

This programme offers excellent incentives for young people wishing to go into a positive outcome, including a £500 employment sign up bonus or 20 free driving lessons should they be successful at the end of the 6 weeks.

Prince’s Trust mentoring support available up to six months after the programme. All travel expenses reimbursed and benefits paid as normal during the 6 weeks.

Interviews for this programme take place from Tuesday 7TH Feb 2017 at local job centres.

All young people wishing to join the programme must attend a Taster Day on Wednesday 15TH Feb at Colchester Institute.

DBS checks are required for this programme at no cost to the young person.

This programme runs from Monday 20TH Feb 2017 – Friday 31ST March 2017

If this is for you PLEASE contact:

Claire Burgess Outreach Executive | The Prince's Trust | 2nd Floor, 17a Lower Southend Road, Wickford, Essex, SS11 8AA | Internal Extension 5208 | Direct Line 01268 568597 Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

In the meantime some motivational music:

Thinking of Starting a Social Enterprise?

St Albans CVS & Volunteer Centre are running two clinics on the 19th Jan in Harpenden and 25th Jan in Hatfield for anyone who wants to test their ideas for setting up a social enterprise.

http://www.volunteerstalbans.org.uk/inspiring-social-enterprise/social-enterprise-events/

Or you can register directly by using the links below :

- https://www.eventbrite.co.uk/e/social-enterprise-clinic-road-test-your-idea-harpenden-session-tickets-29115268552

- https://www.eventbrite.co.uk/e/social-enterprise-clinic-road-test-your-idea-hatfield-session-tickets-29116385894

He Sure Ain’t Going to Work no More - Be We Loved It When He Did

Tragically Rick Parfitt is not going to work no more.

We saw Quo at the Kursal Southend on a sprung dance floor (!!!) and in Rochester on the River Medway.

It seemed too soon to make the connection after his sad passing, but now we feel we can.

Very sad indeed, but a great artist, a kind man and someone who lived his life to the full.

These are the lyrics of :

Softer Ride

I ain't gonna work

I ain't gonna work no more

Stay in bed

Til' I'm satisfied

And let my head

Take a softer ride

I ain't gonna work

I ain't gonna work no more

I ain't gonna work

I ain't gonna work no more

Find me a schack

Where it's cool inside

Turn my back

On the cold outside

I ain't gonna work

I ain't gonna work no more

I could go back

To the job I had

But the same old thing

Only drives me mad, so

I ain't gonna work

I ain't…

National Minimum Wage Employer's - Strange Excuses For Underpaying

Ten of the most bizarre excuses used by unscrupulous bosses found to have underpaid workers the National Minimum Wage have been revealed.

List of strangest excuses for underpaying National Minimum Wage published

- government launches £1.7 million awareness campaign to ensure workers know how much they are legally entitled to

- Business Minister Margot James: “There is no excuse for not paying staff properly.”

Ten of the most bizarre excuses used by unscrupulous bosses found to have underpaid workers the National Minimum Wage have today (11 January 2016) been revealed by the government.

Excuses for not paying staff the minimum wage include only wanting to pay staff when there are customers to serve and believing it was acceptable to underpay workers until they had ‘proved’ themselves.

The list has been published today to coincide with a new awareness campaign to encourage workers to check their pay to ensure they are receiving at least the statutory minimum ahead of the national minimum and national living wages rising on 1 April 2017.

The £1.7 million campaign aims to make sure workers are being paid at least the National Minimum Wage, or National Living Wage, depending on their age, and is part of the government’s commitment to making sure the economy works for all.

Investigators from HMRC have revealed some of the worst excuses given to them by employers caught out for underpaying staff, which include:

- The employee wasn’t a good worker so I didn’t think they deserved to be paid the National Minimum Wage.

- It’s part of UK culture not to pay young workers for the first 3 months as they have to prove their ‘worth’ first.

- I thought it was ok to pay foreign workers below the National Minimum Wage as they aren’t British and therefore don’t have the right to be paid it.

- She doesn’t deserve the National Minimum Wage because she only makes the teas and sweeps the floors.

- I’ve got an agreement with my workers that I won’t pay them the National Minimum Wage; they understand and they even signed a contract to this effect.

- My accountant and I speak a different language – he doesn’t understand me and that’s why he doesn’t pay my workers the correct wages.

- My workers like to think of themselves as being self-employed and the National Minimum Wage doesn’t apply to people who work for themselves.

- My workers are often just on standby when there are no customers in the shop; I only pay them for when they’re actually serving someone.

- My employee is still learning so they aren’t entitled to the National Minimum Wage.

- The National Minimum Wage doesn’t apply to my business.

By law, all workers must be paid at least £7.20 an hour if they are aged 25 years and over, or the National Minimum Wage rate relevant to their age if they are younger.

Business Minister Margot James said:

There are no excuses for underpaying staff what they are legally entitled to. This campaign will raise awareness among the lowest paid in society about what they must legally receive and I would encourage anyone who thinks they may be paid less to contact Acas as soon as possible.

Every call is followed up by HMRC and we are determined to make sure everybody in work receives a fair wage.

Workers are encouraged to regularly check their pay to ensure they are receiving at least the minimum or living wage, depending on their age.

For more information and to report underpayment, visit www.gov.uk/national-minimum-wage or contact Acas for free and impartial advice.

| Year | 25 and over | 18 to 20 | ||||

|---|---|---|---|---|---|---|

| 2015 | £6.70 | £5.30 | ||||

| 2014 | £6.50 | £5.13 | ||||

| 2013 | £6.31 | £5.03 | ||||

| 2012 | £6.19 | £4.98 |

Help for the Homeless in Wales

The Cabinet Secretary for Communities and Children Carl Sargeant has announced £7.8 million for the Homelessness Prevention Programme for 2017/18.

The grant supports Local Authorities and third sector organisations to deliver front line services to prevent homelessness. It helps people who are affected by homelessness through the provision of night shelters, hostels, outreach work, mediation and bond schemes as well as providing a substantial network of advice services.

Announcing the funding, Carl Sargeant said:

“Providing people with a safe, warm and secure home remains a key priority. Local authorities have made a positive start in implementing the legislation we introduced last year to help everyone who is homeless or at risk of becoming homeless. As well as helping local authorities build on this work, the funding will help projects provide services directly to people to address their housing problems.

“Our legislation means more people than ever before are getting help at an earlier stage so that homelessness can be prevented. I would urge anyone who thinks they are at risk of becoming homeless to seek advice and help. The earlier you get advice, the less likely you are to become homeless.”

One of the organisations who will receive funding in 2017/18 is Barnardos Cymru who manage the BAYS Mediation & Home Support service which aims to prevent homelessness in the Swansea area by supporting young people to settle arguments and differences with their family.

Sarah Crawley, Director of Barnardos Cymru said:

“This funding will be pivotal in helping us support young people who are at risk of homelessness by allowing them to remain at home or find other suitable accommodation. We welcome the chance to support Swansea Council in its new duties of preventing homelessness for everyone.”

Cllr Dyfed Edwards, WLGA Spokesperson for Housing said:

“The WLGA welcomes the announcement of the Homelessness Prevention Programme funding. Local authorities and their partners work with thousands of households each year facing the threat and misery of homelessness, this funding is vital in ensuring that the staff and services required to prevent and relieve homelessness are available across Wales."

Executives

-

Simon Collyer

Position: Founder & Director

Simon Collyer hails from Brightlingsea in Essex, a small town on the coast between Colchester & Clacton. Simon worked very successfully in the leisure marine industry in the UK and in Australia. Later in London Simon worked in the web development and publishing fields, founding a below-the-line sales promotion agency in the early nineties and then later a software company Red Banner in South Africa (2002-06). Here in South Africa, Simon became interested in the Third Sector and starting his own organisation.

-

Christopher Johnson

Position: Bookkeeping and Administration

Chris lived in Oxford for twenty years, having been educated at Magdalen College School. Chris sought a career with British Rail and spent twenty years in railway retail management ending with Virgin Trains at Euston Station. Christopher retrained in bookkeeping and accounts in 2000 and now works for Chelmsford Community Transport.

A strong, enthusiastic team player with a meticulous eye for detail, Christopher brings a range of skills to the ABC.

Team

-

Frances Rimmer

Position: Researcher

When not charming snakes Frances is a Modern History student at the University of Essex, focusing specifically on social history. The lives and experiences of the ordinary person rather than on politics or the military. Outside of her studies, Frances enjoys film and writing. As a keen roller skater who plays roller derby with the Kent Roller Girls, Frances secret wish would be to become a skating instructor and open her own rink, as she has always wanted to help people in some way, and feels it would be great to do so while also sharing her passion with like-minded people.

-

Stuart Meyers

Position: Researcher

Stuart Meyer, is a final year American Studies student at the University of Essex. Stuart focussed his academic life on global justice and the rights of migrants. Additionally Stuart has a passion for writing, both creatively and with the aim of providing accessible information to those who need it most Stuart has made a great contribution to our library of Advice Guides demonstrating his versatility by writing intelligently on a wide range of topics.

-

Louis Jones

Position: Film Maker

Louis is a 19 year old TV and film student studying at Colchester Institute. Along with hand-picked fellow students, Louis made the ‘Membership’ video that can be seen on the ABC website. Louis volunteers at, Hospital Radio Colchester, as a football commentator. A true fan of the ‘Great Game’ Louis insights have been sought after on occasions by key local media, the Colchester Daily Gazette & even BBC Essex.

-

Marcus Pierpont

Position: Film Director

Talented student film maker, Marcus Pierpoint, directed the ABC 'Membership' film which can be seen on the organizations website. Marcus has recently graduated from a BTEC course, studying Creative Media Production at Colchester Institute and he claims a true passion for films and filmmaking. Marcus also enjoys radio work and volunteers at the local hospital radio station, producing and presenting his own show. Marcus is enrolled at the University of Greenwich, and dreams of a career in the media industry.

-

Shane Mitchell

Position: Film Maker

Shane Mitchell, is another Colchester Institute Film and TV student that aspirers to be a Director of Photography in the future. Shane was the camera operator for the ABC Membership video, fun to make says Shane but it is also work he is very proud of. Shane loves all things ‘film’ and he makes videos even in his spare time.

-

Joe Corlett

Position: Film Director

Ex-student script writer/director, Joe Corlett, directed the ABC's corporate video (About Us) which is now viewable on the main website. Joe graduated from the Colchester Institute with a BTEC diploma in the field of media. Joe is passionate towards film making and hopes to continue making more that are constructed form his own material. On the side he's loves being out jogging in all terrains and when not out side he's writing scripts for future projects. Joe is now out in the world ready to start his life goal of working in the Media industry.

-

Jon Taylor

Position: Film Maker

Jonathan Taylor has been working in the media sector for 3 years and for our filming projects he worked as the production manager. John worked on graphical elements of our film, About Us for example, rendering images and making them look good on screen.

Jon is also experienced in animation and he made the logo and animation sequences in the ABC corporate videos.

Part of Jon’s brief was to also organise the administration side of filming, known collectively to admin experts the world over as ‘the paperwork’.

-

Thomas Hearn

Position: Film Maker

Thomas Hearn, has been involved in media, for about three years. Tom likes to work a lot at a computer, particularly the editing suite. For the ABC project, Tom worked on the edit itself; created and pieced together both the footage and the music, Tom created the visual elements of the ABC ‘About Us’ video and put most of the visual effects on the video.

I think we can agree that along with the rest of our youthful student team; Tom has done a very fine job indeed.

-

Max Gillard

Position: Film Maker

The last of our film team Max Gillard has recently finished college studying Creative Media Level 3 and Max hopes to continue the course on to University to someday gain a job in the media industry.

We wish Max the best of luck.

-

Harry

Position: Film Maker

My name is Harry Genge and I am an aspiring film maker. I have skills in the majority of film orientated jobs, though I am most interested in the creative roles such: Directing, Director of Photography and Writing. In my spare time I make short films, write, read, draw/paint and take the dog out for long walks.

-

Ned

Position: Producers

My name is Ned Woodcraft and I’m an aspiring Producer. As well as completing a diploma in media production I have also had a number of jobs in the professional market. I’m also a keen sailor and water sport enthusiast.

-

Brandon

Position: Producer

My name is Brandon and I’m an aspiring producer and actor. I enjoy bringing a production together with planning and preparations to create a great finished product. My hobbies also include street magic and bass playing.

-

Callum

Position: Writer and Director

My name is Callum Olive and I’m an aspiring writer and director. I’m always looking for a new project and love writing new stories and screenplays at home and on the move. My hobbies include playing the piano and street magic.

-

Joanie DeMuro

Joanie joined ABC team in early 2017. She was one of six student volunteers from the University of Essex in that cohort. The student team focused on a range of projects, including creation of Wikipedia page,‘training manual’ and most importantly, researching and adding entries to the website directory of organisations that assist the unwaged, or those on low incomes. “This placement was very helpful - thanks for the opportunity Simon.”

-

Cherry Lam

Cherry Lam has been volunteering for ABC for one month. Although it is a short period of time, she knows a lot more about the running of a charity organisation. Cherry is responsible for adding directories to the organisation website according to categories. Joining this placement helped her improving skills and gaining new experiences. Cherry says is extremely appreciative of the support she has received from ABC which allowed her to improve skills.

Join

FREE

Here