Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

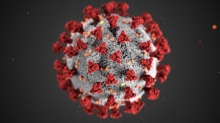

Coronavirus and Claiming Benefits

CORONAVIRUS - This page provides information about coronavirus and claiming benefits. It will continue to be updated. Please check this page regularly for updates on the arrangements the Department for Work and Pensions is making to support those who are affected by coronavirus.

If you’re in work and not claiming benefits

If you cannot work due to coronavirus and are eligible for Statutory Sick Pay you will get it from day one, rather than from the fourth day of your illness. DWP intends to legislate so this measure applies retrospectively from 13 March 2020.

Statutory Sick Pay will be payable if you are staying at home on Government advice, not just if you are infected by coronavirus. This will apply from 13 March 2020.

If you are a gig worker and/or on a zero hours contract, you may be entitled to sick pay. Check your eligibility for Statutory Sick Pay

If you need to provide evidence to your employer that you need to stay at home due to coronavirus, you will soon be able to get it from NHS 111 Online instead of having to get a Fit Note from your doctor. This is currently under development and will be available soon.

If you are not eligible to receive sick pay you can apply for Universal Credit and/or apply for New Style Employment and Support Allowance

You can also apply for these if you are prevented from working because of a risk to public health.

If you’re already claiming benefits

In light of the current coronavirus outbreak, the Department for Work and Pensions has taken the precautionary decision to temporarily suspend all face-to-face assessments for health and disability-related benefits. This is aimed at reducing the risk of exposure to coronavirus and safeguarding the health of individuals claiming health and disability benefits, many of whom are likely to be at greater risk due to their pre-existing health conditions.

If you already have an assessment appointment arranged, you do not need to attend. Your assessment provider will contact you to discuss your appointment and explain the next steps to you.

If you have made a claim for Personal Independence Payment (PIP), Employment and Support Allowance (ESA), Universal Credit or Industrial Injuries Disablement Benefit (IIDB) but do not have a date for an assessment appointment, you do not need to do anything. You will be contacted shortly by telephone or letter to let you know what will happen next.

If you are already receiving PIP, ESA, Universal Credit or IIDB you will continue to receive your current payments as normal.

If you have made a new claim or wish to make a new claim, DWP will continue to take claims for all benefits.

Read the current NHS guidelines on coronavirus, including advice on those who should stay at home.

If you have a jobcentre appointment but are staying at home on Government advice or have been diagnosed with coronavirus, you will not be sanctioned if you tell DWP in good time. If you have a Claimant Commitment, it will be reviewed to make sure it is still reasonable.

If you are staying at home as a result of coronavirus, your mandatory work search and work availability requirements will be removed to account for a period of sickness.

If you’re already claiming Universal Credit and think you may have been affected by coronavirus, please contact your work coach as soon as possible. You can do this by:

using your online journal, or calling the Universal Credit helpline

If you are in work and already claiming Universal Credit, and are staying at home on Government advice, you should report this in the usual way via your online journal. If this means you are working fewer hours, the amount of Universal Credit you receive will adjust as your earnings change.

If you are self-employed and claiming Universal Credit, and are required to stay at home or are ill as a result of coronavirus, the Minimum Income Floor (an assumed level of income) will not be applied for a period of time whilst you are affected.

Jobcentre Plus staff are ready to support you if you are required to stay at home.

If you’re making a new claim

Don’t delay making a benefit claim, even if you think you may be affected by coronavirus.

You can apply for Universal Credit online. If you need to make an appointment, call the number you are given when you submit your claim, and explain the situation. Jobcentre Plus staff are ready to support you if you are required to stay at home.

If you need to claim Universal Credit or Employment and Support Allowance (ESA) because of coronavirus, you will not be required to produce a Fit Note.

If you are affected by coronavirus you will be able to apply for Universal Credit and can receive up to a month’s advance upfront without physically attending a jobcentre.

If you are suffering from coronavirus or are required to stay at home and want to apply for ESA, the usual 7 waiting days for new claimants will not apply. ESA will be payable from day one.

For more information about any aspect of Universal Credit, including how to make a claim, visit the homepage or use the links at the top of this page.

If you’re an employer

If you employ people, you are urged to use your discretion about what evidence, if any, you ask for when making decisions about sick pay.

If you have fewer than 250 employees, you will be able to reclaim Statutory Sick Pay for employees unable to work because of coronavirus. This refund will be for up to 2 weeks per employee.

Find out about other Government support for businesses affected by coronavirus.

ABC Comment, have you say below:

Feeling Depressed - Please Read this Handy Guide

MENTAL HEALTH - How do you know that you are feeling depressed and not just a bit glum?

There are many reasons to feel depressed at the moment and we must thank insurance company, Insurance With for sending us this handy guide. Thank's folks!

Just remember that people who are happy all the time are generally classed as clinically insane!

So don't feel down if you feel down, it's all part of the human condition.

PLEASE click on the link below, it will take you to some very useful information.

ABC Comment, have your say below:

Trump Cuts Food Assistance to a Million Claimants

FOOD POVERTY - Despite the coronavirus pandemic the Trump administration has no plans to scrap or delay a rule change that could strip federal food assistance from a million claimants – a programme called SNAP (Supplemental Nutrition Assistance Program).

The rule would impose more strict work requirements on Supplemental Nutrition Assistance Program (SNAP) recipients and constrain states’ authority to waive those requirements — people are questioning the sense of this in the middle of a pandemic.

Sonny Perdue, head of the U.S. Department of Agriculture, told House lawmakers during an Appropriations Subcommittee hearing this week that the Trump administration considered pushing back implementation of the rule, set for April 1, but ultimately decided against it.

Image: Rep. Barbara Lee (D-Calif.)

“Really it’s a cruel rule, taking food out of the mouths of hungry individuals,” Rep. Barbara Lee (D-Calif.) told Perdue during the budget hearing on Tuesday.

1.3 to 1.5 million people could lose federal nutrition assistance under the Trump administration’s SNAP rule change. The Agriculture Department’s own estimate indicated that the rule would strip benefits from more than 700,000 people.

ABC Comment: As in the UK the stripping of the benefits system is being used to subsidise tax cuts to corporations, wealthy inderviduals and to tackle the deficit, paying the bankers who caused the Great Recession, not their victims.

Council Tax Arrears - Many Struggle to Meet this Cost

COUNCIL TAX - New research from Citizens Advice finds that many people in council tax arrears can’t afford to pay their debts and have an average of just £7 left at the end of the month after covering their living costs. Some four in 10 have no money left at all.

Council Tax is a priority debt and councils have extensive powers to enable them to collect it.

The overwhelming majority - nine in 10 of the people who seek help from Citizens Advice with council tax debt - also owe money on other household bills, most commonly water and energy costs.

Yet outdated government regulations are forcing these people into sometimes desperate hardship. They push councils to use the courts to recover council tax debts which can add legal costs and bailiff fees to the debt.

The charity says the rules also mean people become liable for the full annual bill two weeks after a missed payment. This means that missing an average council tax payment of £167 in the first month of the financial year can escalate to a debt of over £2,000 in just nine weeks. This is almost 300 times the monthly amount available to the average person seeking support from Citizens Advice on council tax arrears.

The system is also failing local councils. A 2019 Freedom of Information request revealed that, for every £1 of debt referred to bailiffs by councils, only 27p is ever returned to them.

Last year, the charity Citizens Advice helped more than 83,000 people in England with council tax problems, over 40% more than the next biggest debt issue.

Image: Will Quince MP, Minister for Welfare Delivery.

ABC Note: In a letter from MP Will Quince to the ABC it has been pointed out that LHA (Local Housing Allowance) rates were introduced in 2008 as a way of calculating Housing Benefit for tenants in the private rented sector and tenants are entitled to a flat rate of rent allowance regardless of the contractual rent paid. Rent is generally paid to the tenant though it can be directed to the landlord in cases of arrears. The Valuation Office in England and the Rent Services in Scotland have the job of keeping the LHA rates that apply with them under regular review. LHA rates are published by Local Authorities and by the Valuation Office Agency. On the Gov.uk website at https://lha-direct.voa.gov.uk/search.aspx tenants can compare how much support is available towards their housing costs in different areas and for different property sizes.

Mr Will Quince MP then says LHA rates are not intended to meet rents in all areas and there should be no presumption that Housing Benefit will always pick up the bill. The intention behind the welfare reform programme is that the same considerations and choices faced by people, not in receipt of benefit should also face those claiming benefit and the LHA policy is designed to achieve this.

The point is though, conventional tenants are not subject to the discrimination faced by those on Universal Credit, where far fewer properties are available in reality than to the average tenant looking for accommodation. Rents have skyrocketed...the UK has seen the biggest increase in rent hikes in Europe. In contrast, our state pensions are some of the worse in Europe and welfare benefits have been frozen for six years far reducing their purchasing power. Thus renters who want to pay their Council Tax are finding that they have no money left to pay them. They are then subject to the costs added by bailiffs and all the distress and anxiety that comes with this process. Tenants evicted soon rack up huge costs in legal fees, moving costs and emergency housing costs.

The cheapest option can often turn out to be the most expensive in the long term, many consumers know.

Government policy is not helping people to work it is making them homeless. At the ABC we say that if people have paid to insure themselves against ill health and losing their employment that they should be paid in full. The Valuation Office like any organisation in the fast-paced world we live in has fallen behind actual events. Their valuations do not reflect the real world. Thus, the living component of Universal Credit is subsidising the missing LHA rate [money] and now with other costs rising many people can no longer afford to pay Council Tax needing to buy food instead. With BREXIT and Coronavirus, this situation can only get worse.

ABC Comment, have your say below:

The Economy has Tanked

ECONOMY - Commenting on today’s GDP figures for the three months to January, Head of GDP at the Office of National Statistics, Rob Kent-Smith said:

“The economy continued to show no growth overall in the latest three months. Growth in construction, driven by housebuilding, offset yet another decline in manufacturing, particularly the drinks, cars and machinery industries.

“The dominant service sector also showed no growth in the latest three months with falls in retail and telecoms balanced by strength in rentals, employment and education.”

ABC Comment, have your say below:

Universal Credit Changes to Advances

UNIVERSAL CREDIT - The government is to increase the repayment period for Universal Credit (UC) advances to 24 months from October 2021, with the maximum rate at which deductions can be made reduced from 30 percent to 25 percent of the standard allowance.

This will be welcome news for many people.

ABC Comment have your say below:

UK Budget Response Generally Disappointing for Those on Low Incomes

UK BUDGET - Today the reaction to the budget has been pretty uninspiring.

Rishi Sunak opens the budget on the coronavirus outbreak: “I know how worried people are … what everyone needs to know is we are doing everything we can to keep this country and our people healthy and financially secure. This is an issue above party.”

The chancellor says “we will get through this together”. But there are other matters also to address, after the election victory. He adds: “We just had a general election where people voted for change … this budget delivers on that change. Yes, it is a budget that provides for security today, but it is also a plan for tomorrow.”

Sunak announces a fiscal stimulus totalling £30bn, including welfare and business support, sick-pay changes and local assistance.

He says this includes £7bn for businesses and families and £5bn for the NHS.

The chancellor says he believes this is larger than any other country at present.

More budget changes

- Many working-age benefits which had been frozen for four years. including Jobseeker's Allowance, Employment and Support Allowance, some types of Housing Benefit, and Child Benefit. will rise in line with the rising cost of living, going up by 1.7%. So, for example, child benefit for the eldest child will go up from £20.70 to £21.05 per week

- Those aged 25 and over will get the National Living Wage of £8.72 an hour, a rise of 6.2%, with younger workers also getting more. This is paid by employers

- The full, new state pension will go up by 3.9% from £168.60 a week to about £175.20 in April. However, most pensioners get the older basic state pension, which is also going up by 3.9%, from £129.20 to £134.25 per week. They may also get a Pension Credit top-up

- Many self-employed people face a higher tax bill from April, when the so-called IR35 rule is extended to the private sector. That could mean thousands of contractors and freelancers will pay more tax

- The gradual process allowing people to pass on property to their descendants free from some inheritance tax will enter its final stage of introduction. It will reach its target by 2021

Welfare

The Chancellor announces £1bn of additional funding, including a £500m local authority hardship fund.

Statutory sick pay will be available to individuals self-isolating. Sick notes will be available by contacting NHS 111.

The Chancellor says millions working self-employed or in the gig economy will also need help. The government will make it quicker and easier to access benefits.

Contributory employment and support allowance (ESA) will be claimable from day one, rather than day eight. The minimum income floor for universal credit will be removed. The requirement to physically attend a job centre will be removed – everything can be done on the phone and online

Additionally

Almost almost £1.1bn of allocations from the housing infrastructure fund will be made to build almost 70,000 homes in high-demand areas.

The chancellor announces a Grenfell building safety fund worth £1bn. The funds will help to remove cladding from tall residential buildings.

He says almost £650m of funding will be made available to help rough sleepers into accommodation.

Commenting on today’s Budget, Chief Executive of Child Poverty Action Group, Alison Garnham said:

“The new Corona virus emergency measures on Statutory Sickness Pay, employment support allowance and universal credit are welcome but low-income families need support in health and in sickness. When it comes to the nation’s longer-term priorities, action on poverty must trump potholes and pubs. We need to properly re-invest in our social infrastructure.

“Universal credit continues to cause havoc for millions, so it is disappointing that the Chancellor brought no substantial permanent reforms to the table today. The temporary lifting of the Minimum Income Floor in Universal Credit is very welcome, but to be effective, a plan for prosperity must include fixes to the fundamental design flaws and funding shortfalls that have left universal credit unfit for purpose.

“It is within the Government’s power to spread opportunity more evenly across the UK and to enable struggling families to get on, but unless funding is restored for universal credit and for children’s benefits, investment in infrastructure will have limited effects. This Budget was an opportunity to begin to slow the rise in child poverty but there was no evidence today that low incomes are the priority that they should be in any effective strategy to level up the country and boost the economy. The Government could lift seven hundred thousand children from poverty by 2023 if it restored support for children in Universal Credit to its 2013 value, added £5 to child benefit and removed the two-child limit and benefit cap. That would begin to level up those children and to send a strong signal to struggling families that they have not been forgotten.”

Corona virus:

While welcoming the new Corana-virus-related benefit changes announced today, Ms Garnham called for further support for people claiming universal credit and other benefits who must self-isolate to reduce the risk of spreading Corona virus. Jobcentre staff need clear guidance enabling them to lift work-search and other requirements on claimants who must self-isolate, in addition to the Budget announcement to lift the requirement to physically attend benefit offices.

Ms Garnham said:

“It is critical that universal credit payments are made available immediately on a non-repayable basis to anyone self-isolating who needs to claim.”

In addition Ms Garnham called for:

- in the event of schools closures there should be an emergency uplift in child benefit at least to the value of free school meals to ensure that all parents can provide their children with adequate healthy food at a time when family incomes are likely to be reduced as parents have to stay off work to care for children, and children cannot receive free school meals. Work-search/work-preparation requirements should be lifted for parents self-isolating or where children are required to stay off school.

- a temporary uplift in key benefits to ensure people who have to self-isolate can afford to eat healthily and heat their homes. Sanctions and deductions should be lifted from people’s awards if they are self-isolating, and/or people who are sanctioned and self-isolating should have automatic immediate access to a hardship payment.

The SNP has said the Tory government is failing millions of workers by refusing to increase UK statutory sick pay to at least the EU average in the face of the Coronavirus crisis.

Speaking at Prime Ministers Questions, Ian Blackford challenged Boris Johnson to follow the example of other European countries who have much higher rates of statutory sick pay.

The SNP Westminster Leader said the UK's current "meagre" £94.25 per week rate was "poverty pay" by comparison to the rate in Ireland of £266 per week, and other countries such as Germany and Austria where it is £287 per week. The UK currently has the second lowest rate in the EU.

Responding to the Budget Statement David Sinclair, Director of the International Longevity Centre UK (ILC) commented:

“The Government has yet again missed an opportunity to recognise the enormity of the policy challenges which come from us living increasingly longer lives.”

“We are failing to maximise the economic potential of longer lives; we are failing to invest in preventing ill health; social care is in crisis; and we know pensioner poverty will start to increase.”

“We have no comprehensive plan of action to respond to the challenges of demographic change.”

“At the same time, we continue to fail to invest seriously to make the most of the potential social and economic opportunity of longevity.”

“The Coronavirus crisis highlights how we have been far too complacent about the impact of infectious diseases despite the fact a major pandemic has been increasingly likely.”

“In the short term there is an immediate need to invest to protect our most vulnerable citizens and ensure our health care system can cope. We very much welcome the Government commitment to ensure the NHS will have the funding it needs.”

“But over the next few years we need to significantly push more health spending towards the prevention of ill health. Investing in the prevention of ill health will result in fewer vulnerable people when the next crisis happens. It is also key to help the Government achieve its ambitious goal of ensuring people can enjoy at least 5 extra healthy, independent years of life by 2035.”

“Longevity could offer a huge economic return for UK PLC. By 2040, over-50s could be spending 63p in every pound. And supporting people to spend or work for longer could add 2% to UK GDP every year.”

“Yet the cost of lost productivity as a result of largely preventable diseases already exceeds £500 billion in better off countries every year.”

“We won’t deliver an economic longevity dividend without investing in health systems.”

“The lack of commitments on adult social care are a real concern. The system is already in crisis. A commitment to cross party talks on the funding of social care may be welcome, but it must not kick spending decisions into the long grass again. Inaction and delay by successive Governments have created a crisis which requires an urgent solution.”

Commenting on today’s (Wednesday) Budget Statement, which set out emergency action to tackle coronavirus, TUC General Secretary Frances O’Grady said:

“The government’s coronavirus plans will leave millions of workers behind. Without urgent action, too many will be plunged into poverty and debt.

“Today’s announcements won’t help the nearly 2 million people who miss out on sick pay because they don’t earn enough. Telling them to turn to the broken benefits system isn’t good enough. We need decent sick pay for all.

“Ministers must now urgently bring together unions and employers to talk about how to support jobs, including through wage subsidies for short time working schemes, and further help for public services – especially social care.”

On investment announcements, she added:

“This spending u-turn is badly overdue. The priority now must be to repair the damage of ten years of Tory devastation.

“Helping working families and rebuilding public services must come first. And we need to see concrete action on the challenges of the future.

“This means banning zero hours contracts, sorting social care, ending the UK’s dire regional inequalities, setting out a credible plan to achieve net zero, and getting an EU trade deal that supports jobs and workers across the UK.”

ABC Comment, have your say below:

UK Budget Speech - You Can Watch it Here

BUDGET - After a terrible ten years UK public sector net debt has surged from about £1 trillion when the Conservatives came to power in 2010 to more than £1.8 trillion. Far from cutting costs by slashing the social security budget Government policy has been driving up borrowing, not least by the cost of implimenting Universal Credit.

Today the Bank of England has cut the base rate from 0.75% to 0.25%, taking the cost of borrowing back down to the lowest level in history.

Our economy is flat on its backside and the EU negociations have not been going well. The government will unveil its first Budget later, amid growing fears about the impact the coronavirus will have on the UK economy.

These are strange times. All bets are off to whether there will be any help to those struggling on Universal Credit.

Budget speech: https://parliamentlive.tv/event/index/2b439ccc-4695-4f26-8210-8c7d1ee9427a

ABC Comment, have your say below:

SNP MP Neil Gray Wants Proper Guidance Over Coronavirus

SANCTIONS - SNP MP Neil Gray has urged the Department for Work and Pensions (DWP) to urgently publish advice for Job Centre staff and welfare claimants to avoid those affected by Coronavirus being sanctioned.

Responding to Mr Gray at Work and Pensions Questions, the Minister for Welfare Delivery, Will Quince MP, confirmed the DWP would not sanction people who are self-isolating for coronavirus and unable to attend Job Centre appointments, adding that discretion will be used by the DWP.

However, the SNP’s Work and Pensions spokesperson has said that “exercising discretion” is not good enough and that guidance must be clear for both advisers and claimants affected by Coronavirus – including those who need to self-isolate and those who need to stay at home to care for children who may be off school. He also challenged the sanctions regime – describing it as callous and punitive - on the basis that if the UK government can make allowances for Coronavirus victims then why not all welfare claimants.

SNP MP Patrick Grady also asked the UK government when it was going to publish its advice for “job seekers, advisers and for those whose job it is to scrutinise what the government is doing” and urged the DWP to be “robust in its advice” because “people aren’t going to be reassured by the idea of ‘exercising discretion’ on something so fundamental.”

ABC Comment, have your say below:

Jobcentre Plus Arrangements Over Easter

DWP OPENING HOURS - Jobcentre Plus opening times are different over Easter:

| Date | Easter opening times |

|---|---|

| Friday 10 April | Offices and phone lines are closed |

| Monday 13 April | Offices and phone lines are closed |

| From Tuesday 14 April | Offices and phone lines are open as usual |

To make sure people receive their payments on a day when Jobcentre Plus offices are open, arrangements have been made to make some payments early.

| Expected payment date | Date benefits will be paid |

|---|---|

| Friday 10 April | Thursday 9 April |

| Monday 13 April | Thursday 9 April |

If the expected payment date is not shown, customers will get their money on their usual payment date.

ABC Comment, have your say below: