Work TV

Watch our TV Channel dedicated to the ‘World of Work’. Explore our video library for informative videos featuring career opportunities at leading companies, franchising opportunities, further education and recruitment professions and their services.

Simon Collyer

Micro lender MiniCredit Forced to Apologize to Customer

MiniCredit has been forced to apologise over threatening to contact a borrower’s employer.

The National Debtline says it heard of numerous cases where MiniCredit acted in an overly aggressive manner.

MiniCredit says it has taken steps to ensure it does not happen again

According to the BBC - The Office of Fair Trading (OFT) says companies should not act in a way that is likely to cause debtors public embarrassment.

OFT guidelines on debt collection state that it is improper for companies to act in a way "likely to be publicly embarrassing to the debtor".

Companies must comply with OFT guidelines if they are to hold on to their licence and significant breaches can lead to a licence being revoked.

An example of a payday loan through Mini Loan Shop, Representative APR Example: Borrow £700 and pay £111.27 per month for 12 months at an interest rate of 140% per annum (fixed). The total charge for credit is £635.24 The total amount repayable is £1335.24. Representative 277.5% APR (variable). The APR you pay will vary depending on which lender that accepts your loan, so always make sure you read the terms and conditions before entering a loan agreement.

So what is APR?

APR is a term you will see on several different lending products. Until March 2016 it was used with mortgages, credit cards and loans. However, there are now two very similar versions, essentially doing the same job.

While every lender uses the same calculation to work out APR, there are a few variables which may make APR seem higher or lower on paper. This is because different consumers will qualify for different rates and may incur different fees and charges.

APR – Short for Annual Percentage Rate, it's a legal requirement for APR to be shown on personal loans, credit cards and hire purchase agreements so that an easier and fairer comparison can be made.

APRC – This stands for Annual Percentage Rate of Charge and is now used for mortgages, including second charge mortgages (secured homeowner loans).

APR is a very prominent figure within financial services because it is used widely by lenders. Every lender calculates it in the same way. As it is a standard measurement, it is a useful figure which can help consumers compare different financial products. All lenders have a legal obligation to give an accurate APR before their customers take on a loan.

What are representative APR and typical APR?

Representative and typical APR are two different ways of working out and presenting APR.

For example: while one borrower may have a long history with a lender and be trusted with a lower APR, another may be a new customer with a poor credit history which inflates the APR available to them. There are lots of factors which may affect the actual APR you pay as an individual. The most common are:

- Your credit history

- Your history with the lender

- How much you want to borrow

- How long you want to borrow for

Representative APR and typical APR are two different calculations lenders use to account for and express these differences.

Representative APR

When lenders use the expression “representative APR” they are referring to a rate which 51% or more of applicants for their product will be offered. This rate includes all interest, fees and compulsory extras including things like obligatory insurance policies.

Typical APR

When lenders advertise a “typical APR” they are referring to a rate which, by law, two thirds or more of applicants for their product will be offered. Again, the rate includes all interest, fees and additional charges.

Understanding the difference between representative and typical APR will help to give you some idea of the actual rate you will be offered. You are more likely to receive a rate closer to typical APR than representative APR, for example. However, because in many cases applicants do not meet the criteria for their loan after they have been offered a product, fewer than two thirds or 51% respectively may ultimately qualify for the APR advertised.

There are several other types of APR which you may come across as you explore financial products. Here is a quick guide…

Types of APR

Fixed APR

When you use a credit card, this is the interest rate you can expect to pay which will not change unless you fail to meet repayments.

Default APR & Penalty APR

If you break a credit card agreement, you may be subject to a default or penalty APR on any new transactions you make. This APR will typically be higher than your usual rate. Missed repayments and exceeding credit card limits are common causes of this.

Introductory APR

In some instances, an introductory APR may be offered to attract new customers. This APR will be lower than the usual rate and must last for a minimum of six months by law. After this period, the APR will return to its usual, higher level.

Variable APR

When national rates and economic factors change, so too can APRs. These are known as variable APRs which are determined by what’s going on in the world.

Delayed APR

This is an APR which will be incurred later. For example, a lender may advertise a product with “no interest until June”. The delayed APR is the APR you can expect to pay once the rate kicks in.

Tiered APR

Different levels of borrowing may be subject to different APRs. This is known as tiered APR and is usually seen with credit cards where the first £1-£500 has an APR of 16% while the next £500-£1500 has an APR of 17%.

What does APR mean for payday loans?

If you’re thinking about using a short-term financial product like a payday loan, you should have taken some time to investigate the APR of different products. In this case, you will already know that APRs on payday loans are usually high compared to other financial products.

While short-term loans can be a more expensive way to borrow, they are also a very accessible and fast way to access emergency finance and may not be quite as costly as their APRs would suggest.

This is because APR is used most often to calculate the cost of longer-term loans. Short-term loans rarely extend beyond a year – in some cases they can last as little as a week – which means APR (which is an annual measurement) is not an accurate way to calculate cost.

A better way to appraise and compare the affordability of short-term loans is to work out the interest you will be charged per day, or per £100. Remember to factor in admin fees and charges when you work this interest rate out.

Image: Drinking using Payday Loan money can really give you a hangover!

Where can I learn more about APR?

Would you like more information about APR? Perhaps you have a money worry you’d like to discuss with an expert? There are lots of excellent resources available which can help. Here are a few of the best:

Financial Help & Advice

Financial help – http://www.financial-ombudsman.org.uk

Find a financial advisor –http://www.unbiased.co.uk/financial-adviser

Free advice on money –http://www.gain4u.org.uk

Free debt advice –http://www.payplan.com

Debt Advice Foundation –http://www.debtadvicefounation.org

Money Advice Trust –http://www.infohub.moneyadvicetrust.org

Independent financial information –http://www.moneybasics.co.uk

Money & debt advice –http://www.nationaldebtline.co.uk

Loan & APR Forums

http://forums.moneysavingexpert.com

Welfare Cuts Will Hit Low Income Families Both in And Out Of Work

New analysis finds the cumulative impact of welfare cuts will hit low income families both in and out of work on average by £41.45 per week by 2020.

Working households are hit hardest at £48.90 per week, with families and local authorities left struggling to plug the gap. Fresh analysis on the cumulative impacts of reforms announced by the Cameron and Osborne administrations on over 180,000 low income households shows exactly how hard these families will be hit.

Policy in Practice analysis shows how the freezing of benefit rates from 2015 will hit the pockets of low-income households hardest by 2020, even more if inflation increases as expected due to Brexit. Low income households in work - those 'Just About Managing' - will lose even more on average - £48.90. This is mainly due to cuts in Universal Credit and the rising cost of private rents. Out of work households are £33.54 per week worse off on average, and are impacted by the benefits freeze, alongside the other changes to benefits. The averages hide the impact on some individual households losing many hundreds of pounds per week.

• 2.9% of households have income lower than their reported housing costs.

• One in ten of these are in temporary accommodation already, with the remainder in the private rented sector

• The average cost of housing a family in temporary accommodation to the local authority (in addition to Housing Benefit) is £3,510 on average.

The loss from welfare reforms across the households in the sample is £381m, while the amount provided by central government through Discretionary Housing Payments is £10m. This leaves local authorities and other local services, as well as the families themselves, struggling to plug the gap. Deven Ghelani, one of the architects of Universal Credit and Director of Policy in Practice said: "The Government has announced no new Benefit cuts over the course of this parliament. "However, our analysis shows that the cumulative impact of reforms already announced will continue to hit the pockets of low earning households through to 2020. "Policy in Practice is being asked to help Local authorities to be smarter and ever more targeted about who gets what support, but their resources are limited. "Central Government should help by taking action to lower rents, look again at the benefits freeze, and invest in work incentives under Universal Credit to ensure work pays as well as under the current system. "Without mitigation, low income households that are already struggling will be pushed further into debt, with knock on consequences for society and the public finances

Retail Sales Stay Healthy

In October 2016, the quantity of goods bought (volume) in the retail industry was estimated to have increased by 7.4% compared with October 2015; all store types showed growth with the largest contribution coming from non-store retailing. This is the highest rate of growth since April 2002.

This is good news. Services are 70% of the UK economy and they are a barometer of the health of the economy.

Napoleon said 'we were a nation of shopkeepers' - he had a good point.

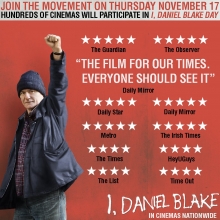

i-Daniel Blake Day

Thursday 17th of November is I, Daniel Blake Day - at hundreds of cinemas. Go see it. Go see it again. Join the movement tweets Ken Loach. #idanielblakeday

The Plot:

Daniel Blake is a 59-year-old joiner living in the North-East of England who suffers a major heart attack. The film begins when his recovery is incomplete and his cardiologist is concerned that Daniel's heart might begin to beat abnormally, putting him at risk of developing a life-threatening arrhythmia. She tells him not to work.

Daniel is reasonably active day-to-day — he can get around and do DIY — and scores some points at his eligibility assessment for the sickness benefit called 'Employment and Support Allowance'; however, his points tally is below the threshold needed to qualify for this benefit and so he is deemed fit for work. Daniel has assumed that the unspecified "healthcare professional" from the outsourcing company that carried out his Work Capability Assessment — portrayed as a simplistic box-ticking exercise — has contacted his doctor for information on his condition, but she has not. The upshot is that the test's criterion for people who are at risk – which would have qualified Daniel for sickness benefits – is not applied by the Job Centre's unseen "decision-maker". Daniel's only option is to claim Jobseekers Allowance, for people who are able and ready to work, while he waits for his appeal against the decision on his fitness for work to be heard. As a condition of receiving Jobseekers Allowance, he must actively look for work.

Daniel seeks work on the local industrial estate and is offered a job working in a scrapyard. He reluctantly turns it down, with his doctor's advice in mind. Daniel's "work coach" feels he is not making enough effort to get a job.

While Daniel struggles against government red tape, he gets to know single mother Katie and her two children, Dylan and Daisy, who have left a homeless persons' hostel in London and, with no other affordable accommodation being available in the capital, have moved to housing 300 miles (480 kilometres) away in Newcastle. On her first visit to the Job Centre Katie is "sanctioned" — her benefits are stopped because she briefly got lost on the way there — and she then cannot feed everyone in her family nor heat their apartment. Widower Daniel, single-parent Katie and her children try to deal with the poverty they face together. They visit a food bank and Katie is overcome by hunger.

Katie is drawn into the black economy, while Daniel hopes that his legal appeal will ultimately be successful, so that he can receive sickness benefit and not have to look for work until such time as his recovery is complete.

Daniel attends court for his appeal hearing, with Katie to support him. He meets his welfare rights adviser who has obtained copies of the medical records; he advises Daniel that his case looks sound. On glimpsing the judge and doctor who will decide on his appeal, Daniel becomes nervous. He goes to the washroom to cool down. Shortly afterwards, someone shouts for an ambulance. Daniel has collapsed. The tribunal doctor is called but finds that Daniel has no pulse. She begins CPR — unsuccessfully.

At his funeral, Katie reads the eulogy.

Courtesy: Wikipedia

Courtesy of Channel 4: Ken Loach: life in austerity Britain is 'consciously cruel'.

Cathy Come Home was an earlier film by Ken Loach that brought his gritty style of film making into the public conciousness.

More in Work But Claimant Count Rises

Between April to June 2016 and July to September 2016, the number of people in work increased and the number of unemployed people decreased. The number of people not working and not seeking or available to work (economically inactive) increased.

There were 31.80 million people in work, 49,000 more than for April to June 2016 and 461,000 more than for a year earlier.

There were 23.24 million people working full-time, 350,000 more than for a year earlier.

There were 8.56 million people working part-time, 110,000 more than for a year earlier.

The employment rate (the proportion of people aged from 16 to 64 who were in work) was 74.5%, the joint highest since comparable records began in 1971.

There were 1.60 million unemployed people (people not in work but seeking and available to work), 37,000 fewer than for April to June 2016 and 146,000 fewer than for a year earlier.

There were 876,000 unemployed men, 15,000 fewer than for April to June 2016 and 82,000 fewer than for a year earlier.

There were 728,000 unemployed women, 22,000 fewer than for April to June 2016 and 64,000 fewer than for a year earlier.

The unemployment rate was 4.8%, down from 5.3% for a year earlier and the lowest since July to September 2005. The unemployment rate is the proportion of the labour force (those in work plus those unemployed) that were unemployed.

There were 8.89 million people aged from 16 to 64 who were economically inactive (not working and not seeking or available to work), 49,000 more than for April to June 2016 but 103,000 fewer than for a year earlier.

The inactivity rate (the proportion of people aged from 16 to 64 who were economically inactive) was 21.7%, down from 22.0% for a year earlier.

Average weekly earnings for employees in Great Britain in nominal terms (that is, not adjusted for price inflation) increased by 2.3% including bonuses and by 2.4% excluding bonuses compared with a year earlier.

DWP Select Committee Live Broadcast - Subject Tax Credits

Since 2012, significant changes to the statutory system of child maintenance have been introduced. These include a new statutory body, the Child Maintenance Service, charges for using the new Service and a new means to calculate the maintenance liability of the paying parent. The overall aim has been to deter separated parents from using the Service and encourage them to make their own arrangements for child maintenance. The Child Maintenance Service replaced the Child Support Agency which was abolished following a series of controversies including accumulating £3.8 billion arrears in unpaid child support.

Evidence received so far suggests that the bulk of this will never be collected.

The Committee is opening this short inquiry with evidence in private from affected parents (an anonymised transcript of this session will be published afterwards) and in public from parents’ advocacy groups:

On Wednesday 16 November 2016 at 10.15am in the Wilson Room, Portcullis House:

Janet Allbeson, Senior Policy Advisor, Gingerbread

Michael Lewkowicz, Business Manager, Families Need Fathers

James Pirrie, Board Member, Resolution and Director, Family Law in Partnership

The inquiry will conclude with evidence from the responsible Minister, Caroline Noakes. Date TBC.

Stop PIP.org Fighting For a Better Treatment of the Disabled.

A campaign to prevent death and harm being committed against our disabled community has been creating some very hard hitting videos.

STOP-PIP.ORG are a humanitarian organisation who has stated that their primary goal is exposing ATOS, MAXIMUS, CAPITA and the DWP for their involvement in the deaths of thousands of disabled people.

The treatment of the disabled is appalling and we must thank the ever vigilent works/volunteers part-time activist & campaigner ‘I was a JSA Claimant’ for bringing this one to our attention.

We like to work with like-minded organisations and people and from 16 October we are starting to seriously add content to our directory section of the ABC website. These entries are free for appropriate not-for-profit organisations. If your organisation wants to join in just let us know.

For taxpayers and those fit and able in work, we hope that our website informs you of the 'living hell' for some that your money is financing.

We can only hope that you feel sufficiently disgusted like us to want to do something about it? It is far from the happy, helpful image, put across to the public by the DWP. The disabled need to be respected and they need to be helped. These are not weak people, or lazy. They are people, perhaps like you, whose lives have changed for the worse or who were born into difficulty. A decent society with a decent government would not be treating people in this way.

Image: The DWP Personal Independence Payments.

Click on the link to visit the website:

University of Essex VTeam - Teams Up with the ABC

The ABC is now working on adding directory content in a team effort with the University of Essex Student Union VTeam. The V incidentally stands for ‘volunteer’.

Joining us this week is a multitalented electronics student Aishwarya Balan. Aishwarya, is starting as a content author and her role will be adding content to our directory of organisations that assist those on low incomes.

We have several people signed up for Digital Marketing Officer placement (application closes on 20th) and for and for a Communication Officer placement (application closes on 20th as well). If you are a student and you see this feature - VTeam placements run for 6 to 8 weeks and it requires a commitment of six hours a week. It is a great way to ‘contribute to society’, gain work experience and add some real work related achievements to your post-graduation CV.

Tomas Kasiulis, Students’ Union Team VTeam Coordinator has this to say:

“We are pleased to be working with Association of Pension & Benefits Claimants which gives new opportunities for our students, lets them develop different skills and gain necessary experience while studying. We are the University of Essex Students’ Union - on adventure to become the world’s most student-centred organisation”.

All the students that have worked sucessfully with the ABC have moved seamlessly into work on leaving education. Perform well and we can provide not just references, but also a full case study.

Working with the ABC is a GREAT way to meet a variety of objectives simultaneously and we like to make it enjoyable and fun where possible.

If you would like to get involved as a student or have your not-for-profit organisation added to our directory, please click of the logo below:

This email address is being protected from spambots. You need JavaScript enabled to view it.

Image: The ABC 'Phoenix Rising' logo.

Image: 'Be part of something' University of Essex VTeam Students in action.

HMRC Employment Status and Intermediaries Team Crackdown

Courier company Hermes failed to provide sufficient rights for its workers has led government to announce a crackdown on firms claiming workers are self-employed to avoid paying proper levels of tax and national Insurance and providing proper worker benefits.

HMRC has launched a new “Employment Status and Intermediaries Team” that actively investigate companies that have declared a high number of self-employed workers, following an inquiry by the Parliamentary Work and Pensions Committee into the so-called “gig economy”. Their remit is to take “all necessary steps” to ensure that companies are paying the correct amount of tax and NIC, which will include both interest and penalties if applicable. The move according to accountancy firm KPMG is intended to clamp down on those companies operating in the ‘gig economy’ who, for whatever reason, incorrectly classify their workers as self-employed.

The Treasury financial secretary Jane Ellison said the “dedicated resource” would give HMRC appropriate expertise to address compliance by companies such as Hermes, in terms of employment rights.

The Prime minister Theresa May has already hired former Blair aide Matthew Taylor to examine workers’ rights.

The creation of a new employment status and intermediaries team at HMRC to focus on status and employment intermediary risks will lead to a redefinition of what is classified as ‘self-employed’.

The parliamentary inquiry into the exploitation of workers in the gig economy opened in July this year and was undertaken by the Work and Pensions Committee – of which Labour MP Frank Field is chair.

A report was recently submitted by Field to HMRC documenting the complaints of Hermes workers suffering in the gig economy. The report recorded several people working for Hermes as couriers, yet not receiving paid holidays, sick pay, and in some cases paid below the National Living Wage (NLW).

The introduction of the Employment Status and Intermediaries Team represents a consensus across government that companies using large numbers of self-employed or agency workers, to avoid providing full entitlement of workplace rights, should be recognised and tackled.

Classification of such workers remains a point of controversy for other companies operating under a similar business model to Hermes – taxi app Uber, for example, in which the Employment Tribunal case went against Uber who plan to appeal.

Employee or employer and unsure of your rights?

The Advisory, Conciliation and Arbitration Service is a Crown non-departmental public body of the Government of the United Kingdom.

Contact ACAS by clicking here:

China Finances Northern Powerhouse Projects

Chinese investors invited to bid for over £5bn worth of projects in northern England

Chinese and international investors have been invited to bid for over £5 billion worth of infrastructure and regeneration projects in the north of England.

A 'Northern Powerhouse investment portfolio' of planned projects requiring private investment has been published to coincide with a two-day Chinese state visit to the UK, at which the governments of the two countries will discuss ways to strengthen economic and trade links. The projects include the expansion of MediaCityUK in Salford, headquarters of the BBC; and a 1,000-home regeneration project at Pall Mall in Liverpool.

China's vice premier Ma Kai and other senior officials are currently visiting London for a series of talks and discussions under the label of the eighth UK-China Economic and Financial Dialogue (EFD). During the two-day event, Ma will meet with UK prime minister Theresa May and Mark Carney, governor of the Bank of England; and is expected to make a number of announcements related to trade, investment and financial services.

The UK government made a series of infrastructure-related announcements ahead of the visit. Chinese state-owned construction company CITIC is to open its UK headquarters at the new development planned for London's Royal Albert Docks, while CITIC and ABP, a Chinese developer, have committed to £320 million of investment into the planned commercial hub as part of Phase 1 of its construction.

The UK has also committed to up to £40m of investment into an Asian Infrastructure Investment Bank (AIIB) fund, which will be used to help developing countries to prepare infrastructure programmes.

The Northern Powerhouse Investment Portfolio consists of 13 projects, each worth over £100m. These include the MediaCityUK expansion project; an office and logistics development at Sheffield Airport and new housing and employment-led developments in Future Carrington, Trafford; Kirkstall Forge, Leeds; Unity, Doncaster; and Liverpool Waters. Industrial investment opportunities include the Protos gas-fired power generation project at Ellesmere Port, Cheshire; and construction of the first potash mine in the UK for over 40 years at Whitby, North Yorkshire.