Simon Collyer

Jeremy Corbyn Vigerously Engages Theresa May at PM's Question Time

Jeremy Corbyn has been vigorously engaging the government over sanctions at PM’s Question Time.

The argument that benefits sanctions and Work Capability Assessments are fair to taxpayers is complete nonsense. The latter assessments cost a fortune to carry out. The testing is frequently crude and inaccurate and this has led to much injustice and to the deaths, in some cases, of claimants wrongly assessed.

The people being sanctioned are, in many cases, the ordinary working people who have lost their jobs and for whom the system tricks out of their benefits (which these people have paid for over many years). People who get sanctioned often have mental health issues, or other severe social problems, or are ethnic minorities who lack a clear understanding of what is required due to language issues.

These individuals get singled-out, as they are often the least able to defend themselves - especially as Legal Aid has been cut so dramatically. People at the very bottom of society often lack the knowledge, support and advice they need to prepare a winning appeal.

Most sanctions are turned-over on appeal however. Yet benefits are stopped without interest or compensation being paid to claimants when these appeals are won.

The argument that the film i-Daniel Blake is fiction and therefore over dramatized, as argued earlier by the DWP minister The Rt Hon Damian Green MP, is utter rubbish.

The film is a strikingly accurate portrayal of how the system treats people, and the suggestion that Theresa May sees the film is an excellent idea indeed.

The pendulum is swinging and the tide turning against the government - the 'Nasty Party' and their equally nasty austerity programs, that are simply cutting benefits to fund tax cuts for the rich, so they can buy more luxury’s.

We should remember that the same day George Osborne introduced the ‘Bedroom Tax’, Chancellor Osbourne announced a tax cut for hedge funds. Nearly half of Britain’s wealthiest hedge fund managers are helping to bankroll the Conservative Party, points out Labour Party analysis of Tory donors.

The government are taking a well overdue pummelling for their cruel treatment of ordinary people, and it looks like there are many more punishing rounds on the way.

Tough Employment Conditions Dog the UAE

Thinking of working abroad?

Job hiring in the UAE remained generally weak, with vacancies posted online registering a significant decline in September compared to a year earlier. Jobseekers in the UAE have been facing difficulty finding relevant employment opportunities online over the past few months, as companies reduce their hiring activity considering the current economic difficulties being faced.

Several major projects currently in the pipeline, including those slated for Expo 2020, will soon open opportunities for jobseekers in the UAE.

However, layoffs are still being implemented, with 17% of UAE companies saying they have trimmed down their workforce.

A new innovation being considered in the UAE is income tax! The fall in oil revenue is putting pressure on government budgets. The times are certainly changing in the land where people would buy a new car when the ashtrays were full.

Tiverton Jobcentre is Moving

The Divide Documentary Film - Well Worth Seeing

Katharine Round’s documentary The Divide is a short, sharp, shock of a film, based on Richard G Wilkinson and Kate Pickett’s book The Spirit Level.

We have already fetured the Spirit Level and its research.

The Divide tells the story of 7 individuals striving for a better life in the modern day US and UK - where the top 0.1% owns as much wealth as the bottom 90%. By plotting these tales together, we uncover how virtually every aspect of our lives is controlled by one factor: the size of the gap between rich and poor.

This isn’t based on real life. This is real life.

Wall Street psychologist Alden wants to make it to the top 1%; KFC worker Leah from Richmond, Virginia just wants to make it through the day; Jen in Sacramento, California doesn’t even talk to the neighbours in her upscale gated community – they’ve made it clear to her she isn’t “their kind”.

By weaving these stories with news archive from 1979 to the present day, The Divide creates a lyrical, psychological and tragi-comic picture of how economic division creates social division. The film is inspired by the critically-acclaimed, best-selling book “The Spirit Level” by Richard Wilkinson and Kate Pickett.

The film launched as a preview at Sheffield Doc/Fest, the UK's premier international documentary festival. It is on general release in the UK from 22 April 2016

National Stress Awareness Day 2nd November

The International Stress Management Association (ISMA) is running the National Stress Awareness Day today. Many people on benefits live under acute stress at times. We have published a downloadable guide for battling stress as an attachment. We hope it helps.

To coincide with National Stress Awareness Day (NSAD) on Wednesday 2nd November 2016, new research from the International Stress Management Association UK (ISMAUK), the UK’s leading Stress Management charity, has revealed that two thirds of employees fear to admit that they are suffering from stress as they believe this could harm their career prospects.

The survey also revealed that over half of those questioned feel unable to take time off work even when suffering from stress, as they felt they would be incapable, have a black mark against their name or that this would be viewed as a weakness.

Data from the Health and Safety Executive (HSE), who support NSAD, shows that 9.9 million days are lost to workplace stress, depression and anxiety each year. Workplace stress contributes to poor health, low performance and financial loss, both to business and to individuals.

To address this issue, ISMAUK created National Stress Awareness Day in 1998 to highlight the endemic incidence of stress throughout the community, and to show that companies which actively encourage resilience in their workforce regularly report improvement in morale and bottom-line results.

The ABC will be featuring ‘stress’ more in future. This however is a good introduction to the ISMA and its valuable work.

Please download the guide below:

House of Lords Womens Pension Inequality Debate

House of Lords Wednesday 2 November, after 3am. Will be debated:

Concerns from Women Against State Pension Inequality about the reduction of the state pension age for women - Baroness Bakewell

Living Wage Goes Up to £8.45 Per Hour

The voluntary wage has been increased by 20p to £8.45 an hour. In London, it has gone up by 35p to £9.75.

The changes announced by the Living Wage Foundation affect 3,000 Living Wage accredited employers.

The rate, calculated independently, applies to all workers aged 18 and above.

Please search the database for accredited employers.

Live Work and Pensions Committee Wednesday 2 November

Work and Pensions Committee

Wednesday 2 November 2016 Meeting starts at 9.30am

Subject: Pension Protection Fund and the Pensions Regulator

Witnesses: Malcolm Booth, Chief Executive Officer, National Federation of Occupational Pensioners, Neil Carberry, Director for People and Skills, CBI, and Joanne Segars, Chief Executive, Pensions and Lifetime Savings Association

Witnesses: Alan Rubenstein, Chief Executive, Pension Protection Fund

National Audit Office Looks at HMRC Approach to Collecting Tax From High Net Worth Individuals

HMRC estimate that its specialist unit dedicated to collecting tax from high net worth individuals raised £416m from its compliance work with this group in 2015-16 according to a report today by the National Audit Office (NAO). This is separate from tax already voluntarily declared by these individuals. As this specialist unit expands HMRC needs to do more to identify the most effective approaches to maximising the tax revenue paid by the very wealthiest people in the UK.

High net worth individuals[1] often have complex tax affairs and they generally have more choice over how they manage their income and assets than the average taxpayer. It can be challenging for HMRC to understand their tax affairs and assess if there are any risks to address.

In 2009, HMRC established a specialist unit to manage the tax affairs of high net worth individuals to give it a better understanding of the overall tax position of high net worth individuals and their behaviour. At the start of 2015-16 HMRC considered there to be around 6,500 high net worth individuals, roughly 0.02% of all taxpayers.

The amounts of tax revenue that are at stake are significant. In 2014-15, high net worth individuals paid over £4.3 billion in tax. This included £3.5 billion in income tax and national insurance (1.3% of the total revenue for those taxes) and £880 million in capital gains tax (15% of all CGT). HMRC does not record other types of tax that are collected, such as Inheritance Tax, in a way that easily allows it to identify the amounts paid on high net worth individuals' wealth.

HMRC is investigating risks from high net worth individuals with a potential value of £1.9 billion. This figure is an initial estimate of the tax that could be due and covers more than one tax year. £1.1 billion of this relates to the use of marketed avoidance schemes; around 15% of high net worth individuals have used at least one scheme. HMRC has identified that the risks from high net worth individuals relate primarily to tax avoidance and the legal interpretation of complex tax issues, rather than tax evasion.

HMRC is currently running a formal enquiry on around a third of high net worth taxpayers, with an average of four issues being examined per taxpayer. Formal enquiries occur where HMRC does not understand or agree with the position taken by a taxpayer. These enquiries can take a long time to resolve with 6,000 issues under enquiry open for more than 18 months, 4,000 of which have been open for more than three years.

HMRC recorded yield of £416 million in 2015-16 from the work of the high net worth unit. This is an increase from £200 million in 2011-12, and exceeds HMRC's internal target of £250 million in 2015-16. In addition to the work of the high net worth unit, since 2009 HMRC has recorded yield from high net worth individuals of around £450 million. Around half of this – £230 million – has come from its work in tackling marketed avoidance schemes. A further £80 million relates to fraud investigations and around £140 million from the use of offshore disclosure facilities (Liechtenstein disclosure facility).

HMRC prioritises the recovery of tax where it identifies fraud and uses civil investigations in the majority of cases. Where high net worth individuals are suspected of tax fraud, their case is passed to a specialist team within HMRC which examines whether the evidence is sufficient to merit a criminal, rather than civil, investigation. In the last five years, HMRC has investigated and closed 72 cases relating to high net worth individuals. 70 of these were investigated with civil powers, raising £80m in compliance yield including penalties. Two cases were criminally investigated and passed to the Crown Prosecution Service, one of which was taken forward and successfully convicted. At October 2016 HMRC was criminally investigating a further 10 high net worth individuals.

Identifying high net worth individuals is not straightforward as most of the information about their wealth such as sources of income or assets owned does not need to be reported. During 2015-16, HMRC undertook a review and identified an extra 1,000 people with net worth of more than £20 million.

HMRC has developed its approach to high net worth individuals over time. HMRC initially focused on getting a better understanding of the circumstances of high net worth individuals. It has since refined its approach to become increasingly focused on the riskiest taxpayers.

HMRC has not evaluated its approach to high net worth individuals. While HMRC knows more about this group that it did when the high net worth unit was set it, it has not looked at what works and why in its current approach. It could use such analysis to increase the impact of its work.

Amyas Morse, head of the National Audit Office, said today:

“The tax affairs of the wealthiest in society are complex, making it harder for HMRC to ensure that they are paying the right amount of tax. HMRC’s specialist team gives it a better understanding of the tax affairs and behaviours of these taxpayers. While the yields from HMRC's work in this area have increased it needs to evaluate what approaches are the most effective and to understand the outcomes it achieves.”

[1] Until 2015-16 HMRC’s high net worth threshold was someone with wealth of £20m. From 2016-17 this was reduced to £10m.

Key facts

6,500 - The number of taxpayers HMRC considered to be high net worth individuals at the start of 2015-16.

£4.3bn - tax collected from high net worth individuals in 2014-15

£416m- HMRC’s estimate of the yield from the high net worth unit's compliance work in 2015-16

| £20 million |

wealth required to be designated a high net worth individual by HMRC until 2016 when the threshold was reduced to £10 million

|

|

| Marketed avoidance |

£1.4bn tax at risk from 1,000 high net worth individuals (1% of all users of schemes, but 10% of the tax at risk). HMRC is making good progress in tackling the use of marketed schemes.

|

|

|

Offshore evasion Inheritance Tax |

137 high net worth individuals have voluntarily told HMRC about £141 million of tax liabilities through the Liechtenstein Disclosure Facility (2% of all disclosures and 11% of total value). HMRC has identified 161 Inheritance Tax records relating to high net worth individuals' estates between May 2014 and April 2016. Inheritance Tax of £183m has been paid on these 161 estates to date. The final amount due is not yet known |

Read the full report below:

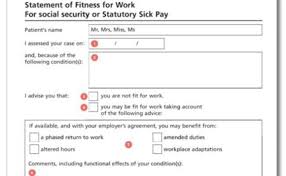

Work Capability Assessment and Sick Notes Green Paper Consultation

Department for Work and Pensions’ long-awaited Green Paper consultation on supporting more sick and disabled people in to work is being reviewd shortly. Among the measures being reviewed as part of the consultation is the controversial Work Capability Assessment

This is as well as the system of statutory sick pay and GP “fit-notes” to encourage phased returns to work as people recover from a long-term illness.

We await the outcome with interest.

Executives

-

Simon Collyer

Position: Founder & Director

Simon Collyer hails from Brightlingsea in Essex, a small town on the coast between Colchester & Clacton. Simon worked very successfully in the leisure marine industry in the UK and in Australia. Later in London Simon worked in the web development and publishing fields, founding a below-the-line sales promotion agency in the early nineties and then later a software company Red Banner in South Africa (2002-06). Here in South Africa, Simon became interested in the Third Sector and starting his own organisation.

-

Christopher Johnson

Position: Bookkeeping and Administration

Chris lived in Oxford for twenty years, having been educated at Magdalen College School. Chris sought a career with British Rail and spent twenty years in railway retail management ending with Virgin Trains at Euston Station. Christopher retrained in bookkeeping and accounts in 2000 and now works for Chelmsford Community Transport.

A strong, enthusiastic team player with a meticulous eye for detail, Christopher brings a range of skills to the ABC.

Team

-

Frances Rimmer

Position: Researcher

When not charming snakes Frances is a Modern History student at the University of Essex, focusing specifically on social history. The lives and experiences of the ordinary person rather than on politics or the military. Outside of her studies, Frances enjoys film and writing. As a keen roller skater who plays roller derby with the Kent Roller Girls, Frances secret wish would be to become a skating instructor and open her own rink, as she has always wanted to help people in some way, and feels it would be great to do so while also sharing her passion with like-minded people.

-

Stuart Meyers

Position: Researcher

Stuart Meyer, is a final year American Studies student at the University of Essex. Stuart focussed his academic life on global justice and the rights of migrants. Additionally Stuart has a passion for writing, both creatively and with the aim of providing accessible information to those who need it most Stuart has made a great contribution to our library of Advice Guides demonstrating his versatility by writing intelligently on a wide range of topics.

-

Louis Jones

Position: Film Maker

Louis is a 19 year old TV and film student studying at Colchester Institute. Along with hand-picked fellow students, Louis made the ‘Membership’ video that can be seen on the ABC website. Louis volunteers at, Hospital Radio Colchester, as a football commentator. A true fan of the ‘Great Game’ Louis insights have been sought after on occasions by key local media, the Colchester Daily Gazette & even BBC Essex.

-

Marcus Pierpont

Position: Film Director

Talented student film maker, Marcus Pierpoint, directed the ABC 'Membership' film which can be seen on the organizations website. Marcus has recently graduated from a BTEC course, studying Creative Media Production at Colchester Institute and he claims a true passion for films and filmmaking. Marcus also enjoys radio work and volunteers at the local hospital radio station, producing and presenting his own show. Marcus is enrolled at the University of Greenwich, and dreams of a career in the media industry.

-

Shane Mitchell

Position: Film Maker

Shane Mitchell, is another Colchester Institute Film and TV student that aspirers to be a Director of Photography in the future. Shane was the camera operator for the ABC Membership video, fun to make says Shane but it is also work he is very proud of. Shane loves all things ‘film’ and he makes videos even in his spare time.

-

Joe Corlett

Position: Film Director

Ex-student script writer/director, Joe Corlett, directed the ABC's corporate video (About Us) which is now viewable on the main website. Joe graduated from the Colchester Institute with a BTEC diploma in the field of media. Joe is passionate towards film making and hopes to continue making more that are constructed form his own material. On the side he's loves being out jogging in all terrains and when not out side he's writing scripts for future projects. Joe is now out in the world ready to start his life goal of working in the Media industry.

-

Jon Taylor

Position: Film Maker

Jonathan Taylor has been working in the media sector for 3 years and for our filming projects he worked as the production manager. John worked on graphical elements of our film, About Us for example, rendering images and making them look good on screen.

Jon is also experienced in animation and he made the logo and animation sequences in the ABC corporate videos.

Part of Jon’s brief was to also organise the administration side of filming, known collectively to admin experts the world over as ‘the paperwork’.

-

Thomas Hearn

Position: Film Maker

Thomas Hearn, has been involved in media, for about three years. Tom likes to work a lot at a computer, particularly the editing suite. For the ABC project, Tom worked on the edit itself; created and pieced together both the footage and the music, Tom created the visual elements of the ABC ‘About Us’ video and put most of the visual effects on the video.

I think we can agree that along with the rest of our youthful student team; Tom has done a very fine job indeed.

-

Max Gillard

Position: Film Maker

The last of our film team Max Gillard has recently finished college studying Creative Media Level 3 and Max hopes to continue the course on to University to someday gain a job in the media industry.

We wish Max the best of luck.

-

Harry

Position: Film Maker

My name is Harry Genge and I am an aspiring film maker. I have skills in the majority of film orientated jobs, though I am most interested in the creative roles such: Directing, Director of Photography and Writing. In my spare time I make short films, write, read, draw/paint and take the dog out for long walks.

-

Ned

Position: Producers

My name is Ned Woodcraft and I’m an aspiring Producer. As well as completing a diploma in media production I have also had a number of jobs in the professional market. I’m also a keen sailor and water sport enthusiast.

-

Brandon

Position: Producer

My name is Brandon and I’m an aspiring producer and actor. I enjoy bringing a production together with planning and preparations to create a great finished product. My hobbies also include street magic and bass playing.

-

Callum

Position: Writer and Director

My name is Callum Olive and I’m an aspiring writer and director. I’m always looking for a new project and love writing new stories and screenplays at home and on the move. My hobbies include playing the piano and street magic.

-

Joanie DeMuro

Joanie joined ABC team in early 2017. She was one of six student volunteers from the University of Essex in that cohort. The student team focused on a range of projects, including creation of Wikipedia page,‘training manual’ and most importantly, researching and adding entries to the website directory of organisations that assist the unwaged, or those on low incomes. “This placement was very helpful - thanks for the opportunity Simon.”

-

Cherry Lam

Cherry Lam has been volunteering for ABC for one month. Although it is a short period of time, she knows a lot more about the running of a charity organisation. Cherry is responsible for adding directories to the organisation website according to categories. Joining this placement helped her improving skills and gaining new experiences. Cherry says is extremely appreciative of the support she has received from ABC which allowed her to improve skills.

Join

FREE

Here